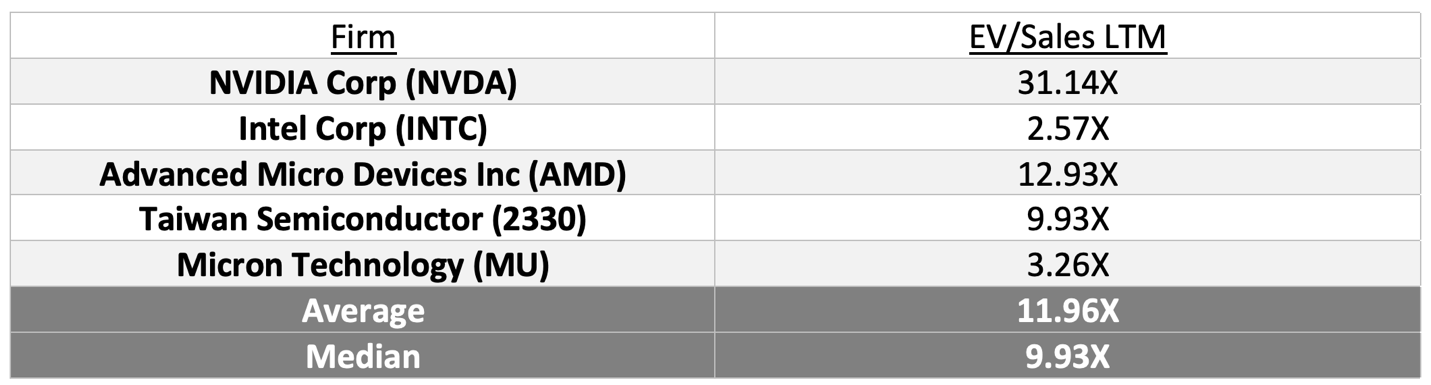

When asked to name firms in the semiconductor space some of the most common names on anyone’s list would be (1) NVIDIA Corp (NVDA), (2) Intel Corp (INTC), (3) Advanced Micro Devices Inc (AMD), and (4) Taiwan Semiconductor (2330) and for those who are a little more advanced (5) Micron Technology (MU).

Outside of Taiwan Semiconductor, the rest of this list consists of firms that are all headquartered in the USA. This list of 5 firms generated just shy of $US200 billion in sales in the last twelve months putting them right between Peru (GDP of $US202 billion) and Iran (GDP of $US192 billion) when it comes to their ability to generate monetary value from their finished goods and services during a specific period.

This large scale has made these firms, and the sector, unconventional household names with large economies of scale, brand loyalty, and business goodwill. The enterprise value for each of these firms compared to the sales generated (or better known as the EV/Sales ratio) showcases that full price discovery might have been fully priced in by investors large and small for some of the names. It also shows that others are going through short-term problems or are in the maturity phase warranting a lower valuation.

The Canadian Semiconductor industry has thus far gone unrecognized by investors as most of the firms are way smaller in scale. Canada has an estimated semiconductor market size of about $US 3-4 billion compared to the global market size of $US550 billion in 2021.

If you do a quick Google search for Top Canadian Semiconductor Stocks the powerful search tool provides you with a list of hits that shed light on how little is known about the Canadian markets’ semiconductor players.

Of the 21,400,000 results, I went with the article appropriately named, “The Best Canadian Semiconductor Stocks in Canada” as my reference and choose to quickly analyze the four stocks names in this article without reference to the contents of their piece of work.

My hope was that I would get to the bottom of why this sector is not covered more commercially by the media and analysts. With the premise that if there was no underlying disadvantage to running a semiconductor business in Canada compared to the neighbors in the south, then I could conclude there would be a profit to be made by identifying stocks that seem to meet some sort of quantitative or qualitative metrics of future growth potential and attractiveness.

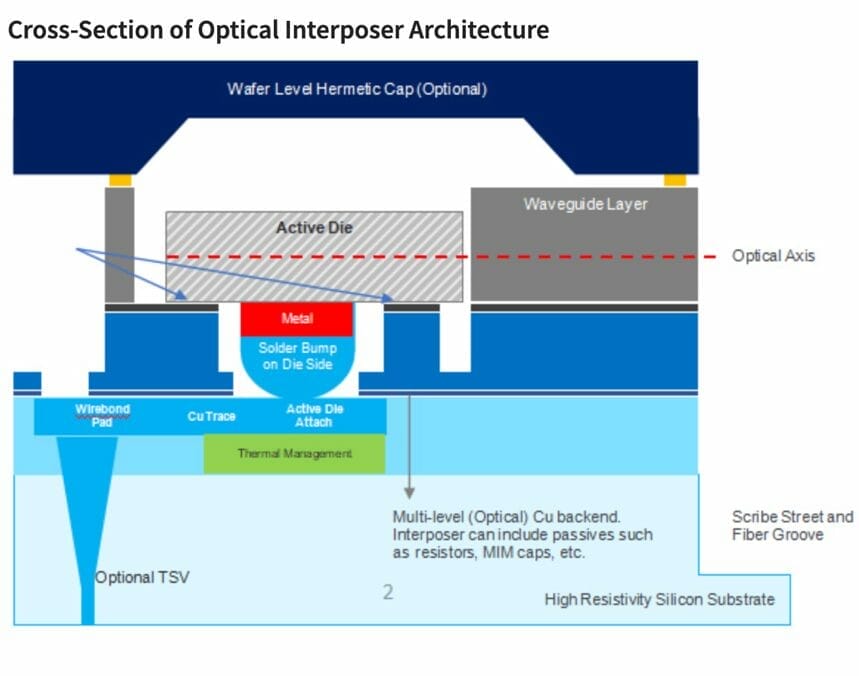

The first stock on their list was POET technologies (PTK.V). PTK designs, develops, manufactures, and sells integrated optoelectronic solutions for data communications and telecommunications markets. Wikipedia defines optoelectronic solutions as the study and application of electronic devices and systems that source, detect and control light, usually considered a sub-field of photonics.

PTK is marketing its proprietary POET Optical Interposer platform which utilizes a novel waveguide technology that allows the combination of electronic and photonic devices into a single multi-chip module.

PTK’s Optical Interposer eliminates costly components, assembly, and testing methods used in conventional photonics solutions. In addition to lowering costs compared to conventional devices, PTK’s Optical Interposer provides a flexible and scalable platform for a multiplicity of photonics applications ranging from data centers to consumer products.

The company is run by Suresh Venkatesan who is the Chairman and CEO of PTK. Dr. Suresh Venkatesan joined PTK from GLOBALFOUNDRIES where he served as the Senior Vice President of Technology Development and was responsible for the company’s Technology Research and Development. Suresh is an industry expert with over 22 years of experience in semiconductor technology development and holds a Bachelor of Technology degree in Electrical Engineering from the Indian Institute of Technology and Master of Science and Ph.D. degrees in Electrical Engineering from Purdue University.

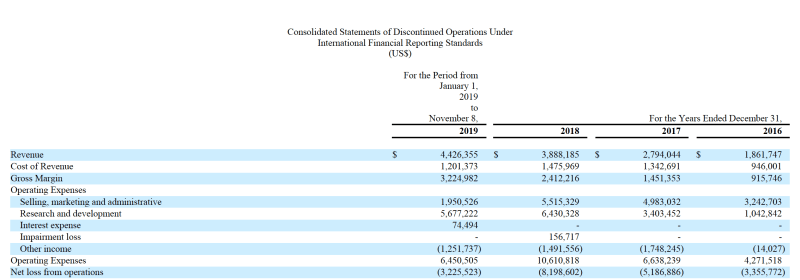

Of the 4 firms in their article, only two are currently producing sales, and only PTK is producing growing sales.

Our next firm is Spectra7 Microsystems (SEV.V) and is the other sales producing firm. SEV is a high-performance analog semiconductor business targeting large, high-growth markets in virtual reality (“VR”), augmented reality (“AR”), data centers, and consumer connectivity. The firm holds about 55 patents relating to its products and during the three and nine months ended September 30, 2021, the firm generated approximately 99% and 99% of its revenue from two customers, respectively.

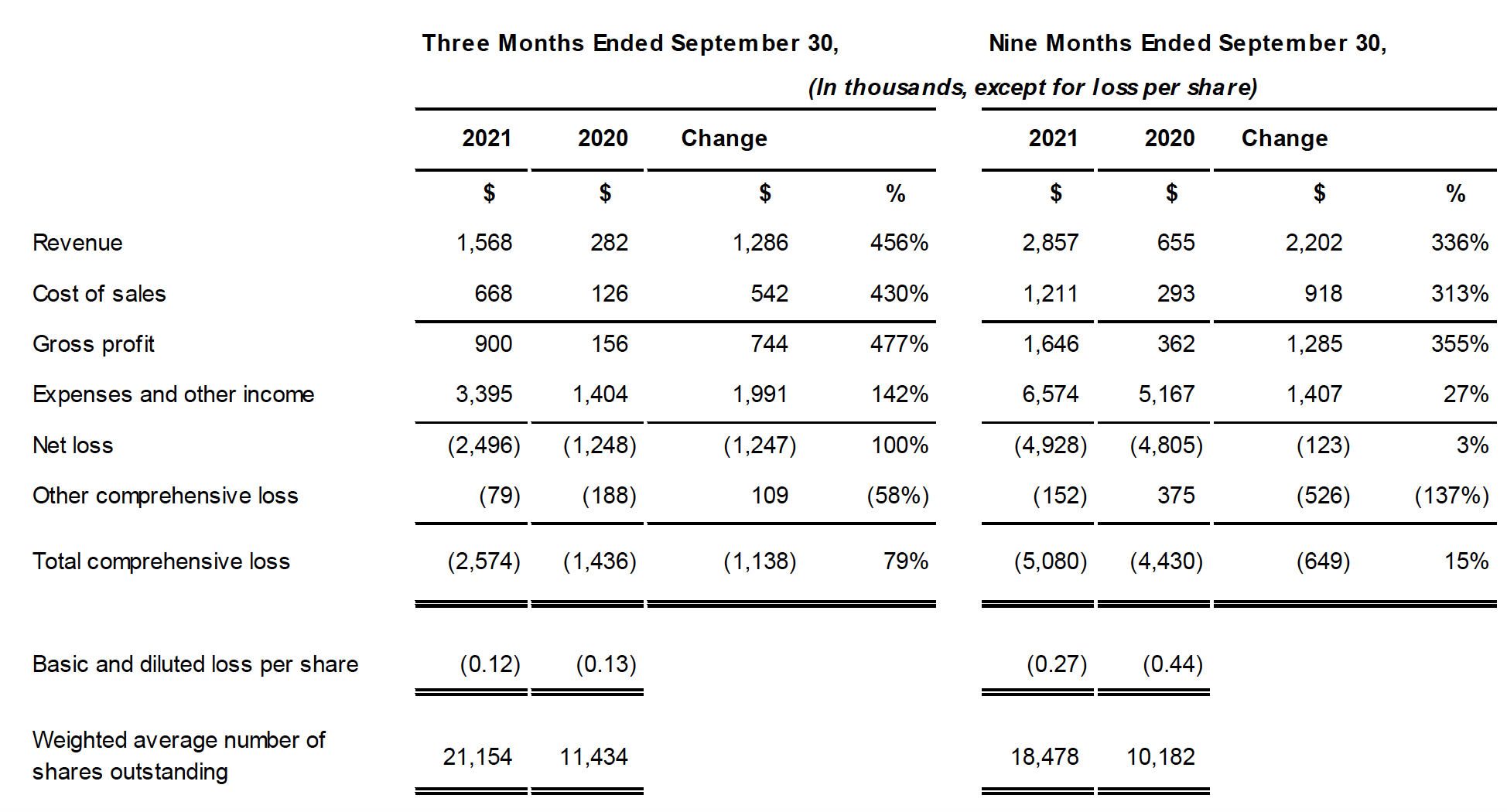

For the nine months ended September 30, 2021, they generated $US2.8 million in sales which was up 336% from the previous year. This produced a gross profit of $US1.6 million or a gross margin of 57% compared to 55% in the same period in 2020.

They currently have $US3.5 million in assets consisting of $US170,000 in cash, 1.27 million in receivables, 1 million in inventory, and 640,000 in property plant and equipment. Historically, the firm has funded its operations from the sale of equity securities and from debt financing.

With its current capital structure and balance sheet, its objectives are to grow revenue by expanding its product lines and entering new markets. They also want to finance investment in research and development and to ensure that capital resources are readily available to meet obligations as they become due.

On the other side of the spectrum, we have Quantum eMotion (QNC.V) who haven’t produced any sales yet but are gearing up to take advantage of the growing sector. QNC is a Montreal-based advanced developer that is leading the way towards a new generation of quantum-safe encryption for the quantum computing age. Quantum computers perform calculations based on the probability of an object’s state before it is measured – instead of just 1s or 0s – which means they have the potential to process exponentially more data compared to classical computers.

QNC’s family of Quantum Random Number Generators (QRNGs) is optimized to provide more speed, scalability, and true randomness at a fraction of the cost of other devices in the market. As we mentioned above, they have not generated sales yet but are focused on growing and commercialization.

We can look at their balance sheet for a glimpse of how they have structured their capital and funded operations to date.

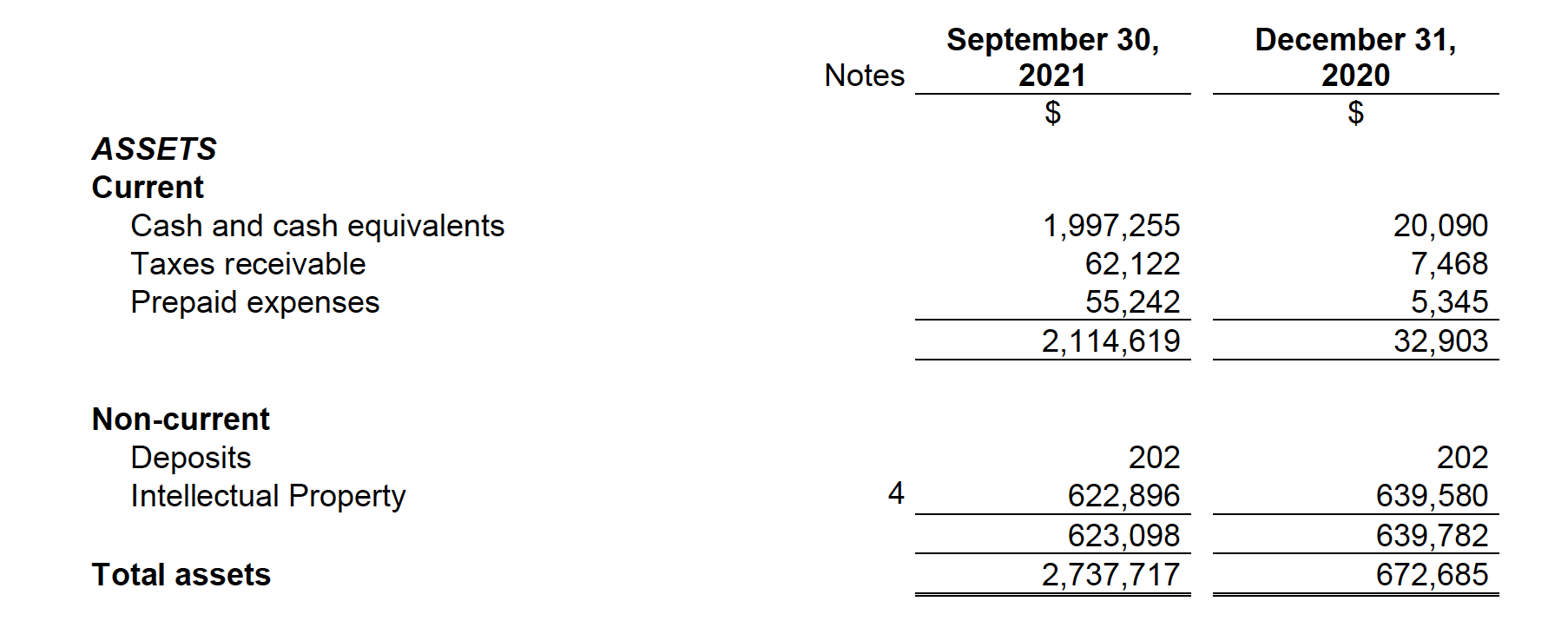

The company has $1.9 million of cash, some prepaid expenses of 55,000, and tax receivables of close to 62,000 as of their latest balance sheet. this brings their total current assets to close to $2.1 million mostly consisting of that cash balance. They also have intellectual property of about $600,000 and some deposits of $200.

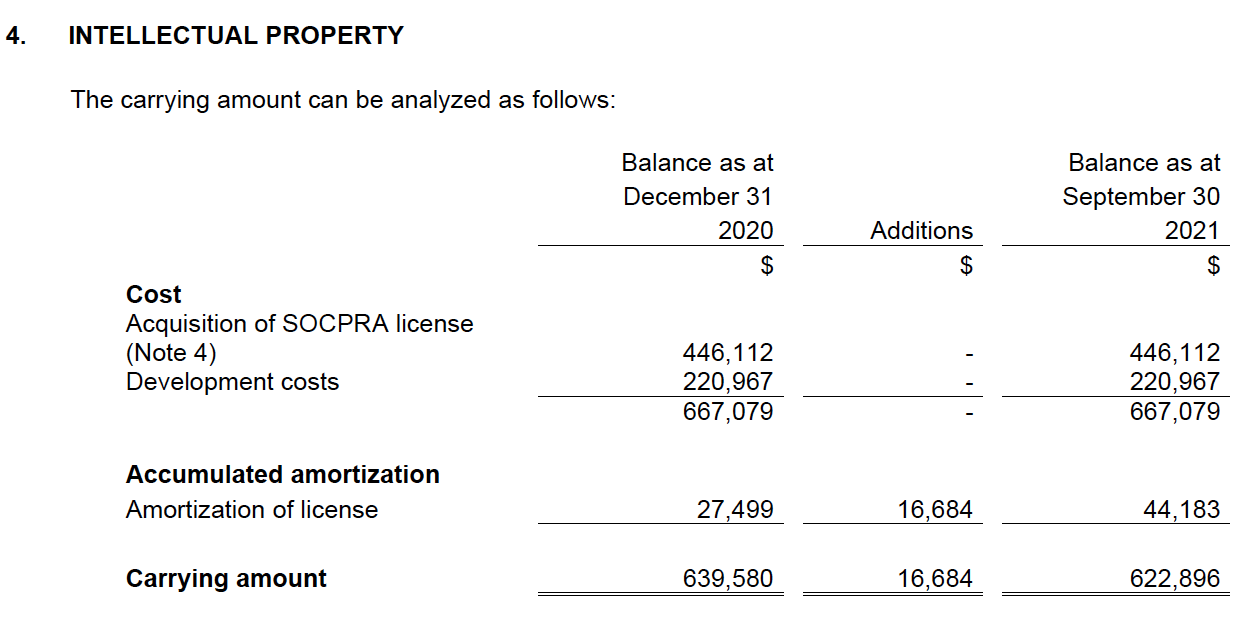

The bulk of their intellectual property is from their acquisition of SOCPRA license and development costs. In their September quarterly report, they described the deal as follows:

“On August 3, 2016, the Company entered into an Intellectual Property Assignment Agreement with Société de Commercialisation des Produits de la recherche appliquée SOCPRA Sciences et Génie SEC (“SOCPRA”) and its inventors by issuing a total of 6,000,000 common shares of the Company at a fair value of $0.05 per share, representing a total fair value of $300,000. The Company also reimbursed $13,838 to SOCPRA for the professional fees associated with the protection of the patent (“Acquisition”).

Until the expiry of the last patent rights, the Company will pay to SOCPRA a royalty of 5% calculated on the net sales price of products sold by the Company. The royalty shall be calculated on a 12-month basis starting on the effective date and shall be paid by the Company to SOCPRA within 90 days following the expiry of each reference year. The Company may have an option to buy back the royalties in the future at terms and conditions to be agreed upon by both parties. Pursuant to the IP Agreement, if the Company did not find or develop a commercial application within three years, 50% of the intellectual property would be transferred back to SOCPRA. As the Company found a commercial application within three years, 50% of the intellectual property shall not be transferred.

The Acquisition was not considered to be a business combination and was accounted for as an asset acquisition. Total purchase price of $300,000, finder’s fees of $30,000 and transaction costs of $116,112, which includes the reimbursement of $13,838 above, totalling $446,112, were capitalized to intellectual property.”

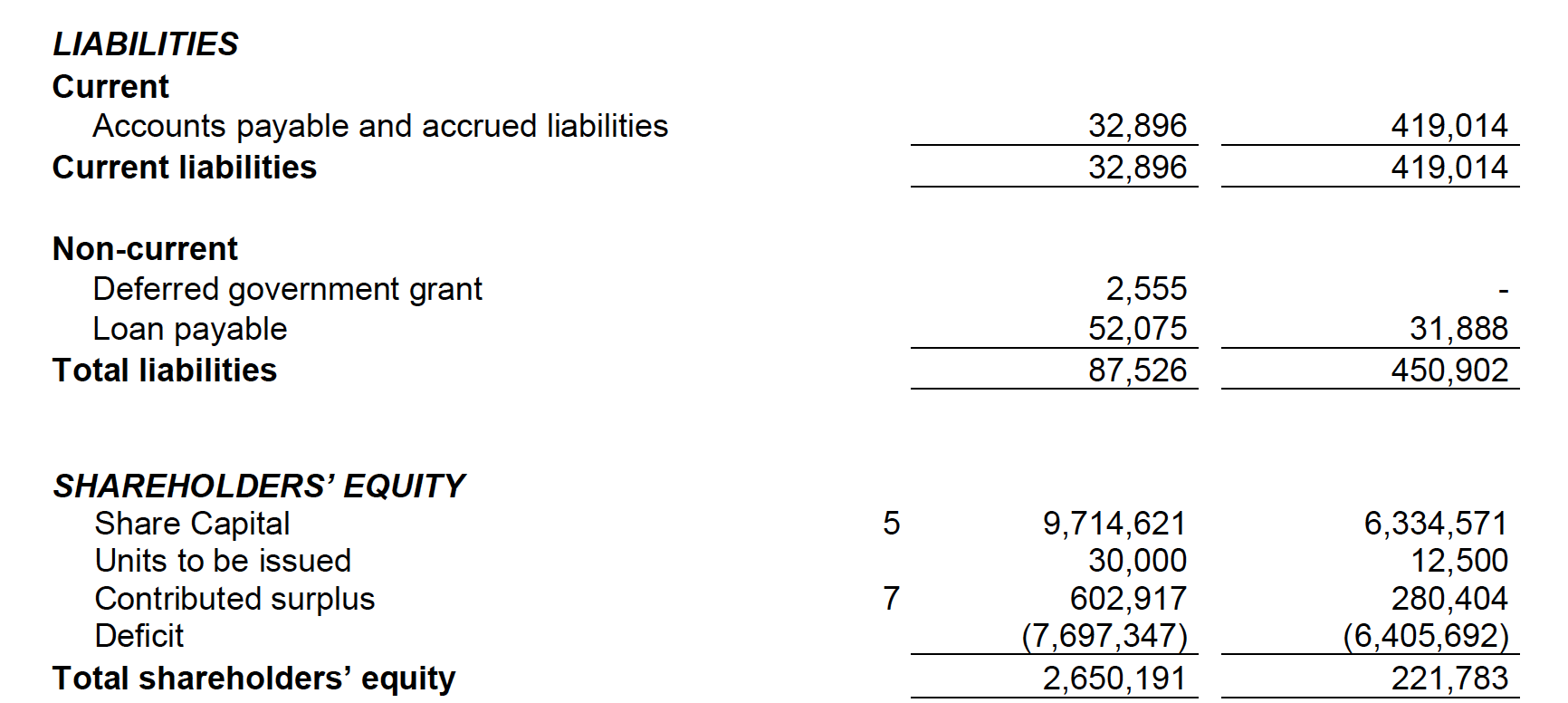

Thus far they’ve only used loan payables of $52,000 and mostly share capital to find the business meaning their balance sheet is set up with a bottom-heavy structure. As of September 2021, they had $9.7 million in shape capital an accumulated deficit of 7.6 million bringing their total shareholders’ equity to $2.6 million.

This sort of structure allows the company to be nimble and only raise equity when the need is there allowing them to also pay their dues with any cash available in their balance sheet putting them in a positive working capital position. The majority of their cash has gone to their intellectual property because the nature of the business is in the technology space allowing them to capitalize on some of the patents that will allow them to generate sales in the future.

Of course, an operation like this is generally speculative and there is no set timeline to win the company would record sales but achene understanding of how they structured their balance sheet is an indication of how the management thinks about their operations.

So far, these three companies seem to be the candidates that are best suited for investors in Canada who are looking to gain exposure to the semiconductor space without venturing into some of the large-cap stocks in the United States. The industry is still relatively small and any purchases of securities in the sector should be seen as speculatory at best. But as the going says on Wall Street when the risk is higher the reward is usually high if the analysis behind the investment is sound.

With Canada being traditionally left out of the conversation when it comes to semiconductor manufacturing this is a ripe opportunity to do some analysis on the companies in this sector and expand your understanding of how important the sector is to your day-to-day lives. The tailwind seems strong.

POET sounds like it has the goods to be successful. Thank you for the article as it is very insightful

Thank you for reading. I have more I think you would like to check out on substack at https://takundachena.substack.com.