Most of these rundowns have followed a similar course: stories about coming regulations, the Chinese mass-migration, and sometimes some speculation on the future of cryptocurrency.

This rundown isn’t going to be much different. We run the normal course you’d expect, but we’re also going to note some interesting trends. For example, most of the charts have shown companies hopping onboard with Bitcoin’s latest moonshot. The exceptions are companies that aren’t correlated with Bitcoin (like if their deals involve a coin that isn’t correlated with Bitcoin) or for some reason, DMG Blockchain Solutions (DMGI.V), which makes zero sense because they clearly have the most interesting blockchain related tech on the list in terms of upside, and in producing an equitable future.

So let’s get started.

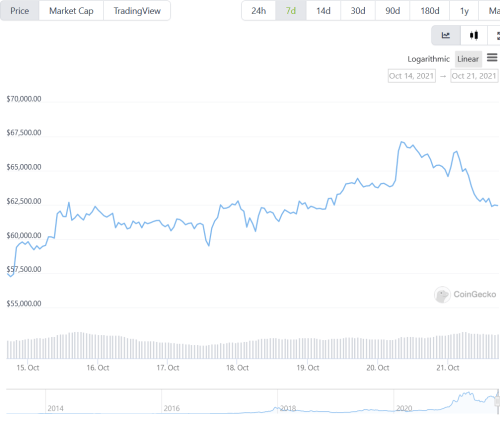

Bitcoin Futures ETF launches and Bitcoin blows up

The race for an actual Bitcoin ETF is still ongoing, but they managed to sneak a watershed moment past the Securities and Exchange Commission politburo this week in the form of a Bitcoin Futures ETF. That’s noteworthy. It’s called the ProShares Bitcoin Strategy ETF, trading under the ticker BITO, and it rose by 4.9% to $41.94. More than a million shares were traded on Tuesday, according to Bloomberg.

“From our conversations with market participants, I think it’s related to the growing belief as the trading day goes on that this is going to be considered a successful launch. Given the amount of avenues retail investors already have to participate in BTC, clearly the U.S.-based ETFs are nonetheless satisfying some kind of latent, even if niche, demand,” said Stephane Ouellette, chief executive and co-founder of FRNT Financial Inc., a crypto-focused capital-markets platform.

Whether or not this is a precursor to an actual Bitcoin ETF, which has been the focus of plenty of companies over the past decade, is still not known.

Also, Bitcoin blew the hell up this week—busting past its previous all time high on Wednesday and setting new records. If you bought the dip back when it was ranging around $40K, then congratulations. If you didn’t? Well. Better luck next time because if there’s one thing we can be certain of when it comes to BTC, there will be a next time. The future may be uncertain, but that isn’t.

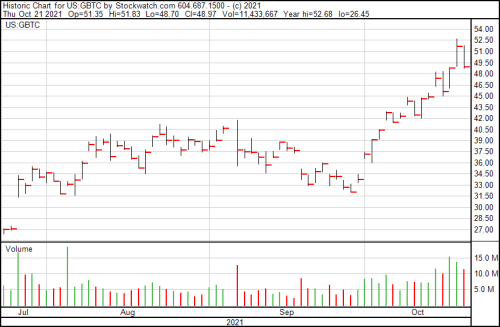

Grayscale files to turn their trust into an ETF

Not to be outdone, Grayscale Investments, which handles a number of different cryptocurrency trusts, announced they filed all the appropriate forms with the SEC to convert their Grayscale Bitcoin Trust (GBTC.Q) into a Bitcoin spot ETF.

They announced they were going to do this when the idea of a Bitcoin ETF became a hot topic a few months ago. It’s also been their plan the whole time. Technically, though, it makes sense, figuring the business model behind Grayscale Investments various coin-related trusts wasn’t that far off from what’s offered by an ETF.

You bought GBTC when you wanted to benefit from Bitcoin’s fortunes without the hassle of owning bitcoin. The core asset went up and GBTC’s shares went up, and folks who bought them made money from Bitcoin’s rise without the security risk or massive learning curve of figuring out how crypto works (and doesn’t work). It was a win-win, but it wasn’t an ETF. Now if the SEC gives the nod, it will be.

“Since 2013, the Grayscale team has worked tirelessly to build the world’s largest, most transparent Bitcoin investment vehicle, GBTC, while partnering with policymakers and regulators to build familiarity and trust in Bitcoin, blockchain, and the underlying Bitcoin market. In becoming the first crypto SEC reporting investment vehicle, GBTC has helped move the entire digital currency ecosystem forward. As we file to convert GBTC into an ETF, the natural next step in the product’s evolution, we recognize this as an important moment for our investors, our industry partners, and all those who realize the potential of digital currencies to transform our future,” said Michael Sonnenshein, CEO of Grayscale Investments.

The chart’s trajectory shouldn’t surprise anyone. I’m curious what’s going to happen here in the future.

Neptune Digital may be late to the game, but they play hard

The only entrant today in the ‘who increased their mining capacity’ category today is Neptune Digital Assets (NDA.V), which boosted their operation by 200 Antminer S19 Pro ASICS today. They’ve already been tested, installed and are now producing Bitcoin, adding to the overall hashrate at 110 terahashes per second, with an energy efficiency of 29.5 joules per terahash and a power consumption of 3,250 watts.

The total number comes out to 22,000 TH/s and are deployed using the Luxor mining pool.

This isn’t really large enough to make a dent in the competition, but it’s better than just mining Dash, which is what the company was originally doing before their pivot and coin expansion a few months back.

“We are very pleased that our new partners, Luxor Technologies and Frontier Mining, have helped get our U.S. mining program off to a successful start. Bitcoin mining has become a core program for Neptune and we plan to continue to aggressively add to our fleet of installed miners working with proficient and capable partners throughout North America. This new deployment increases Neptune’s revenues and puts the company into an even stronger financial position as we grow our bitcoin mining operations,” said Cale Moodie, Neptune chief executive officer.

That’s not to say that there isn’t value in smaller cap crypto-miners. They presently have $60.1 million in assets, no debt and make $645,000 per month in earnings, indicating there’s still enough money coming out to justify make shareholders happy.

Cosmos Now Supported By BTCS Blockchain Infrastructure Operations

I’ll make no bones about it: I like cosmos. I like its infrastructure, its promise of interoperability between independent blockchains, and the fact that it’s a staking coin. If we’re going to combat the whole proof-of-work is slowly killing us via climate change, then we’d best start looking to staking coins in the future. Beyond that, I like its price and its position: presently hovering in the $36 and up 562.0% from this time last year. This is one of the coins that I looked at last year as a potential buy, and honestly wish I’d thrown a grand into—not only is it less risky than overhyped Shiba Inu, but it actually has utility. Elon Musk doesn’t talk about it and it still makes money. That’s a good rubric for me.

Now BTCS (BTCS.Q) has added Cosmos’ $7 billion platform to their ongoing blockchain infrastructure advancement, including its own node, which will make the company money by staking it.

Here’s what Cosmos does:

It was built to give an easy to build upon blockchain capable of handling transactions at scale while facilitating connections with other blockchains, thereby creating a decentralized internet of blockchains.

“Currently, more than 30 enterprise-grade public chains are part of the Cosmos ecosystem – projects such as Terra, Crypto.com, OKB, as well as more than 250 Decentralized Applications. Combined with its interoperable communication layer between different blockchain networks and its ability to replicate other blockchains, Cosmos in our view has significant long-term potential,” said Michal Handerhan, chief operating officer of BTCS.

Honestly, it’s one of those hidden gems among the altcoins that’s sadly overlooked for the utility it brings. Mostly, I think, because it doesn’t have a cute dog on the front and Elon Musk hasn’t seen it.

But this does spell a savvy move for BTCS.

LQwD to raise $6 million for Bitcoin operations

LqwD Fintech (LQWD.V) is looking to raise $6,000,050 through a private placement sponsored by Canaccord Genuity, and intends to offer 17,143,000 shares at $0.35 a piece, as well as warrants exercisable at $0.50. The offering is expecting to close October 28, 2021.

intends to offer 17,143,000 shares at $0.35 a piece, as well as warrants exercisable at $0.50. The offering is expecting to close October 28, 2021.

If you’re an accredited investor and want to get in on a cryptocurrency adjacent company. Their Coincurve isn’t an exchange (nor have I called it one) but would effectively be called a “digital asset management platform” which is something I learned this week, and now you know too.

But their latest moves from last week of getting involved with Bigg Digital Assets (BIGG.C) subsidiary Netcoins as their official liquidity provider, followed by this move, suggests that this company may be trying to take advantage of the sudden fortunes available in the crypto-space.

The funds are mostly going to buying some Bitcoin, because running a crypto exch… sorry, “digital asset management platform” ain’t cheap.

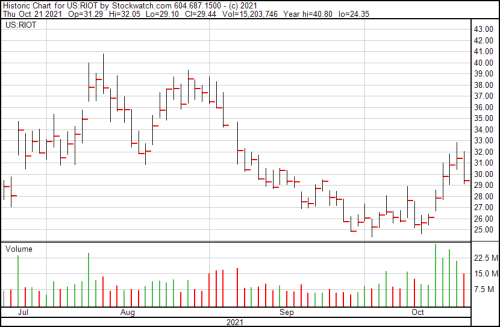

Riot Blockchain tries out a new avenue for cooling their ASICs

One of the biggest hurdles any miner is going to face when it comes to keeping their overhead low and their efficiencies high is how to keep the damn ASIC rigs cool when you’re gunning it full bore in search of that sweet Bitcoin payoff.

That’s why cool climates are preferred. Hut 8 Mining (HUT.T) and Cryptostar (CSTR.C) are based in Alberta, where polar bears think twice before treading during the winter. Other companies like Hive Blockchain (HIVE.V) fling open their back doors to the cold north winds in Sweden, and you get the idea. It needs to be cold. You let mother nature do the job instead of paying the electrical company to jack up the rates on your air conditioning bill, and you can spit out cheaper Bitcoin and stay competitive. If you’re in Texas like Riot Blockchain (RIOT.Q) is then flinging open the back gates is only going to let desert heat and tumbleweeds in, if my hours of research on Texas is any indication. (Most watching old John Wayne cowboy movies.)

But if necessity is the mother of invention then high overhead is definitely a codependent abusive stepfather. That’s why Riot has gotten onboard with the development of 200 megawatts of immersion-cooling technology at its Whinstone facility.

Immersion cooling is exactly what it sounds like. You take the ASIC rigs pre-meltdown and immerse them in something cool. It’s then circulated to keep the ASICs’ circuits operating at lower temperatures. The heat gets absorbed by the fluid, and the heated fluid is then pumped out and recirculated to help release the heat into a secondary heat exchanger before being pumped back in. It’s a novel technology, but it still comes with a pricetag so it’s probably not the way of the future.

But Texas is cheap for electricity, so maybe it’ll pay off for them.

And then again, maybe it won’t. You’re still spending money on the new technology, whereas mother nature will do it for free.

The next generation of regulations will include KYC and AML for wallets

The next wave of regulations for the future of cryptocurrency could theoretically include know-your-customer and anti-money laundering (KYC/AML) provisions for more than just exchanges. It’s a good idea. DMG Blockchain Solutions has made transactions with Zodia Custody using DMG’s Blockseer platform Petra from its Core suit of services.

Normal KYC and AML comes into play whenever you sign onto an exchange. It’s a pain in the ass, but it’s necessary. Even if you’re on the fence (or outright against) the idea of the government getting their regulatory claws into crypto, they’re going to stop your off-ramp and on-ramp ability if they don’t like the way you’re playing with their fiat. Hence, why we have the arrival of government compliance and acceptable exchanges such as Coinbase (COIN.Q) or Netcoins, and why banks like the Royal Bank of Canada won’t let you load up your Binance account using one of their credit cards.

The implication is clear: Binance is dirty. Because it is. And Netcoins isn’t, and it plays by the rules. Coinbase would play by the rules if the SEC was clear with what rules they should be playing with. Now the KYC and AML headache will likely be extended to include wallets in the future, and routing transactions through carbon neutral mining facilities.

That part’s kinda neat. I’m not gonna lie.

It’s part of Blockseer’s ongoing stretch of regulatory compliance vehicles, including Blockseer: Explorer, which lets law enforcement follow a coin down the blockchain. Add KYC and AML to the mix, and each address on the blockchain you can do business with (in jurisdictions where DMG operates) will have a government recognized face.

In the future someone will be able to tell if you’re being naughty with your Bitcoin.

“Petra is a concept that DMG conceived many years ago. However, we did not have the technology to bring this concept to the market until now. Using core technologies in Blockseer’s Walletscore, Explorer and Helm, we have been able to create a new and very relevant product for companies and individuals who have particular interest in governance, regulatory issues and ESG goals aligned with optionality that Petra permits. Our partnership with Zodia Custody is moving quickly and we look forward to completing all our testing and bringing this product to market,” said Sheldon Bennett, DMG’s CEO.

Your move badguys.

Oh. Right. Monero is still a thing.

Graph sells their cardano and makes $703,700

Because speculation isn’t just for kids anymore. Companies like Graph Blockchain (GBLC.C) get in on it too.

“The company exited from its position in ADA and is pleased to announce that it generated capital gains and yield of $703,700 or 88 per cent in a seven-month period beginning on March 29, 2021. The subsidiary had purchased a total of $800,000 in digital assets,” according to a press release.

Admit it. You’re jealous. It’s okay. So am I. Cardano is the fifth largest coin by market cap and in March 29 they were trading at $1.20. Now they’re trading at $2.16.

And that’s your mid-October crypto-roundup. I’ll see myself out.

—Joseph Morton