A lot of action on the charts. Positive action if you are a trader. A great week with technical levels being broken and triggered. This Market Moment will have a lot of charts.

Let’s start with the big data today and tie that in with things going forward. Inflation. Are you sick of it yet? Well, don’t be because you will see more of it. Another record inflation reading for the US. Inflation came in at its fastest 12-month pace in nearly 40 years during December. The consumer price index, a gauge that measures costs across dozens of items, increased 7%. The annual move was the fastest increase since June 1982. Excluding food and energy prices, core CPI increased 5.5% year over year and 0.6% from the previous month.

The Fed retired the word ‘transitory’, but have told the markets they expect inflation to come in hot until mid 2022 before tapering off. They blame this on supply chain issues. Going forward, when inflation data comes out higher, headlines may force algos and traders into assets such as precious metals and commodities. Stocks tend to do well in an inflationary environment as it offers the best yield. The big risk factor comes from the Federal Reserve. As we get closer to mid 2022, and inflation data continues to come in hot, the markets may begin to think the Fed is losing control of inflation. Which means that they would have to hike interest rates much faster. Not great for a stock market that is propped up by cheap money policy.

I wanted to transition from rate hikes to Powell yesterday, but before I do, a quick comment on inflation. At the beginning of the year, a few Fed President’s came out stating rate hikes would have to come this year in order to get ahead of inflation. Remember the Fed telling us inflation is here because of supply chains and NOT their monetary policy ie printing a boat load of money? Well, nobody is really explaining how rate hikes would help solve the supply chain issues. The fact is inflation is high because of the Fed’s policy. More money but productivity has not gone up. There is more money competing for the same number of goods and services.

Anyways back to Powell. Yesterday, Fed Chair Jerome Powell testified to congress. A chance for US politicians to ask him questions…and really, to gain some brownie points with their constituents looking all cool and asking the hard questions. I have stopped listening to them because they aren’t about monetary policy anymore. The majority of the testimony is all about climate change and even race. The Fed chair politely reminds politicians that the Fed deals with monetary policy, and those issues are things the government is meant to deal with.

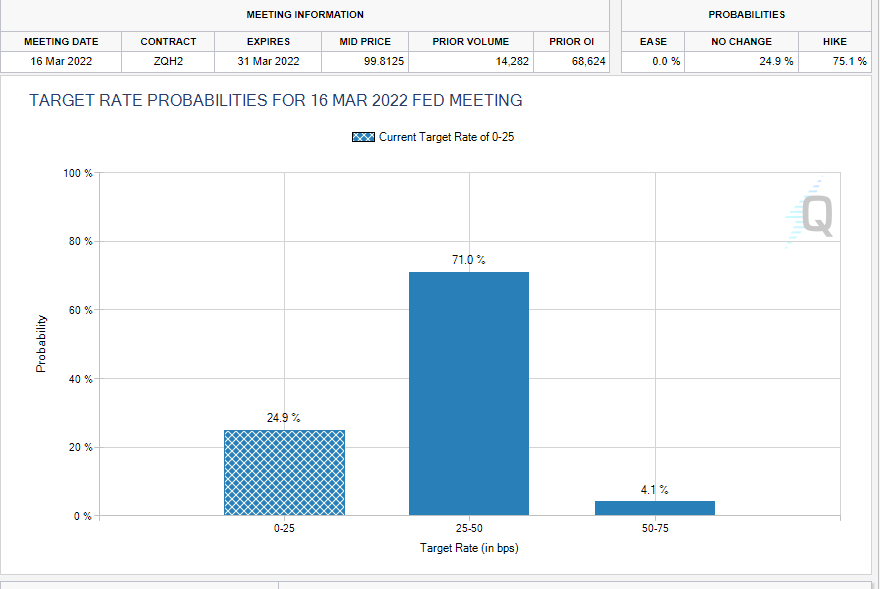

But I digress. When Powell did speak about tapering and rate hikes, he curbed his hawkishness. And the stock markets loved it. He did not say anything about a rate hike being concrete in March 2022, although we expect the Fed will have to given the market is expecting a 25 basis hike. No timeline for hikes, but Powell successfully portrayed that the Fed wants to move away from expansionary emergency policy to a restrictive stance attempting to cool off an overheating economy. In a way that reduced near term risk.

A rate hike probability still stands at 75%, but let’s see if that reduces as we approach March. There is a lot of time from now until March. Anything can happen to change the Fed’s stance. It would be particularly on the pandemic side. US hospitalizations are overflowing again hitting record highs Covid cases in the US. I still remember how the media ripped on President Trump for not shutting down the country because hospitals were overflowing. Let’s see if they take the same stance here with President Biden. That would certainly get the Fed to kick the rate hike down the road.

The US Stock Markets liked what Fed Chair Powell had to say. Technically, we have bounced from our channel to the dot. As long as this channel holds, we are in an uptrend. Yesterday’s daily candle reclaimed support (what was acting as resistance) of 4705. Stocks are bullish above this zone. Now we are looking at testing previous record highs.

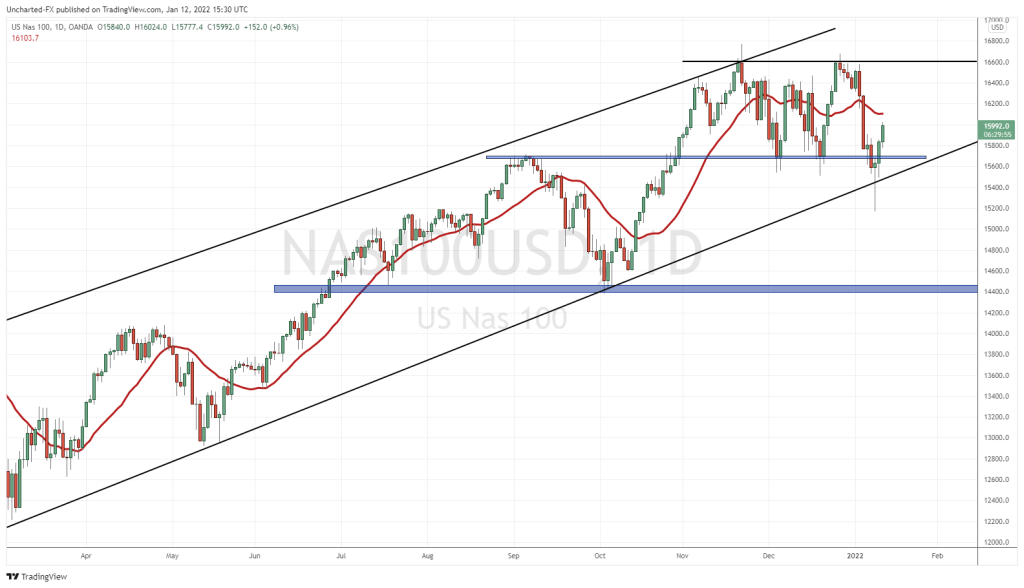

The Nasdaq is one we can go long on after yesterday’s candle close took out Friday’s high. The support breakdown has been nullified, and we remain above our channel. 16,600 is the upside. We break that, and we make new record highs.

The Russell 2000 is another chart I am liking for the upside. We held support at the huge support zone at 2120. A support which has been held since March of 2021. One that if broken, would have initiated a new downtrend.

The previous two day candles displayed large wicks. But today’s daily candle is looking a bit iffy. We have given back all of the overnight move. The Russell tends to lead the major markets, so let’s see if the S&P and the Nasdaq follow.

I nestled my stop loss below 2120, and will add on the breakout above 2280.

Now this is one of the most important charts for traders. The 10 year yield. We broke above 1.70%, and just like technicals on any other market, we have pulled back to retest it. If we bounce from here and continue higher, the stock markets will feel some pressure. We want to see a breakdown. It would also indicate the markets pricing in a more dovish Fed, meaning not pricing in 3 or 4 hikes this year.

The US Dollar is finally breaking the range it has been in since November 2021. Another sign markets are pricing in a somewhat dovish Fed. If you are a precious metals trader, you are liking this. In fact, overall this is great for commodities in general.

Oil continues to rally. We remain bullish above $75. It does look like we will be taking out recent highs around $85 this year. Analysts are expecting $100-$125 a barrel by the end of 2022. This could be an inflation trade, as I maintain commodities will do well. Or, it could be OPEC plus propping prices higher. We saw President Biden and a few countries try to lower Oil prices by releasing reserves. Looks like it didn’t work.

In summary, stock markets have held major support zones. Just a few days ago, we were worried a new downtrend would begin if we closed below our channels. This can still happen of course, but right now we are sitting nicely above the channels. Keep an eye on rates. What that 10 year yield does will be super important to know whether the market is pricing in multiple rate hikes or not.