Wild day for stock markets as the sell off continues. Major support zones and channels have been broken. To me, the uptrend is over for now, and I expect more downside. The hope for bulls is that when we retest the breakdown zones, we close above them and confirm a false breakout/ fakeout.

What’s the fear from? Two things come to mind. I won’t speak much about the first. I suggest you check out my Market Moment article today for that. Oil related, and the markets could be sensing some fear due to the situation in Russia. The other reason? A hawkish Fed raising interest rates.

Not necessarily due to a strengthening economy. As we have seen, US retail sales and employment for the month of December came in with big misses across the board. Can the Fed hike in a weak economy? The reason it seems is to curb inflation. The catch is the Fed previously stated inflation was due to supply chain problems and not monetary policy. Now, Fed presidents are changing their tune but are low key about it. Nobody is asking how a rate hike will fix supply chain issues. The truth is the Fed knows it is because of easy money policy.

Can the Fed tame inflation? We will have to wait and see. The $1,000,000 question is how many times can the Fed hike before breaking governments and consumers who are loaded with debt. This is the situation many Western nations are facing. Are we like Japan, Switzerland and the EU who cannot raise rates cause it would cause the financial system to basically implode? If so, obviously the Fed or the Bank of Canada will tell you this.

Ray Dalio has written extensively about this in his new books. He’s a fan of Gold because he thinks it is the best currency out there. A currency that cannot be tampered with by central banks. Honestly folks, it seems very likely central banks will inflate currencies as they are running out of tools in their tool kit. I think you want to be in Gold and Silver.

As my readers know, I prefer the physical stuff and my royalty and streamers. But I do think a few juniors should be in your portfolio as well. Focus on those that are in good jurisdictions, experienced management with a track record of success, and highly prospective areas. Oh and being a technical analyst, I like to look for based stocks. Because the chance of a breakout and a new uptrend is higher.

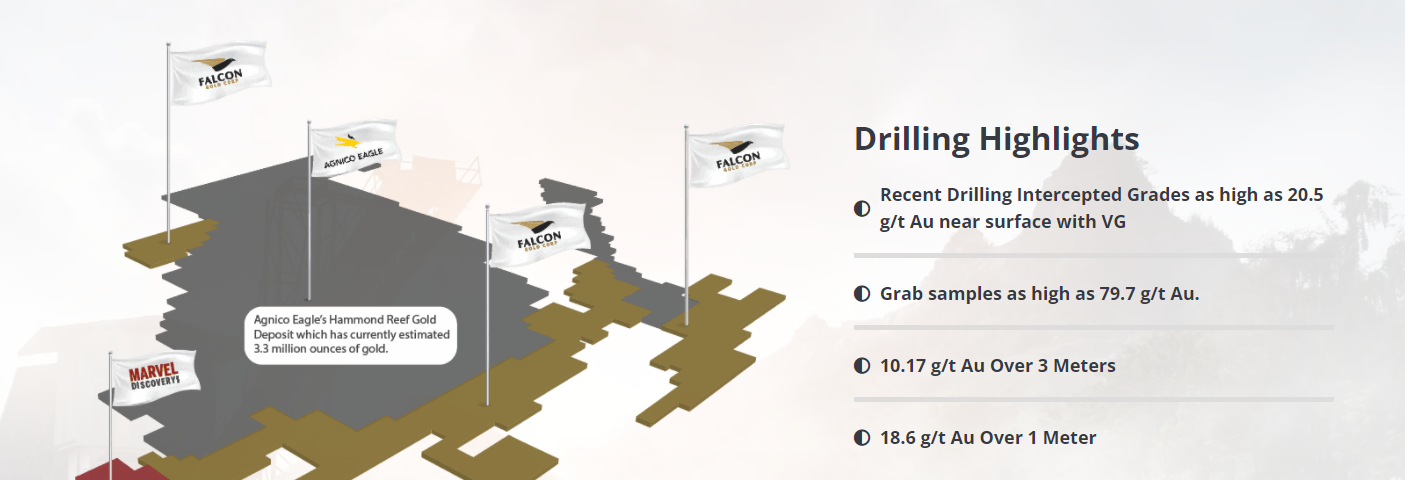

Falcon Gold (FG.V) fits the bill. The company acquires, explores, and advances quality mining projects in the Americas. Their assets are in Canada, Chile and Argentina with their flagship project being Central Canada and bordering Agnico Eagle Mines 4.6 million ounce Hammond Reef deposit.

This is the one thing I like about Falcon Gold. The majority of their properties are next to large proven deposits. Which means the veins could extend onto their land. Creates an exciting prospect for great drill results. Major catalysts for the stock price. The hope is one of these assets hits something big and more drilling begins to unveil a resource. Then, perhaps a larger miner jumps in with a joint venture, or just straight up buys the asset.

I still am bullish Gold above our breakout around $1800. We cannot make any recent highs, and a pullback is looking likely. But I must say, Gold has held up really well considering the US Dollar strength and rising yields. Yields are going crazy, and I was expecting Gold to drop. This is definitely saying something. Either Gold is that inflation trade, or the markets are not buying multiple rate hikes this year. Time will tell.

Silver has been the real hero. On a day when stock markets were dropping, Gold was red, Bitcoin was red, the Dollar was rising, and yields spiked and the VIX spiked…Silver was up nearly 2% for the day. Acting like the real safe haven. But honestly, I think it is because of the technicals. We have bounced at such an important major support zone. The close today confirmed a major breakout of a double bottom pattern. Really like what I am seeing here.

If these metals continue to move higher, it will be great for precious metal traders. Miners, junior miners, project generators, ETFs (GLD, GDX etc) and Royalty and Streamers are correlated to the price of the commodity. The move in the junior space is where the real gains can be made.

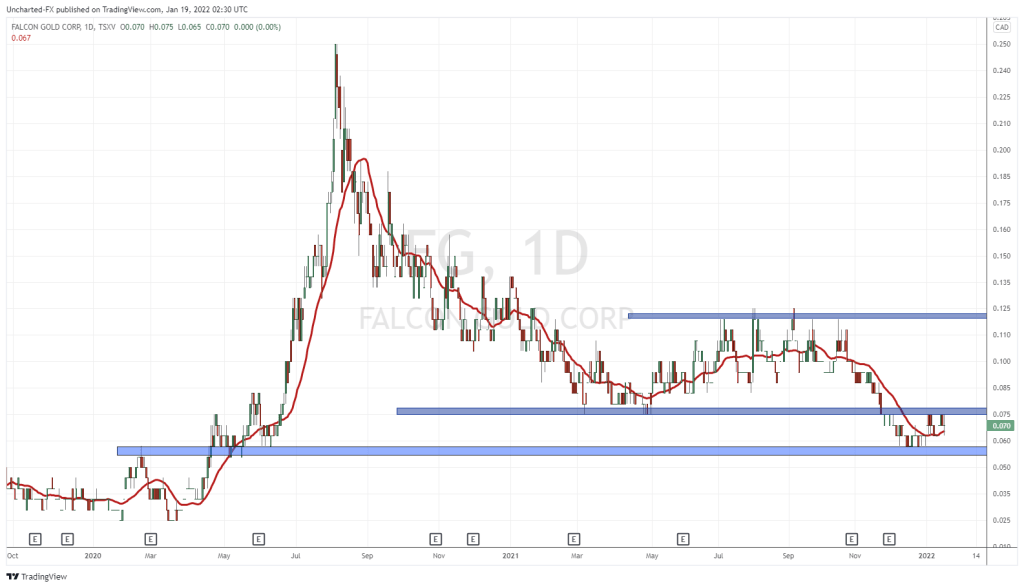

I am seeing some positive things here on the Falcon Gold chart. A new uptrend could be in the works.

First off, major support has been tested. When a stock is in a downtrend, I want to see multiple swings and prices to hit what I call a flip zone. Basically an area that has been support and resistance multiple times in the past. $0.055 fits this bill. Falcon Gold hit this support, and began to range here.

Now, the breakout zone is $0.075, which we attempted to break in the past few days. What I am seeing is the infamous cup and handle reversal pattern. Price has flipped over my moving average, and things are looking great. But I must stress, we need that close above $0.075 to trigger the breakout and the cup and handle pattern.

Watch for this breakout with a nice green candle and good volume. January 14th 2022 saw half a million shares traded. The stock sees decent volume consistently.

With the prices of Gold and Silver holding on and likely to increase given the large macro picture, a stock that is based and is ready to print a reversal pattern, is put at the top of my watchlist. $0.12 would be the first target. A large percentage gain from where we are currently. Then, we will be watching for the major breakout above $0.12, which would then have us targeting previous record highs.