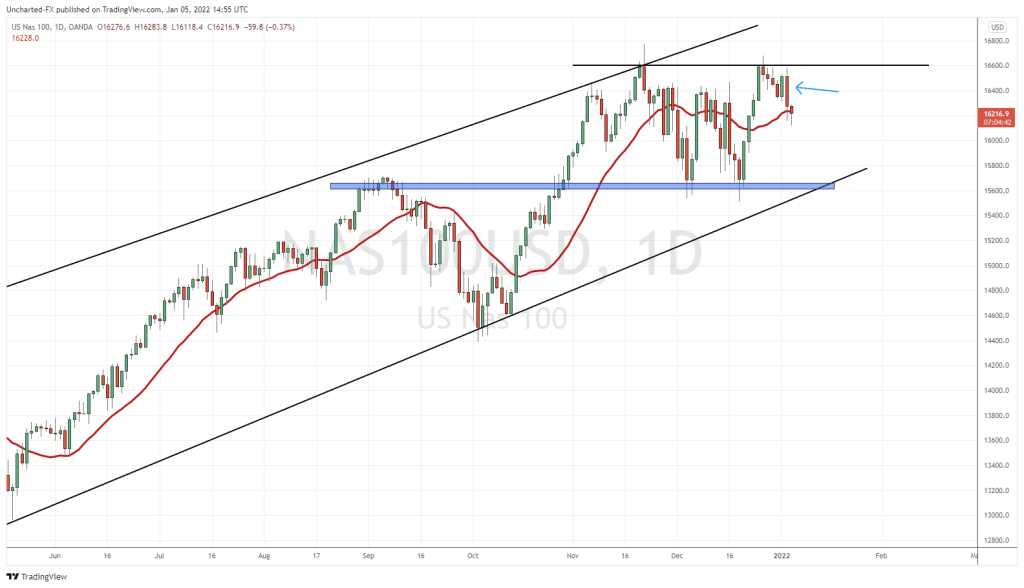

Yesterday was all about the fall in growth stocks. The Nasdaq was taking a hit. If you are a member of the Equity Guru Discord channel, I discussed how the S&P 500 and the Dow Jones were printing new record highs, and we were waiting for the Nasdaq to confirm the trifecta. It did not happen. Instead we got this:

The Nasdaq attempted to close above resistance at 16,600 to confirm a new record close. My readers know how important breakouts and candle close confirmations are. If you went long the Nasdaq on December 28th 2021 expecting the breakout to continue, you got faked out. It pays to be patient and wait for candle closes to confirm the breakout.

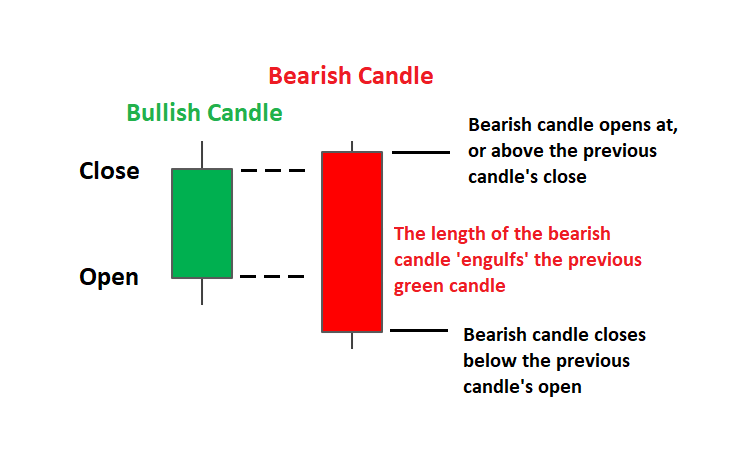

I want to point out the arrow I used to highlight yesterday’s daily candle. We got a large red bodied candle which took out price action from the previous five trading days. This large candle is referred to as an ‘engulfing candle’. If you are someone wanting to dig a bit deeper into candlesticks, the engulfing candle should be at the top of your list.

As with all candlesticks, context is important. Where the candle was printed in the trend. Engulfing candles have a higher chance of being valid when they occur at a resistance zone or at a support zone. Especially followed by a trend. Or, if there is no trend, then an engulfing candle could hint at a range continuing. The Nasdaq fits the bill. We printed a bearish engulfing at a resistance zone, after a move higher. I am sure some traders took shorts and placed their stop loss snuggly above the engulfing candle.

So what’s the cause? Some say the Omicron variant cases. But Omicron might become old news as a newer and more deadlier variant, IHU, has appeared. Let’s wait to see how that plays out. But I disagree with the markets in whole reacting to the virus. Remember, if more restrictions and variants appear, it means the likelihood of more cheap money continues…which is actually bullish stock markets. Markets could initially fall on another lockdown, but I don’t think the impact on equities would be as bad as the one in 2020 because we did not have the current monetary policy back then.

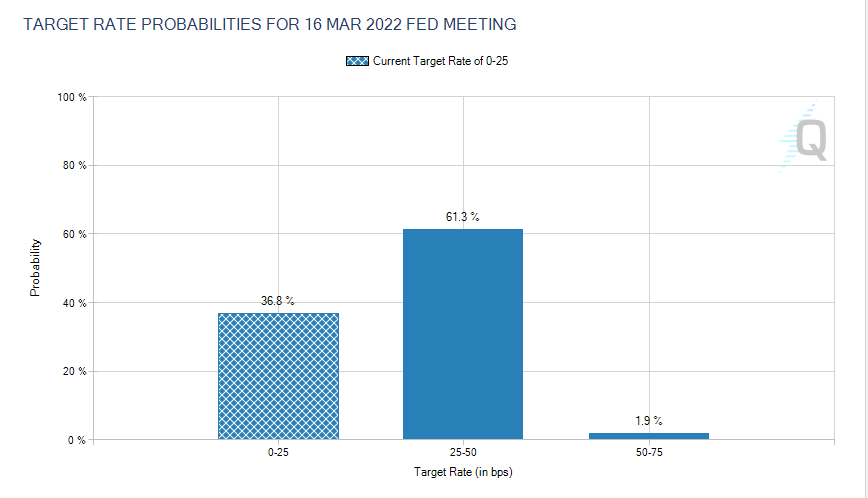

This is where I want to stick with: the cheap money. Growth stocks took a hit because of the fear of a Fed rate hike.

Current Fed futures shows the market is expecting a rate hike at the March 2022 meeting. A 25 basis point hike. The probability of a hike is 63.2%. This of course can change as we get closer to March. A lot of things can happen with variants from now till then. The January Fed futures isn’t showing the market pricing any rate hike. 99% of the market sees rates remaining unchanged in January 2022.

Bond yields have been spiking with the market pricing in rate hikes. Watch the 2 year yield of course, but here I have posted the 10 year yield above. A major resistance zone around 1.70%. If we climb above it… then growth stocks could be feeling the pinch.

If you go back to take a look at my Nasdaq chart, take note of the channel trendlines and the support and resistance zones. Resistance we talked about. The channel trendlines still point to an uptrend being intact. Now the support zone at 15,600 is what you really want to be watching. I am not saying the Nasdaq will sell off to that zone. What I am saying is that as long as price remains above this support zone, I remain bullish equities. Keep buying that dip. If that support breaks down, we also break the channel trendline. Very bearish, and we would then be looking for a new bear market.

In terms of fear and money leaving growth stocks, I must highlight the current price action on the Dow Jones.

After breaking out into new record highs, the Dow Jones has held up relatively well compared to the S&P 500 and the Nasdaq. The Dow actually managed to close green yesterday. This brings up an interesting point, something I mentioned back in the day. Money could run into the Dow Jones for ‘safety’. Holding dividend paying stocks is better than holding bonds for real yield. I expect when things get rough, money will flow into these dividend paying stocks, which would keep the Dow nice and propped.

It is all about hunting for yield in this world, and managed money cannot just stay in cash for a long time. Managers are not paid to sit on cash. Money has to be active, and I think that money goes into good, large dividend paying stocks. If the Dow begins to sell off hard with the Nasdaq and the S&P…then we have some trouble.