I am getting excited about Uranium again. Mind you, I am pretty much bullish on most commodities on the inflation trade. Add in geopolitical fueled supply chain disruptions and uncertainty and we have a winning combo. Commodities have been going HAM lately.

Uranium though has another fundamental catalyst. The push towards clean CO2 free energy (as Bill Gates has said, Nuclear is the best).

Sticking with geopolitics, the Uranium markets got quite the stir when the former Soviet Republic of Kazakhstan was seeing protestors hit the capital. Citizens showing their displeasure due to high energy prices among other issues. When it comes to Uranium production, Kazakhstan is the Saudi Arabia of Uranium. Kazatomprom is the Aramco of Uranium. The company accounts for 40% of the world’s global Uranium supply.

I am here to say that geopolitical issues may continue to put upwards pressure on Uranium. Yes, I am talking about the current situation in Ukraine. In fact, this hot spot could see all energy commodities spike if the situation escalates. This is what I am worried about as Germany seems to be the only country trying to de-escalate the situation. I am not seeing much diplomacy.

Russia is also very important when it comes to nuclear energy. Not only do they have stakes in exporting Uranium, they also build reactors, enrich Uranium, supply new Uranium, and dispose of used Uranium. For more info on how Russia is cornering this market, I highly recommend Marin Katusa’s book, “The Colder War: How the Global Energy Trade Slipped from America’s Grasp“. Definitely worth the read or reread given what is happening today.

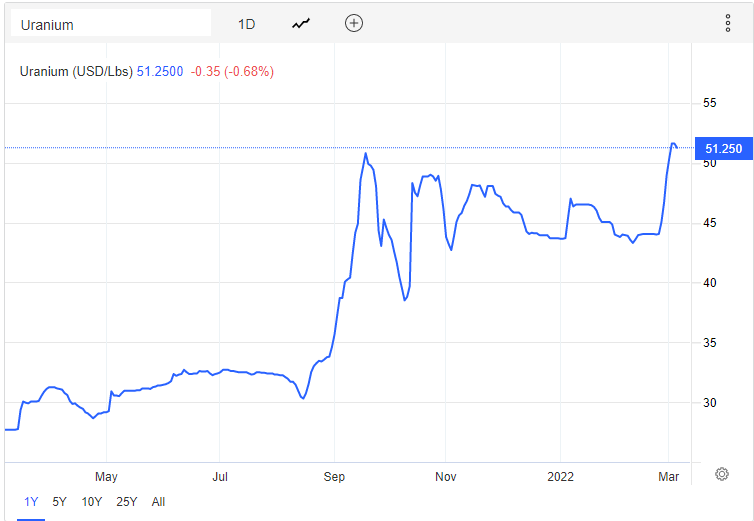

So knowing these fundamental catalysts are there, how do the technicals line up? Let’s take a look at a few Uranium and Uranium miner charts.

Starting with the spot Uranium chart from tradingeconomics, can somebody say breakout? There was a large support zone around $43, which has held up three times since November 2021. The chartist in me is a bit excited because I can draw a triangle pattern. Don’t worry, I will show you what I mean when I look at a chart I can pull up on tradingview down below. A downtrend line can be drawn connecting the tops. We broke that so a new uptrend has begun. But let’s speak about the MAJOR elephant in the room. We also broke above recent highs of $5130

On the longer term monthly chart setup, Uranium should have bulls excited! The breakout trigger above $40 was big. With recent geopolitical headlines, Uranium did not pull back to retest $40 before continuing higher. We just broke out higher. Perhaps the Fed raising interest rates, or the Russia-Ukraine situation resolving peacefully, can be the triggers to see Uranium pullback. More of the latter rather than the former. However, I think $50 is a very psychologically important zone. Just looking at the line chart above, we do seem to have some resistance up to $55.

I promised to show you that downtrend line, and this is what I meant. The Sprott Physical Uranium Trust (U.UN) is what I use to watch spot Uranium prices. The market structure and the technical set up is the same. The $11.50 zone coincided basically with our big $40 zone on spot Uranium.

Breakout, just as we see with spot Uranium. The dips are being bought, but there is a possibility of U.UN pulling back to retest the broken trendline before continuing higher. We have a nice support zone at $15, but as long as we remain above the broken downtrend line, things are bullish.

Cameco Daily Chart

Cameco Daily Chart

Canadian behemoth Cameco (CCO.TO) also broke above a channel pattern. Very similar to the trendline breakout. In this case, price has pulled back pretty aggressively to retest near the trendline breakout. Now it is about confirming our first higher low on this trendline breakout by taking out recent highs at $32.

For the longer term, Uranium remains in an uptrend. We expect to see higher lows and higher highs in the future, but prices could pull back to retest the breakout zone if geopolitical tensions cool down. Patience for our longer term plays. In this scenario, it may be prudent to pick up some junior Uranium stocks that have some catalysts, and have a basing chart, or have a chart that just broke out.

Enter Azincourt Energy (AAZ.V).

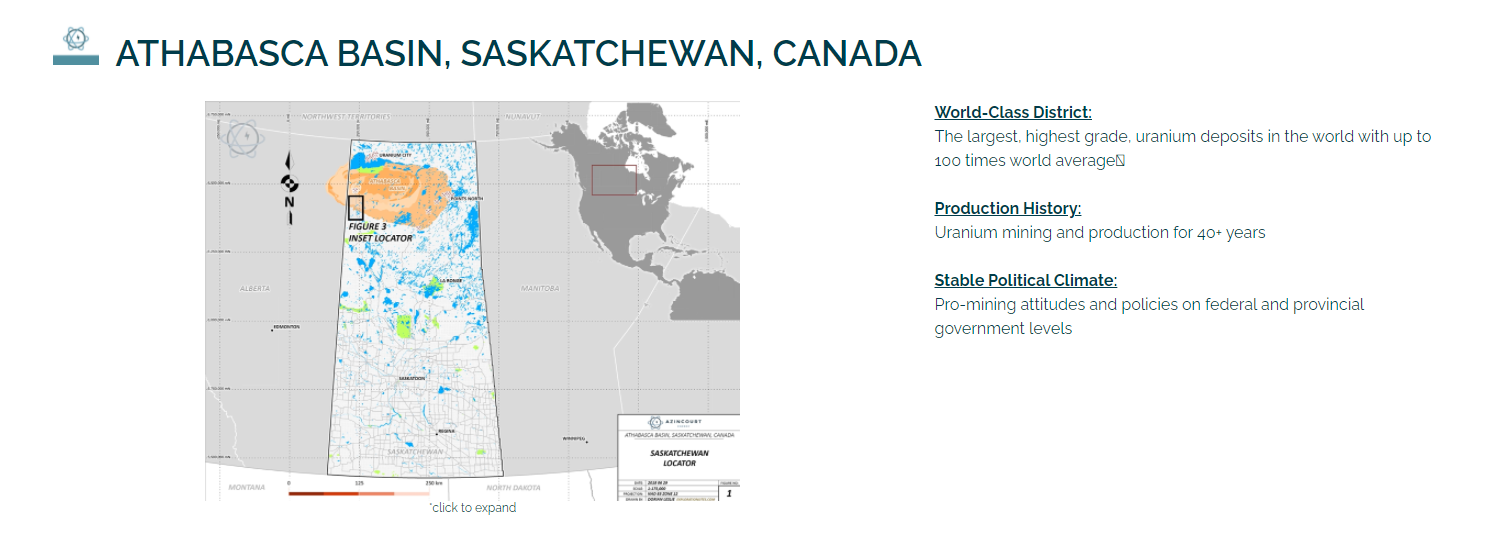

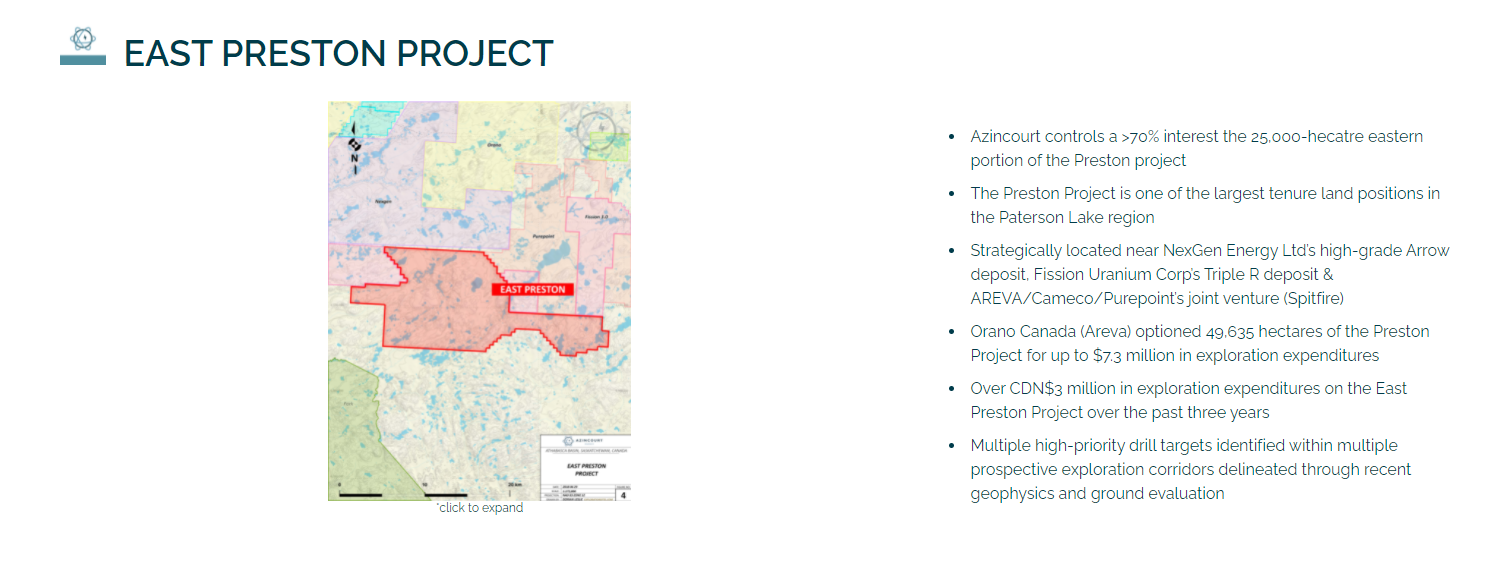

Azincourt Energy (AAZ.V) is a Canadian-based resource exploration and development company focused on the alternative fuels/alternative energy sector. The core projects are in the green energy space focusing on Uranium projects in the prolific Athabasca region. Good jurisdiction, and high grade Uranium. The place you want to be. Azincourt also holds lithium/uranium projects in Peru, on the Picotani Plateau. Currently, Azincourt is developing the East Preston uranium project, located in the prolific Athabasca Basin, with partners Skyharbour Resources (TSX.V: SYH) and Clean Commodities Corp (TSX.V: CLE) , and the Escalera Group lithium/uranium project in Peru.

Azincourt controls a majority interest (72%) in the 25,000+ hectare East Preston project as part of a joint venture agreement with Skyharbour Resources (TSX.V: SYH), and Dixie Gold. Three prospective conductive, low magnetic signature corridors have been discovered on the property. The three distinct corridors have a total strike length of over 25 km, each with multiple EM conductor trends identified. Ground prospecting and sampling work completed to date has identified outcrop, soil, biogeochemical and radon anomalies, which are key pathfinder elements for unconformity uranium deposit discovery.

Recent news provided an update on the drilling progress at the East Preston Uranium project.

Drilling at the East Preston Project commenced on January 24th, and to date, 1,334 meters has been completed in 6 drill holes. After some initial startup delays due to the extreme cold weather, two drill rigs are now operational on the project. Four drill holes are complete and two are in progress on the G-Zone. One drill rig is being moved to the K-Zone.

TerraLogic Exploration Inc. is executing the winter 2022 diamond drilling program under the guidance and supervision of Azincourt’s Vice President, Exploration, Trevor Perkins, P.Geo, and Jarrod Brown, M.Sc., P.Geo, Chief Geologist and Project Manager with TerraLogic Exploration. The program is planned for approximately 6,000m of drilling in 30-35 drill holes. Drilling will focus on the A-G and K-H-Q trends and commenced in the G-Zone where the 2021 drill program ended.

“It is nice to have the drills turning and core coming in,” said VP, Exploration, Trevor Perkins. “There were a few hiccups with startup due to extreme cold and the resultant impact on waterlines and equipment, but that is not unusual when working in this remote environment in the winter in Northern Saskatchewan. The drill program is now progressing well,” continued Mr. Perkins.

Technically, we have the similar breakout structure of Uranium stocks I talked about above. I would say the stock is heavily supported between the $0.05-$0.06 zone. Not that it matters now because of the trendline breakout. We did pullback to retest the breakout on March 4th 2022. Buyers stepped in, indicated by the green candle and the large volume. We have had volume in the millions in the past few days. Just yesterday, we saw 5,946,187 shares traded. 7 million on March 1st. Wow.

Note how back in September 2021, we ripped over 105% after breaking out above this zone. Let’s hope for similar price action on this breakout which based at the exact same support zone!

I like the risk reward here. The stock has been seeing some significant volume here in the past few days. The breakout and the retest has been confirmed. All that is left now is for a daily close above $0.085 and then we have our first higher low in this new uptrend. If we do manage to break back below the trendline, then the $0.05-$0.06 support zone is still very important. I would expect buyers to jump in there.

Investors are paying attention to this major zone and this stock. Azincourt technically is looking very promising as Uranium prices breakout!