There’s this ongoing joke here at Equity Guru that I am in LOVE with Silver. I don’t deny it. In this post, I will profess my love for the precious metal, and give a breakdown of the charts. Really exciting times.

Instead of going out for a Valentine’s date, I spent the money I would have used for dinner and wine to purchase a 1 Oz Silver coin from Cambodia. It is Cambodia’s first minted bullion and it is getting us collector’s going crazy. Here it is in all it’s beauty:

My Silver journey began in 2012 when I began buying the precious metal at around $32-35 CAD at the time. I was young at the time, and didn’t know much about financial markets at the time. I just believed all of those that were saying an economic collapse was going to happen. A few years later, I am more well versed in the Austrian School, understand Classical Economics and the Gold Standard, and have come to the conclusion that those contrarians back in 2012 were right, they just got their timing wrong.

After collecting Canadian Silver Maples and American Silver Eagles, I began a project, which for you new stackers, is not the best way to get into collecting Silver. I saw this video on world bullion and it inspired me:

I am a big fan of world history and precious metals so I thought this would be a great hobby and investment. For those that do not know, when the US confiscated Gold back in the day, any coins that were deemed collectables, or had numismatic value, were exempt. So in this way, I am ensuring my collection isn’t confiscated by the government if things get that crazy. Sounds far fetched? Ray Dalio in his new book has warned something like this could happen if the government wants to prevent money from leaving fiat currency.

Anyways, my favorite coin in the collection above is from the war torn country of Liberia. On one side, the Liberian coat of arms. On the other side, the duo of President George W. Bush and Dick Cheney.

My collection is going well, and for years I have been doing some Dollar Cost Averaging. Buying 1 or 2 coins for the collection per month. I said taking the global approach for the collection isn’t the best way because of the high premiums. If you are beginning to stack, I would go for 1 oz coins or bars that are backed by the country you live in.

For example if you are Canadian then Silver Maples, American then Silver Eagles, Mexican then Libertads, British then Brittania’s etc. This is because domestic mint coins tend to be cheaper than foreign mint coins. Although, recently I have seen South African Krugerrands going for a few dollars cheaper than Canadian Maples. Silver is Silver, so it is good to pay as little as possible. When Silver steals your heart, then you end up like me, and pay much higher premiums for 1 oz coins.

So why Silver and why now?

If you are a regular reader of my work here, then you know I believe commodities and hard assets are going to be the inflation trade. When people begin to lose confidence in the government, the central banks and the fiat currency, money will run into precious metals. Honestly, we could be seeing the initial signs of this. As a hard asset, Silver is the most undervalued. I do think prices could still drop with a stronger US Dollar, but that in itself will create problems with emerging market countries with large Dollar denominated debt. Also, if you are stacking, you will notice that physical silver prices really don’t change much because of the premiums.

The bears say Silver is an industrial metal. However, Silver correlates more with Gold, the precious metal, than it does with Copper, the industrial metal. Although that might not be seen now because the environment is great for all commodities. In my opinion, you get the best of both worlds, the industrial and the monetary.

When I say cheap, we refer to the Gold Silver ratio which historically has been between 15-16:1 when Silver was money. We are not at 78. I am not saying we will ever get back to historical levels, but with Silver being Gold’s little brother, I think there is a good chance the gap could lessen.

The precious metals markets are getting more attention for two reasons:

- Inflation

- Geopolitics

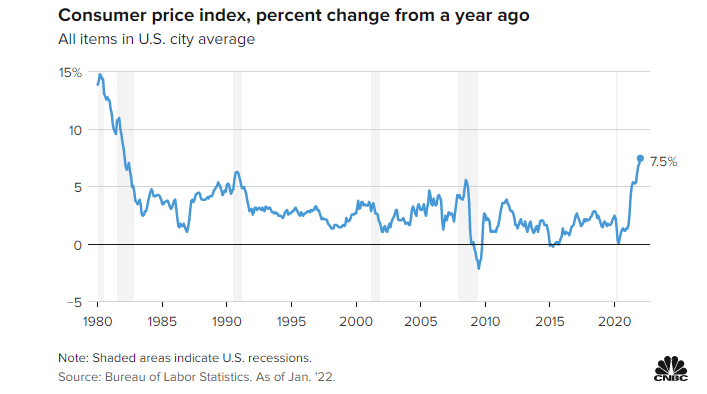

Last week, we found out inflation came out higher than expected. In fact, the highest levels seen since 1982 or forty years. The consumer price index for all items rose 0.6% in January, driving up annual inflation by 7.5%.

You hear things about supply chains being the cause of inflation. In reality, it is the central bank’s fault. We are now in a situation where there is more money competing for the same number of goods and services. Since 2008, a lot of the printed money has gone into assets and stock markets. Productivity was the key and is what differentiates now and back then when the Fed initiated QE during the GFC 2008. Inflation will be here to stay, and because of the amount of debt out there, a lot of contrarians do not think the Fed has the tools left in the tool kit to tame inflation.

The last bout the US had with inflation in the 80s saw Paul Volcker hike rates to 20% in a short period of time. Aggressive hikes like this would hit markets and consumers with large amounts of debt. Real estate would be hit too. Governments would also have to pay for interest on the money they are borrowing. In essence, a rate hike might be enough to initiate a recession as consumers slow down on purchases due to higher rates and due to inflation. Jerome Powell and the Fed really are in a tough position, but they cannot just come out and say everything is f’ed. So far, they have used the transitory inflation story, and the majority of the markets believe inflation will taper when supply chain issues are resolved mid 2022.

There could be a period of time when rates are rising by 25 basis points, the US Dollar is moving higher, but inflation continues to come in strong. If so, more of the market might be betting the Fed cannot tame runaway inflation. In this situation, we could see the Dollar, Gold, Silver, and Stocks all move up together. It will be crazy.

I’m betting on the debt. Gold and Silver are ways to preserve my purchasing power, and I consider it as insurance.

The geopolitical side doesn’t need much explanation. Reports out on Friday that the US believes Russia will invade Ukraine. Even telling American citizens to leave Ukraine. The scary thing is, that when this article is released, maybe the Russians have moved in. But at time of writing, nothing has happened. Personally, I don’t think anything will. The President of Ukraine is telling the West to stop the fear porn, and to be honest, this seems like a distraction from inflation and other issues happening domestically. Which actually gets me even more bullish Silver due to the confidence ciris. But nonetheless, this kind of geopolitical tension headlines and uncertainty really will get money interested in Gold and Silver. If there is a war, it doesn’t matter which side wins because Gold and Silver are always money in any regime. With geopolitical headlines, Silver performed really well on Friday.

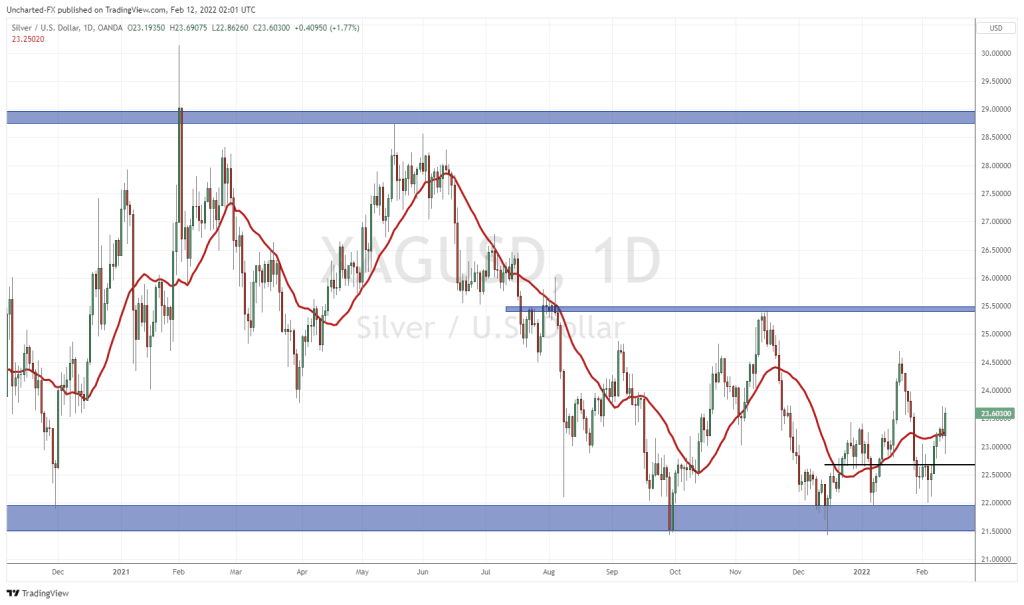

My bullish stance on Silver remains. If you are a member of our Discord group, I highlighted the range two weeks ago. This $22 zone is HUGE support going back to 2020. Silver has bounced above this zone six times since 2020, and if we were ever to break below, I would have to re assess. Although, as I said earlier, there is a possibility Silver prices can fall on a rising Dollar. Especially if the geopolitical fears blow over.

The range was broken on February 7th 2022. We went long on the break. Rode the momentum and took some profits. Technically, I am expecting another leg higher as long as Silver remains above $22.70, which is the breakout zone. I have an interim target around $25.50, and if that breaks…we will be making a run to $29.

So I am relatively bullish, but understand that things can reverse if nothing dramatic happens in Europe. I still suggest buying physical Silver rather than trading the paper contracts. Paper contracts is not for everyone, and Silver does trade with a lot of volatility. The inflation trade won’t be going away, and I am sure there will be more future geopolitical tensions not only from Russia, but with China too. Keep on stacking apes.