Problematic Psychedelics?

Psychedelics and mental health treatment go together like orange juice and toothpaste. That’s what I would have said five years ago. Prior to the publication of multiple peer-reviewed studies, I adamantly believed psychedelics would melt your brain. In retrospect, that belief is just about as bogus as going to hell for premarital hand-holding.

In reality, the more commonly known serotonergic psychedelics LSD, psilocybin, and mescaline are not known to cause brain damage and are classified as non-addictive. Furthermore, numerous clinical studies have demonstrated that psychedelics do not cause long-term mental health problems. In fact, adverse effects of psychedelics are usually short-lived, with serious psychiatric symptoms typically being resolved within 24 hours.

Let’s talk about monkeys. In 2004, a study published in Behavioural Pharmacology investigated the capacity of several hallucinogenic compounds related to self-administration behavior in rhesus monkeys. The researchers presented one group of primates with a lever that, when pressed, would inject them with a dose of a hallucinogenic compound derived from certain mushrooms, otherwise known as psilocybin.

In addition to the first group, the second group of primates was hooked up to levers that injected a placebo. Here’s the kicker. In similar experiments, monkeys have been known to repeatedly press levers that inject substances such as heroin, cocaine, and MDMA. On the contrary, when it came to psilocybin, on average, monkeys were no more prone to self-administration than placebo.

When it comes to humans, serotonergic psychedelics like psilocybin are not known to cause damage to the brain or other organs of the body. Moreover, substances like psilocybin have not been known to cause withdrawal symptoms or elicit addiction. According to the National Survey On Drug Use and Health, of 130,152 respondents, 21,967 reported lifetime psychedelic use.

That being said, of this demographic, there were no significant associations between lifetime use of any psychedelics, including psilocybin, and an increased rate of mental health outcomes. Quite the contrary, psychedelic use was associated with a lower rate of mental health issues in several cases. With this in mind, every new publication in support of psychedelics for mental health accelerates the growth of the psychedelics sector.

From an investor’s perspective, there’s no shortage of psychedelics companies looking to capitalize on this market, which is expected to reach USD$10.75 billion by 2027, up from USD$4.75 billion in 2020. However, that’s not to say every psychedelics company out there deserves your investment. Some companies are simply in it for the money while others actually bring value to the table. Let’s take a look at a company that’s in the market for the right reasons.

Filament Health Corp.

- $28.009M Market Capitalization

Filament Health Corp. (FH.NE) is a clinical-stage natural psychedelics drug development company driven by the belief that safe, standardized, naturally-derived psychedelic medicines can improve lives. With this in mind, the Company is building a comprehensive platform to support the treatment of mental health conditions through the administration of natural psychedelic drug candidates into FDA authorized human clinical trials. That’s quite the step up from monkeys.

As previously mentioned, numerous studies have been conducted in support of psychedelic use for mental health treatment. To be more specific, there are over 130 active clinical trials globally advocating for the use of psychedelics as an alternative to the USD$280 billion spent on mental health treatment in North America.

With this in mind, Filament Health recently received FDA authorization for a Phase I trial evaluating the efficacy of the Company’s drug candidates PEX020 and PEX030 against PEX010, Filament’s botanical psilocybin drug candidate. In addition to Filament Health’s Phase I trial, the Company received Health Canada approval on January 31, 2022, for a Phase II clinical trial using PEX010.

Furthermore, Filament Health holds a unique position in the plant medicine sector, which is expected to reach a value of USD$40 billion in 2022. Dollar value aside, plant medicine accounts for 40% of western-world pharmacy products, including the top 20 best-selling prescription drugs in the United States (US). Additionally, 42% of all new drugs from 1981 to 2019 have come from natural origins.

Trade Secrets

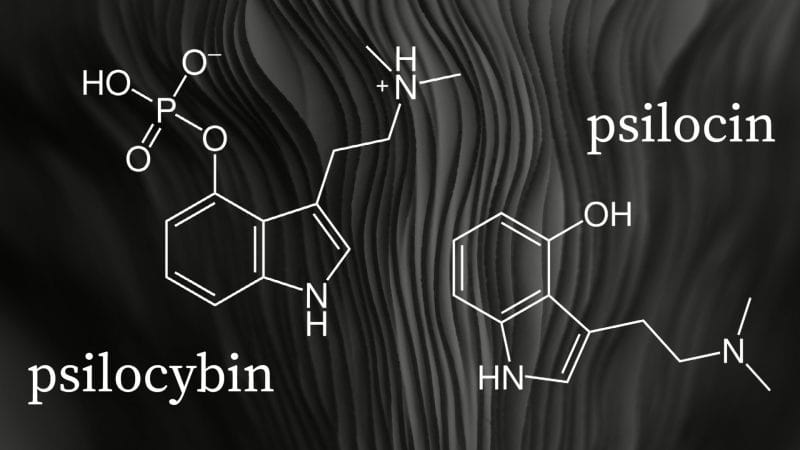

Psilocybin is a prodrug, a compound that metabolizes after administration, that is converted into the pharmacologically active compound psilocin in the body. However, manufacturing stable synthetic psilocin is incredibly difficult. As a result, psychedelic companies to date have instead focused on developing alternative synthetically-derived compounds.

Not Filament Health. Impressively, the Company has developed its own proprietary technology capable of producing stable, natural psilocin in addition to psilocybin. Furthermore, through Filament Health’s wholly-owned subsidiary Psilo Scientific Ltd., the Company operates one of the first GMP facilities in the world to also have a Health Canada Dealer’s License.

These certifications enable Psilo Scientific to supply in-house trials and distribute the Company’s Intellectual Property (IP) and drug candidates to drug developers, researchers, and other licensed parties, generating near-term revenue for Filament Health.

Aside from the Company’s own clinical trials, Filament Health has also partnered with leading researchers worldwide and commits to low or no-cost study drugs for academic researchers. To date, the Company has partnered with EntheoTech, Cybin Therapeutics, and the University of Toronto, in addition to other withheld sponsors.

While naturally-occurring compounds cannot be patented, Filament Health’s IP strategy is focused on developing and protecting the Company’s technology capable of converting natural compounds into pharmaceutical-grade products. With this in mind, Filament Health is the first company to be issued a patent for the extraction of natural psilocybin, positioning the Company to receive additional patents covering other elements of its proprietary technology.

Latest News

Most recently, on January 31, 2022, Filament Health announced that Health Canada has approved a Phase II clinical trial utilizing the Company’s PEX010. To be more specific, Cybin Therapeutics has licensed the Company’s PEX010 for use in an upcoming clinical trial including individuals with Major Depressive Disorder (MDD) who are undergoing serotonin reuptake inhibitor (SSRI) therapy, as well as those who are SSRI-naive. For more details, check out this article!

Previously, Filament Health and Cybin Therapeutics announced an initial licensing agreement on January 14, 2022, whereby Filament Health will license PEX010 to Cybin for two upcoming Phase II clinical trials addressing depression and Alcohol Use Disorder (AUD) with an additional two trials planned for 2022.

In addition to Cybin, on November 18, 2021, Filament Health announced an exclusive licensing agreement with EntheoTech Bioscience Inc. For context, EntheoTech is a bioscience company focused on the research and development (R&D) of formulas to support opioid tapering and treatment for chronic pain, depression, and other mental health conditions.

According to the terms of the agreement, Filament Health will exclusively license PEX010 to EntheoTech for two upcoming clinical trials addressing opioid use for chronic pain and depression. Additionally, Filament Health will co-develop psychedelic drug candidates derived from mushrooms grown from EntheoTech’s proprietary spore library.

If that wasn’t enough, on November 2, 2021, Filament Health announced FDA authorization to initiate the first clinical trial utilizing naturally-sourced psychedelic substances. This also represents the first approval for the direct administration of psilocin, namely Filament Health’s PEX010, PEX020, and PEX030, opposed to psilocybin. The Phase I trial will be led by the Translational Psychedelic Research Program (TrPR) and the University of California San Francisco (UCSF).

Aside from the Company’s numerous clinical trials, Filament Health’s wholly-owned subsidiary Psilo Scientific Ltd. was recently added to Health Canada’s list of licensed psilocybin producers. This list is intended to support researchers looking to access psilocybin for use in clinical trials in Canada and practitioners requesting psilocybin for emergency use treatment of a patient under the Special Access Program (SAP).

“Our inclusion in this list will aid us in adding to our growing number of partnerships in the Canadian psychedelic ecosystem…We commend Health Canada on their continuing support of the SAP and of scientific research into psychedelics,” said Benjamin Lightburn, Chief Executive Officer of Filament Health.

With this in mind, through multiple agreements, Filament Health is able to drive revenue even before having completed its own clinical trials. For example, regarding the Company’s licensing agreement with EntheoTech, the company will pay Filament Health a total consideration of $525,000 based on the achievement of certain milestones. As for Cybin, there’s surely a pretty penny involved, however, the financial terms have not been disclosed.

Financials

Speaking of financials, according to Filament Health’s Q3 2021 Financial Results for the three and nine months ended September 30, 2021, and 2020, the Company had cash and cash equivalents of CAD$6,444,291 on September 30, 2021, compared to CAD$847,430 on September 30, 2020.

As of September 30, 2021, Filament Health had total assets and total liabilities of CAD$19,897,056 and CAD$1,248,127, respectively. For the same period in 2020, these numbers translate to CAD$881,561 and CAD$67,917, respectively.

Since going public, Filament Health’s expenses have increased substantially, which is to be expected especially for a clinical-stage company in the psychedelics sector. For the three and nine months ended September 30, 2021, the Company’s R&D expenses were CAD$176,403 and CAD$434,863, respectively.

With this in mind, R&D is pivotal in markets where the discovery and development of medicines can make or break a company. For example, in the pharmaceuticals market, many companies invest a sizeable portion of their revenue into R&D. To be more precise, on average, pharmaceutical companies spent over 25% of revenue on R&D in 2018 and 2019. Now, let’s apply this number to a hypothetical revenue for Filament Health.

According to Filament Health’s Q3 2021 Financial Results, the Company did not report revenue. However, shortly following the Company’s Q3 2021 results, Filament Health announced various licensing agreements with EntheoTech and Cybin. While the financial details of the Company’s agreement with Cybin remain undisclosed, we know that EntheoTech will pay $525,000 to Filament Health based on the achievement of certain milestones.

That being said, if we assume Filament Health’s current revenue to be $525,000, which it isn’t, and take into consideration the Company’s R&D expenses of CAD$176,403 for the three months ended September 30, 2021, Filament Health would have invested approximately 33% of this imaginary revenue into R&D during this period. That’s pretty darn close to the pharmaceutical sector’s comparable 25%, and this doesn’t even take into account the Company’s other potential revenue streams.

Moving on, as of September 30, 2021, Filament Health had 164,756,869 issued and outstanding shares. Coming up, on February 22, 2022, 500,000 stock options at an exercise price of $0.30 will expire. Supported by multiple licensing agreements, unique IP, and various Health Canada approvals, Filament Health is a psychedelics company with some substance to it.

Personally, I am interested to see how Filament Health’s revenue shapes up now that it has established licensing agreements, been approved by Health Canada for various clinical trials, and was added to the list of licensed psilocybin producers available through the SAP. The Company has clearly done its homework, now let’s see if the fruits of its labor come to fruition.

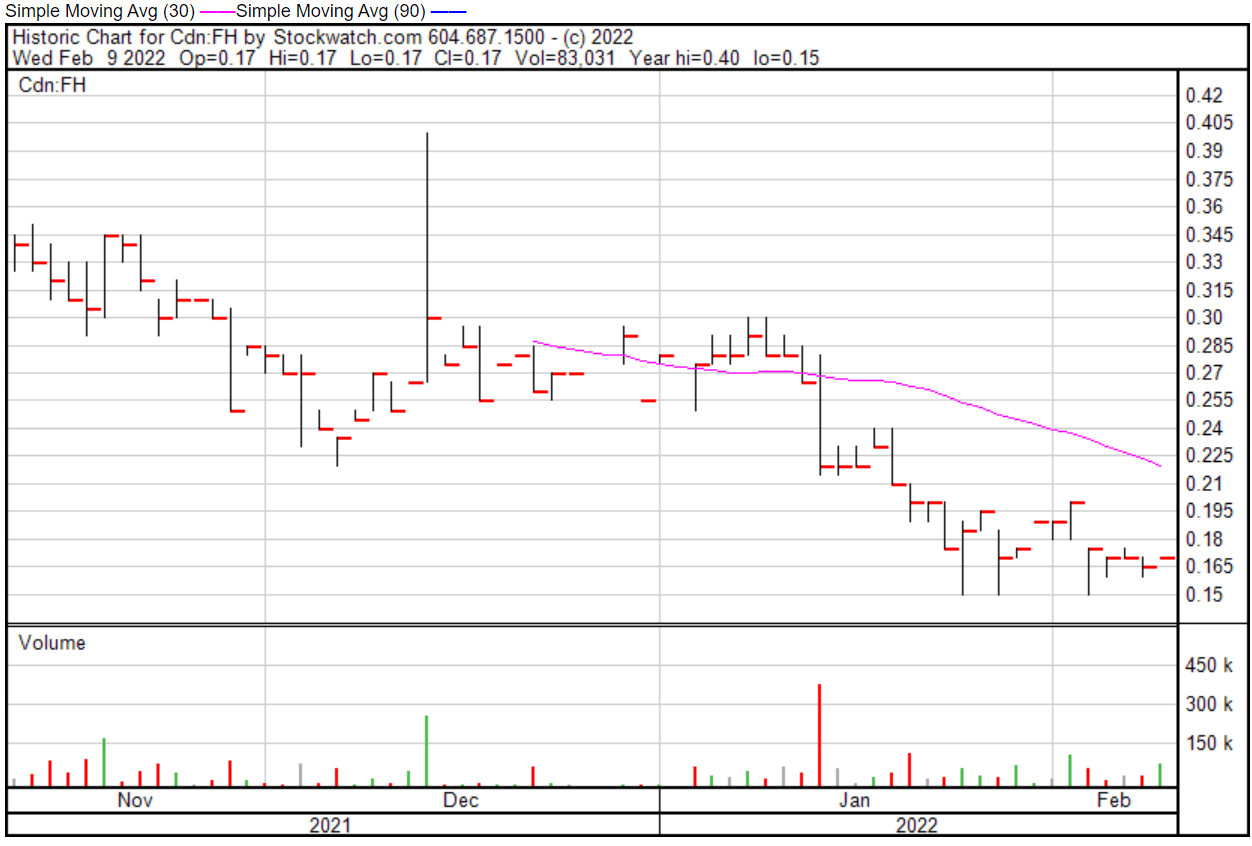

Filament’s share price opened at $0.17 on February 9, 2022, up from a previous close of $0.165. The Company’s shares are up 3.03% and were trading at $0.17 as of 11:52 AM EST on February 9, 2022.

Full Disclosure: Filament Health Corp. (FH.NE) is a marketing client of Equity Guru.