Space…the final frontier. Come on. It was so tempting, it just had to be done. Funnily enough I am a Star Wars fan boy rather than a Trekkie. Pop culture aside, space is becoming a sector trend that investor’s are beginning to pay attention to. I just think it is for the wrong reason.

A lot of money is looking into space in regards to space tourism. Sure, space tourism might be here sooner than anticipated, but will these companies be making revenues? From what I am reading, ticket prices will be in six figure amounts. The retail crowd and financial media has been all over space because of these billionaires:

Musk has been making headlines recently with his battle with Bezos. The latter was suing NASA over its deal with SpaceX. Musk’s SpaceX inked a contract with NASA back in April of 2021. The love isn’t lost between the two billionaires with Musk taking a jab at Bezos by saying “You can’t sue your way to the moon“, and about how Bezos should be spending more time at Blue Origin rather than a hot tub. In Musk’s mind, Blue Origin lags behind SpaceX.

Just a few weeks ago, Elon Musk did say SpaceX could go bankrupt due to engine production. Leading to speculation that Musk is selling Tesla shares to raise funds to throw into SpaceX, and leading to rampant speculation that Musk will take SpaceX public sometime in the future. He certainly has a way with the retail crowd, and I am sure the IPO would be a huge hit with the retail and meme crowd.

In terms of Branson’s Virgin Galactic…the summer saw some action with test fights. Even news that ticket sales were opening to the public. The stock was attempting to make a run to take out previous record highs at $62.80. But then this:

Reality set in. The stock is still speculative as revenues are still long ways away. It was announced that Sir Richard Branson himself sold a $300 million stake in Virgin Galactic back on November 16th 2021. Not really the best sign of confidence.

Is space tourism the best way to invest in space? Not really. We have a long way to go, and as I mentioned, some of these companies won’t seeing revenues for a while. Honestly, the best source of revenues would be government (NASA) contracts, and factoring this, SpaceX has the advantage.

A lot of interesting things are happening in space, that’s for sure. Last week we saw the first Uber Eats food delivery to space. The cost? $80 million US Dollars. Japanese billionaire Yusaku Maezawa, and space tourist, took ready-to-eat canned Japanese foods to the ISS.

As someone interested in precious metals, naturally I am excited about asteroid mining. You’ve read those crazy headlines. Mining gold from a single asteroid would make enough money to pay off the entire world’s debt. Maybe a bit of exaggeration, but recent media headlines have boldly stated that, “Space Mining is Here“.

Luxembourg might become the leader in space mining.

“With a decades-long track record of making space a profitable business, Luxembourg is betting big on everything from space resources and satellites to training the next generation of space entrepreneurs.”

When I think about investing in space I think satellites. And unfortunately, I also think about war. If you have read any books on the Thucydides trap that is the US vs China, Space superiority is key for the US. The Americans want to maintain military superiority. The US advantage lies with their space satellites which allows the US military to hit anything in the world with pinpoint accuracy. China has been working on space weapons to take these satellites down, which would neutralize US superiority in space. This was the whole reason for the Space Force. China is catching up in conventional ‘terrestrial’ based weapons (missiles, tanks, aircraft etc), and US strategists believe it is paramount to stay ahead in space. For more details on this, I suggest reading any geopolitical book. “Destined for War” by Graham Allison is one of my favorites.

What does this mean for investors? The US government will be spending big on space and space warfare. This to me is the real opportunity.

Companies like Raytheon and Maxar technologies come to mind. On the Canadian side, Magellan Aerospace has me intrigued. In this technical breakdown article, I will take a look at the charts of Kratos Defense, Howmet Aerospace and AST SpaceMobile.

Kratos Defense (KTOS)

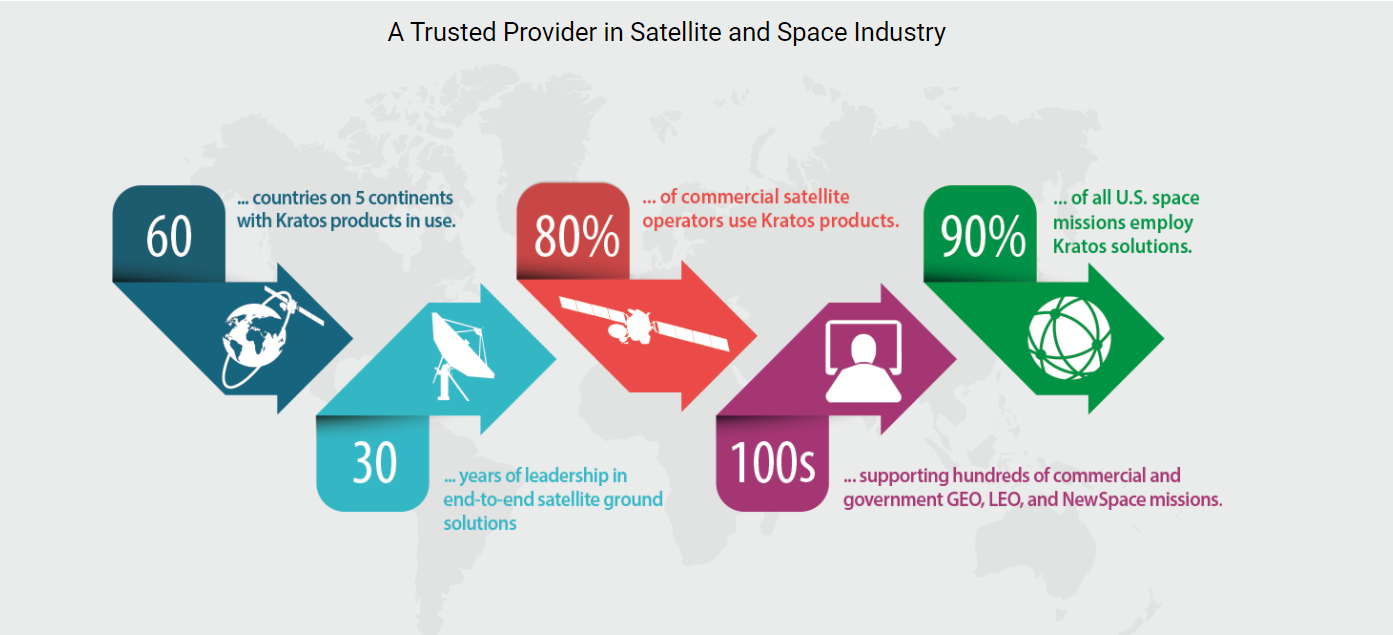

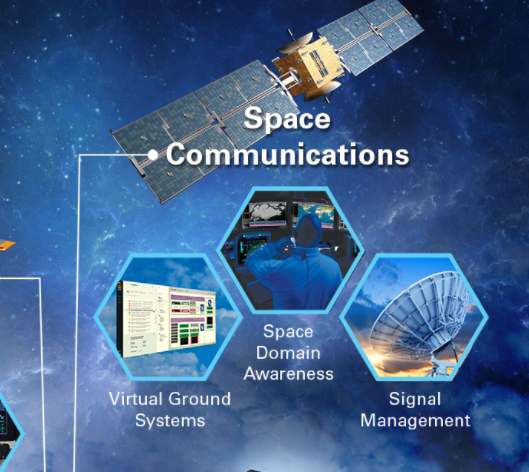

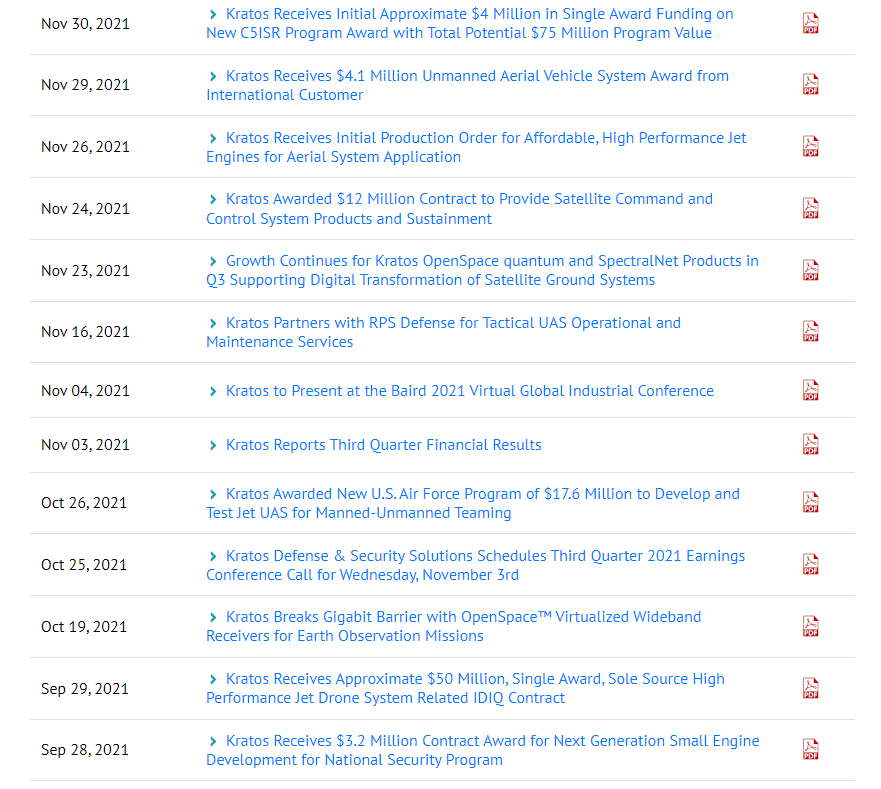

Being named Kratos is already a win for the company. Any God of War video game fans out there? An apt name as Kratos Defense deals with warfare. Kratos Defense & Security Solutions operates as a government contractor of the U.S. Department of Defense. The company operates through two segments, Kratos Government Solutions and Unmanned Systems. The Kratos Government Solutions segment offers microwave electronic products, space, training and cybersecurity/ warfare, satellite communications, C5ISR/ modular systems, turbine technologies, and defense and rocket support services. The Unmanned Systems segment provides unmanned aerial systems, and unmanned ground and seaborne systems. It serves national security related agencies, the department of defense, intelligence agencies, and classified agencies, as well as international government agencies and domestic and international commercial customers.

Space Domain Awareness is all about satellite command and control, satellite communications and manageable satellite ground operations.

With 90% of all US space missions employing Kratos solutions…these guys will be a big player in Space Defense for years to come.

Just take a look at their website and you will see command rooms and technology that you see in Call of Duty Modern Warfare.

The stock itself has been in a downtrend. The broader stock market sell off isn’t helping. Even dividend paying stocks like Raytheon are taking a hit. Watching to see if Kratos can find some buyers at support around $18.00. The company is releasing regular press releases on contracts, and will be a winner on more defense department spending on space.

Howmet Aerospace (HWM)

Howmet Aerospace is an ingenious way to play space and defense if I do say so myself. Not many of us think about the components and parts used to build these things. Howmet Aerospace is a global leader in engineered metal products. Their engines, fasteners and structures for aerospace and defense, as well as their forged wheels, are transforming the aerospace and commercial transportation industries.

Howmet’s Aerospace is the company’s fastest growing market with an order book with an 8.5 year backlog for both commercial aircraft and aero engines. We are talking about innovative investment castings, advanced coatings, seamless rings, forgings, titanium extrusions, and titanium mill products, to fasteners that hold aircraft together.

In terms of space, Howmet collaborates with military and business partners to create materials that are lighter, faster, stronger and cost effective. Howmet’s materials science expertise helped land the Apollo spacecraft on the moon and launch the shuttle program.

The company released Q3 21 highlights on November 4th 2021. Here are highlights:

- Revenue of $1.28 billion, up 13% year over year and up 7% sequentially

- Income from continuing operations of $27 million, or $0.06 per share, versus $36 million, or $0.08 per share, in the third quarter 2020

- Income from continuing operations excluding special items of $120 million, or $0.27 per share, versus $13 million, or $0.03 per share, in the third quarter 2020

- Operating income of $205 million, up 181% year over year

- Operating income excluding special items of $224 million, up 124% year over year

- Generated $67 million cash from operations and $115 million of adjusted free cash flow; $106 million of cash used for financing activities; and $50 million of cash provided from investing activities

- Issued $700 million aggregate principal amount of 3.000% Notes due 2029; Tendered $600 million aggregate principal amount of 6.875% Notes due 2025; Repurchased $100 million aggregate principal amount of 5.125% Notes due 2024 across third quarter 2021 and October 2021

- Cash balance at end of quarter of $726 million including impacts of debt actions, common stock repurchase, and reinstatement of common stock dividend

The stock is constrained in a channel. There was a breakout and retest back when earnings came out, but to no avail. No momentum was sustained and we closed back below the channel. I am looking at support once again at $28, hoping for a double bottom perhaps. It should be said in terms of revenues, a lot of it comes from the aerospace side of things, but if governments are to spend more on space, Howmet’s material expertise comes in handy.

AST SpaceMobile (ASTS)

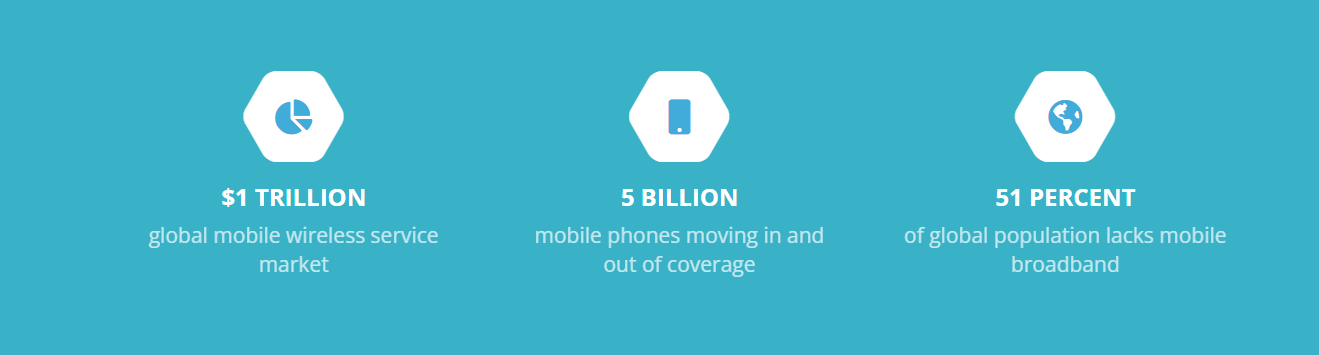

Okay so this one is a bit different than the rest. This company focuses on civilian applications. AST and their global partners are building the first and only space-based cellular broadband network to be accessible by standard smartphones. This ultra powerful network is called SpaceMobile, and will be able to provide connectivity at 4G/5G speeds everywhere on the planet be it on land, at sea or in flight. Mobile subscribers will be able to automatically roam from land networks to a space network. Whether in the most remote location, on rural farmland or in the midst of a crisis or natural disaster, people will remain connected no matter what – without having to invest in expensive, specialized hardware.

A recent corporate update provided us with these highlights:

- Our next satellite, BlueWalker 3, a 693-square-foot phased array for planned direct-to-cell phone connectivity at 4G/5G speeds, is going through final integration and testing, with all components for the build now on hand

- Midland, Texas headquarters buildout is completed with approximately 35,000 square feet of clean room for assembly, as well as test equipment to support production requirements

- Entered into an agreement to purchase an additional 100,000 square foot facility in Midland, Texas, which, together with our headquarters facility, will provide a combined 185,000 square feet of capacity

- Signed a lease for approximately 16,000 square feet of new space for our Maryland Technology Center, intended to be the future home of our Satellite Operations Center and Network Operations Center

- Signed Memoranda of Understanding (“MOUs”) with MTN Group (Africa, Middle East), YTL Communications (Malaysia) and Somcable (Somaliland)

- Growth of 40 employees across all offices in the third quarter of 2021, with a team of 509 as of September 30, 2021, including 301 full-time employees, 47 full-time contractors and 161 employees of 3rd party engineering service providers working on AST SpaceMobile

In terms of technicals, ASTS is a stock that one can act on quite soon. It is already testing a major support zone around $8.00. We have bounced here a couple of times this year. Here is hoping for a third. The stock has been basing here for 5 trading days. All we need is a strong green candle, and I would say, a daily close above these ranging candle bodies above $8.60. If this support does not hold, then we are looking at the $7.00 zone which was previous all time record lows.

It should be said the company does have a large cash burn, and some may say there is competition in regards to another Elon Musk company, Starlink.