The world is an inherently dangerous place if you’re looking to find a safe space to put your money. Here’s a list of what’s happening in cryptocurrency, blockchain, NFTs and a few hints, tips and concerns to help you make the right decisions this week. You can thank me later.

Cryptostar: the severely undervalued crypto-miner that gets no respect

Honestly, Cryptostar (CSTR.C) getting on the OTC Markets Group to trade on the OTC Venture Market in the United States isn’t the story. It’s more of a preamble. Most companies aim to get on the OTC because it’s a safe, if not anodyne move that’s worth a press release, and spells greater liquidity and more access to cashed-up crypto-hungry investors who want to find a safe way to get in on the Bitcoin boom without actually owning bitcoin. The problem is that there’s so many garbage companies on the OTC that they may end up getting lost in the flotsam.

They shouldn’t and it relates to the second part of the story—that they’ve increased their self-mining hash-rate.

At present, they have an aggregate self-mining hashrate of 89,050 MH/s from GPU miners and 55.4 PH/s from ASICs running at their data centres. The GPU miners contribute USD$805,449.76 per month to their self-mining revenue. But let’s not let a salient point slip by—that’s not Bitcoin. That’s anything but Bitcoin. Bitcoin gets its own section.

The deployment of the 89K MH and then55.4 PH of existing hashrate givs them $9.7 million in annualized revenue, and they’re growing. The company bought 600 high performance ASICS, which will be delivered in the six months from January 2022 to June 2022. That’ll will increase their hashrate by 8.8 PH/s every month, and they’ll end up with a hashrate of 52.8 PH/s.

That’s not anywhere near Marathon Digital Holdings (MARA.Q), Hut 8 Mining (HUT.T) or privately owned Genesis mining, but Cryptostar doesn’t have their market cap, nor their price. They’re presently trading at $0.15 with a $63 million market cap. They are a safe absolute steal.

Powerbridge Technologies has big brass balls the size of the great wall of China

Let’s talk about a company that’s definitely not playing it safe.

Powerbridge Technologies (PBTS.Q) has a subsidiary called Powercrypto Holdings. We’ve talked about it in previous weeks and nothing I’ve read or written has indicated that this company had the testicular fortitude to buck a popular geopolitical trend.

Said geopolitical trend is for Bitcoin (and crypto) miners to vacate China, based on said country’s recent banning of their core business. Well. Powerbridge has either not been paying attention to what’s happening on the world stage, or decided to take their chances with the economic, political and social grey area that is Hong Kong, because they’re setting up Bitcoin and Ethereum mining operations.

Hong Kong has played a pivotal role in the history of cryptocurrency. Sometimes the immensity of its role is forgotten as other places, like the crypto-valley in Europe, take centre stage, but it has. Now Hong King has proposed regulations governing virtual asset service providers in a licensing regime overseen by the Securities and Futures Commission. The city’s government will vote on it next  year.

year.

It’s a risk, for sure. Lots of companies are bailing out for greener pastures.

Meanwhile, Powercrypto intends on completing the deployment of their new ASIC rigs in Hong Kong and getting their hashrate up to 60 PH/s, and 2,000 miners for ethereum with a hashrate of 1,000 GH/s.

Oh, but they’re quick to point out that they will be completely environmentally friendly and use green, sustainable energy. That’s great! Maybe you can use your flower power to counteract China’s glower-power. And their guns. Don’t forget their guns.

BIT Mining’s subsidiary running away from mainland China

Now here’s a company that’s all about playing it safe.

BIT Mining (BTCM.NYSE) exists as a counterpoint to Powercrypto in that they’re picking up stakes and leaving as fast as they can. They’ll be taking their website, BTC.com and leaving the mainland China market, and retiring accounts of existing users in mainland China starting today.

The company covers crypto mining, pools, and data center operations. BTC.com is a blockchain browser and the mining pool business operated under said site includes multi-currency mining including BTC, BCH, ETH and LTC.

Its business covers cryptocurrency mining, mining pool, and data center operation. The Company owns the blockchain browser BTC.com and the comprehensive mining pool business operated under BTC.com, providing multi-currency mining services including BTC, BCH, ETH and LTC.

It’s going to hurt the company’s bottom line, but jail time, fines or worse, will probably hurt it more, so leaving mainland China, under this context, makes all the sense in the world. That way they can land elsewhere and get on with the process of building their business.

This seems like the rational response when an increasingly totalitarian government says that your business is persona non grata. That’s why the Powercrypto move seems so strange—even to the point of being absurd. Most people run away from a flaming building. Bit Mining is not only running away from China as fast as it can go, but it’s settling down in Ohio.

Imagine the culture shock.

Bit Digital Gets to the 1 Exahash mark with latest Bitmain haul

Bit Digital (BTBT.Q) inked agreements with Bitmain this week to buy another 10,000 ASIC rigs. The rigs will put the company’s hashrate over the 1 Exahash (EH/s) rate.

One exahash, at least for right now, is the benchmark. It’s what separates the wannabes from those who have made it. Naturally, the farther you can get beyond it, the better off you are, and while that seems almost redundant it’s still remarkably true. There are a handful of companies struggling to get to that mark. It’s also not true that companies under this mark aren’t worth watching—primarily because it’s expensive to maintain a fleet of that size—and in terms of revenue to overhead, it may be more lucrative for some companies to stay in their lane and scale at a lower rate in the next little while as debt acquisition becomes more precarious.

For Bit Digital, which carries a $588 million market cap and closed today at $10.70. It’s honestly about time. Contrast that with relatively minuscule Cryptostar, named above who has close to 1% of their market cap and much more upside, and you have to wonder if maybe for that price they should have pushed over the 1 exh/s mark long ago.

Yes, apparently, people do still read Maxim magazine

ZK International Group (ZKIN.Q) and its subsidiary xSigma Collectibles are launching the beta version of their MaximNFT platform in cahoots with Maxim magazine on October 15th.

Maxim magazine, you might remember from an earlier story, is the 90’s era lad mag that’s somehow managed to survive decades after delving into irrelevance. Well. It’s back in digital form. Technically, I guess it never left, except most of us wished it had.

The beta testing will be open to only a few select users and is intended for safety and utility testing of the marketplace functions. MaximNFT will reward the most effective testers with NFTs. The marketplace, once its complete, will give its customers the ability to mint, buy and sell digital collectibles. MaximNFT will support ETH, Polygon and Binance Smart Chain blockchains.

Ripple and Nelnet start a $44 million clean energy fund

The next story isn’t about a public company. Normally, we reserve this space to chat about companies you could theoretically invest in—but in this case, it’s public adjacent, because it’s a company that’s behind the cryptocurrency XRP. You could, theoretically buy XRP. Some people do at least. Not me, though. Far from safe.

“Guaranteeing a clean energy future is a major priority across every industry, not only to drive future economic growth but also to ensure a more sustainable world. As the adoption of cryptocurrencies and blockchain continues to grow, it’s evident that the technology will underpin our future financial systems,” said Ken Weber, head of social impact at Ripple.

The point Weber makes is a strong one and worth mentioning. Bitcoin’s power output is akin to a Scandinavian country and it’s not going anywhere anytime soon. Getting big name players like Ripple on board with building a new environmental regime is a positive step. The solar projects financed by the Ripple Nelnet Renewable Energy Fund are estimated to offset over 1.5 million tons of carbon dioxide over 35 years, which is the equivalent amount of CO2 emissions from consuming 154 million gallons of gasoline.

Let’s also point out that this type of initiative is supported by a number of different cryptocurrency and blockchain related companies, such as Hive Blockchain (HIVE.V), DMG Blockchain Solutions (DMGI.V) and Marathon.

Getting onboard with companies involved in environmentally friendly crypto-mining is the next big thing. It’s still not enough to make me buy XRP, though.

BIGG Digital Assets picked by LqwD as liquidity and compliance partner

The slow inexorable march towards regulation for cryptocurrency gained a few more steps this week, as Bigg Digital Assets (BIGG.C) exchange subsidiary Netcoins agreed to provide liquidity to Lqwd Fintech (LQWD.V). Bigg Digital is a company that wants to make the world safe for crypto, and I’m here for it.

Lqwd was once known as Interlapse Technologies, and they had a little quasi-exchange called Coincurve. It offered a one-way fiat-to-crypto way to get your hands on some Bitcoin that came with jacked onboarding costs of 8% that sincerely approached predatory levels. It was a safe way for Bitcoin n00bs scared off by the learning curve associated with navigating traditional exchanges to get their hands on some BTC. As such, it didn’t make a killing. It’s still around and you can still do business with it, if you’re so inclined.

Seriously, though, Coinbase carries fees in the 2% range for most of their services and even that’s too steep when compared to Binance, an exchange that’s far from safe. Coincurve is the place I send people I don’t like to buy their crypto.

Regardless, Bigg will also be lending their suite of institutional-grade and government grade compliance software including BitRank and Qlue, and Netcoins will establish a node on the bitcoin Lightning Network as a payment channel.

“We are grateful to have a strong relationship with Netcoins and Blockchain Intelligence Group as we expand our footprint in the rapidly emerging bitcoin Lightning Network. Lqwd can now leverage BitRank and Qlue for our AML needs and route crypto purchases for our [Coincurve website] and additional platforms through Netcoins, Canada’s first publicly traded, licensed crypto trading platform. It also allows Netcoins to have an early-mover advantage in the Canadian markets for handling instant deposits and withdrawals of bitcoin via the bitcoin Lightning Network,” said Shone Anstey, chairman and CEO of Lqwd.

Let’s finish this off with the world of gaming.

Ubisoft has made a blockchain RPG that gives players ridiculous freedom

One of the things I liked about Skyrim and other sandbox games like Fallout was the open-world idea. You could give up on the main quest and chase rabbits. I have literally spent hours taking side-roads, and setting up shop in towns and going out hunting for deer and bandits in nearby pastures to sell to local markets.

Because I can.

Because no other game lets you do that. It was immersive and I loved it. But it was limited and when those limitations made an appearance, you felt the lack. It broke the immersion, but honestly, not as much as some.

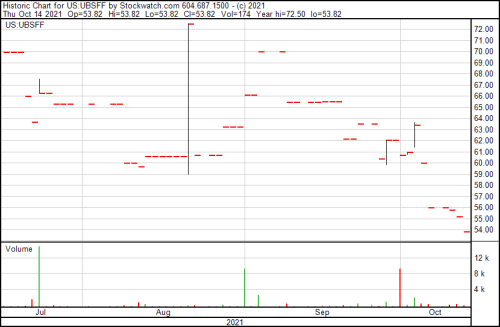

Nine Chronicles, a blockchain-driven decentralized role playing game backed by Ubisoft (UBSFF.Q) latest blockchain RPG takes that idea and runs with it. Nine Chronicles technically isn’t a sandbox game, but an MMORG (massive multiplayer online roleplaying game) developed by a company Planetarium. It allows players to mod it, like many games before it, but each mod actually represents a significant fork in the blockchain ecosystem underlying the game.

Each player represents a decentralized node and changes to the game are done democratically, just like if a blockchain wanted to hard or soft-fork. This is also not the first time video games and blockchain tech have intersected—my favourite is still Litebringer on the Litecoin blockchain.

This whole blockchain gaming thing isn’t without issues or detractors, but it is, at the very least, safe, interesting and innovative.

During the final maintenance of the mainnet, several configuration errors were found, and the mainnet will be set up from scratch. We will deploy the mainnet client at 9PM KST, not 7PM KST. The opening of the on-going sale is similarly postponed.

— Nine Chronicles (@NineChronicles) October 27, 2020

Wondr Gaming gets in bed with MegaCat Studios to make NFT children

Week after week companies get deeper into the non-fungible tokens—enough that talking about the NFT space doesn’t seem like a misnomer. It’s literally taken on a life of its own and companies are deftly moving through it, gobbling up revenue from possibly overly enthusiastic individuals hungry for whatever cachet these pixelated images can bring.

Let’s take Wondr Gaming (WDR.C) and their deal with MegaCat Studios. They’re an entertainment company involved in branding, NFT and a platform, that signed on the dotted line with MegaCat Studios, a United States based video game developer, to make NFT based games for sports, music and games.

MegaCat has developed games for Sony Playstation, Xbox, Nintendo, Nintendo Switch, Sega and Microsoft Windows, so they’re not a small fish in a big pond and likely a safe bet.

They’ll make new games that will give players a chance to interact with their favourite athletes and teams, musicians and bands, streamers, gamers, etc. Their white-labelled NFT tech is hosted on Ethereum, which provides enough space and time to help the companies build out their brand and stake their claim in the ever-so-frothy NFT space before the music stops, and whoever’s left holding the bag loses out.

“James and the team at MegaCat have built a strong legacy in the video game development community that is recognized for its authentic roots in retro games that are timeless, and loved by gamers all over the world. We could not have asked for a better partner as we grow our gaming NFT footprint, and bring new and exciting revenue silos to our sports, music and gaming partners. The team at Wondr believes sustainable monetization in the NFT space lies in curated content and NFT based games that let fans engage with their favourite athletes, musicians and gamers in a way like never before,” Jon Dwyer, chairman & CEO of Wondr Gaming

Honestly, though. Anything that generates this much hype cannot be around for long. Be like Astar the Robot from the 1980’s PSA’s on this one, and Play Safe.

You don’t want to be the one holding the bag (or your arm) when this one pops.

—Joseph Morton