It has been a wild week for financial markets. The long anticipated Federal Reserve rate decision came and passed. In fact, five central bank rate decisions all in one week. A good way to wrap up major event risks as we head into the Christmas and New Year’s lull. In terms of Agriculture, a bit of a quiet week in terms of headlines as many companies wrap things up for the year. There won’t be many headlines until January.

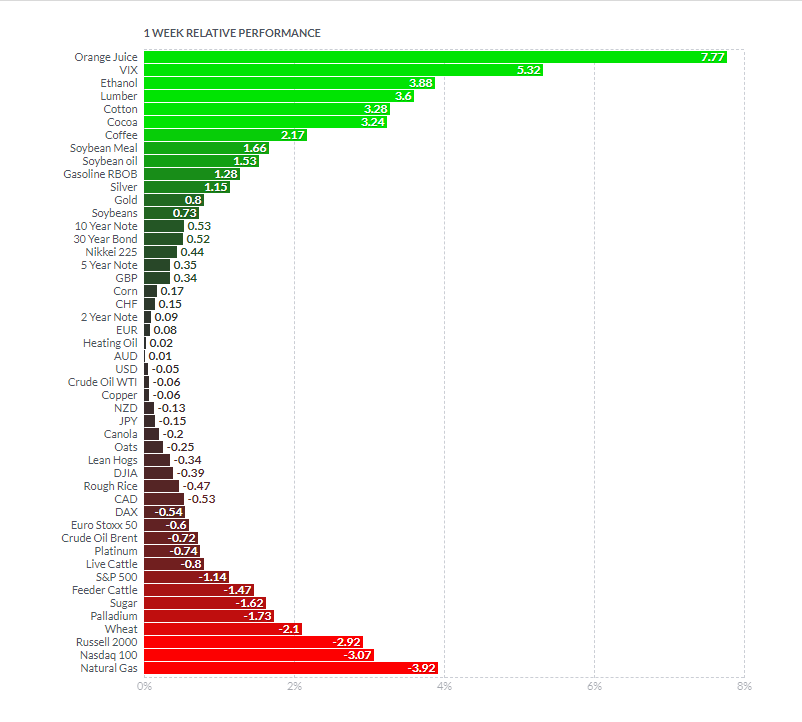

Here is the 1 week performance up to Thursday. Not a great week for wheat, but Orange Juice is this week’s big winner.

Funnily enough, my new broker allows me to trade Orange Juice CFDs. I had the chart on my watchlist when prices crossed over my moving average. I then spotted the cup and handle breakout which triggered on the close above $130. It’s looking good, so I will be watching for a breakout next week. It would be my first time ever holding Orange Juice contracts which I am looking forward to too.

On the grains side of things, I spoke about Soybeans last week. The chart set up is still looking prime. A nice range pattern and we are just waiting for that breakout. We have tried on multiple trading days to climb above this resistance but to no avail so far. What gets me even more excited for this setup is that this resistance zone is also important on the weekly chart. AND it lines up with my moving average. We have something here, and the breakout is all I am waiting for.

On a side note, the US and China relations have been making headlines. The US and other countries are doing a diplomatic boycott of the Olympics in China. There are also signs that the US may come down hard on Chinese listed stocks such as Didi. Trade war? Maybe. But it seems more like the Thucydides trap between a falling power and a rising power. Ray Dalio has recently released a book on this dynamic, and he has been saying things will get more rough in the future. I remember that Soybean prices jumped on Trade war headlines. China imports a lot of food including soybeans from the US. However, China has been making deals with countries in South America and Africa for their agricultural needs. This time around, the US may not have the Soybean card to play.

This is a play that might even have broken out by the time this article comes out.

MustGrow Biologics (MGRO.CN)

I think the most exciting news comes from MustGrow Biologics. This company has appeared in numerous Ag sector roundups both because of what they are doing and because of their technical chart. The company develops natural biopesticide products from mustard seed. It provides natural biopesticide that acts as a pre-plant treatment for soil borne diseases and insect pests. The company is also developing bioherbicide and post-harvest food preservation biopesticide products for storage and food. It serves fruits and vegetables, and other industries.

MustGrow have raised a significant amount of money, including a large amount from Ira Gluskin and Gluskin related parties. They also have an exclusive agreement with Japanese conglomerate Sumitomo Corporation. Sumitomo Corporationis a diversified multinational corporation and one of the world’s largest general trading companies. Sumitomo Corporation is listed on three Japanese stock exchanges (Tokyo, Nagoya and Fukuoka under the symbol “8053”) and is a constituent of the TOPIX and Nikkei 225 stock indices. For the year ended March 31, 2021, Sumitomo Corporation had US$41.8 billion in annual revenue. The big leagues.

Recent news details positive news on the trials with Sumitomo corporation. MustGrow, working with Sumitomo, announced the successful initial field trial program in the US on cotton, soybeans and cucurbits. MustGrow’s mustard-based technology showed efficacy comparable to synthetic chemical standards for treatment of multiple nematode species. The trials will now be expanded into multiple countries and new crop categories including Mexico, Peru and Chile.

A nice pop up on the 13th and the 14th on the news. 313,067 shares were traded the day after the news was announced. Getting back above $3.00 is positive for the stock. We are now finding some resistance at $4.00. There is a chance the stock can fall back to $3.00, where I expect buyers to step in, but I would be watching the $3.50 zone as it meets my moving average. Like the company, one to watch going forward, and expecting exciting things on the press release front.

Argo Living Soils (ARGO.CN)

Argo Living Soils Corp engages in agribusiness. It develops and produces organic products, including soil amendments, living soils, bio-fertilizers, natural pesticides and fungicides, vermicompost, and compost tea kits formulated specifically for high value crops.

Big action on the stock yesterday creating new all time record highs AND a new all time record close. The candle body closed above $0.25, which becomes the support going forward. A breakout. The stock saw 103,000 shares traded on the news that Agro Living Soils has received full-service Depository Trust Company (DTC) eligibility in the United States. The Company’s common shares are quoted for trading under the symbol ARLSF on the OTC Pink Sheets in the United States and became DTC eligible on December 15, 2021.

Gerry Diakow, CEO of Argo, commented, “We are very pleased to have obtained DTC eligibility to improve settlement of our shares for current and future shareholders in the United States. DTC is a very important step towards establishing the company with the American investment community.”

Good technical break, and the stock will be supportive above $0.25.

Farmers Edge (FDGE.TO)

Farmers Edge is leading the next agricultural revolution with the industry’s broadest portfolio of proprietary technological innovations, spanning hardware, software, and services. Powered by a unique combination of connected field sensors, artificial intelligence, big data analytics, and agronomic expertise, the Company’s digital platform turns data into actions and intelligent insights, delivering value to all stakeholders of the agricultural ecosystem.

This week the company announced the creation of DigiAg Risk Management (DigiAg). This wholly-owned subsidiary of Farmers Edge will provide farmers across Canada with innovative parametric insurance products, unique risk transfer solutions, and comprehensive group benefits. It creates opportunities for Canadian farmers to mitigate risk with high tech insurance solutions and innovate group benefit plans. DigiAg is the sole Managing General Agency (MGA) with access to proprietary, field-centric datasets coming directly from broad-acre farms, including satellite imagery, on-farm weather events, predictive crop models, acreage reports, and more. These site-specific datasets create new insurance solutions and risk transfer opportunities for farmers that have been previously unavailable in the marketplace.

The stock has been rocked. The last two earnings have caused the stock to break down support levels, and break them down hard! But Canada’s Warren Buffett, Prem Watsa from Fairfax, has bought some stock at these low prices. In fact, I think you would be getting in at a better price point than him down here. The stock is just ranging. It requires a break back above $4.00 to trigger a breakout and hopefully, some momentum higher.

Village Farms (VFF.TO)

From a company listing to the US, to now one delisting from Canada. Village Farms has voluntarily decided to delist its common shares from the Toronto Stock Exchange. With Village Farms’ common shares being listed on the Nasdaq Capital Market since February 2019, the Company believes the trading volume of its common shares on the TSX no longer justifies the expense and administrative requirements associated with maintaining a TSX listing. The Company also believes Nasdaq provides its shareholders with sufficient liquidity, and the cost savings from the elimination of TSX listing fees and associated professional fees, as well as the savings in time and effort of management required to maintain a dual listing, can be redirected to initiatives intended to generate shareholder value. Effective at the close of markets on December 31, 2021, Village Farms’ common shares will no longer be listed or traded on the TSX.

For Canadian shareholders, don’t fret, you will be able to trade your common shares through their brokers on the Nasdaq. Shareholders holding Village Farms’ shares in Canadian brokerage accounts should contact their brokers to confirm how to trade the Company’s common shares on Nasdaq.

I am showing the Canadian listing, but the US listing looks the same just in US dollars of course. In previous roundups, we have been watching the support zone at around $9.50. Unfortunately, it did not hold. Next support comes in at $6.00.

AppHarvest (APPH)

AppHarvest is a development stage company, builds and operates high-tech greenhouses to grow fruits and vegetables in the United States. Its products include tomatoes and leafy greens.

The company has announced it entered into a $100 million common stock purchase agreement with B. Riley Principal Capital.

“As a company in hyper-growth mode, this arrangement gives us a smart optional tool to access liquidity to execute our business plan, with full flexibility around issuance timing, which minimizes dilution,” said AppHarvest President David Lee. “We have a strong track record of raising capital in shareholder-friendly ways to fund our growth, and this committed equity facility with B. Riley is an incremental funding tool we are pleased to have as we ramp up our network of four farms selling tomatoes, leafy greens and berries by the end of next year.”

Under the agreement, AppHarvest has the right, without obligation, to sell and issue up to $100 million of shares of its common stock to B. Riley, subject to certain limitations and satisfaction of certain conditions.

The stock is battling at support. A break here and we make new record lows. The company has seen some legal issues, not a good sign, and there is a chance that shareholders get diluted in the future. The money though would be used for a catalyst…and hopefully not legal issues. Just one to follow for now.

Evogene Ltd (EVGN)

Evogene Ltd together with its subsidiaries, operates as a computational biology company. It focuses on product discovery and development in multiple life-science based industries, including human health and agriculture, through the use of its Computational Predictive Biology (CPB) platform.

Lavio Bio is a leading ag-biologicals company focusing on improving food quality and agricultural productivity and sustainability through the introduction of micro-biome based products, and a subsidiary of Evogene, announced the advancement to the pre-commercialization development stage in its bio-fungicide program targeting fruit rot diseases. The announcement follows the completion of three consecutive years of vineyard trials, including promising 2021 results, conducted in Europe and the U.S., for two of its leading bio-fungicide product candidates, LAV.311 and LAV.312. Lavie Bio has prioritized LAV311 as its lead candidate for final development and submission of a regulatory dossier, expected to be filed with the federal U.S. Environmental Protection Agency (EPA) and California EPA during 2022.

Mr. Ofer Haviv, Active Chairman of Lavie Bio and President & CEO of Evogene, stated: “I am excited to see the progress achieved in Lavie Bio’s bio-fungicide program. Bio-fungicides could provide a valuable opportunity for implementing sustainable practices in valuable fruit and vegetable categories. Advancement to the pre-commercial stage in this program represents the very beginning of the robust pipeline Lavie Bio is developing.”

The technicals intrigue me because of the possibility of a reversal pattern. The volume is quite consistent for the stock too. I am looking for a possible double bottom pattern here. The key trigger is the breakout which validates the double bottom. People forget this for all patterns including head and shoulders, double tops and bottoms etc. The structure is there, but it doesn’t mean the pattern is triggered for a trade. Some experienced wall street traders know the retail crowd see these patterns, push the price up indicating a breakout, and then quickly reverse the price so it closes below the breakout zone. Lesson is to be patient and wait for a confirmed candle close. In the case of Evogene, a close above the $2.10 resistance/neckline.