It’s been a hodlers delight this week. The moment we’ve all been waiting for since probably mid-May when we started to see our fortunes plummet. If you’ve been paying attention then this is old news, but Bitcoin broke its previous all-time high of $64,888 yesterday, hitting $66,974. Folks have since skimmed their profits and we’ve seen a slight dip back to where it now stands at $63,277.32.

I’m not even remotely qualified to give investment advice, so I won’t. But I can share my own experiences—and they say to not get emotionally involved on either side. If it’s up. Good. It’ll come down. If it’s down, good. Buy more because it’ll go up again. I’m a long term hodler for Bitcoin so it being up is interesting, but nothing to get excited about.

Trying to figure out reasons why Bitcoin is moving is often like trying to manage a room full of toddlers. You can get a handle on maybe three, but the rest of the kids are going to throw too much chaos in the mix to get a handle on things. The same with Bitcoin—there can be two or three core reasons, like we have this week, but there could be any number of different reasons that we can’t see and know about that are affecting the way people are buying and selling.

But this week we can reasonably be sure the price has been effected by two strong currents—these being the emergence of the ProShares Bitcoin ETF and what it means for the future of Bitcoin ETFs, and the end of the Chinese diaspora.

ProShares Bitcoin ETF

The ProShares ETF tracks the price of Bitcoin futures, which are contracts to buy or sell BTC at a previously agreed upon price. They have an expense ratio of 0.095%, which means that investors will have to dole out $95 to ProShares per year for every $10,000 they invest in the fund. It collected more than $1.1 billion in assets in the first two days.

If the whole notion of futures is still confusing think of it like a contract that obligates both parties to buy an asset at a future date and price, regardless of where the price may sit on that day. The buyer must buy (or the seller must sell) at that price on that date. So if Bitcoin is ranging at $45,000 and someone sells you a futures contract that you can otherwise buy at $60,000 two months from that date, if BTC is still ranging at that date, money still exchanges hands even if there’s no change in price. Not to be too crude about it, but it’s betting on the future.

Futures can be used for speculation (because some people like to gamble) or to hedge their bets. Hedging, in this case, would be buying a future’s contract today, with the prospect of selling it a few months from now if the asset depletes in price. So you buy Bitcoin at $63k with a due date of two months, and if Bitcoin dips to $30K by the due date, you buy it back and keep your money.

It’s relevant because it’s the first time the securities and exchange commission has come around on the idea of cryptocurrency being a valid means of investment. This isn’t a Bitcoin ETF, mind you, but it still derives its value from the movements of the core asset and therefore is a distinctive dog whistle for the legitimacy of Bitcoin (and by extension, cryptocurrency) as an asset class.

And companies have certainly heard that dog whistle.

Companies like Grayscale Investments, which fast-tracked the trajectory of their core product, the Grayscale Bitcoin Trust (GBTC.Q), into an application to try to become the first Bitcoin ETF, will be in competition with VanEck, which has been trying to get themselves a BTC ETF past the SEC for almost a decade.

Secondarily, The Valkyrie Bitcoin Strategy, the second BTC futures ETF launches tomorrow on the NASDAQ.

That’s the probable reason why your BTC bet is up, and the reason why it may stay up relates to a much older, more ongoing story regarding China, and Bitcoin miners fleeing a hostile regime for greener pastures.

The Chinese diaspora

It’s relatively old news now but the biggest news story for Bitcoin was probably its continually disintegrating relationship with China. It banned cryptocurrency transactions, mining and eventually all of crypto period shortly before bringing out its own central bank backed cryptocurrency, the digital yuan. That’s part of a larger story wherein the communist party has been gradually turning their polity into collectivist surveillance dystopia the likes of which Yevgeny Zamyatin or George Orwell could never have dreamed up.

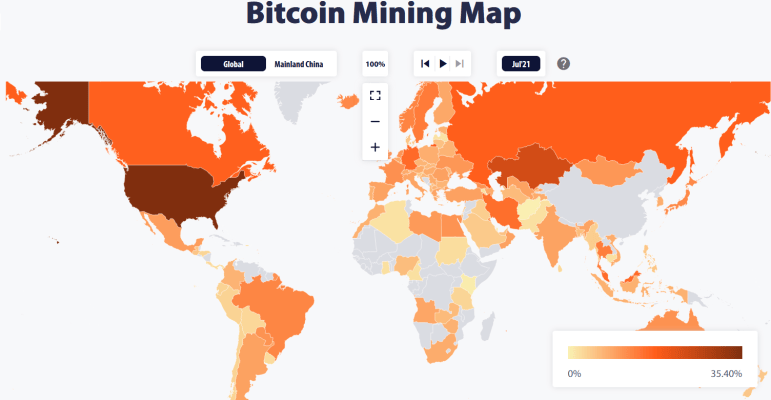

Naturally, crytominers large and small decided en mass to vacate China to escape the bevy of punishments, fines and worse, awaiting them if they didn’t. This caused BTC’s price to crater, as at the time China sponsored somewhere between 60%-75% of the global hashrate depending on what source you’re getting your info from.

The diaspora did wonders for the future of Bitcoin, because it added an extra layer of decentralization. Instead of a majority of the hashrate existing under the largess of one country, said majority has been spread out and diluted over a number of different polities. The two principle winners in this particular sweepstakes seem to be the United States (with 35.4% per July 21) and Kazakhstan (with 18.1%).

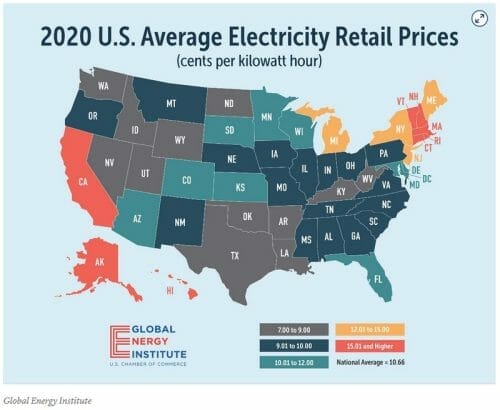

In terms of particular states, we seem to see companies landing in Texas and Ohio with a smattering spread out across other states where the electricity is cheap and there’s no government body peering over your shoulder. Yet. A few examples include Bit Mining (BTCM.NYSE), covered in last week’s roundup, who have made a permanent home in Ohio.

And abroad, we have formerly Beijing-based Canaan Creative (CAN.Q), which creates superconductor chips for ASIC rigs, and has found a new home in Kazakhstan.

What this means is that the diaspora is definitely over, and Bitcoin is stronger for it having happened.

—Joseph Morton