- $247.858B Market Capitalization

Shopify Inc. (SHOP.T) is a leading provider of essential internet infrastructure for commerce. The Company offers tools to assist in the growth, marketing, and management of retail businesses of any size. Shopify was founded in Ottawa by Tobias Lutke and Scott Lake. Initially branded Snowdevil, an online store for snowboarding equipment, ‘Shopify’ was launched in June 2006 after two months of development.

With this in mind, Shopify has grown exponentially, powering over 1.7 million businesses in more than 175 countries. Additionally, the Company is trusted by major brands, including Gymshark, Heinz, and Staples Canada, to name just a few.

I am a sucker for sustainability. That being said, Shopify has its own Sustainability Fund and Social Impact Initiatives. Through the Company’s Sustainability Fund, Shopify intentionally overpays for carbon removal while also funding pilot projects. More specifically, Shopify invests $5 million annually and has identified 10 industries as high-potential.

Before I go off on a tangent, let me give you a brief lesson on carbon that I am not qualified to teach. When one atom of carbon is bonded with two atoms of oxygen, it becomes carbon dioxide, the primary cause of global warming. Keep in mind, most carbon dioxide comes from human activities like burning fossil fuels, coal, oil, and natural gas. In fact, human-caused emissions have increased atmospheric carbon dioxide by approximately 50%. Yikes. With this in mind, Shopify’s Sustainability Fund has two portfolios intended to limit carbon emissions:

Frontier Portfolio

The Company’s Frontier Portfolio focuses on groundbreaking technologies intended to permanently remove carbon from the atmosphere. Shopify’s goal is to spend most of the Sustainability Fund on this category each year.

- Direct Air Capture: pulling carbon directly out of the air, then storing it safely and permanently

- Product: injecting and storing carbon directly into usable products (e.g. concrete)

- Ocean: maximizing the world’s largest carbon sink, the ocean, and reducing ocean acidification

- Biomass: using organic material to create renewable energy and store carbon in creative ways

- Mineralization: turning carbon into a mineral that can be permanently stored away

- Collaboration: partnering with like-minded organizations looking to reverse climate-change

Evergreen Portfolio

The Evergreen Portfolio is intended to provide key solutions that temporarily remove carbon emissions.

- Forest: planting, restoring, and protecting forests to allow trees to store more carbon

- Soil: using specific techniques to increase soil health and its ability to store carbon

- Renewable Energy: creating fossil fuel alternatives that cause less pollution while being scalable

- Transporation: reducing and offsetting emissions caused by transport vehicles

Latest News

Shopify announced today (November 30, 2021) a record-setting Black Friday + Cyber Monday (BFCM) weekend. From the start of Black Friday in New Zealand through the end of Cyber Monday in California, the Company reported sales of $6.3 billion globally. This represents a 23% increase in sales from the more than $5.1 billion reported during Shopify’s 2020 BFCM weekend, and more than double its merchants’ sales from the same holiday shopping weekend in 2019.

“We call Black Friday / Cyber Monday the Super Bowl of commerce, and this year was the biggest yet…These record sales showcase the monumental impact that independent businesses have on the global economy. We’re watching these entrepreneurs evolve in real-time, embracing selling strategies across every sales channel you can think of and showing up wherever their customers want to shop. This is the future of commerce, and it’s incredible to see our merchants around the world leading the revolution,” said Harley Finkelstein, President of Shopify.

This year, Shopify saw deals starting earlier than ever as brands and shoppers got ahead of shipping and supply chain delays, with daily total sales increasing 28 days before Cyber Monday versus 19 days in 2020. In total, Black Friday’s online sales reached $8.9 billion, slightly below 2020 levels, according to Adobe Analytics. On the contrary, physical store traffic rose significantly from last year. With this in mind, the mixed performance points to shifting consumer trends like buying earlier. Having gone to the mall earlier this month, I can attest to this. From packed parking lots to crammed stores, Christmas shoppers were already out in full force after Halloween.

Shopify 2021 BFCM Global Highlights:

- Black Friday saw the highest shopping volume during the weekend, with peak sales of more than $3.1 million per minute at 12:02 PM EST on November 26, 2021

- 47 million consumers globally purchased from independent and direct-to-consumer (D2C) brands powered by Shopify

- Shopper spending increased across many countries, with consumers globally spending $100.70 per order on average throughout the BFCM weekend

- Consumers in Canada, Australia, and the United States spent the most on average

- cross-border sales represented 15% of all orders globally

Furthermore, for the second year in a row, Shopify is doing its part to combat climate change during BFCM. This year, the Company purchased enough carbon removal to completely eliminate the impact of carbon emissions from shipping on every single order on Shopify’s platform over the shopping weekend. This amounts to nearly 60,000 tonnes of carbon emissions offset, compared to almost 62,000 tonnes in 2020. Not too shabby.

Financials

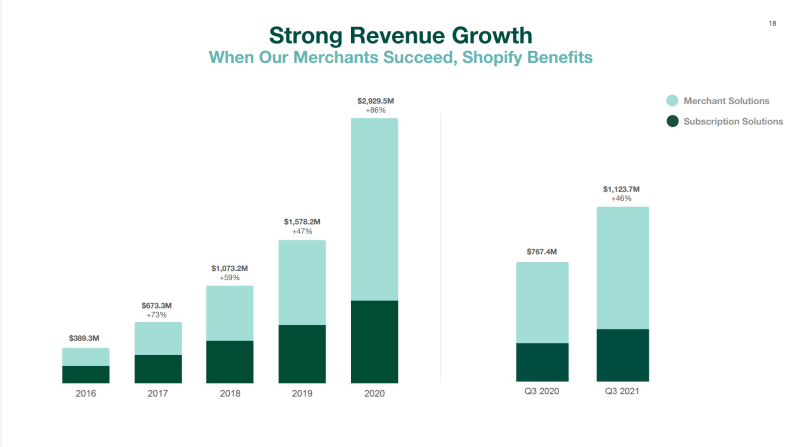

According to Shopify’s Q3 2021 Financial Results, the Company had cash and cash equivalents of USD$2,189,613 on September 30, 2021, compared to USD$2,703,597 on December 31, 2020. On September 30, 2021, Shopify had total assets and total liabilities of USD$13,536,518 and USD$1,569,684, respectively. The Company’s total liabilities increased marginally from USD$923,850 compared to its total assets, which increased substantially from USD$7,762,905.

“It took 15 years for our merchants to get to $200 billion in cumulative GMV and just 16 months to double that to $400 billion…Our merchants’ GMV remained strong in Q3. As the share of GMV from offline expanded within our total GMV, it is clear that entrepreneurs are embracing a future in which retail happens everywhere. Shopify is making it easier for more merchants worldwide to build direct and authentic relationships with their customers, in creative ways that work best for them,” said Harley Finkelstein.

In total, Shopify reported a gross profit of USD$608,909 on September 30, 2021, compared to USD$405,148 year-over-year (YOY). Although the Company’s operating expenses increased to USD$613,010, Shopify reported a net income of USD$1,148,432 for the three months ended September 30, 2021. For the nine months ended September 30, 2021, the Company reported a net income of USD$3,285,970 indicating a significant increase from USD$195,637 in the same period last year.

Keep in mind, Shopify is competing with Amazon, which possessed a 39% share of U.S. Retail eCommerce Market sales in 2020. On the other hand, Shopify achieved an 8.6% share of this market, ahead of competitors like Walmart, eBay, Apple, and The Home Depot, to name just a few.

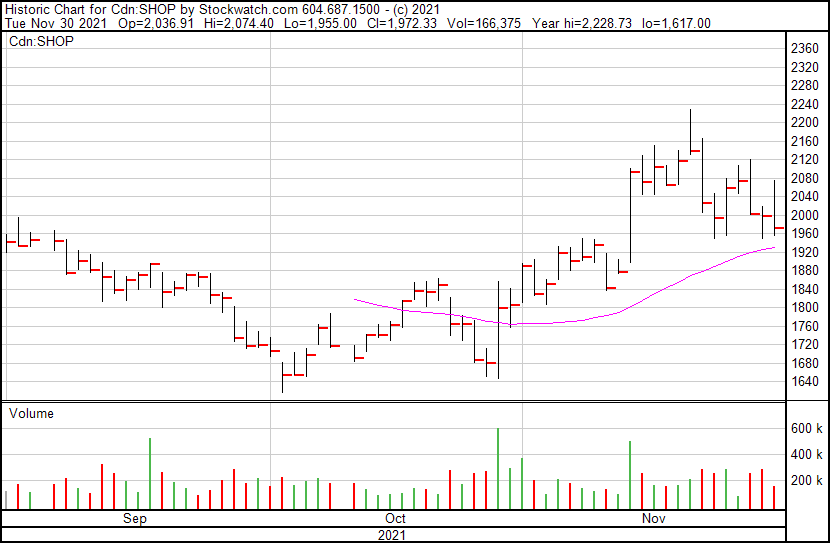

Shopify’s share price opened at $2,036.91, up from a previous close of $2,000.00. The Company’s shares are down 1.51% and were trading at $1,969.82 as of 12:18 PM EST.