Continuing our series on how to trade Russia-Ukraine, today I will discuss Platinum and Palladium. Firstly, I want to address yesterday’s article. Some people did not like the idea of investing in defense contractors. That’s fine. I did not too, but I was giving you an analysis of why defensive spending will be important. A new arms race and western governments spending money on weapons means we are likely to maintain cheap money for longer. That the Fed will not be hiking aggressively. This is the real play.

Just to add to my analysis, after I wrote my article news came out that the Pentagon awarded three contracts worth more than $1 Billion to defense contractors. Two of the companies were highlighted in yesterday’s Market Moment post.

The agency awarded three contracts: $700 million to Lockheed Martin, $692 million to Northrop Grumman and $382 million to York Space for the Transport Layer Tranche 1. Each company has to deliver 42 satellites by 2024. A total of eight bidders competed for the three awards. The Space Development Agency (SDA) is building the Pentagon’s first-ever internet in space — a network of small satellites in low Earth orbit to support military communications, surveillance and tracking of enemy targets.

Fear not. There are other ways to play, including Agriculture and metals.

In terms of metals, Russia and Ukraine lead global production in Nickel, Iron, and Copper. They are also largely involved in the export and manufacture of other essential raw materials like neon, palladium and platinum.

Platinum and Palladium are worth your attention as Russia holds large supplies of both. South Africa is also at the top of the list. There are Platinum resources in North America, so where Russia and South Africa dominate would be Palladium. Both of these countries account for 85% of the total Palladium production. In the past, we have seen rises in Palladium with the Russian government announcing the halt of shipments.

In terms of mining companies, you can look at Anglo-American, but I would also look at Nickel miners, since Platinum Group Elements (PGE) deposits are found near Nickel deposits.

So what are Platinum and Palladium used for?

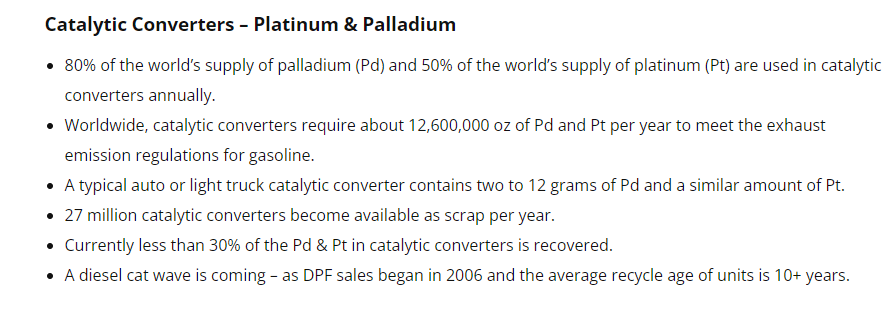

The biggest use comes from catalytic converters. Both metals have a jewelry component, Platinum has industrial uses, and Palladium is used for dentistry and electronics. But catalytic converters by far account for the largest consumption of these metals.

For those of you that do not know, Platinum and Palladium are used interchangeably (depending on the price of the commodity) in catalytic converters to lessen exhaust pollution emissions. I guess you can say they are green metals in a way. When prices of both metals were increasing a few years ago, my mechanic friends told me of situations where they came back to their garage only to see people under vehicles trying to steal the catalytic converters. Even at night, homeless people would be stealing converters in order to sell the platinum or palladium within. Now many mechanic shops have put up fences and camera’s in their lots to protect the old vehicles they have just sitting there.

We were bullish on Platinum with the breakout above $1000. A very important psychological number, and a nice resistance zone. Still remains the major support, and we are above a trendline too. Resistance remains at $1100, but a break above would confirm a second higher low in this new uptrend. I would also be watching where we are trading currently. Looks like a good area for support.

Palladium is reflecting the Russia news. As we just said, Russia and South Africa make up a large chunk of this market. We were bullish Palladium on the break above $1900. We formed our first higher low there. Now, we have a large support zone at $2200. Interim support comes in at the $2400 zone, where we broke out on Russia-Ukraine headlines. Resistance comes in at $2700, where we tested twice. Large wicks here.

If we can get a candle close above $2700, then we likely make all time record highs above $3000.

Right now, all the market is talking about is energy. Rightly so, but I think traders should be watching Platinum and Palladium as well as Agriculture, which I will cover tomorrow.