A shortened Thanksgiving week, but still some action in the Financial markets. President Biden might be beginning an Oil price war with OPEC+, and analysts predicting retail sales data for Thanksgiving and Black Friday. However, I think there is one news piece that should be garnering more attention. In some macro circles, analysts are saying this news confirms food shortages in H1 2022. The big news out this week: There is a North American fertilizer shortage, which could lead to a shortage and higher food prices. Some might think this is gloom and doom, but regular readers of my Agriculture sector knew there were signs and a pretty good possibility that this would happen. Hence why we think investing in Agriculture will provide us with exceptional returns.

A global shortage of nitrogen fertilizer is driving prices to record levels, prompting North America’s farmers to delay purchases and raising the risk of a spring scramble to apply the crop nutrient before planting season. Farmers use Nitrogen to boost crop yields of Corn, Canola and Wheat, and higher fertilizer costs would mean higher meat and bread prices for consumers. Food inflation is already breaking decade plus records, so this becomes a worry. The Fed’s transitory inflation may not be so temporary.

The weather and natural gas are to blame. The Texas Arctic blast in February and Hurricane Ida in August disrupted US fertilizer production. The rising prices of natural gas, a key input in producing nitrogen, soared in Europe due to high demand and low supplies.

Here is what Daren Coppock, CEO of the US based Agricultural Retailers Association, had to say:

In the US, nitrogen fertilizer supplies are adequate for applications before winter, said Daren Coppock, CEO at the US-based Agricultural Retailers Association. Applying fertilizer before winter reduces farmers’ spring workload.

But with prices so high, some farmers are delaying purchases, risking a scramble for supplies during their busiest time of year, Coppock said.

Delaying fertilizer purchases until spring runs the risk of further supply chain congestion as farmers rush to apply fertilizer and plant seed during a tight window.

“There’s going to be a lot of people who wait and see,” Coppock said. “[But] if everybody’s scrambling in the spring to get enough, somebody’s corn isn’t going to get covered.”

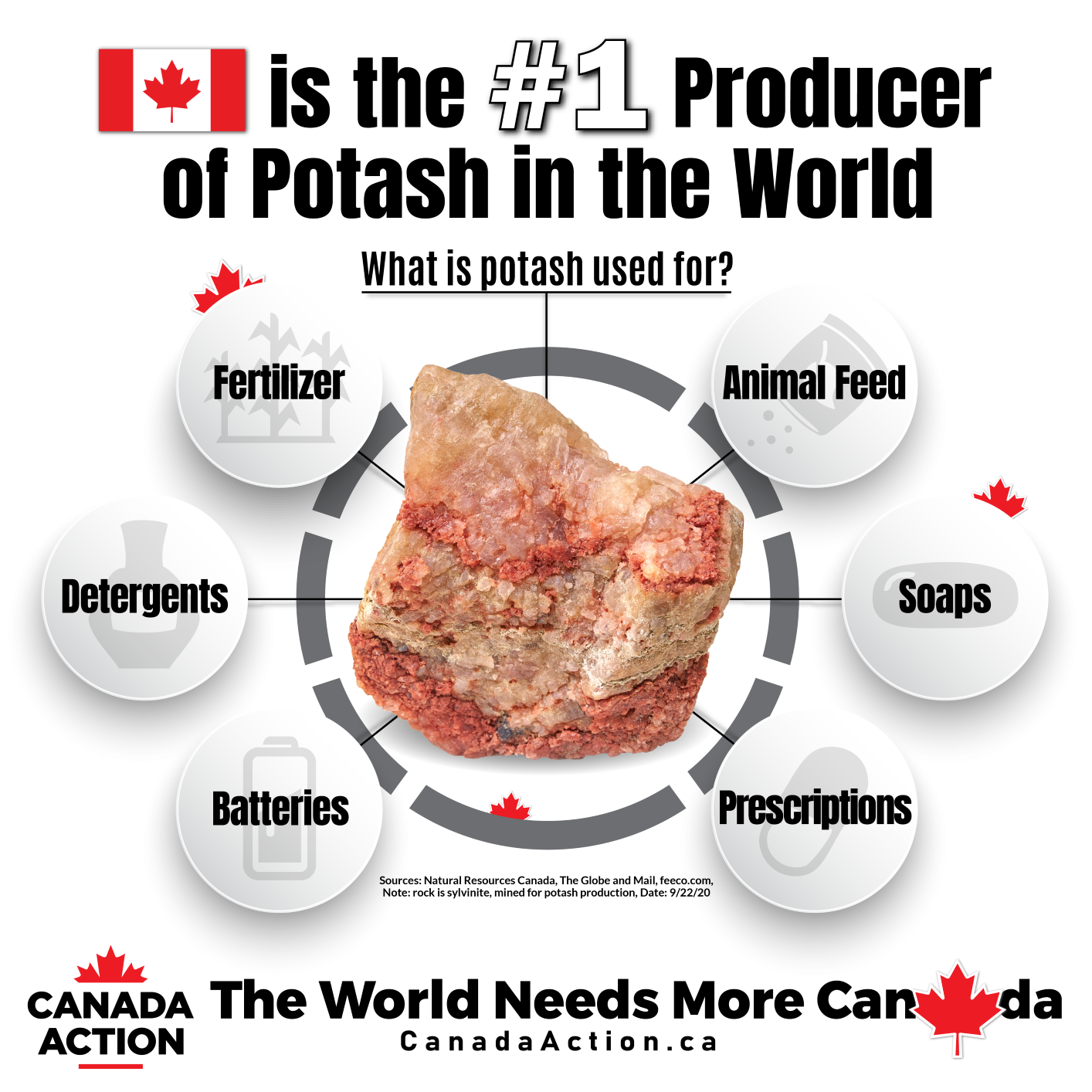

Since this is going to be a hot topic for months to come, today’s Agriculture Sector Roundup will be focused on fertilizers (potash). What is Potash you ask? Mosaic company, which we will take a look at further below, explains Potash nicely:

Fertilizer potassium is sometimes called “potash”, a term that comes from an early production technique where potassium was leached from wood ashes and concentrated by evaporating the leachate in large iron pots (“pot-ash”). Clearly, this practice is no longer practical and is not environmentally sustainable. In food production, potassium is removed from the soil in harvested crops and must be replaced in order to maintain future crop growth.

Potassium is a natural plant food because fertilizers such as potassium chloride and potassium sulfate are widely found in nature. Fortunately, there are huge reserves of potash in the earth that can meet our need for this nutrient for many centuries to come. This fertilizer is clearly not an artificial or manufactured chemical, since it comes directly from the earth and is simply recycled through very long geological processes.

Potassium is essential for plant health and there must be an adequate supply in the soil to maintain good growth. When the potassium supply is limited, plants have reduced yields, poor quality, utilize water less efficiently, and are more susceptible to pest and disease damage.

In many parts of the world, agricultural soils are gradually becoming depleted of potash. Some soils were high in potassium when they were first cultivated long ago. However, after many years of intensive cropping and repeated nutrient removal during harvest, many fields now require regular inputs of potash to maintain their productivity.

Above I have the top producing Potash companies. PotashCorp doesn’t exist anymore. A merger of PotashCorp and Agrium led to Nutrien. What better way to start off the fertilizer roundup than with Nutrien.

Nutrien (NTR, NTR.TO)

Nutrien is the largest US farm supplier. They are the big guys in Potash. The company offers potash, nitrogen, phosphate, and sulfate products; and financial solutions. It also distributes crop nutrients, crop protection products, seeds, and merchandise products through approximately 2,000 retail locations in the United States, Canada, South America, and Australia.

Recently, Jeff Tarsi, Nutrien’s senior Vice-President of retail, stated the company has secured less nitrogen fertilizer than usual for Spring delivery because manufacturers are making less available. However yesterday, Nutrien announced they will be building four blending facilities in Brazil to double its capacity amid a global shortage.

Above I have the TSX traded chart, but Nutrien can be bought on the US exchange. Readers are familiar with this company and the chart. They really are the major Potash play. I want to say think of them as the Aramco or Kazatomprom of Potash. This will be the first company that comes up on Wall Street screeners and financial media tv screens if Potash shortages lead to food issues. There will be a lot of action.

The stock is up 45% year to date. In previous roundups, I discussed the new record high breakout above $80. We hit all time highs at $91.15, and now, another push looks likely. A DAILY close above $90 would trigger the breakout and another leg higher. The big $100 level would be the next major resistance zone of interest.

Western Resources (WRX.TO)

Western Resources Corp is constructing Canada’s newest and most innovative, environmentally friendly and capital-efficient potash mine in Saskatchewan. This will be the first potash mine in the world that will leave no salt tailings at the surface, thereby reducing the water consumption by half as well as significantly improved energy efficiency. Recent news regards their updated NI 43-101, which can be read here (including details of the Cap Ex and resource).

Let’s say it together everybody. This chart looks BASED. The stock has been ranging since March of this year. $0.175 is our key support. This zone must hold for further upside momentum down the line with a good catalyst. Every time we drop to this support, buyers step in just like they did recently on November 19th. A huge 22% pop on the 22nd of November with 204,000 shares traded. The most volume traded on this stock since May 10th 2021. Something is a foot, and if Potash sees an increase in investor and trader demand, then I find based/ranging charts to be the best.

Verde Agritech (NPK.TO)

Verde is an agricultural technology company that develops and produces fertilizers. They hold properties, and are based out of Brazil. The company produces and sells K Forte, a multinutrient potassium fertilizer; and Super Greensand, a fertilizer and a soil conditioner.

The company recently put out stellar earnings and forward guidance. A 169% increase in revenue for Q3 2021 and revised upward targets for the year.

Readers were notified on the breakout above $1.10, and the market structure set up. The retest of $1.10 saw buyers taking us into new recent highs, and confirming a higher low in this new uptrend. We have now closed above $1.90. Very bullish. This company has great fundamentals, and will attract more funds on a Fertilizer shortage. Zooming out on the chart, and the next resistance I see comes in at $2.50.

Karnalyte Resources (KRN.TO)

Karnalyte Resources Inc. explores for and develops agricultural and industrial potash, nitrogen, and magnesium products in Canada. Karnalyte owns the construction ready Wynyard Potash Project, with planned phase 1 production of 625,000 tonnes per year of high grade granular potash, and two subsequent phases of 750,000 TPY each, taking total production up to 2.125 million TPY.

The company announced third quarter results which included an update of capital cost summaries, operating cost summaries, and an update of the market and economic analysis. The market liked it, and the stock popped hard.

I zoomed out on this one, because I want to show you the important resistance coming up ahead. But first, the trendline break at around $0.17 led the stock to this resistance. The trendline breakout was covered in a previous sector roundup.

Here is where things get interesting. If we can climb and close above $0.315, it would trigger a broader range breakout going back to 2019! $0.50 comes after, and then higher. This is another based/ranging set up I prefer to put my money in on money flowing to fertilizers.

Gensource Potash (GSP.V)

Gensource is a fertilizer development company based in Saskatoon, Saskatchewan and is on track to become the next fertilizer production company in that province. With a modular and environmentally leading approach to potash production, Gensource believes its technical and business model will be the future of the industry. Gensource operates under a business plan that has two key components: (1) vertical integration with the market to ensure that all production capacity built is directed, and pre-sold, to a specific market, eliminating market-side risk; and (2) technical innovation which will allow for a small and economic potash production facility, that demonstrates environmental leadership within the industry by using significantly less water per tonne compared to conventional solution mining operations, producing no salt tailings, therefore eliminating decommissioning risk, and requiring no surface brine ponds, thereby removing the single largest negative environmental impact of potash mining.

Their Tugaske project in Saskatchewan is shovel ready, has debt financing secured, and initial activities such as team formation and ramp up have begun.

The stock is up 82% year to date. Just printed new record all time highs of $0.475 at the beginning of November 2021. This is a company worth keeping tabs on. I like what I am reading. The project is derisked, and seems like a prime takeover candidate if management wants to sell.

Technically, the range break above $0.25 was huge. Since then, we have been making higher lows and higher highs. The main skeleton of an uptrend. We have sold off, but I will be watching this higher low at $0.35. If we break below this level, then a push to $0.30 and $0.25 is likely. I want to see how price reacts at $0.35. If we get a green candle with nice volume that would be an entry opportunity. The confirmation of the resumption of the uptrend would be a close above $0.41.

The Mosaic Company (MOS)

Another one of the big boys that will attract Wall Street and Institutional money as this fertilizer shortage develops. The Mosaic Company produces and markets concentrated phosphate and potash crop nutrients in North America and internationally. The company operates through three segments: Phosphates, Potash, and Mosaic Fertilizantes. It owns and operates mines, which produce concentrated phosphate crop nutrients, such as diammonium phosphate, monoammonium phosphate, and ammoniated phosphate products; and phosphate-based animal feed ingredients primarily under the Biofos and Nexfos brand names, as well as produces a double sulfate of potash magnesia product under K-Mag brand name. The company also produces and sells potash for use in the manufacturing of mixed crop nutrients and animal feed ingredients, and for industrial use; and for use in the de-icing and as a water softener regenerant.

This chart looks appealing. As an option trader, I think I may initiate some contracts on this one. The stock made new 52 week highs tagging $43.24. We have then pulled back to retest resistance now turned support around the $36.00 zone. Note the last 3 weeks of price action. We have just been ranging here. A battle between the bulls and the bears. A breakout above $38 keeps us going. alternatively, a large green engulfing candle or a green candle with a large wick here would provide an early entry opportunity. I like what I am seeing given the fundamentals.

Scotts Miracle-Gro Company (SMG)

Okay, so not technically a Potash company, but I had to include this one given the technicals. But an overall good company for us interested in Agriculture in general.

The Scotts Miracle-Gro Company engages in the manufacture, marketing, and sale of products for lawn, garden care, and indoor and hydroponic gardening in the United States and internationally. The company operates through three segments: U.S. Consumer, Hawthorne, and Other. It provides lawn care products comprising lawn fertilizers, grass seed products, spreaders, other durable products, and outdoor cleaners, as well as lawn-related weed, pest, and disease control products; gardening and landscape products include water-soluble and continuous-release plant foods, potting mixes and garden soils, mulch and decorative ground cover products, plant-related pest and disease control products, organic garden products, and lives goods and seeding solutions.

It does not get any better than this! A new uptrend was triggered after we broke above $150 with stellar earnings. We have the fundamentals, and the technicals to back this move and further momentum. As long as we remain above $150, the uptrend continues. Look for a higher low to form. Price is touching my 20 day moving average, and generally I see buyers here. I will be watching for a green candle. Alternatively, just await for the break above $180 to join the next wave. This would be more of a trade approach, but higher prices are coming based on the uptrend shift.

CF Industries Holdings (CF)

CF Industries Holdings, Inc. manufactures and sells hydrogen and nitrogen products for clean energy, fertilizer, emissions abatement, and other industrial applications worldwide. Its principal products include anhydrous ammonia, granular urea, urea ammonium nitrate, and ammonium nitrate products. The company also offers diesel exhaust fluid, urea liquor, nitric acid, and aqua ammonia products; and compound fertilizer products with nitrogen, phosphorus, and potassium.

Another company that will attract institutional and Wall Street funds. CF Industries is close to making new all time record highs. There are just highs from 2015 at around $70 that need to be taken out. The uptrend here remains intact. Support for a pullback comes in at $62.00.

Itafos (IFOS.V)

Another Canadian company that has appeared in multiple sector roundups in the past. Itafos operates as a phosphate and specialty fertilizer platform company. It operates through Conda, Arraias, and Development and Exploration segments. The company produces and sells monoammonium phosphate (MAP), MAP with micronutrients, superphosphoric acid, merchant grade phosphoric acid, single superphosphate (SSP), SSP with micronutrients, and ammonium polyphosphate.

Itafos confirmed an important and bullish technical pattern. The flag pattern. The breakout confirmation came on November 12th after posting record Q3 numbers and raising forward guidance. No momentum after, but prices remain around $1.30-$1.60. Very big volume on the 25th (yesterday). Over 230,000 shares traded.

SOPerior Fertilizer (SOP-H.V)

SOPerior Fertilizer Corp. engages in the exploration, evaluation, and development of mineral properties and related projects in the United States and Canada. The company explores for alunite deposits to produce sulphate of potash, sulphuric acid, and alumina. Its principal mineral project is the Blawn Mountain project covering an area of approximately 15,404 acres of land located in Beaver County, Utah.

Zooming out on this chart, you can all see the opportunity. The stock has been ranging since 2020. It really gets interesting if we break above $0.075. This one can be interesting since it is cheaper than other set ups. Could provide good returns if Fertilizer stocks get a bid.

Intrepid Potash (IPI)

Let’s end off with another big company that will be on Wall Street radars.

Intrepid Potash, Inc. produces and sells potash and langbeinite products in the United States and internationally. It operates through three segments: Potash, Trio, and Oilfield Solutions. The Potash segment offers muriate of potash or potassium chloride for use as a fertilizer input in the agricultural market; as a component in drilling and fracturing fluids for oil and gas wells, as well as an input to other industrial processes in the industrial market; and as a nutrient supplement in the animal feed market. The Trio segment provides Trio, a specialty fertilizer that delivers potassium, sulfate, and magnesium in a single particle.

We had a major breakout above $36, which saw momentum taking the stock above $52. No retest just yet, but I like the stock above $36. Big volume day on Wednesday for Nutrien, CF Industries, The Mosaic Company and Intrepid Potash on Fertilizer shortage news.