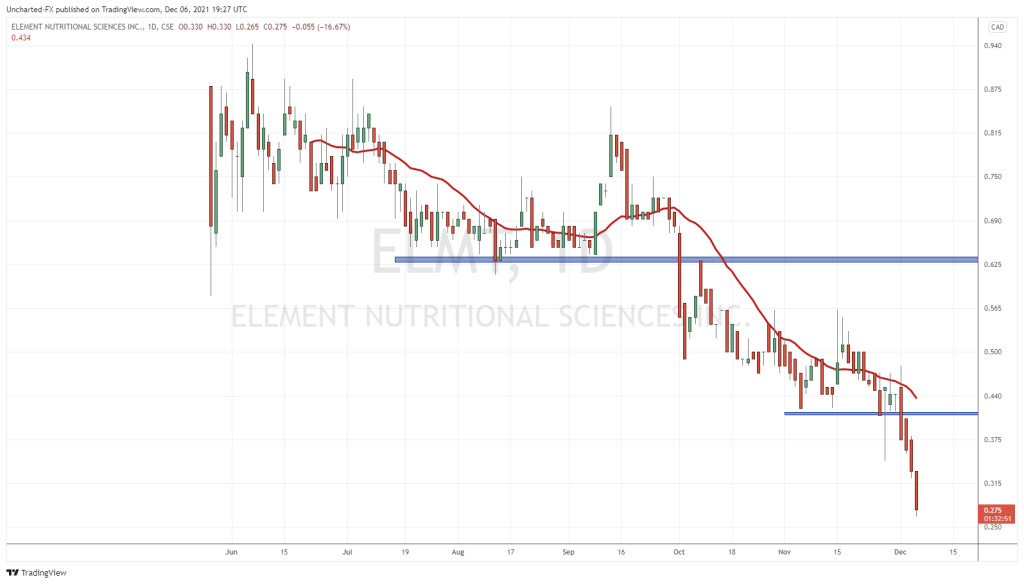

We’ve been talking about Element Nutrition (ELMT.C) for some time on Equity.Guru and it’s been frustrating to watch its stock slowly slump over the last six months while the company keeps putting out good business.

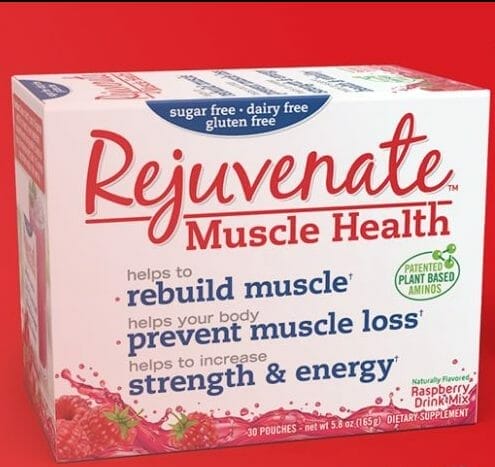

Their Rejuvenate Muscle Health product sits in the drug store aisle next to the Boost and Ensure drinks, which sell a ton of product internationally, specifically to seniors looking for either a meal replacement, or a protein/vitamin boost. The problem with those industry leaders is they’re generally high in sugar, lactose, and ingredients you’d struggle to name.

That’s the opportunity Rejuvenate has jumped on, to provide the same product but without lactose, sugar, and gluten, while low in fat and calories, and providing essential amino acids that help battle muscle loss.

The big battle for a new product looking to penetrate an existing SKU section is shelf space. Often companies will need to pay for placement, or at least show they’ve engaged in a national advertising campaign before the big box stores and national chains will let them in.

Rejuvenate has pushed right in, and quickly, without having to break its back. Initially the product was a supplement to add to water and smoothies, but they’ve added ready-to-drink products now, which draw from a much larger market. the company is promising to bring sports nutrition options and immunity boost products in the near term, now that their distribution channels have proven out.

The deal announced Monday, which involves the placement of an initial order from the WalMart (WMT.NYSE) bulk-buy subsidiary Sam’s Club, with 589 locations and a global presence, may be their biggest deal yet.

The deal follows an intial test run on Sam’s Club’s online portal in July.

Element Nutritional Sciences Inc.’s Rejuvenate ready-to-drink organic plant protein beverage will be available at all 589 Sam’s Club locations, with shipments beginning Nov. 29, 2021. This follows the launch of Rejuvenate on the Sam’s Club e-commerce platform in the United States announced on July 14, 2021. [..] Founded in 1983, Sam’s Club is a wholly owned subsidiary of WalMart in the United States and Puerto Rico, in addition to locations in Brazil, China and Mexico. For the fiscal year ending Jan. 31, 2021, Sam’s Club’s total revenue was $64-billion.

No small feat. Finding a spot on that chain’s roster means many smaller retail chains will be happy to take the product. Amazon reviews show 4 stars out of 5, which bodes well for repeat use.

The Sam’s Club deal means the products can now be found at Loblaws, CVS, Walgreens, Shoppers Drug Mart, Amazon, Food Lion, Fortinos, Metro, and iHerb, among others, which puts it across North America and beyond. A recent Asia Pacific distribution deal promises to open more global markets.

CEO Stuart Lowther told Keith Schaefer that the deal to break into Sam’s Club took TWO YEARS to close, so this is a watershed moment. Ultimately, supply chain issues at other companies presented the opportunity.

“That meant that Sam’s Club was keen for product and we were talking to them anyways. Knowing we had an opportunity and the inventory, we followed up with the buyer. The buyer asked if we had inventory and how fast we could fulfill? We said yes and he said– ‘we can accelerate this thing’. In a matter of 10 business days we had PO’s in hand and rolling.”

Let’s be real – Element has struggled to inspire the market since going public, despite ongoing good work from the company in building distribution to some 16,000 stores across North America. What’s needed to jack the share price is strong revenues, but this Sam’s Club deal seems likely to get the company there being as it’s Costco-equivalent and bulk in nature. As seniors walk out with bulk packs, rather than the one-off purchases that tend to come in drug stores, the bottom line may be set to move hard in the weeks ahead.

Last quarter financials showed a 212% year-over-year growth in revenues, most of which trailed these deals kicking in. Sam’s Club will be taking product from the end of November, so it’s unlikely to penetrate into the next quarter of financials coming in days, but expect some guidance as to the size of those deals and a big following quarter.

ADDENDUM: The post was initially written before ELMT’s financials dropped and, as expected, the new Sam’s Club order wasn’t a factor in them. The share price has duly dropped low enough that I think it’s time I began accruing.

— Chris Parry

FULL DISCLOSURE: Element Nutrition is an Equity.Guru marketing client.