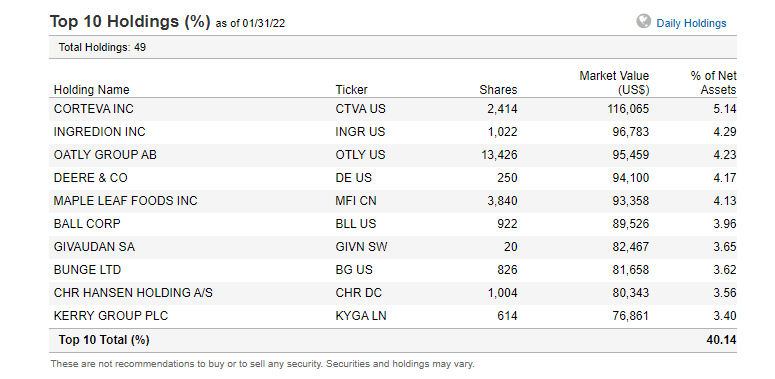

As stock market volatility continues, a couple of the plant based stocks here have caught my attention. I am speaking about Plantable (PLBL.NE) and The Planting Hope Company (MYLK.V). Sustainable food is going to be something discussed in the near future. I have spoken many times here about VanEck’s The Future of Food ETF YUMY. Their key points are:

- Population growth, environmental sustainability imperatives and evolving consumer preferences have created demand for Agri-Food innovations and alternatives with greater efficiency, resiliency and sustainability

- The agricultural and food sectors are in the early stages of what is likely to be a multi-decade transformation

- Active management provides the ability to target growth opportunities in this nascent market

The growth in this space is just beginning. As many market participants consider defense contractors and cybersecurity companies for the future, I have an eye on agriculture and plant based foods. Both which can be under the going green/sustainable umbrella. Some say ESG investing.

I have written about Plantable in the past. If you want a deep dive, I highly recommend you read Kieran’s piece here. Not gonna lie, my waist size is heading out of control as Kieran says the company watches its waist.

Plantable is a clinically supported lifestyle change program that combines behavioral psychology, neuroscience and nutritional science to transform health and wellness. Plantable drives healthy weight loss and an improvement in performance, health and well-being, by bringing together plant-based meals, personalized coaching support and lifestyle tools to empower people to change their dietary habits.

Think of it as a combination of Noom and a food delivery app.

The signature product is the reboot program. A 28 day program for immediate results and habit change that lasts. This includes 48 chef prepared plant based meals, and one-on-one coaching with a personal coach and access to lifestyle tools. I am a vegetarian, but I know many people who are not, but when they look at the food Plantable has on the menu, they say it looks real good.

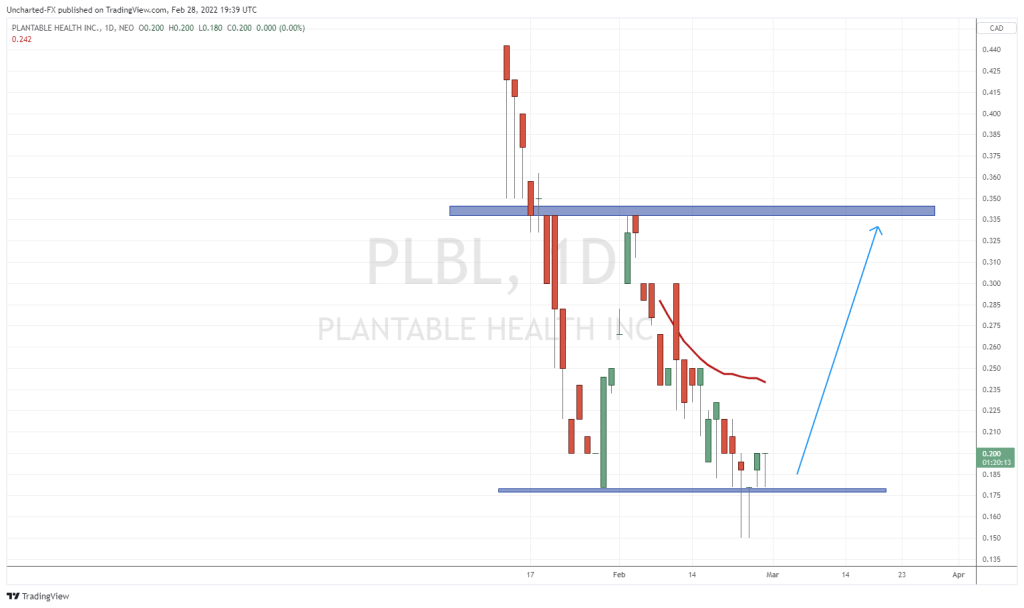

Before we break down the technicals, it should be noted the company began trading this year. One big thing to look out for in the future will be the first earnings report. Currently, using technicals, we can form support and resistance levels.

In terms of support, we are at a major one right now. We have tested this major support in the last four trading days. The most important candle is the one printed on February 23rd. A hammer candle with a very large wick, indicating a big group of buyers stepping in below $0.175. Hammer’s are great candles, but I would not say they are a one stop candle to commit too. The key trigger is the candle close above the hammer candle. We almost had that on Friday February 25th 2022. Look for a candle close above $0.20 in the next few days.

A very nice zone for a support bounce, and the next resistance comes in at the $0.335 zone.

The Planting Hope Company (MYLK.V) is an interesting one. Planting Hope develops, launches, and scales uniquely innovative plant-based and planet-friendly food and beverage brands. The brand family includes Hope and Sesame® Sesamemilk, RightRice® Veggie Rice, Mozaics™ Real Veggie Chips, and Veggicopia® Veggie Snacks.

Recent news highlighted strong forward guidance. Growth highlights include:

- Expanded Total Distribution Points (“TDP”) by an additional 2,767 retail facings across Hope and Sesame® (1,287 facings), RightRice® (1,450 facings), and Mozaics™ (30 facings).

- Launched 17 new products across three brands:

- Hope and Sesame® Non-GMO refrigerated sesamemilk, 48 oz bottles, three flavors.

- Hope and Sesame® Non-GMO shelf-stable sesamemilk, shelf-stable 1L cartons, six flavors.

- Hope and Sesame® Barista Blend.

- Mozaics™ Real Veggie Chips Non-GMO in sustainable NEO Plastics packaging, in 0.75 oz single-serving and 3.5 oz retail share-size bags, three flavors in each format.

- Veggicopia Greek Kalamata Snack Olives, 1 oz pouches.

- Added more than 40 new ecommerce listings on third-party online marketplaces.

2022 is all about continuing the expansion and momentum.

I would say the company’s flagship product is its Hope and Sesame milk, hence the ticker MYLK. This is the first commercially available sesamemilk globally following four years of product development and refinement to create a highly nutritious and truly sustainable alternative to dairy milk.

I’m someone who drinks almond milk and oat milk. The big thing against almond milk is there is literally no protein. This has been the challenge for me. I have switched to oat milk because the protein content is a bit higher. Planting Hope’s milk is more nutritious and sustainable than most almond, soy, nut and oat milk packing 8 grams of complete protein per 8 oz serving, all 9 essential amino acids, and an excellent source of Vitamin D and Calcium. Before Hope and Sesame® sesamemilk was introduced, only dairy and soy milks delivered COMPLETE protein, with all 9 essential amino acids needed for human nutrition.

The big question I have again is the earnings. The stock recently began trading, and an earnings report will give us a better sense of the fundamentals. My concern is with food inflation increasing, and people getting pinched with energy costs and pretty much inflation in everything else, will they continue to spend money on vegan/sustainable/plant based foods which are on average more expensive?

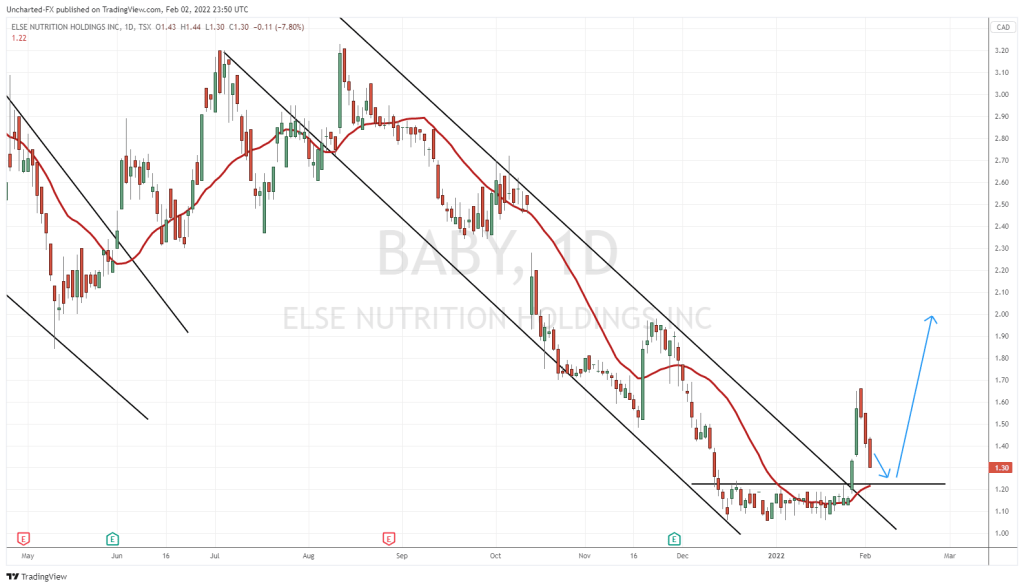

Putting those fundamentals aside, we cannot argue with the technicals. The stock had a nice breakout pop a few weeks after its IPO, hitting highs of $1.23. Since then, the stock has pulled back and range, but has created some important support and resistance levels for us.

Support wise the $0.85 zone is key. Look at that retest in late January of this year. To the upside, $1.15 is the major resistance zone. We have held below twice, and it looks like a third test is incoming.

I have drawn a triangle connecting the very lows and the highs. We had three touches to the trendline which just broke, so I consider this a breakout. Decent volume too with 136,000 shares traded which is more than the average volume. A move above $1.00 is important since it is a highly psychological number. For a further move higher, I would watch for a daily candle close above $1.15 which would confirm a new record close as well.

Technically, both charts look very decent. Great potential. A support bounce play and a triangle breakout play. The first earnings report will play a major role on the fundamentals. In this regard, Planting Hope will have an advantage given they are in retail. Don’t discount Plantable for earnings. I think the type of service they provide does have a large addressable market. I am eager to see how their earnings come out.