Bringing Plant-Based to Digital

What is digital health? Digital health is defined as the use of technologies to drive improvements in the design of medical products and the delivery of health care services. According to the U.S. Food & Drug Administration (FDA), digital health includes categories such as mobile health, health information technology, wearable devices, telemedicine & telehealth, and personalized medicine.

Aside from copious amounts of alcohol, takeout, and television, digital health tools have helped keep millions of people sane. For example, Dialogue and Maple, two virtual healthcare providers, offer similar platforms allowing users to access on-demand primary care, mental health therapy, and other services. This is referred to as participatory digital health, whereby the time an individual has to themselves is spent managing their own health through digital health services.

With this in mind, the Digital Health Market has become quite lucrative in the last few years. In fact, global investments in digital health companies totaled more than $57 billion in 2021, representing an increase of almost 80% compared to 2020. From wearable devices to lifestyle platforms, there is an increasing demand for digital health tools as consumer wellness continues to shift towards virtual. Let’s take a look at a company capitalizing on the potential of the digital health market.

Plantable Health Inc.

- $12.65M Market Capitalization

Plantable Health Inc. (PLBL.NE) is a clinically supported plant-based program committed to transforming people’s health. The Company drives healthy weight loss and an improvement in performance, health, and well-being by bringing together plant-based meals, personalized coaching support, and lifestyle tools to encourage people to change their dietary habits.

The Company recently began trading on the NEO Exchange (NEO) on January 12, 2022. Currently, Plantable offers consumers two programs, namely its Reboot and Quickstart programs. Plantable’s Reboot Program represents the fruit of the Company’s labor and is the first clinically-supported lifestyle program combining plant-based nutrition and behavioral psychology. After all, who doesn’t like their meal with a side of therapy?

Jokes aside, Plantable’s Reboot Program appears to be the real deal. The clinical trial initiated in May 2015 assessing the Reboot Program demonstrated a cohort average weight loss of over 9 pounds during the 28- day intervention. Similar to Reboot, Plantable’s Quickstart Program is much of the same, however, consumer access is a tad more limited. Here’s a breakdown for each package, including cost:

Reboot Program:

- $175.00 billed weekly for four weeks

- choice of 48 chef-prepared entrees

- up to three months of one-on-one coaching

- 12 months of access to lifestyle tools

Quickstart Program:

- $225.00 billed once for a seven day period

- choice of 12 chef-prepared meals

- one week of one-on-one coaching

- introductory onboarding call

- one month of access to lifestyle tools

Plantable’s business structure is unique in the sense that it combines plant-based wellness with behavioral psychology. To be more specific, Plantable pairs its plant-based foods with one-on-one life coaching. In doing so, the Company provides support seven days a week to its customers. In addition, Plantable’s life coaching includes onboarding calls, weekly check-in calls, and SMS access. Ultimately, this is intended to help customers rapidly change their eating habits.

However, if you have commitment issues, Plantable also offers its A La Carte Menu where consumers can build a custom box of 12 Plantable menu items. Keep in mind, unlike the Company’s Reboot or Quickstart programs, this does not include life coaching or access to lifestyle tools.

Latest News

On February 15, 2022, Plantable announced that it has entered into an investor relations service agreement with Apollo Shareholder Relations, a full-service investor communications agency with a specific focus on the modern investor. Ranging from traditional phone line management to Reddit, Apollo offers expertise in capital market advisory, branding, and infrastructure support for modern businesses.

“After seeing Apollo’s unique and innovative investor relations offerings, we knew they were a perfect fit for Plantable…We understand that the investing scene has changed greatly these days, which is why it was important for us to adapt quickly to these changes. We can trust we are in good hands with Apollo to get our Company’s story out there and build relationships with our investors,” commented CEO Dr. Nadja Pinnavaia.

Through this agreement, Apollo will provide a number of services to Plantable, including but not limited to, strategic communications, news flow planning, press release writing, and attending to investor inquiries via email, phone calls, and chatrooms.

Shortly after announcing its public listing on the NEO Exchange, Plantable announced the launch of its first digital product with the introduction of its lifestyle app on January 18, 2022. Dubbed the “Plantable App,” this marks the Company’s first expansion outside of the United States (US) and the first phase of its digital health initiatives. Moving forward, Plantable intends to use proceeds from its recent IPO financing to further develop the app. If you’d like to know more about Plantable, check out this article!

Financials

According to Plantable’s Financial Statements for the three and nine months ended September 30, 2021, and 2020, the Company had cash of USD$997,562 as of September 30, 2021. This represents a significant increase from USD$127,238 on December 31, 2020. As of September 30, 2021, Plantable had total assets and total liabilities of USD$1,256,000 and USD$410,104, respectively. For December 31, 2020, these numbers translate to USD$385,786 and USD$1,793,494, respectively.

For the three months ended September 30, 2021, Plantable reported revenue of USD$210,798 compared to USD$271,507 on September 30, 2020. For the nine months ended September 30, 2021, the Company reported revenue of USD$867,847 compared to USD$858,307 on September 30, 2020.

In total, Plantable reported a net loss of USD$516,386 for the three months ended September 30, 2021, up from a net loss of USD$126,453 on September 30, 2020. For the nine months ended September 30, 2021, Plantable reported a net loss of USD$3,694,939 compared to USD$449,139 on September 30, 2020.

On July 23, 2021, 3,000,000 options were granted to Dr. Pinnavaia, Plantable’s CEO and Founder, at an exercise price of $0.05 per common share. The options are set to expire on July 23, 2031, and will vest if the Company achieves a trailing 12-month revenue of $25,000,000 or a certain change of control of the Company occurs.

It is worth noting that Dr. Pinnavaia has invested $1.5 million of her own money into Plantable, demonstrating a personal interest and confidence in the Company’s future. Pre-IPO, Plantable’s CEO ownership was 43%.

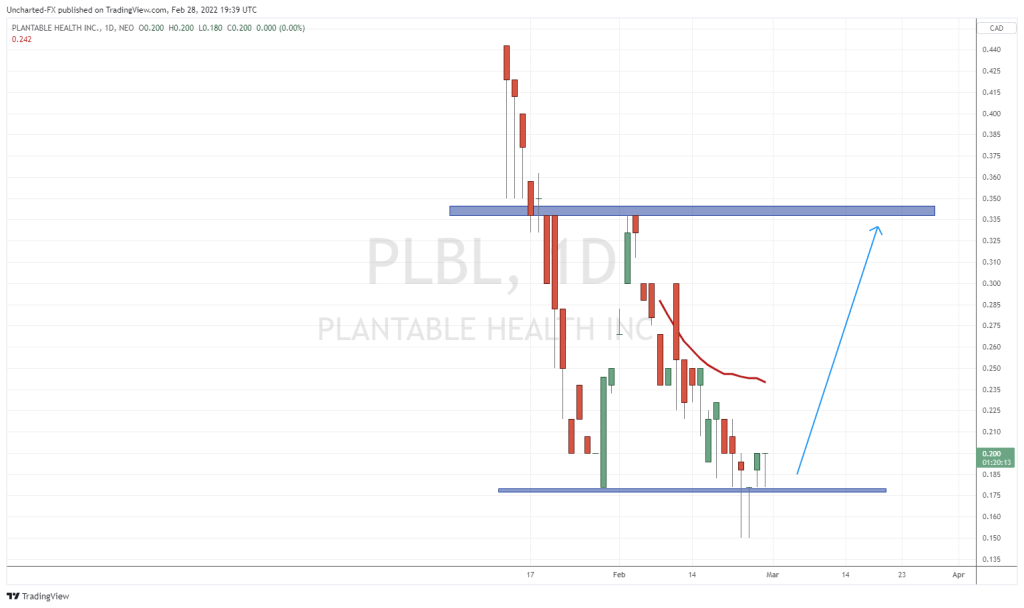

Plantable’s share price opened at $0.20 on February 28, 2022, compared to a previous close of $0.20. The Company’s shares were trading at $0.20 as of 1:08 PM EST on February 28, 2022.

Got Sesame Milk?

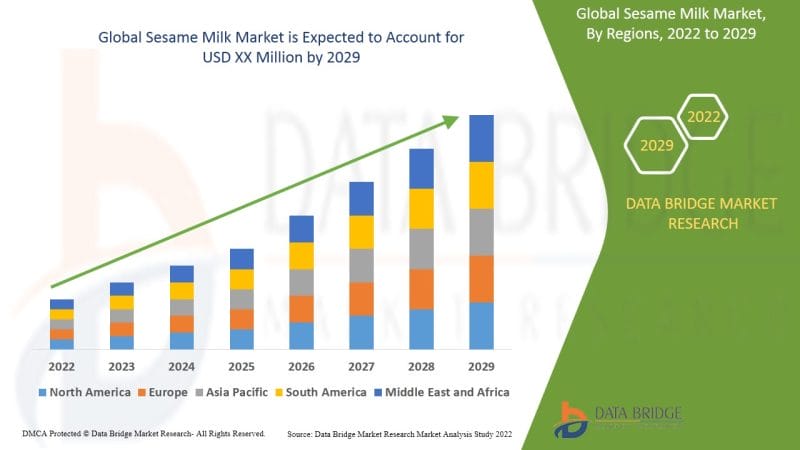

I have talked about the plant-based dairy alternatives market enough to last a lifetime…why stop now? However, I won’t be talking about the usual culprits including oat milk, soy milk, and almond milk. Instead, let’s focus on sesame milk, an up-and-comer in the dairy alternatives market. According to Data Bridge Market Research, the Sesame Milk Market is expected to gain traction during the forecast period of 2022 to 2029, expanding at a Compound Annual Growth Rate (CAGR) of 6.7%. Here’s why.

Unlike many other crops, sesame is highly sustainable, durable, and capable of thriving in arid climates. Furthermore, sesame is able to produce a successful yield with little water, especially when compared to other crops associated with the production of plant milk. I am looking at you, almond milk.

Speaking of which, I have never liked almond milk. It tastes like garbage, has the consistency of water, and goes terribly with cereal. If that wasn’t enough, turns out there are more reasons to dislike almond milk, especially when it comes to the environment. Almonds are notorious for being one of the most water-intensive crops. To put things into perspective, it takes approximately 15 gallons of water to produce a measly 16 almonds.

Ironically, more than 80% of the world’s almonds are grown in California, a US state already plagued by droughts. Even so, the commercial production of almonds in California requires ground and surface waters to be diverted from the state’s aqueduct system for irrigation. As a result, the ground in San Joaquin Valley, where a majority of almonds are grown, is sinking each year due to groundwater depletion. Let that sink in.

To make matters worse, almonds require pesticides and imported pollinators for a successful yield, which can be harmful to the population of bees and other pollinators. On the contrary, sesame is self-pollinating, pest-resistant, and requires fewer supplementary agricultural inputs reducing the need for herbicides and pesticides. Bearing all of this in mind, let’s take a look at a company capitalizing on the potential of sesame.

The Planting Hope Company Inc.

- $39.172M Market Capitalization

The Planting Hope Company Inc. (MYLK.V) develops, launches, and scales plant-based and planet-friendly food & beverage brands. Founded by experienced food industry entrepreneurs, Planting Hope is a women-managed and led company, focused on three impact pillars, including nutrition, sustainability, and representation. Impressively, the Company’s Board of Directors represents one of the first all-women Boards on the TSX Venture Exchange (TSXV).

Planting Hope recently began trading on the TSXV on November 18, 2021. The Company’s flagship brand, Hope and Sesame, represents the first commercially available sesame milk worldwide, uniquely positioning Planting Hope at the forefront of the sesame milk market. In addition to being sustainable, sesame milk is nutritious, boasting a nutritional profile that is comparable to dairy milk.

More specifically, sesame milk contains 8 grams of complete protein and all 9 essential amino acids. Moreover, sesame milk requires 95% less water than almond milk and 75% less water than oat milk to produce. Planting Hope also claims that its Hope and Sesame products contain 30% more calcium than most dairy milk. In addition to Hope and Sesame, Planting Hope also offers Mozaics, Veggicopia, and RightRice products.

Mozaics Real Veggie Chips are intended to provide a nutritional alternative to traditional potato and corn-based chips. Mozaics chips are made using real veggies including green peas, yellow peas, potatoes, and extra virgin olive oil, as opposed to vegetables powders and pastes. Nutritionally, Planting Hope’s Mozaics are low in calories and are high in protein and fiber.

Moving on, the Company’s Veggicopia products include long-shelf-life products, ranging from 12-24 months, packaged in single-serving portions in order to minimize food waste. Veggicopia products include single-serving dip cups and snack olives, all of which utilize Planting Hope’s proprietary ingredient technology. Veggicopia’s single portions of pitted Green snack olives are both paleo and keto-friendly.

Lastly, Planting Hope’s RightRice products are intended to serve as an alternative to traditional rice and flavored rice blends. Every RightRice bowl is made from lentils, chickpeas, peas, and rice, resulting in more than double the protein, five times the fiber, and almost 40% fewer net carbs than a bowl of white rice.

Latest News

On February 28, 2022, Planting Hope provided an operation update demonstrating the progressive execution of the Company’s growth strategy through its various partnerships. One of Planting Hope’s most notable achievements includes expanding the Company’s total distribution points (TDP) by an additional 2,767 retail facings across Hope and Sesame, RightRice, and Mozaics products.

“Since our IPO, we have continually developed and scaled our business through retail and eCommerce distribution networks, innovative product launches, and the strategic acquisition of the RightRice® product lines…We have set clear strategic priorities for 2022, including expanding product lines and production capacity to meet the growing demand to position us for strong growth in 2022 and beyond,” said Julia Stamberger, CEO and Co-founder of Planting Hope.

Planting Hope also launched a total of 17 new products and added more than 40 new e-commerce listing on third-party online marketplaces since the Company’s IPO in November 2021. Looking forward, Planting Hope intends to continue expanding its TDP through the acquisition of new grocery retail distribution and launching new product line extensions into existing retail partners.

Furthermore, Planting Hope plans to expand its production capacity in order to mitigate supply chain risk across its network of suppliers and production partners. In doing so, the Company hopes to diminish potential supply chain delays caused by COVID-19 while keeping Planting Hope ahead of its growing product demand.

The Company also accomplished several operations milestones including the first successful commercial run of Hope and Sesame non-GMO, refrigerated, shelf-stable, and barista sesame milk lines. Additionally, Planting Hope imported and launched its new line of Veggicopia products, which have become one of the Company’s best-selling items on Amazon and other direct-to-consumer (D2C) channels.

Upcoming, following a successful trial, Planting Hope will preview its new Hope and Sesame Sesamilk creamers at the Natural Products Expo West trade show in Anaheim, California from March 9 to March 12, 2022. The Company will also preview two new Mozaics flavors at the Natural Products Expo West.

Financials

According to Planting Hope’s Q3 2021 Financial Statements, the Company had cash of USD$906,380 as of September 30, 2021, representing a significant increase from USD$28,794 on December 31, 2020. As of September 30, 2021, the Company had total assets and total liabilities of USD$1,768,178 and USD$5,598,114, respectively. As of December 31, 2020, these numbers translate to USD$601,538 and USD$3,773,115.

For the three and nine months ended September 30, Planting Hope reported a net loss of USD$4,550,476 and USD$5,924,623, respectively. In terms of loss per share, this translates to $0.08 and $0.11, respectively. With this in mind, a sizeable portion of Planting Hope’s expenses were incurred as a result of the Company’s planned listing on the TSXV, which totaled USD$2,435,446.

However, Planting Hope also reported record net revenues of USD$649,528 for Q3 2021, representing an increase of 300% from Q3 2020. For the nine months ended September 30, 2021, this number translates to $2,066,612, representing a 120% increase from USD$941,133 on September 30, 2020.

On November 12, 2021, Planting Hope completed its IPO through the sale of 22,500,000 subordinate voting shares at a price of $0.40 per share for process proceeds of CAD$9,000,000. On June 30, 2021, Planting Hope issued 8,300,000 common units at a price of CAD$0.02 per unit for gross proceeds of USD$133,847. Upcoming, 585,750 warrants at an exercise price of $0.40 are set to expire on August 31, 2023.

Overall, Planting Hope is a company with a unique portfolio of products. Of these products, the Hope and Sesame brand uniquely positions the Company in the Plant-Based Milk Market, which is expected to reach a value of USD$30.79 billion by 2031. Of this market, the sesame milk segment is still in its infancy, however, Planting Hope currently stands at the forefront boasting the first commercially available sesame milk product.

With this in mind, I am genuinely looking forward to seeing what Planting Hope has planned for the future. Supported by a steady flow of news, acquisitions, and partnerships, Planting Hope is definitely a company worth keeping an eye on as the plant-based dairy alternative market continues to grow.

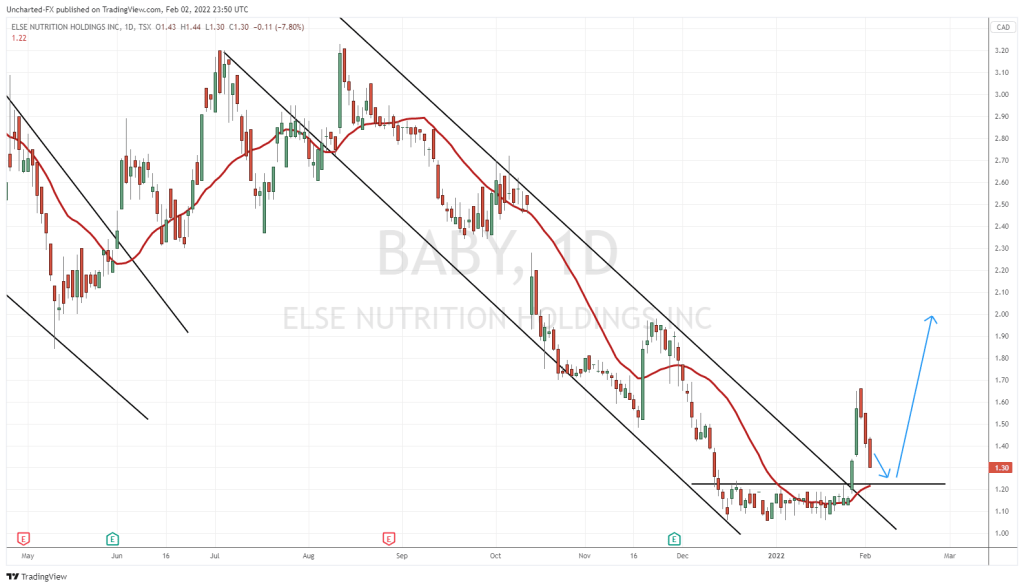

Planting Hope’s share price opened at $1.05 on February 28, 2022, compared to a previous close of $1.05. The Company’s shares were up 0.95% and were trading at $1.06 as of 1:08 PM EST on February 28, 2022.