We’re entering into the final stretch between obscurity and legitimacy for Bitcoin and cryptocurrency as either a currency or an asset class, aided primarily by big name financial institutions getting involved, and the prospect of the first SEC accepted Bitcoin spot ETF. It could happen as early as January, but we’ll come more to that later. But there’s still a long way to go. For every BTC futures ETF there are three scammers bilking grandma out of their money, and as the title of this week’s roundup says, it seems like we’re taking two steps back for every step forward.

The Squid Game exit scam is a lesson to crypto enthusiasts

You have to be careful with the so-called meme coins. These are usually ERC-20 coins minted and run on Ethereum, and most are here today gone tomorrow. Not necessarily due to scamming, but often enough due to bad leadership or faulty tokenomics, and sometimes they’re an outright scam. Coins like Shiba Inu are the exception rather than the rule, and part of doing your due-diligence when you’re investing in altcoins, is knowing what kind of coin you’re investing in. Otherwise, you may end up falling for an exit scam.

An exit scam is a type of con where an established business stops shipping orders while still getting paid for those orders. Customers do not realize their orders aren’t being met until the business is already gone. It isn’t hard to figure out how this applies to crypto. You hear of a new crypt on Reddit and get excited that it’s going to be the next Dogecoin or Shiba Inu, and you throw a few grand at it, figuring that when it comes to a penny, you’re going to join the ranks of the elite.

Except next week, the coin’s gone. No exchanges are holding it. And you’ve got a tens of thousands of this bullshit coin and the “team” behind the new coin is gone with your money. As an example, we have the Squid Game token. It showed up on the BBC, Business Insider, Yahoo, CNBC, Bloomberg and plenty of other publications, and plenty of folks bought in because of the legitimacy conferred by these organizations.

It was all bullshit. Just because news organizations showcase a coin doesn’t necessarily mean it’s legit. It means it’s newsworthy (and questionably so at that). The Squid Game development team promptly pulled the rug out from its investors (in a move not ironically called a “rug pull”) and left investors with wallets full of a bullshit coin nobody will take.

It’s beginning to look like the only possible next step to take is regulation of this space.

The competition for ASIC producer dominance continues

The two big players in terms of Bitcoin mining rig construction are Bitmain and Canaan Creative (CAN.Q), but the key difference between them, at least as far as investments are concerned, is that CAN is a publicly-traded company.

Whether or not Avalon ASIC rigs are better than Antminers are up for debate. Some suggest Avalons gobble up more electricity and are therefore more inefficient, but others suggest Avalons are more reliable. So really, it depends on what you’re looking for.

“We are pleased to be building on our strategic alliances with Canaan, a leading ASIC manufacturer, to achieve our goals and drive value for our shareholders, while executing on a transaction that increases our cash flow and green mining capacity. HIVE currently has approximately 1.2 Exahash per second (EH/s) of Bitcoin mining capacity, and with this new purchase, HIVE’s Bitcoin ASIC pipeline will be at 2 EH/s by December 2021, and 3 EH/s by March 2022,” said Frank Holmes, executive chairman of HIVE.

Regardless, Canaan and Hive Blockchain Solutions (HIVE.V) have tacked on another 6,500 units of Avalon miners to their existing haul of 4,000 and 6,400 units in August and January respectively.

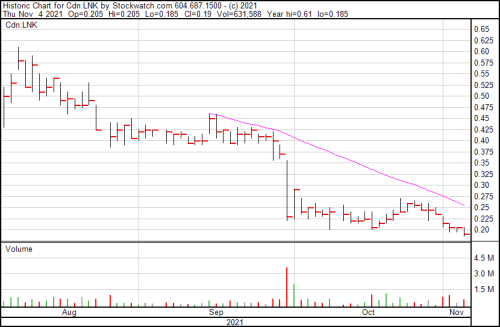

Link Global nails down bid for carbon neutrality

The environment is swiftly becoming a contentious issue within and between actors in the cryptocurrency space, and over the past few years there have been concentrated efforts towards cleaning up the space’s environmental footprint ahead of regulation. This spate of self-regulation has included the birth of the Crypto Climate Accord, of which Link Global Technologies (LNK.C) is a signatory.

Their latest news involves closing their acquisition of Clean Carbon Equity (CCE), which trades in Verified Emission Reduction Credits in the voluntary carbon offset market. CCE gets their credits from a global supplier base, selling them to customers to offset the CO2 emissions made by the customer’s operations.

“We are excited to be joining the Link Global family. We will now have the ability to support existing and new clients in what is going to be a boom time in the carbon credit sector. The timing really couldn’t be any better to grow and expand the offset program to all industries and with plans to develop new products such as carbon-neutral NFTs, and indigenous certified carbon credit registries,” said Chad Clovis, CEO of Clean Carbon Equity.

Picking this up gives LINK the ability to take steps towards providing carbon offsets in this sector, gather cash flow and create long term revenue possibilities. Now that the acquisition is finished, the company has also put its plans into motion to become carbon neutral by 2026, which is well ahead of the ambitious 2030 goal set aside by the Crypto Climate Accord.

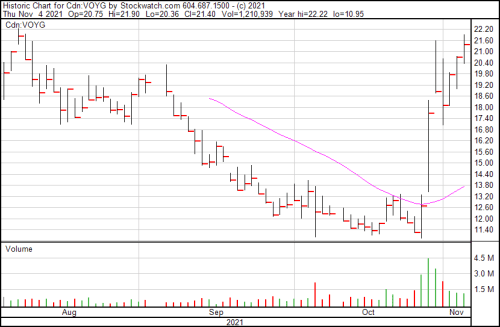

Voyager Digital Announces Normal Course Issuer Bid

Voyager Digital (VOYG.T) gave notice to the Toronto Stock Exchange (TSX) to request starting a normal course issuer bid.

If you’re not familiar with all the esoteric nuances, moves and options offered by the world of stocks, you’re in good company, because neither am I.

Here’s what Investopedia had to say:

“A normal-course issuer bid is a Canadian term for a public company’s repurchase of its own stock in order to cancel it. A company is allowed to repurchase between 5% and 10% of its shares depending on how the transaction is conducted. The issuer repurchases the shares gradually over a period of time, such as one year. This repurchasing strategy allows the company to buy only when its stock is favorably priced.”

The notice gives Voyager a 12 month period starting November 2, 2021, and ending November 1 2022, to buy up to 8,114,699 common shares, or up to 5% of their total outstanding. All of the shares purchased in the NCIB will be for cancellation, and any purchases made on the market through the TSX (and other exchanges), and it will be conducted through Eight Capital, itself a member of the TSX.

On October 27, 2021, there were 162,293,997 common shares issued and outstanding.

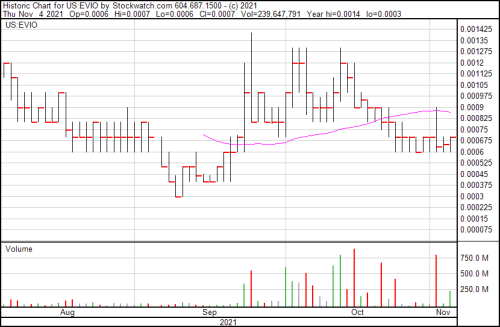

American cannabis company recognizes synergy between blockchain and cannabis

The company is EVIO (EVIO.OTC), and they’ve recognized the opportunities for increasing revenue and return on capital by getting strategic with blockchain technologies. They’ve laid out two areas where they’re planning on getting involved:

- The company is evaluating opportunities to leverage distributed ledger technologies (“DLT”) to dramatically improve the way cannabis and pharmaceutical test results and product metadata are authenticated, accessed, and securely transmitted between owners.

- The company is also negotiating the acquisition of cryptocurrency mining equipment. The company believes in the future of cryptocurrency, and with recent relative price of coins and cost of mining equipment, mining can provide high annualized returns and provide better stability to our balance sheet.

So mining and the actual storage and ledger function of the blockchain itself. There’s nothing here stating which coins they’re looking to mine, so there is a fair amount of opportunity available to a nascent altcoin miner. But in order to mine Bitcoin and turn a profit requires a fair amount of upfront expenditure.

“Now that the blockchain ecosystem is maturing, EVIO is in a unique position to offer to its hemp and cannabis growers, breeders, product manufacturers and brands new ways to demonstrate authenticity of its products and drive interest in their brands. Meanwhile, cryptocurrency mining provides a way to diversify into the blockchain space with an effective use of capital,” said Lori Glauser, CEO.

The proper usage of blockchain technology, though, is always a curious point. If they plan to use it correctly (which it sounds like they might) then they could get every penny back they spend on it, and then some.

No Spot ETF decision for Bitcoin until after the ball drops

The Securities and Exchange Commission has put off making a decision on whether or not they’re going to open the floodgates to BTC spot ETF’s until January 7, 2022. The saga continues as Valkyrie Funds LLC is the latest company for the SEC to defer, doing what they can to procrastinate on what’s probably the biggest decision in Bitcoin’s short history thus far.

In their defense, Bitcoin’s been climbing in legitimacy for the better part of five years and reached a landmark decision when the SEC allowed the first BTC Futures ETF to land on an exchange, opening the way for many imitators (including one from Valkyrie). Now they’re taking it a step further. It’s decently understandable why as well—it’s not like coming up with regulations for this type of asset is going to be easy. They’ll likely try to shoehorn in something preexisting like regulations for other assets, but it won’t exactly fit and thus, maybe being circumspect about this is the right choice.

Hard to say.

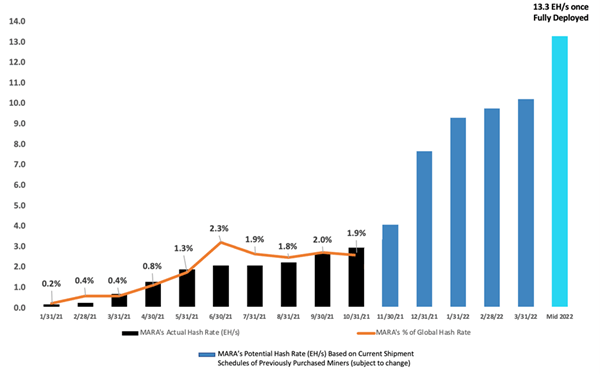

And now for something truly impressive

Over the past year Marathon Digital Holdings (MARA.Q) has gone from obscure (relatively) tiny bitcoin miner to giant-sized leader in the field. They’ve taken all the necessary steps to scale to monumental sizes at a striking rate, and not gotten bogged down in any of the details.

Here’s their hashrate chart:

They’re projecting 13.3 EH once they get everything deployed, and they have partnerships with DMG Blockchain Solutions (DMGI.V), the Marapool, are signatories in the crypto climate accord, and are easily in the top five Bitcoin miners presently operating.

Check this out:

Corporate Highlights as of November 1, 2021

- Produced 417.7 self-mined bitcoins during October 2021, increasing total bitcoin holdings to approximately 7,453 with a fair market value of approximately $457.4 million

- Cash on hand was approximately $20.9 million and total liquidity, defined as cash and bitcoin holdings, was approximately $478.3 million

- Received approximately 42,381 top-tier ASIC miners from Bitmain year to date with 12,331 delivered to a Compute North facility and an additional 3,285 ASIC miners currently in transit

- Existing mining fleet consists of 27,280 active miners producing approximately 2.96 EH/s

- Total hash rate of the Company’s bitcoin mining pool, MaraPool, reached 3.0 EH/s in October

- In October, began chartering planes to mitigate the impact of global logistics issues and to ensure that shipments of new miners occur in a timely manner

Unfortunately, they’re outside of many of our price ranges and have been for many months. But they stand as an example of what the tiny bitcoin miner you invest in today could be in a year or two, given market conditions.

The curious case of tech-curiosity, Hello Pal International

Hello Pal (HP.C) is a curiosity because their two verticals couldn’t be far enough away, but yet they seem to make them work. The verticals are live-streaming, teaching language and social crypto. The first two? Sure. You can livestream a language teacher to millions of people and presumably teach a language. That works.

But social crypto? What does that even mean? Yeah. We never found out.

Still, the livestreaming portions have seen a 10,000% increase in revenues from non China territories over the first two quarters of 2020, with large scale expansions into the Middle East and Southeast Asia. Okay. That’s a great first step.

Their crypto, and specifically they’re mining both Dogecoin and Litecoin after acquiring mining rigs in May, and they’ve pulled in a profit of $1,449,335 for the first half of the financial year. Their partner in the cryptocurrency mining sector is Shanghai Yitang, and they have managed the company’s mining operations to ensure decentralization across multiple different green renewable energy sites.

They’re green. They have two disparate and unconnected verticals and they’re making money. What’s not to like?

Wondr Gaming to host its first NFT auction November 15th through Shopify Plus

In five years there’s a strong probability that we’ll look back and wonder what we were thinking, but for right now, though, there’s a lot happening in the non-fungible token space.

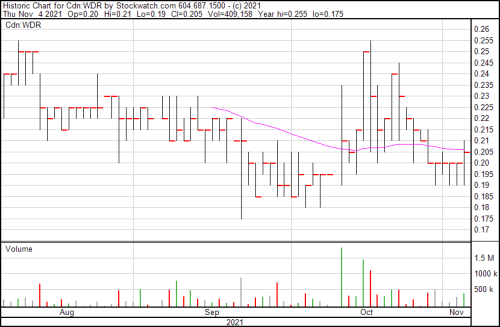

Wondr Gaming (WDR.C) and a Canadian crypto-custodian have teamed up to mint NFTs on Wyre, its own white labelled NFT platform, to exchange crypto for fiat so Wondr doesn’t hold any crypto on its balance sheet. These NFTs are going to be offered via auction on Shopify’s (SHOP.NYSE) Shopify Plus marketplace where you can buy NFTs via your credit card.

“When Wondr acquired Enterprise Gaming Inc. and its white-labelled NFT platform, we gained not only the ability to mint and sell our own NFTs, but to also offer our media clients NFTs as an add-on to our creative content campaigns. We are in the business of helping the largest brands in North America understand and interact with GenZ and Millenial gamers. Live online streams that feature athletes, musicians and influencers playing their favourite video games for millions to watch, provide a powerful marketplace for brands to showcase their products. Our NFT offering focuses on those same communities, providing a new tool for gamers to interact with their favourite brands,” Jon Dwyer, chairman & CEO of Wondr Gaming.

Make hay while the sun shines, right?

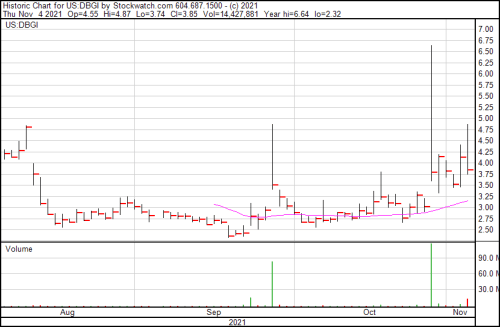

DBGI Announces it will Accept Cryptocurrencies as Form of Payment

This is the second and final time Shopify shows up in this week’s roundup, and this time it’s with Digital Brands Group (DBGI.Q), a collection of lifestyle, digital-first brands, which will now be accepting cryptocurrency as payment across all of its brands.

The first steps to legitimacy for cryptocurrency have been slow, and not at all inexorable. Not just one day or one step at a time, but one retailer, one government, and one bit of legislation at a time. In this case, it’s traditionally crypto-friendly company Shopify lending their platform’s flexibility to a retailer that otherwise would have missed out.

“Shopify enables our brands to accept cryptocurrencies as a form of payment. We believe this form of payment will continue to grow as a potential currency in our industry,” said Hil Davis, chief executive officer of Digital Brands Group.

—Joseph Morton