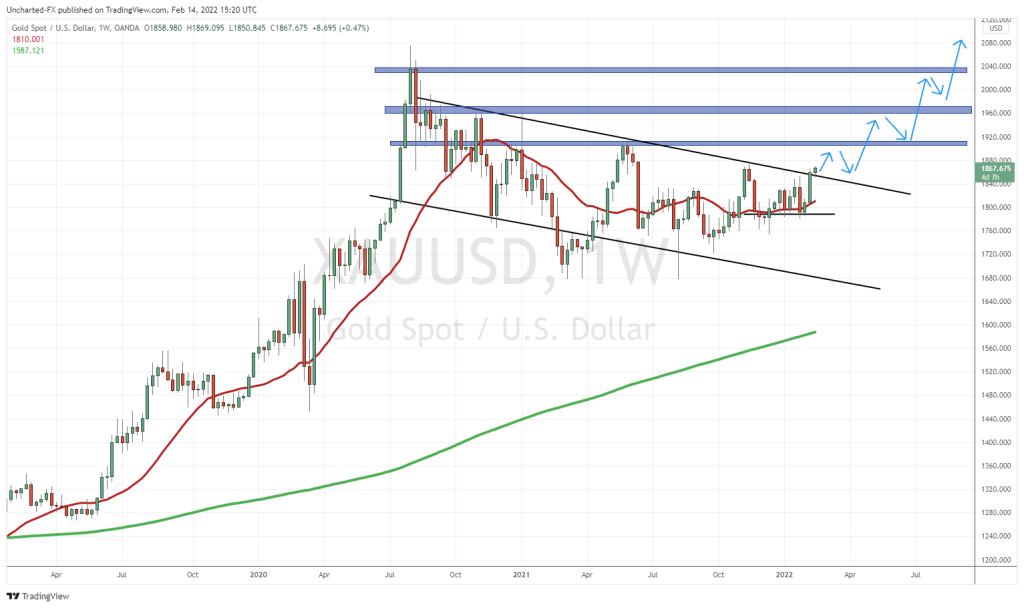

Are you a Gold investor? If you are, last week was very exciting. Oh, and you probably came across tons of precious metal investor tweets and Youtube videos showing you this major breakout:

Above is the weekly chart of Gold vs the US Dollar. Yes folks, Gold did close above our major trendline, confirming a flag pattern, but others have drawn it as a triangle. The key takeaway is that the upper trendline broke. Gold confirmed a close on the weekly, which means that we will eventually run to create all time record highs in this new leg up.

The geopolitical tensions in Eastern Europe is what got Gold going. The safe haven trade. If a war breaks out, Gold is always money regardless of who wins the war.

Now this is where I might tick off some of the Gold bulls…but I am not getting too excited on this breakout just yet. Firstly, I don’t really like the weekly close. To be honest, I wanted to see a breakout candle extend higher rather than just barely closing over the trendline. Secondly, I want to see how this week plays out. We are likely to retest the breakout. We actually already have, but I expect it can happen again before this week ends. What I want to see is another strong weekly close ABOVE our trendline this week. Of course if we close below, then we have a fake out. If geopolitical tensions fizzle away, Gold might not rally.

But don’t worry, it isn’t just about geopolitics.

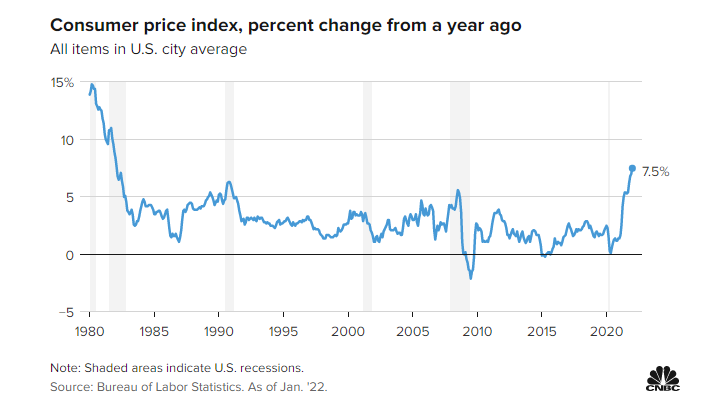

If you expect inflation to be persistent, and will not be temporary as the Fed says, then you want to be in Gold. It should be noted that Gold and Silver aren’t supposed to make you rich during inflationary periods. Holding the metals are supposed to protect your PURCHASING POWER. This is something important that not many new stackers understand. It is almost like an insurance for your money and wealth.

I have one fear right now regarding the Gold and Silver prices: the US Dollar. I do believe the Federal Reserve will hike interest rates. Multiple times. How many? Well, Fed President’s keep flip flopping, but I think they will take rates up to 0.75%-1.0%. Of course the Dollar would get a bid, and when this happens, Gold tends to drop. Gold would also feel the pressure on rising yields…although currently, yields are rising and Gold is rising, but this could be explained by the safe haven trade due to geopolitics.

Here is what I think could play out this year: The Fed begins to hike rates in March. Not sure how many hikes they pull off, but in Q3 2022, the Fed may be forced to cut rates because they have triggered a recession by hiking. Too much debt, and consumer’s slow down purchases to save money. Not to mention that inflation does not lessen. If the Fed is forced to cut rates due to a recession and stress in the system, it would be a confidence crisis.

Interestingly enough, Fed President Bullard this morning hinted at a confidence crisis by saying the Fed’s credibility is at stake here, and the Fed needs to ‘front load’ rate hikes.

Going back to my weekly Gold chart, I have levels marked out. They are $1910, $1970 and then $2030. The $2030 is self explanatory. Once we get a weekly close above that, we are making new all time record highs.

$1910 and $1970 are some near term resistance levels we will likely see in the upcoming weeks and months. I would like to see Gold hit $1910 before the Fed rate hike on March 15th. Perhaps from there, is when Gold begins to pullback once again to retest our broken trendline, before bouncing and heading to $1960.

I have laid out my trajectory in the chart above…and the trigger for a larger move into record high territory is just speculation on my part for now. But either inflation continues to rise, getting the markets to realize that the Fed’s 25 basis point hikes won’t be enough to deal with it, or the Fed is forced to cut rates later on this year due to a recession caused by hiking rates, leading to a confidence crisis.

Whatever comes, Gold and Silver are poised to have an exciting year. The Gold technical breakout is getting a lot of people excited, but my excitement levels will be determined on whether Gold can confirm another weekly close above our breakout level this week. It’s looking good so far, but Gold has gotten us bulls excited before, until the price drops off, neutralizing the breakout. They say the most dangerous words in investing are “this time it is different”, but with inflation hitting levels not seen for 40 years, and geopolitics heating up like never before…it does seem like things are different.