Publicly traded companies operate in one of five horizontal layers:

Level 1: Subterranean Diggers like Lundin Mining Corporation (LUN.TO), Transocean Ltd. (RIG.NYSE) and Rio Tinto Group (RIO.NYSE).

Level 2: Earth Crust Straddlers like Village Farms (VFF.Q), Archer-Daniels-Midland (ADM.NYSE) and Canopy Growth (WEED.T).

Level 3: Street Level Hustlers like FedEx (FDX.NYSE), Tesla (TSLA.Q) and Amazon (AMZN.Q).

Level 4: Low Flying Birds like The Boeing Company (BA.NYSE), Drone Delivery Canada (FLT.V) and American Airlines (AAL.NYSE).

Level 5: Space Cowboys like Astra Space (ASTR.Q), Rocket Lab USA (RKLB.Q) and Momentus (MNTS.Q)

Mining gold, growing cannabis, delivering catfood or flying tourists to Phuket all seem like potentially profitable business.

But how do you make money in space?

Where is the customer base?

Do you set up a fruit stand in the exosphere, and wait for a Martian to pop by and purchase a bag of oranges?

As it turns out, there is a lot of business activity in space.

“Astra Space went public on July 1 via Holicity (HOL),” reports Investors.com on December 10, 2021, “Momentus went public via Stable Road Capital (SRAC) and Vector Acquisition (VACQ) took Rocket Lab public in August in a deal that values the space company at $4.1 billion.

Redwire Space (RDW) is merged with Genesis Park (GNPK) to go public in September. Satellite imaging company Planet (PL) went public via SPAC on Dec. 8.

Virgin Galactic’s (SPCE) sister company, Virgin Orbit, is going public via a blank-check merger with NextGen Acquisition II (NGCA)”.

“The space market has advanced by leaps and bounds in the past few years, driven by massive investment from billionaires like Elon Musk, Jeff Bezos, and Richard Branson who have succeeded in bringing down the cost of a satellite launch from $200 million ten years ago to around $60 million,” reports Yahoo Finance.

Richard Branson’s Virgin Galactic (SPCE.Q) is offering 90-minute flights into the upper atmosphere starting at a modest USD $200,000.

“We are at the vanguard of a new industry determined to pioneer twenty-first century spacecraft, which will open space to everybody — and change the world for good,” reported Branson.

“The bad news for Branson and Lex Luthor is this trip already exists,” reports Equity Guru’s Chris Parry on July 7, 2021, “For $6k you can get in a Boeing plane and be flown high enough and at enough of an arc that you go weightless for 30 seconds through Space Adventures…and they’ll let you do that fifteen times in one trip”.

In this furious storm of SPAC mergers and atmospheric thrill-rides, we have identified 5 Space Companies that are operating real businesses.

Maxar Technologies (MAXR.NYSE) is a$2 billion Earth Intelligence and Space Infrastructure innovator, exploring and advancing the use of space.

The company deploys solutions and deliver insights with speed, scale, and cost effectiveness. Maxar’s 4,400 team members in more than 20 global locations.

On November 3, 2021, MAXR released Q3, 2021 financials for quarter ended September 30, 2021 in USD.

Key Highlights:

- Net income from continuing operations of $14 million

- Diluted net income per share of $0.19

- Consolidated revenues of $437 million

- Adjusted EBITDA1 of $113 million

“We continued to make progress on our strategic growth plans this quarter, with solid bookings in both Earth Intelligence and Space Infrastructure generating a book-to-bill over two times,” stated Dan Jablonsky, President and CEO.

“Earth Intelligence performance was driven by growth from commercial and international defense and intelligence customers, while Space Infrastructure benefited from recent commercial awards offset by the timing of work on certain government programs,” added Jablonsky.

Total revenues remained relatively unchanged as they increased to $437 million, or by $1 million, for the three months ended September 30, 2021, compared to the same period of 2020. Revenue in our Earth Intelligence segment was inclusive of a $20 million decrease in the recognition of deferred revenue related to the EnhancedView Contract.

For the three months ended September 30, 2021, Adjusted EBITDA was $113 million and Adjusted EBITDA margin was 25.9%.

Maxar had total order backlog of $2.1 billion as of September 30, 2021 compared to $1.9 billion as of December 31, 2020.

Kratos Defense (KTOS.NASDAQ) is a $2.4 billion company that specializes in unmanned systems, satellite communications, cyber security/warfare, microwave electronics, missile defense, hypersonic systems, training, combat systems and next generation turbo jet and turbo fan engine development.

On November 3, 2021 the company reported Q3 Revenues of $200.6 Million

Key Highlights:

Third Quarter Space, Satellite and Cyber Busines Revenues of $72.0 million Increased Organically 17.5 percent over the Third Quarter of 2020

Third Quarter Unmanned Systems Segment Revenues of $61.3 Million, Increased Organically 14.6 percent over Third Quarter 2020

Third Quarter 2021 Consolidated Book to Bill Ratio of 0.9 to 1

Last Twelve Months Ended September 26, 2021 Consolidated Book to Bill Ratio of 1.0 to 1

Third Quarter 2021 Unmanned Systems Book to Bill Ratio of 1.1 to 1

Last Twelve Months Ended September 26, 2021 Unmanned Systems Book to Bill Ratio of 1.0 to 1

For the third quarter of 2021, Kratos reported consolidated bookings of $174.2 million and a book-to-bill ratio of 0.9 to 1.0, with consolidated bookings of $770.9 million and a book-to-bill ratio of 1.0 to 1.0 for the last twelve months ended September 26, 2021.

Backlog on September 26, 2021 was $839.1 million, down sequentially from $865.6 million at June 27, 2021 and down from $873.1 million at September 27, 2020, and Kratos’ bid and proposal pipeline was $9.1 billion at September 26, 2021. Backlog at September 26, 2021 was comprised of funded backlog of $618.0 million and unfunded backlog of $221.1 million.

“Since our last report to you, we have received approximately $374 million in sole source, single award target drone related contracts, of which we expect to realize substantially the entire IDIQ amount in Kratos’ revenue over the period of performance,” stated Eric DeMarco, Kratos’ President and CEO.

“We have successfully competed for and received a U.S. Air Force Off-Board Sensing Station affordable tactical jet drone program award, which we believe has potential future opportunity similar to Kratos’ Valkyrie, Gremlins, Air Wolf and Thanatos programs”.

“Kratos is the growth leader in space, satellite communications and unmanned drone systems as reflected in our results today and our C5ISR, Rocket System and Next Generation Engine businesses are also positioned to be future growth leaders,” added DeMarco.

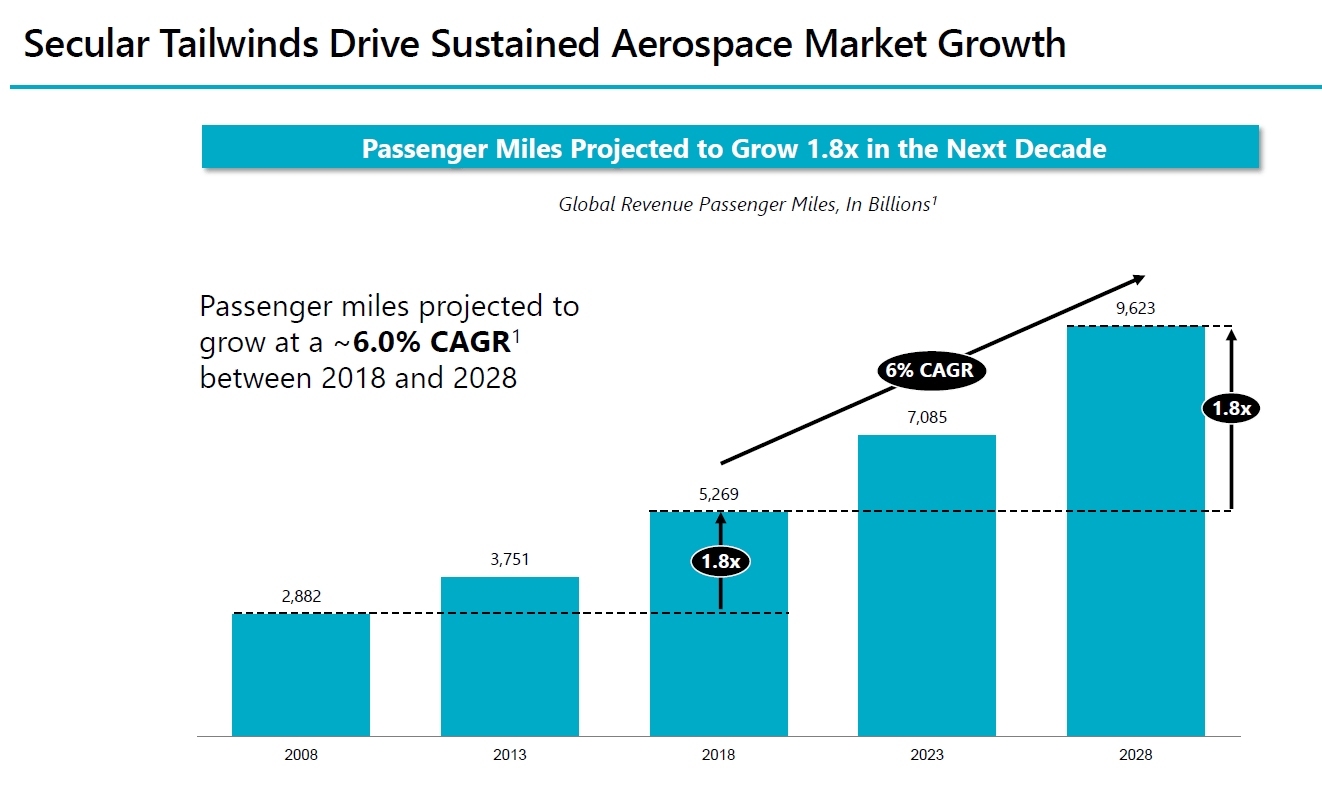

Howmet Aerospace (HWM.NYSE) is a $12 billion company that provides advanced engineered solutions for the aerospace and transportation industries, focusing on, aerospace fastening systems, and titanium structural parts necessary for mission-critical performance and efficiency in aerospace and defense applications.

On November 4, 2021 HWM released Q3, 2021 Financial Highlights

- Revenue of $1.28 billion, up 13% year over year and up 7% sequentially

- Income from continuing operations of $27 million, or $0.06 per share, versus $36 million, or $0.08 per share, in the third quarter 2020

- Income from continuing operations excluding special items of $120 million, or $0.27 per share, versus $13 million, or $0.03 per share, in the third quarter 2020

- Operating income of $205 million, up 181% year over year

- Operating income excluding special items of $224 million, up 124% year over year

- Generated $67 million cash from operations and $115 million of adjusted free cash flow; $106 million of cash used for financing activities; and $50 million of cash provided from investing activities

- Issued $700 million aggregate principal amount of 3.000% Notes due 2029; Tendered $600 million aggregate principal amount of 6.875% Notes due 2025; Repurchased $100 million aggregate principal amount of 5.125% Notes due 2024 across third quarter 2021 and October 2021

- Cash balance at end of quarter of $726 million including impacts of debt actions, common stock repurchase, and reinstatement of common stock dividend.

Third quarter 2021 operating income was $205 million, up 181% year over year.

Operating income excluding special items was $224 million, up 124% year over year.

“Third quarter 2021 marked the start of the commercial aerospace recovery, with commercial aerospace revenue up 16% sequentially, driving total revenue growth of 7% sequentially,” stated Howmet CEO John Plant.

“We ended the third quarter 2021 with approximately $726 million of cash including impacts of debt actions, common stock repurchase, and reinstatement of the common stock dividend,” added Plant.

Raytheon Technologies (RTX.NYSE) is a $121 billion aerospace and defense company that provides advanced systems and services for commercial, military and government customers worldwide.

With four businesses ― Collins Aerospace Systems, Pratt & Whitney, Raytheon Intelligence & Space and Raytheon Missiles & Defense – RTX delivers solutions in avionics, cybersecurity, directed energy, electric propulsion, hypersonics, and quantum physics.

On October. 26, 2021 Raytheon reported its Q3, 2021 results.

Third quarter Hightlights:

- Sales of $16.2 billion

- GAAP EPS from continuing operations of $0.93, which included $0.33 of acquisition accounting adjustments and net significant and/or non-recurring charges

- Adjusted EPS of $1.26

- Operating cash flow from continuing operations of $1.9 billion; Free cash flow of $1.5 billion

- Company backlog of $156.1 billion; including defense backlog of $65.0 billion

- Achieved approximately $165 million of incremental RTX gross cost synergies

- Repurchased $1.0 billion of RTX shares

Outlook for full year 2021

- Sales of ~$64.5 billion, from $64.4 – $65.4 billion

- Adjusted EPS of $4.10 – $4.20, from $3.85 – $4.00

- Free cash flow of ~$5.0 billion, from $4.5 – $5.0 billion

“Our performance this quarter clearly demonstrates our ability to capitalize on the increased demand across our commercial aerospace and defense businesses, and our intense focus on cost reduction and operational execution,” said Raytheon CEO Greg Hayes.

During the quarter RTX completed of the first flight test of a scramjet-powered Hypersonic Air-breathing Weapon Concept (HAWC) for DARPA and the U.S. Air Force.

Notable defense bookings during the quarter included:

- $962 million of classified bookings at Raytheon Intelligence & Space (RIS)

- $570 million for Advanced Medium-Range Air-to-Air Missile (AMRAAM) for the U.S. Air Force, Navy and international customers at Raytheon Missiles & Defense (RMD)

- $543 million for two F-135 sustainment contracts at Pratt & Whitney

- $432 million to provide Guidance Enhanced Missiles (GEM-T) for an international customer at RMD

- $358 million for Evolved Sea Sparrow Missile (ESSM) for the U.S. Navy and international customers at RMD

- $291 million for Stinger missiles for international customers at RMD

- $212 million for F100 engines for an international customer at Pratt & Whitney

AST SpaceMobile (ASTS.NASDAQ) is a $420 million company that is building a global cellular broadband network in space to operate directly with standard, unmodified mobile devices based on its IP and patent portfolio.

ASTS’s stated objective is to eliminate the connectivity gaps faced by today’s five billion mobile subscribers and bring broadband to the billions who remain unconnected.

Unlike the other companies on our list, AST SpaceMobile is pre-revenue, but it is chasing a big prize, that appears within reach.

This writer spends time on Bowen Island, British Columbia. As I drive across the mountainous island, the service cuts in an out.

My ex-wife lives in a valley 20 kilometers north of Princeton, BC. She has no signal. Lack of broadband connection has stunted the economic grown in the valley.

If you can’t swing an axe, you can’t make a living.

ASTS’s technology promises to solve these problems. It also has dramatic ramifications for the 3rd world, and disaster response.

On November 15, 2021 AST SpaceMobile provided a business update for the third quarter of 2021.

“We are now entering the last stage of build, integration and testing of our next satellite, BlueWalker 3,” said Abel Avellan, Chairman and CEO of AST SpaceMobile.

Business Highlights

- The next satellite, BlueWalker 3, a 693-square-foot phased array for planned direct-to-cell phone connectivity at 4G/5G speeds, is going through final integration and testing, with all components for the build now on hand

- Midland, Texas headquarters buildout is completed with approximately 35,000 square feet of clean room for assembly, as well as test equipment to support production requirements

- Entered into an agreement to purchase an additional 100,000 square foot facility in Midland, Texas

- Signed a lease for approximately 16,000 square feet of new space for our Maryland Technology Center, intended to be the future home of our Satellite Operations Center and Network Operations Center

- Signed Memoranda of Understanding (“MOUs”) with MTN Group (Africa, Middle East), YTL Communications (Malaysia) and Somcable (Somaliland)

- Growth of 40 employees across all offices in the third quarter of 2021, with a team of 509 as of September 30, 2021, including 301 full-time employees, 47 full-time contractors and 161 employees of 3rd party engineering service providers working on AST SpaceMobile

Third Quarter 2021 Financial Highlights

- Ended the third quarter with cash and cash equivalents of $360.4 million and no financial debt as of September 30, 2021

- Total operating expenses of $23.1 million for the third quarter of 2021, compared to $25.1 million in the second quarter of 2021, primarily due to a decrease in research and development costs of $4.7 million, partially offset by $2.2 million increase in engineering services, $0.4 million in depreciation and amortization, and $0.1 million in general and administration expenses

- As of September 30, 2021, invested $56.7 million in the construction of BlueWalker 3 satellite, which includes non-recurring engineering development cost, satellite componentry, and launch cost

- As of September 30, 2021, invested $19.9 million in property and equipment, net of accumulated depreciation, primarily in the buildout of the headquarters facility in Midland, Texas

“According to investment bank Morgan Stanley, the global space industry has the potential to generate around $1 trillion in revenues by 2040, up from $350 billion presently,” reports Yahoo Finance.

“Professional services firm Deloitte estimates that the sector will grow at a compound annual growth rate of over 15% this year”.

Forget about Space Tourism.

That business is destined to cannibalize its own customer base. In 2022, paying $200,000 to go into space gives you good bragging rights.

When your dentist makes the same trip three years later for $35,000, that spasm of pride turns into resentment. Dramatic price drops are problematic for fluffy prestige services.

Instead look to companies like Maxar Technologies (MAXR.NYSE), Kratos Defense (KTOS.NASDAQ), Howmet Aerospace (HWM.NYSE), Raytheon Technologies (RTX.NYSE) and AST SpaceMobile (ASTS.NASDAQ) – that are doing real business out in space.

Full Disclosure: Equity Guru has no commercial relationship with the companies mentioned in this article.