In December 2018, we dropped an article about a company we’d spotted in the wild, a private cannabis company making moves in Africa and claiming they’d cracked the nut – that they were the largest cannabis farmer/distributor/exporter in the world and taking investment quickly to grow.

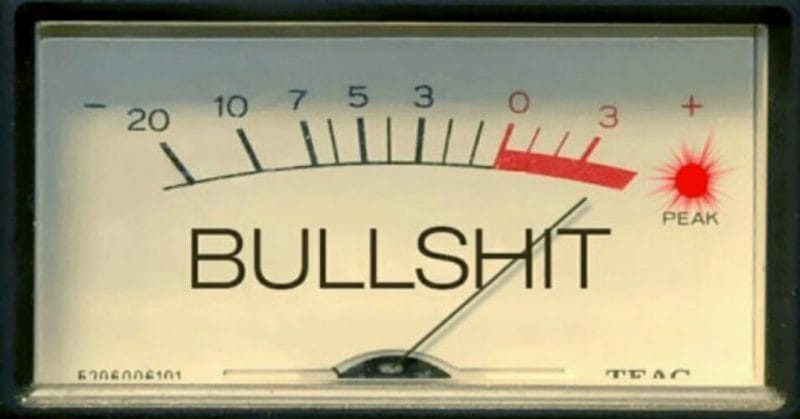

Their claims didn’t match up with how we knew the world to work, so we started to explore and soon found a mountain of bullshit propping up the whole story.

This not-yet-public ruse for rubes claims, in a paid for, non-bylined, promotional piece sent out this week to wire services that don’t have quality control, that it’s ‘Canada’s largest cannabis producer’ and is bringing down CBD oil prices by 96.3%.

Those two claims are actually in the headline.

Also worth noting: Both are lies. Instadose doesn’t ‘produce’ anything. It hasn’t brought down any prices because it doesn’t sell, or produce, or grow or export or import or do a damn thing.

Here’s a sample of the lies:

TORONTO — Flying under the radar for the past few months, InstaDose Pharma is ready to hit the market with 2 million liters of CBD oil in 2019. InstaDose Pharma has over 200,000 farmers harvesting cannabis out of the Democratic Republic of the Congo on over 100,000 hectares of land. The main production facility is GMP certified and pharmaceutically accredited with EU Pharmacopeia standards.

Ready to hit what market? The stock market? The Congolese CBD market?

200,000 farmers farming a football field of land each?

Instadose is a scam. It’s a fraud and I’ll stand right here at the risk of a lawsuit and say so to it’s lying, scamming, fraudulent, asshole face.

Our revelations blew up online and soon the company was calling us, asking us to go easy, claiming they’d just made some rookie mistakes and third parties had laid on the bullshit about them that they felt compelled to go along with it all, and even offered us a unique financial deal if we’d commit to being their ‘oversight’ going forward.

We usually make our money talking about companies as investment opportunities (or otherwise) and consider ourselves a form of oversight as standard, so this wasn’t a stretch for us, but we didn’t want to be seen as kicking a company in an effort to extort a marketing deal out of them, so it got complicated dealing with Instadose.

We agreed we’d receive every document they had and fact-check everything. We’d interview partners, investors, government officials.. we’d vet every deal before they announced it, we’d keep an open line to management.. basically we agreed to verify everything they said and did, like a public markets Heart Foundation ‘health check’ tick.

They paid up, then they dropped a thick folder of documents on us (commonly known in the media world as a ‘document tsunami’ – a means of hiding information by drowning you in it), and then when we asked our first questions of those documents … they vanished. The CEO was having health issues. Then the CEO was back but not answering email. We said we were ready to go any time… and then they were gone. It was as if they’d quit on the whole thing.

So we moved on. We’d get occasional phone calls from early and potential investors where they’d ask what we thought of Instadose, and we said nothing had changed for us.. that it didn’t seem like a real company, even though everyone involved promised the world.

Then one day, three years later, they were public on the US OTC pink sheets.

Back in July, as we began to rev our engines once again on this deal, the Ontario Securities Commission announced they were hauling the founder, Grant Saunders, in for questioning over allegations of self dealing and fraud. Seemed like the situation was finally in hand.

TORONTO, July 9, 2021 /CNW/ – The Ontario Securities Commission (OSC) announced that Grant Ferdinand Sanders of Burlington, Ontario, has been charged quasi-criminally with one count of fraud. Mr. Sanders is charged in relation to his role as the Chairman and Chief Executive Officer of Instadose Pharma Corp. (formerly the Excellence Health Group). Instadose purports to be a licensed certified grower and cultivator of medicinal cannabis. Since July 2017, Instadose has raised more than $9.4 million from investors. The OSC alleges that investor funds were diverted to the benefit of Mr. Sanders, his family, and associates. The OSC further alleges that Instadose materially misrepresented the nature of the company’s business.

Seemed like the situation was in hand.

But one should never underestimate the ability of companies on the pinks to get insane preposterous valuations – just cuz.

By October, even with the founder accused of fraud, the company had a $3.5 billion valuation.

THREE POINT FIVE BILLION.

They were suddenly larger than Tilray (TLRY.Q). Bigger than Canopy Growth Corp (CGC.T). And they didn’t own a damn thing.

The SEC announced this week they were halting trading of the company, and about time too, as those involved began cashing out, sliding the stock from $60 down to $25 in under a month. That still leaves the company at a nutsarooni value of $1.8 billion.

The U.S. Securities and Exchange Commission has halted Instadose Pharma Corp., a Canadian-linked OTC Markets listing that claims to be an international cannabis distributor. The SEC says that there are questions about the accuracy of the company’s disclosure, particularly in light of significant increases in its share price and volume. The SEC has deemed a suspension to be necessary for the protection of investors.

The halt is contained in an order that the SEC issued on Wednesday, Nov. 24. As with all SEC halt orders, the regulator has provided few particulars. A glance at Instadose’s chart, however, provides a large clue. The stock closed at $47.25 on Nov. 5, 2021, up from the $3.50 it was at six weeks earlier. (All figures are in U.S. dollars.)

The activity gave the company a market capitalization of $3.5-billion (based on the number of shares it reported to have issued on Oct. 13, 2021), putting its value in the same neighbourhood as established cannabis giants like Tilray Inc. and Canopy Growth Corp. Unlike those companies, Instadose’s financial picture is a relatively bleak one. The company’s most recent balance sheet, dated Aug. 31, 2021, showed no assets at all and $113,233 in liabilities. Those financial statements also included the “going concern” warning, a disclaimer advising shareholders that the company’s future prospects are contingent on its ability to raise money.

Crazy.

Crazier: Most of Instadose’s news releases follow a similar pattern. They claim a deal with a foreign JV partner that they won’t name. The partner is going to get them licensing in a country that most people aren’t paying attention to, and the fact that country has no legal licensing structure is washed aside with a vow the partner will help change the rules. An example:

In July 2021, Instadose and the Cameroon JV Partner commenced negotiations on a plan of joint venture that would see the parties work together in Cameroon to secure government‑issued licenses to, among other rights, grow, cultivate, process, produce, and export medicinal cannabis in and from Cameroon.

Operational Update[..] The Cameroon JV Partner has been working with the appropriate authorities in Cameroon for the eventual legalization of the commercial production, distribution, and export of medicinal cannabis in and from the African country. Instadose Canada believes that Cameroon will become a meaningful contributor to the Global Distribution Platform as yet another source of medicinal cannabis in Africa.

In other words, they have a deal with a company they can’t name, to do a thing that can’t legally be done.

CHECKMATE, CANADA!

Before that, another JV was announced in India, where the company appeared to be suggesting a cannabis production license was on the way.

In February 2021, Instadose and Sanctum agreed to a plan of joint venture that would see the parties work together in India to secure multiple State‑issued licenses to, among other rights, grow, cultivate, process, produce, export, and sell Medicinal Cannabis (with an initial maximum THC content level of 0.3%) and Cannabinoid Oil (the “India JV Licenses“) on certain agricultural lands in India (the “India JV Lands“) starting with the Uttarakhand License and Uttarakhand Lands (the “India Joint Venture“). On February 18, 2021, Instadose and the India JV Partner executed the India JV Agreement formalizing their relationship under the India Joint Venture. In doing so, the India Joint Venture would serve the Global Distribution Platform as both a Medicinal Cannabis Cultivation Participant and Cannabinoid Oil Production Participant.

But India doesn’t allow cannabis production – hence the reference to THC content below 0.3%. You can supply seeds and leaves in India, but not the good stuff – the MEDICAL stuff. What Instadose wants to do – export cheap cannabis – isn’t legal.

CHECKMATE, LPS!

The SEC move will make it much harder for paper holders to trade away their INSD holdings, even after trading resumes. And their punishments for offenses proven are much harder than the OSC’s.

We expect, once trading is allowed to resume, some serious ‘clarification’ on what the company has and doesn’t have, and that the stock price will drop like a stone when it’s clear the company has next to nothing to its name.

And those documents they dropped on us back in the day? We still got em..

— Chris Parry

Ya so why not go over the documents then? Too much to read, what is it all blank paper? No its not, is it? But you dont want to read it do you, you simply want to write and change your tune once again, even after your second article about them said they were real, they were an investors dream even, thats what you said. Do I need to post a link? Here read this Chris

https://equity.guru/2018/12/29/instadose-mistakes-were-made-but-company-makes-commitment-to-oversight-and-improvement/

Change tunes with the weather much?

Where the hell did I ever say they were ‘an investor’s dream’.. I said they were liars, and that they’d admitted it, got carried away they said, and promised they would do better going forward.

You pretty much had all the knowledge you needed from that point to figure out whether to go in or not, and if you chose ‘go in’, boy howdy, that’s a personal failure of due diligence.

FWIW, it’s not my job to police every private company in North America, nor every company that gets a shitlisting on the pinks and runs on CLEARLY BULLSHIT NEWS.

Some people emailed me over the last few years asking if my opinion had changed on the company and I told them I didn’t have any additional information, nor any reason to believe them. You didn’t bother with that minor amount of effort, so look inward if you lost money.

‘Investor’s dream’.. yeah boy, go link me to anywhere I said that, or even a ‘second article.’

Where did the article say they were an investors dream. He applauded their effort in trying to be transparent, but clearly that was just a complete lie. Instadose is going to zero, and the people who ran the pump and dump will be charged. Period. If instadose has anything left after the fines and charges, then maybe shareholders will be able to recover something. Assuming there is any real assets to begin with. Not just complete fluff news releases about Joint ventures in obscure countries.

You’ve sure been quiet about em since u got paid by them…. til now.

If those were real investors buying in at 60 Bux I’m sure theyd’ve appreciated a more timely follow up to the “mistakes were made” article.

You said that after inviting you to take a closer look and basically paying you

for a redeeming self rebuttal…. they then deliberately obfuscated and ghosted you off the hop.? 3 years ago?

I guess since you got paid, they got some rope. That’s a long time to let that info sit.

Probably coulda helped some people avoid this mess.

They’re not the only ones looking bad here. More than undermines your credibility a little bit.

So let me get this straight.. after 3 years of them seemingly having disappeared, I’m supposed to set a Google alert to tell me if they ever show up on the pink sheets in another country?

I did my bit. Though I admittedly added a preface to my original article pointing out they’d admitted they made mistakes first time around, I also left up THE ENTIRE ARTICLE that pointed out their initial lies.

If you bought in at $65, a $3b market cap mind you, even after reading my article, it’s not on me, it’s ALL on you. I did the job nobody else did, three years before the regulators got off their arse.

Hi Chris

I distinctly remember this and the first article you put out on this scam years ago.

It had scam written all over it then and it seems the same here all over again.

However, if one had some play money back then and throw a few bucks at it and

forgot about it one may have got a big bagger but are far and few.

Thanks again.

Im still LOL.

You’re right, someone made bank.