Plurilock Security Inc (“PLUR.V”) Plurilock is an identity-centric cybersecurity solutions provider to businesses.The Cyber Security Market Size, Share & Trends Analysis Report By Grand View Research published in April 2021 states that,

“The global cyber security market size was valued at USD 167.13 billion in 2020 and is expected to register a CAGR of 10.9% from 2021 to 2028. The growth of the market can be attributed to the growing sophistication of cyberattacks. The frequency and intensity of cyber scams and crimes have increased over the last decade, resulting in huge losses for businesses. As incidents of cybercrimes increased significantly, businesses worldwide channeled their spending on advanced information security technologies to strengthen their in-house security infrastructure. Furthermore, the need to defend critical infrastructure from Advanced Persistent Threats (APTs) has encouraged governments across the globe to reform their cyber security strategies, creating a pool of opportunities for industry participants.”

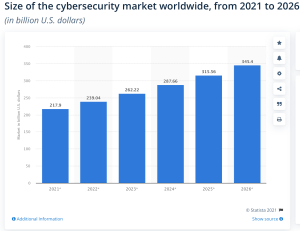

Supporting this claim the popular data website and publisher statista.com published the table below:

They believe the global cybersecurity market size is forecast to grow to 345.4 billion U.S. dollars by 2026 compared to Grand View Research’s 310 billion U.S dollar forecast.

As the market continues to grow, due to demand-side factors, companies in the space will benefit from higher sales volume as the B2B and Business to Government/State customers realize the need for a safeguard against Advanced Persistent Threats.

PLUR and its peers are in the epicenter of this productivity and with recent trends in sales, this compounding machine still has legs. Reminds me of the kids’ tale of the persistent Gecko.

“It’s the dry season in Africa and the animals are in desperate need of water. They decide that the animal that finds water first will be the leader. Elephant and Boar want to use their tusks, Rhino and Deer want to use their horns, but Hippo suggests stomping because everyone has feet. But then Snake chimes in and reminds them that he doesn’t have horns, tusks, or feet. The animals didn’t hear him and are already stomping.

It’s quite hot out so it’s not long before Elephant is hot and tired. Then Hippo and Rhino take their turns until they got hot and tired. Then Buffalo, Giraffe… All the big animals took a turn until they were all hot and tired. The medium sized animals were up next, such as Monkey. Monkey took his turn until he was distracted by bananas. Then the small animals like Rabbit took their turns.

Finally, Gecko pipes up and asks for a turn. Everyone laughs at him; they believed little creatures could not affect change. Gecko didn’t listen. He jumped into that hole and started stomping like his life depended on it. And after a long while, WATER! Immediately Elephant tried to take the credit, but the other animals told him to get out of the way.”

This Gecko (PLUR) seems to want to keep pounding away in search of water to finally take its place as the chief in command.

The Filters

3-year Revenue Growth (“CAGR”): -10%

PLURs sales went from $650,000 to $480,000 between 2018 to 2020. In March 2021 sales were $80,000 and in June they produced $8.6 million. PLUR currently sells to larger enterprise and government customers. For this reason, sales cycles are relatively long and unpredictable as well as seasonal. This can cause the companies’ earnings(losses) and financial condition to fluctuate rapidly as it adjusts the cyclical demand.

The bulk of their sales in the period ended June 2021 came from hardware sales ($7.5 million) and in the same period 2020 they had $nil. Electronic software license and maintenance sales were $805,000 and in the same period in 2020, they had $163,000. They also produce Professional services of about $290,000 compared to 19,000 in the 2020 period. Although the three-year CAGR for sales was a let-down the company has shown its ability to acquire large contracts from the municipal and sovereign clientele.

3-year Operating Loss Increase (“CAGR”): 35%

It does cost them more to produce their final services at the moment and the operating loss has increased by 35% since 2018. It went from $1.41 million to 3.54 million. In the last twelve months, it shot up to $4.85 million in operating losses. As the business has scaled up its operations it’s needed more manpower to facilitate the services. On the sale of his hardware in June at $7.5 million it also registered a cost of services of close to $7.9 million.

If management is unable to manage these input costs, they will be unable to sustain their business model for long periods of time. The key would be to identify economies of scale with their key suppliers or negotiate contracts with their clients that have lower COGS as a % of sales/volume.

Quick Assets over Liabilities (“Current Ratio, Quick Ratio, Total Liabilities /Assets”)

I have been critical of their operations thus far and I feel I should shed light on the large cash position they have in their books and the backlog of purchase orders they also have. The firm has 4.98 million in cash and 4.6 million in receivables. They also have 6.74 million in payables and $200,000 in debt outstanding which is probably used for day-to-day operations.

The cash they have was generated was raised from the issuance of common stock (they raised 7.55 million from stock in the LTM). This means the shares outstanding increased by 75% in a 3-year period and depressed the return on capital to about -200% on average in that 3-year period.

The macro trend is with them, but the microeconomics of their business model seems to be pushing against profitability. The beauty of the market is that if the tide shifts and the managers continue to allocate incremental cash productively shareholders will be well compensated for the risk they took once the business’s economics change for the better. For now, we wait!