Last week we finished by looking at three of the largest institutions in the online gaming sector by market capitalization and sales revenue. We realized that the economics of the industry have relied on massive spending on future projects or intangible assets to generate more sales or volume on their platforms.

This week we’ll continue our search by looking at rush street interactive and golden nugget online gaming to get a further understanding of what a mid sized firm in the industry is doing to differentiate itself and who owns and runs the firms as well.

Rush Street Interactive is firm from our previous group with a total market cap of $4 billion and trades under the ticker symbol RSI. The common stock is currently trading at US$21.25 per share and the corporate treasury has thus far issued 59 million shares outstanding.

Of those 59 million shares outstanding Harry L. You holds 6,338,404 shares which is 12% of the shares outstanding followed by Fidelity Management & Research Company LLC who own 4,779,210 shares bringing their total shares held to 8%.

Rush Street Interactive (RSI) was founded by industry gaming veterans and its management team has years of experience in developing, supplying, and operating regulated Online Gaming sites. The firm only works in the legal and regulated markets which means they always pay gaming taxes to the local governments in all of our markets.

Based in Chicago, RSI launched its first Social Gaming site, Sugarhouse Casino4Fun in July 2015. Shortly thereafter, Social Gaming sites were launched for Rivers Casino Pittsburgh, Rivers Casino Des Plaines, and Rivers Casino Schenectady.

RSI launched its first Online Gaming Casino site, PlaySugarHouse.com in New Jersey, in September 2016, and subsequently, in August 2018, it added a fully integrated Online Gaming Sportsbook. Moreover, they were the first U.S. gaming company to launch a regulated Online Gaming Sportsbook in Latin America.

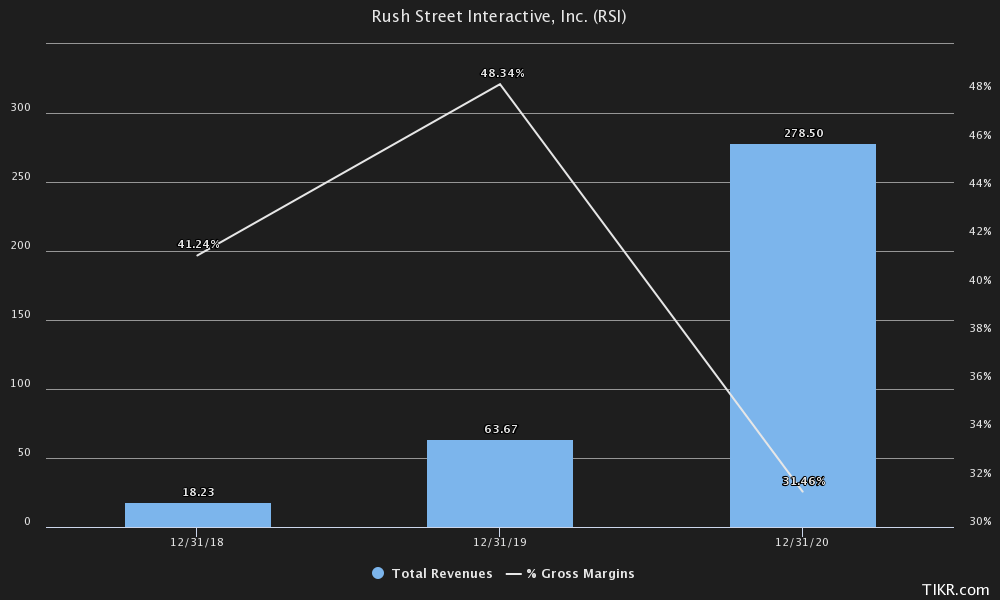

As of the last 12 months the firm has been able to generate a total of US$400 million in sales and US$ 130 million in pross profit bringing their gross margins (a measure of production quality or pricing power) to 31%. The industry average for the Casinos & Gaming Industry was 62%. This 30-percentage points difference could be due to the strategic investments that the company is making or due to inefficiencies in their value chain structure.

As companies venture into new markets, they generally deploy capital into lower margin businesses depressing their gross margins or profitability figures. In 2018 RSI had gross margins of 40% followed by another 41% in 2019 and a recent drop to 31% in 2020. During that. The company spent US$150,000, 430,000 and 1.9 million on capital expenditures from 2018 till 2019. They also deployed 250,000, 5.3 million and 4 million on the acquisition/purchase of intangible assets.

These cash outflows can be depressing to the fundamentals of the business as the income statement carries the burden of the expenses. Usually, the initial outlay is not the biggest problem, but the acquisition of extra selling and general administrative expenses and other corporate overhead could hang over the head of the company. The company spent 17 million on S&G in 2018, 51 million in 2019 and 200 million in 2020.

Investors can expect this trend to continue as the company deploys its cash resources into other assets that helped him acquire the eyeballs of more users as they try to generate economies of scale by reducing the incremental cost of customer acquisition.

Golden Nugget Online Gaming has a total market cap of $800 million and trades under the ticker symbol GNOG. The common stock is currently trading at US$17.61 per share and the corporate treasury has thus far issued 46 million shares outstanding with an implied share count of 79 million assuming the conversion of all convertible subsidiary equity into common.

Of those 46 million shares outstanding their CEO and Chairperson Mr. Tilman Fertitta owns 4,090,625 shares which is 8% of the shares outstanding followed by Magnetar Capital Partners LP who own 3,399,998 shares bringing their total shares held to 7%.

GNOG operates an online gaming and digital sports entertainment company. It offers patrons the ability to play their favorite casino games and bet on live-action sports events in New Jersey and Michigan. As the online gaming affiliate of Golden Nugget Atlantic City, GNOG has taken the best aspects of its legacy brand and modified them to attract today’s online gaming customer.

The Golden Nugget name is synonymous with the Golden Nugget chain of luxury hotel brands and casino brands. It currently operates five casino resorts in Nevada, Louisiana, New Jersey, and Mississippi. The original location was the Golden Nugget Las Vegas which opened in 1946.

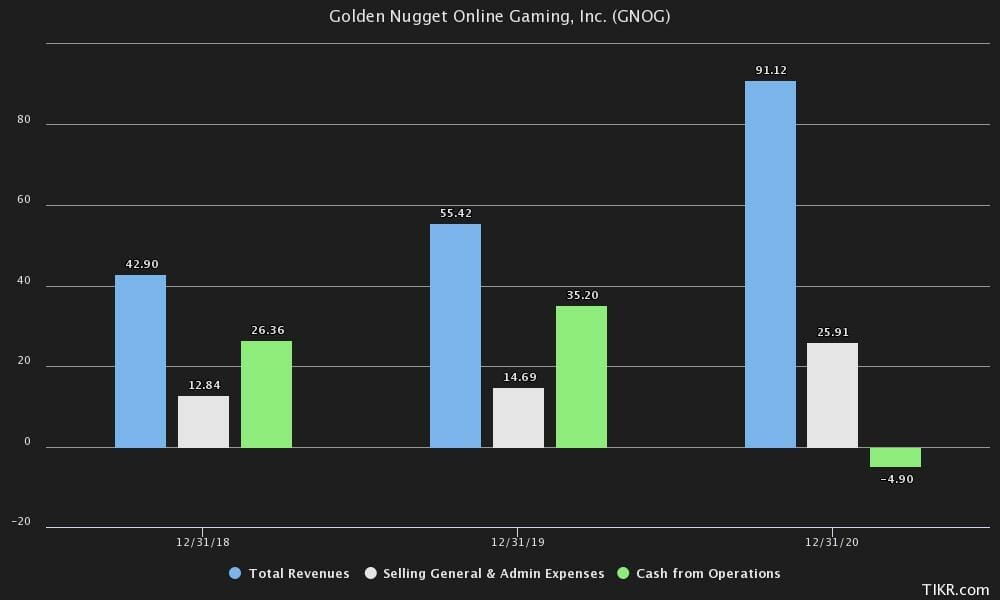

In 2020 the GNOG made 80 million in sales and 28 million in profits. This was all done with working capital deficit of 6 million (44 million in current assets and 50 milling in current liabilities). In 2020 they raised 288 million in debt and 16 million in stock. They currently have 146 million in cash in their books and 58 million in restricted cash.

Just like RSI above GNOG has spent more cash on selling and general administrative expenses since 2018. In 2018 they a total of $12 million followed by 14 million in 2019 and then finally 25 million in 2020. The company has not made any strategic acquisitions or extra capital expenditures outside of the ordinary maintenance of their underlying business. they have also been pretty conservative in their purchases of intangible assets.

Majority of the rise in selling and general administrative expenses is probably due to an increase in these services they’ve had to provide as the volume that goes through their platforms has increased since 2018.

Having gone through a few of the larger corporations in the online gambling sector we can take the economics of the industry that we’ve learned thus far and apply it to smaller capitalized firms. this base will help us in our understanding of the underlying products being offered by the smaller firms and any unique selling points that differentiate them from their massive counterparts.

Next week or dive into some of the illiquid stocks available for the investor. these would generally be unknown firms that are trying to take away market share from their larger counterparts.