Mind Cure is a life sciences company that develops and commercializes mental health and wellness products in North America. It focuses on the development of digital therapeutics tech and researching psychedelic compounds to rapidly scale science-backed and evidence-based mental health therapy.

They have two research projects currently running:

The first is the desire project that focuses on using MDMA-assisted psychotherapy to help women overcome lack of desire. 14% of premenopausal women in the US suffer from HSDD. This equates to an estimated 9.5 million women struggling daily. Hypoactive Sexual Desire Disorder (HSDD) is a common female sexual disorder characterized by persistent low sexual desire and emotional distress that is not attributable to an existing medical condition or relationship issue.

The second project is the Ibogaine Project. The company is manufacturing synthetic ibogaine to provide researchers and clinicians with the resources they need to promote healing related to addiction, migraines, cluster headaches, neuropathic pain, treatment-resistant mood disorders, and more.

On the digital technology side, the firm has launched the development of iSTRYM, the company’s digital therapeutics tool. They believe this is a first-of-its-kind software application that will optimize the healing journey for both patients and clinicians. The company is using both internal resources and third-party consultants to develop iSTRYM. They have released the minimum viable product version of iSTRYM in August 2021 and expect to begin full commercial deployment to clinics in the first quarter of 2022.

iSTRYM will offer therapists global, science-backed protocols, customizable dashboards, integration plans, insights into patient journeys, and real-time assessments for personalized client care. The development of iSTRYM establishes a significant project that has not yet generated revenue.

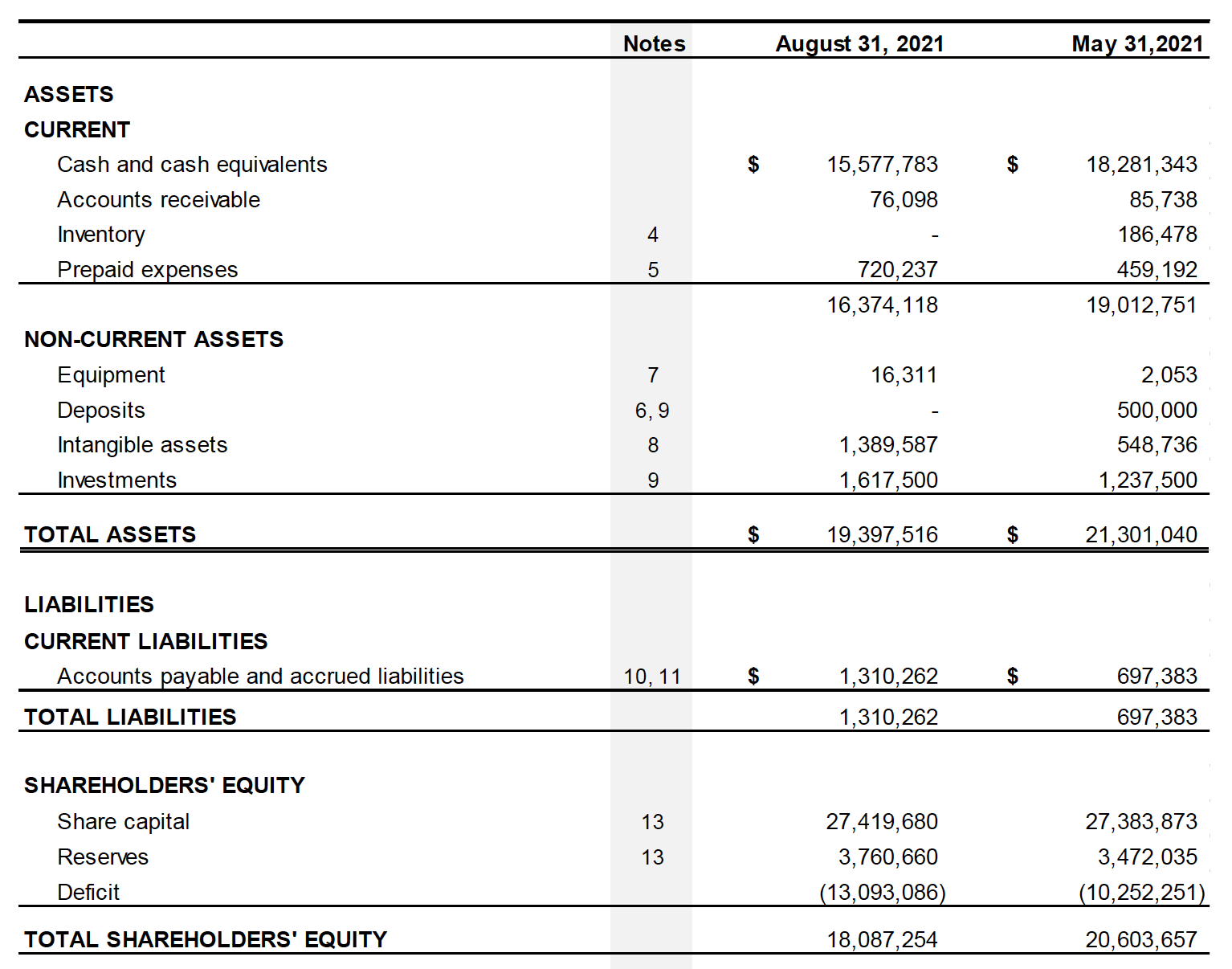

Since the company is pre-sales, we can look for clues about its capital structure and financial position in the condensed consolidated interim financial statements for the three months ended August 31, 2021.

Right from the get-go, we can see that the company has a large stockpile of cash in its balance sheet about $15.5 million to be exact. They have about a $29 million market cap, and they trade at 0.3 cents per share on the open market. Their current cash position is almost half of the market capitalization of the entire business, and they also don’t have any long-term or short-term debt outstanding.

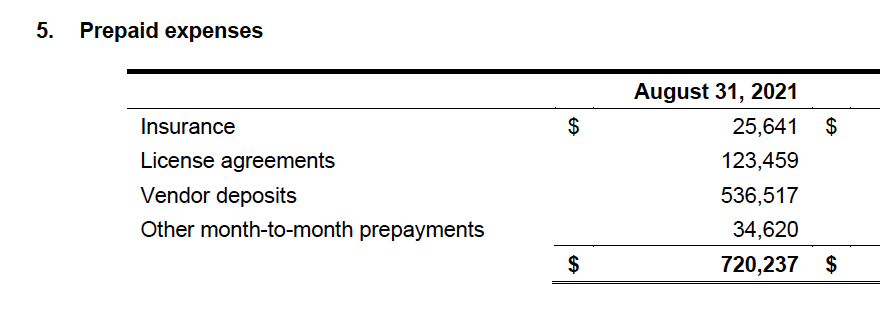

They have about $76,000 in accounts receivables and $720,000 in prepaid expenses.

The bulk of their prepaid expenses is in vendor deposits and license agreements coming in at a total of $659,000. the rest of it is between insurance premiums that they have paid and other month-to-month prepayments. The firm has total current assets of close to $16 million and total current liabilities of $1.3 million mainly in the form of accounts payables.

Now we look at some of the noncurrent assets like property plant equipment and goodwill. The company has an equipment account of $16,000 and most of this equipment is from additions they made in May of 2021. The company has a total of $1.38 million in intangible assets. This is mainly from the iSTRYM Digital Therapeutic SaaS Platform that they are developing internally. This internal intangible asset has value if the company deems it possible to generate future cash flows from the project once it is launched in the first quarter of 2022.

Of course, this number should be taken lightly as it is an estimate by the management team and their auditors on what the net present value of the project would be over time, but it is a good reflection of what the underlying business is able to generate.

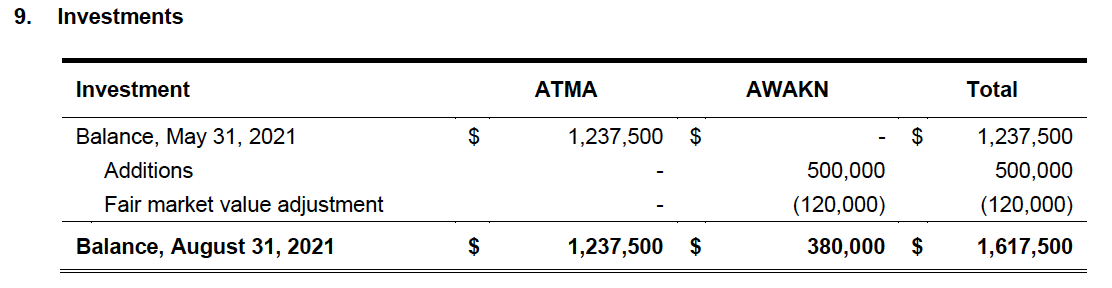

Outside of the normal operations of the business, they have also made some strategic investments in some common shares of two publicly traded companies. they have a total balance of $1.2 million in ATMA stock. ATMA ticker belongs to Atlas Mara Limited a private equity firm specializing in potential and bolt-on acquisitions. The firm prefers to invest in the sub-Saharan African market, though it also invests outside Africa.

ATMA has a market cap of about $US25 million, $US67 million in sales in the last twelve months, $US2.6 billion in assets, $US 2.2 billion in liabilities, and $US 330 million in equity.

They also own 380,000 in AWAKN stock. The AWAKN ticker belongs to Awakn Life Sciences Corp a 68-million-dollar biotechnology company that engages in the researching, developing, and delivering of psychedelic therapeutics to treat addiction and other mental health conditions in the United Kingdom and Europe.

The company has a very clean balance sheet and an equity-heavy capital structure that is very conservative (debt-free). They have close to $15 million in cash that they can use on their two research projects or to further develop their proprietary digital technology platform. As they gear up to launch we will have to wait and see the reception from their customers and vendors as the business structure changes as it adapts to the new volume.