Bitcoin and Ethereum acting as I laid out in last week’s Market Moment covering the cryptocurrencies. Bitcoin has hit its support, while Ethereum battles at $3000 but a major support still sits below. Just want to mention how yesterday’s Market Moment on stocks was bang on. The Nasdaq and the S&P 500 held above our channel trendlines. The funny thing is, I said I would not be surprised if the Nasdaq closes above our channel trendline by the end of the day. “They” managed to prop the Nasdaq and give us not only a close above our major technical inflection point, but also a GREEN close. The biggest dip buy in Nasdaq history?

So why do I mention the stock markets? If you are a Bitcoin trader, you must be following the price action on stock markets. Right now, Bitcoin is still moving as a risk on asset. The positive correlation is in the high 90 percentile.

I know hardcore crypto enthusiasts may disagree, but I trade the markets I see, not the ones I want to see. I still maintain that Bitcoin and cryptos will turn risk off in the future. There will be a divergence…which by the way is required for Gold and Silver too. Both of which still seem to follow the stock markets most of the time. When we get issues with the currency, which I believe is coming, money will run into non-fiat assets. I like commodities plus the metals, and I also include the major cryptocurrencies in my list. The one major outlier which could derail this? Government’s and Central Bank’s coming down hard on private crypto because they want you to use their digital currency.

Big events this week such as Powell’s testimony which is live as I write this, US CPI on Wednesday and US Retail Sales for the month of December. All three can impact the stock markets as they can increase (or decrease) the probabilities of future rate hikes.

What I am trying to say is that if the Nasdaq and the S&P 500 break below our channel, then Bitcoin and other cryptos would follow as they are risk on assets and currently positively correlate with equities. Let’s hope Powell can curb his hawkishness to give us a nice pop and close in markets.

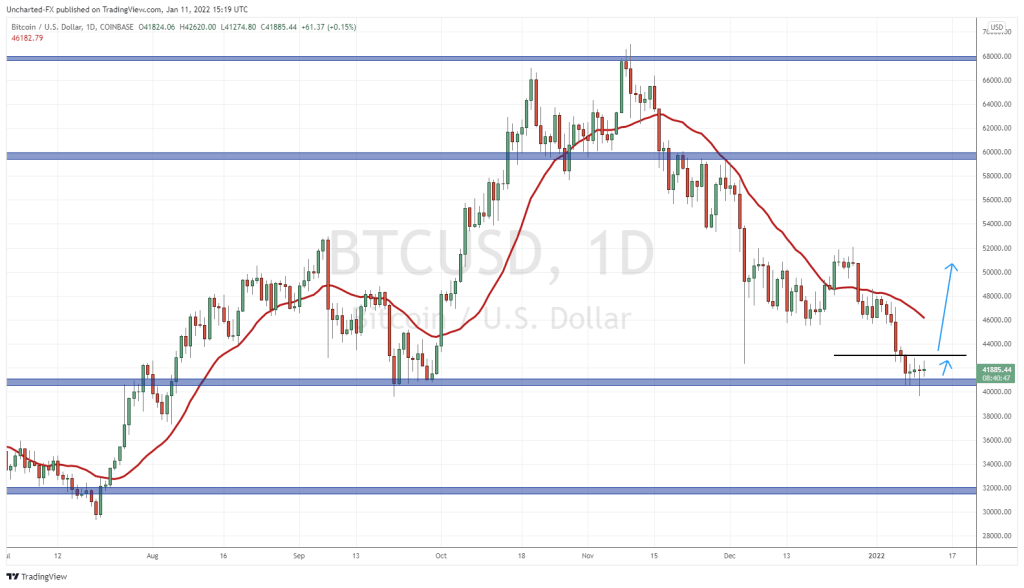

But you all came for Bitcoin, so let me provide a chart update. Our support zone that was targeted in last week’s analysis has been reached. The $40,000 zone is a major support zone. You don’t need to be proficient in technicals to see that buyers are coming in and holding the line.

The past four daily candles have seen wicks popping up from $40k indicating a pool of buyers here. A couple of spinning top candles also indicates a battle between the bears and the bulls, and signifies that a trend reversal could be in the cards. Those who follow my work, know I love to see prices beginning to range after a long downtrend. Mind you, this range cannot just happen anywhere, but must occur at major support or resistance zones. Bitcoin obviously meets my criteria.

So what now for Bitcoin? To see the range breakout trigger, we need the breakout. A critical element. What I would like to see is a candle close above the $42,800 zone. Just above one of the top wicks in this recent range. For those with itchy finger triggers, let’s go down to the four hour chart.

This chart actually shows you the range much better. Each candlestick represents 4 hours worth of price action. A very nice range structure here. Right off the bat, I see another bullish sign. Note the large wick that broke below $40,500 but then was bought up. That four hour candle was once fully red, but then closed like how you are seeing it now. Typical fake out price action. Trapped some sellers who were thinking this support was breaking and Bitcoin was going to tumble. This is why we always wait for candle CLOSES to confirm and trigger our patterns.

The fake out is a technical positive, and one could enter a small long position here with their stop loss nestled a few pips below the large fake out wick. I would then look to add on the breakout of the range. We have an area around $42,800 as I mentioned which acts as resistance. If we get a 4 hour close above this zone, it would bode well for the daily candle close trigger.

I prefer to wait for the daily candle confirmation, but the 4 hour is the one intraday chart that can give us an early entry signal as long as the trends look similar. There are instances where the daily chart of an asset looks bearish, but the 4 hour chart of the same asset looks bullish. This would then be a case of a pullback rather than a trend reversal. Bitcoin does not show contradictory signs like this. Both the daily and 4 hour charts are aligned which looks real good for us Bitcoin bulls.

In terms of targets: $46,00o will be an important resistance zone to overcome for Bitcoin to regain price levels of $50,000 and higher. I will be watching that level closely if we break out of this range.

Ethereum looks somewhat different. I prefer the major flip zone support at $2800, meaning another drop lower is possible. But then again, currently we are at an important psychological support zone. The $3000 zone. Looking to the left, I can see signs of this area being supported. The way I determine good support though favors $2800 better. This area just looks a bit choppy to determine good support. But we trade the markets we see, not the ones we want to see.

Ethereum, just like Bitcoin, has developed a range in the past few days. The Bitcoin price action looks better, but we do have a fake out candle with a large wick on Ethereum too. Indicating that buyers are here. Once again, it is all about the breakout for us.

Taking a look at the 4 hour chart, we see that there is still some work that needs to be done before we can confirm a breakout. We require a candle close above the $3220 zone. Just looking at the chart, we see my moving averages turning, and hints of a reversal pattern. I am sensing an inverse head and shoulders, which means the next price action would have to be a pop up to $3200, then a drop, before breaking out. That would create our right shoulder if this is the pattern we will be printing.

In summary, I like the Bitcoin chart here. A major support zone is being tested after a long downtrend with multiple lower high swings. The range is indicating basing. Buyers are piling in at support. The range breakout is all that is required to confirm the reversal trigger. Keep an eye on equities, as right now Bitcoin is acting like a risk on asset. If stocks continue to tumble, there is a real possibility that Bitcoin does not breakout, but break down instead. We await the confirmation trigger, and accept the risk posed by an early 4 hour chart entry.