Vejii Goes Deli

Vejii Holdings Ltd. (VEJI.C) announced today that the Company has signed a consignment and fulfillment services agreement with Unreal Deli Inc. According to the terms of the agreement, Unreal Deli will provide inventory to Vejii Fulfillment Services (VFS) on consignment.

“We continue to see increasing demand from brands looking to leverage our distribution network which spans across the US and Canada, to provide D2C shipping for their products. Approximately 40% of our Vejii Express offering, which makes up all of our top-selling SKUs are now on consignment through the VFS platform,” said Kory Zelickson, CEO of Vejii.

Through VFS, brand partners are able to send their products to Vejii’s warehouses and take advantage of the Company’s pre-established distribution network. With this in mind, Vejii currently has five fulfillment centers across two countries and five distribution centers across the United States (US), reaching 100% of the continental US, and Hawaii with ground delivery. Currently, there are over 100 independent vendors fulfilling orders through VFS.

“We will also be undertaking sample distribution, which we’ve identified as a key opportunity to support our brand partners. This provides a new revenue stream for the company but also deepens our relationship with new and innovative brands like Unreal Deli, which is already a top-selling SKU for Vejii”, said Darren Gill, President, and COO of Vejii.

As previously mentioned, Unreal Deli will provide inventory into VFS. In doing so, Unreal Deli’s products will be available for sale on Vejii Express and through its own direct-to-consumer (D2C) consumer channel. On the other hand, Vejii will pick, pack, and ship orders for Unreal Deli products both on ShopVejii.com and Unreal Deli’s own eCommerce platform, unrealdeli.com.

Unreal Deli Inc.

If it wasn’t already painfully obvious, Unreal Deli is a plant-based deli company. Since appearing on Shark Tank and securing an investment from Mark Cuban, Unreal Deli has offered New York-style deli meat through retailers like Whole Foods, Publix, Wegmans, and Quiznos, to name just a few. Furthermore, the company offers its products through its own D2C consumer channels and its existing relationship with ShopVejii.com and VeganEssentials.com.

“We are so excited to partner with Vejii to expand and streamline our D2C capabilities as Unreal continues to build its dominance in the premium plant-based deli category. Vejii has already been a great partner, and we are excited to deepen our relationship”, said Jenny Goldfarb, Founder and CEO of Unreal Deli.

If backing from Mark Cuban wasn’t enough, Unreal Deli was also voted the No. 1 Best Plant-Based Meat on Thrillist and was ranked as the No. 1 Best-Selling Vegan Deli Meat on Amazon. In addition to being 100% plant-based, Unreal Deli’s products are also high in protein and are GMO-free.

Share Consolidation

On March 11, 2022, Vejii announced that subject to the approval of the Canadian Securities Exchange (CSE), it intends to consolidate its issued share capital on the basis of one new common share without par value for every four existing common shares without par value. For context, shares without par value effectively have no minimum baseline from which to be priced. Instead, share value is determined by the amount that investors are willing to pay.

With this in mind, Vejii will consolidate its shares at a ratio of 4:1. No fractional shares will be issued in connection with the share consolidation and any existing fractional shares comprising less than one-half of one share will be deemed to have been tendered by the shareholder to the Company. Any fractional shares comprising greater than or equal to one-half of one share will be converted into one whole share.

Vejii anticipates the effective date of the share consolidation will be March 28, 2022. Following share consolidation, the Company plans to apply to the CSE for the repricing of certain outstanding common share purchase warrants. Warrant repricing remains subject to the approval of the CSE.

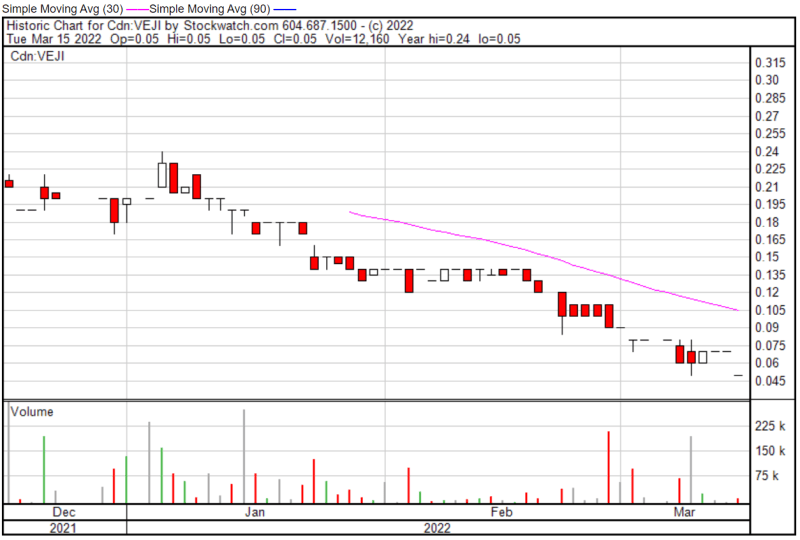

Vejii’s share price opened at $0.05, down from a previous close of $0.07. The Company’s shares were down -28.57% and were trading at $0.05 as of 10:20 AT EST.

Full Disclosure: Vejii Holdings Ltd. (VEJI.C) is a marketing client of Equity Guru.