We’re closing in on three years now and it’s becoming hard to believe there was a market before COVID-19. We can barely remember it. Cannabis was a thing briefly, and before that we had crypto, and after cannabis’ untimely deflation in the summer of 2018, we were looking for the next source of market exuberance. There was a brief spate of time where we seriously thought psychedelics may have been the next big thing to fight against diseases, and there are a handful of companies that benefited from that market largess, and still do if we’re being fair, but that’s wasn’t it.

No. The market turned combative with many companies recognizing the profit potential in putting together something—anything to fight COVID-19, which despite being possibly the weakest strain of influenza in history, still managed to shut down the world economy.

Mostly out of, dare I say it? Panic.

The race was on for a vaccine and the winners were Pfizer (PFE.NYSE), Moderna (MRNA.U) and Astrazeneca (AZN.Q), with also-ran Johnson and Johnson (JNJ.NYSE). If you were in any of these before the pandemic, then congratulations, but the odds are good if you’re here reading these pages, then maybe the four aforementioned companies are a tad out of your price range.

There’s also the whole problem of these being fast-tracked and pushed through FDA approvals swiftly, but we’re not here peddling conspiracy theories. The stats don’t bear out that there’s been any wrongdoing. Even the “most dangerous” of all the news stories regarding the Astrazeneca cherry picks the most obvious cases, while ignoring the facts that blood clots happen in 3.1 cases per 100,000 uses in folks under 50 with the numbers in people north of 50 being even less.

That’s either lazy or irresponsible reporting, and for a point of comparison, aspirin kills more people every year.

Still, your luck here is a mixed bag, though. On the bad luck side, it’s doubtful that any of these companies (or any companies period) are going to solve the novel coronavirus problem. We’ll never have a cure. We’ll likely need bumper shots, and booster shots, and maybe an entirely new vaccine every few years for the rest of our lives, because the nature of this type of virus is survival and replication. The influenza virus has been around at least as long as humans have, and given that it jumps ship from animals with regularity, possibly even longer. The hope going around is that within five years we understand much more and fear much less, and can get these boosters the same way we get the flu shot.

On the good luck side, the bumper shots and booster shots and new vaccines will need to be made by some company, and we’ll never be short of market entrants, looking to do their part in fighting the most annoying scourge of the 21st century behind Justin Bieber. On that note, we have Revive Therapeutics (RVV.C), which is still onboard with the psychedelics movement, but has shifted their primary focus to get some of those sweet profits enjoyed by the companies further up in this story.

What’s Revive Therapeutics?

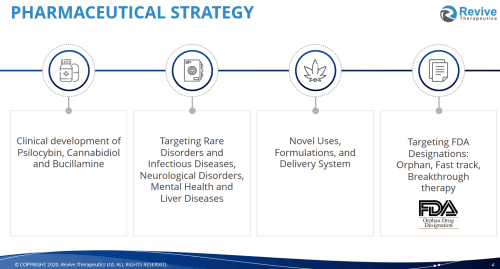

Revive is a life science company laser-focused on the research and development of drugs for infectious diseases and rare disorders. The company has prioritized their drug development efforts with regulatory incentives put forth by the FDA in mind—such as orphan drug, fast track, breakthrough therapy, and rare pediatric disease designations.

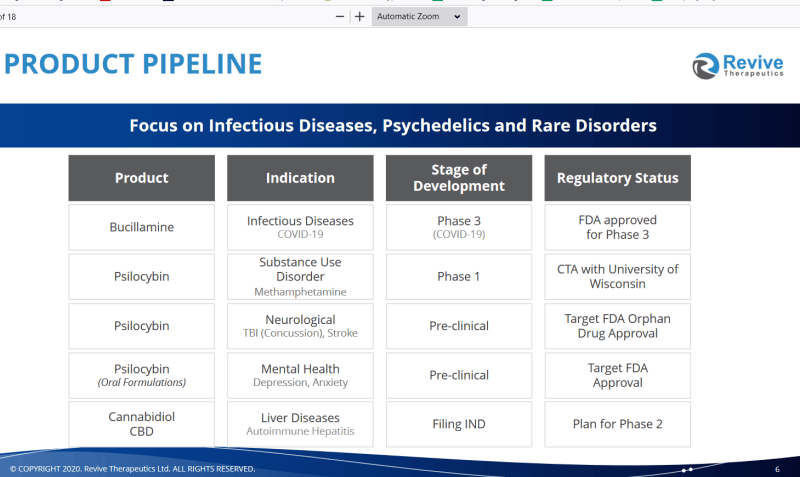

The company’s pipeline straddles three different verticals, including psilocybin, cannabidiol (CBD) and bucillamine.

Bucillamine is their stake in the ground against COVID-19, but it also has other potential uses, including fighting other infectious diseases, like the flu and COVID-19, but also helping surgeons do their job, and we’ll get into that indepth in a bit

They also recently acquired Psilocin Pharma to advance the case for psilocybin-based therapeutics as potential treatments for various diseases and disorders. Last, Revive’s cannabinoid pharma portfolio works on rare inflammatory diseases, and they’ve been granted orphan drug status for their use of cannabidiol (CBD) to treat autoimmune hepatitis (liver disease) as well as ischemia and reperfusion injury post organ transpant.

Back to Bucillamine. As an aside, the image at the top of this article is Bucillamine’s molecular composition. It’s a drug popularly prescribed to treat rheumatoid arthritis in Japan and Korea for decades. Its unique molecular makeup is believed to be beneficial in preventing acute lung injury during influenza infections. Also, bucillamine is believed to be instrumental in preventing oxidative and reperfusion injury and heart and liver tissues.

Oxidative should be self-explanatory: damage caused by oxygenation of the tissues. But reperfusion may take some explaining. Reperfusion injury, also known as ischemia-reperfusion injury (IRI) is a type of tissue damage that happens when blood supply returns to tissue after it hasn’t been there for awhile. When oxygen and blood nutrients have been absent from tissue due to surgery or whatever other reason it creates a condition wherein the restoration of circulation comes with inflammation and oxidative damage courtesy of oxidative stress either instead of or along with the restoration of normal function.

The company’s timing with working with Bucillamine isn’t coincidental. The company is presenting entering into phase 3 clinical trials dealing with bucillamine to see if it’s going to be any use against COVID-19. They hypothesize that the same series of chemical reactions that make Bucillamine useful against influenza-related lung damage could easily translate to fighting acute lung injury during nCov019 infections, thereby justifying this investigation that the drug may be good for intervention against COVID-19.

Now we know the what and the why regarding this company. Who are the people behind the company?

The People

At the helm we have Michael Frank, acting as chairman and CEO. He brings a background in operations, business development, mergers and acquisitions and capital markets to the table, so he’s more keen to the workings of the financial angles of the company rather than the scientific. He’s also presently the president of Mifran Consulting, which does consultation work for the companies in the tech space. His experience is as CEO and director of Sprylogics International and the Internet of Things company, as well as senior management positions at Ernst & Young, Data General and NCR.

Next question: who’s handling the science? If the chairman and CEO is responsible for making sure the lights stay on and the team has all the right equipment, then it’s equally important to make sure that the team has a strong, experienced leader guiding the work.

Handling the science for the company is Dr. Kelly McKee, Jr, who is presently the senior scientific and medical advisor for Pharm-Olam. Before that Dr McKee was Pharm Olam’s chief medical officer, and vice president of vaccines and public health, in the infectious diseases and vaccines center of excellence at IQVIA. He sports three decades of experience in research and development with expertise in vaccines, emerging diseases, biodefense, respiratory viral infections and sexually transmitted diseases. So the science is in good hands.

The Numbers

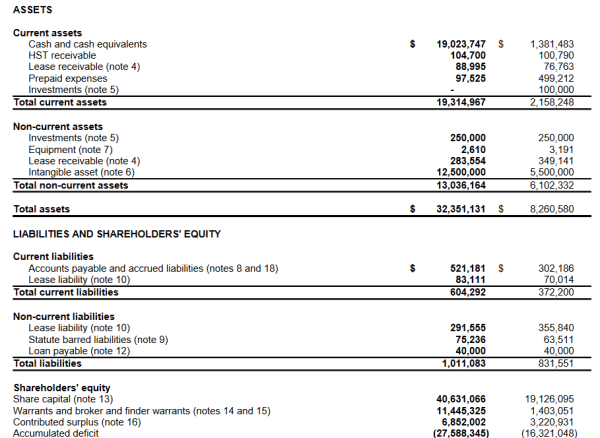

The numbers tell a story about a company on the move. What immediately stands out is their $19,023,747 cash position, and the $10 million development from this time last year. Clearly, they’re gearing up for the unloading, wherein they transition their products through the regulatory clinical trial hoops and get them out to the public.

It’s a solid amount of money and they’re going to need it to push their products through human trials. The cost of phase 1, 2, and 3 clinical trials conducted in the United States can be quite costly, ranging between the $1.4 to $6 million for phase one to $11.5-$52.9 million for the final phase, according to a study

It’s easy to see that Revive is well aware of this fact and has taken steps to do what it is they need to do to get their products on shelves.

Beyond that, though, the quick glance at the numbers confirms that this company is poised for good things.

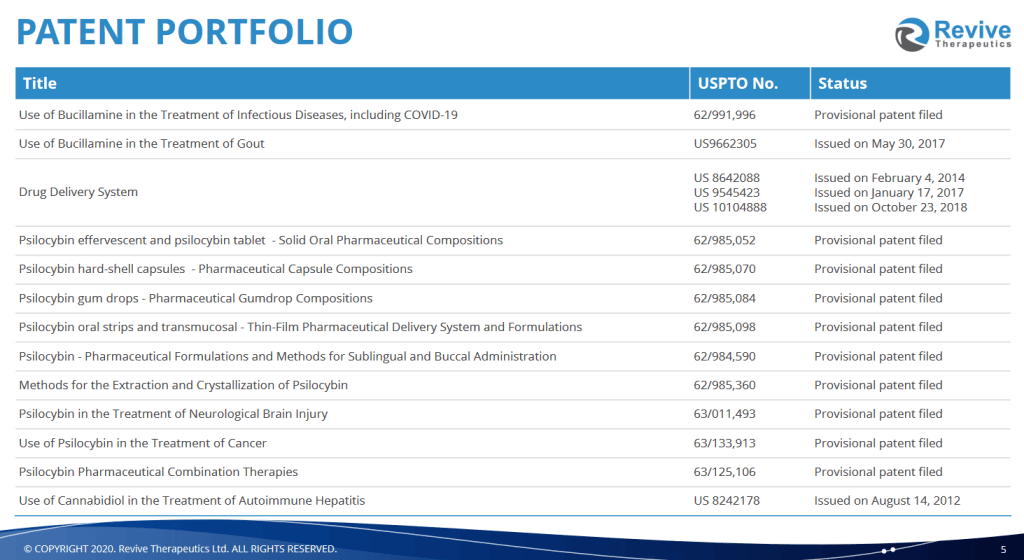

The majority of their assets consist of intangible assets, and in this case, patents and other forms of intellectual property.

Patent Highlights

Earlier this year, the company picked up Psilocyin Pharma, and their patent-pending formulation and production solutions for psilocybin. The intellectual property acquisition here includes extraction and crystallization methods, but also methods of production for psilocybin-based formulations, including the Hydroxy Line. The line includes capsules, a sublingual spray, gel cap, tablets and breath strips. Five different types of highly effectively products with variable bioavailability ready to go when psilocybin goes live.

The dosages are precise and they will work wtih both natural and synthetically derived psilocybin, which is slated for clinicals and subject to the nod from the FDA to treat common ailments like depression, anxiety, bi-polar depression, bulimia and anorexia and other such diseases.

There’s more.

February of this year, RVV got into an asset purchase agreement with PharmaTher (PHRM.C) for the full rights to their psilocybin IP. Revive agreed to pay $10 million in a mix of cash and paper.

“We have built a diverse intellectual property portfolio of novel uses and FDA-approved drug combinations of psilocybin for neurological disorders for a strategic partner such as Revive, which has committed to developing novel psilocybin formulations, to unlock value of the psilocybin program for the long-term. With the proposed sale of our psilocybin program we will be able to dedicate resources to our core clinical-stage product pipeline of FDA-approved ketamine to treat neurological disorders, such as Parkinson’s disease, depression and pain towards FDA Phase 2 clinical trials,” said Fabio Chianelli, CEO of PharmaTher.

Don’t misunderstand what’s being said here: there’s definitely money to be made in psilocybin. According to Emergen Research, the global depression market was valued at USD 12.06 Billion in 2019 and is anticipated to reach USD 16.06 Billion by 2027 at a CAGR of 3.9%. Those numbers were also generated before we understood what kind of a threat that COVID-19 would bring to our collective mental health, so the odds are good the number’s are higher. That’s good news for folks looking to find treatments (or cures) for certain types of mental illnesses, and bad news for those of us who suffer from them.

But the real value here is the potential in Bucillamine to be an alternative to the spate of vaccines put out by Pfizer, Moderna, Astrazeneca and Johnson and Johnson for treatment of COVID-19 and subsequent diseases. That’s where the mixed-bag that is this pandemic has an upside that’s all yours.

—Joseph Morton

Full disclosure: Revive Therapeutics is an equity.guru marketing client.