Pure Extracts (“PULL.C”, “PRXTF.OTC”) is commercial cannabis and psychedelics firm in British Columbia, Canada that holds a Health Canada standard processing license under the Cannabis Act and related regulations.

PULL has a fully built carbon dioxide extraction facility developed to European Union GMP standards. PULLs intention is to undertake the business of the extraction and processing of cannabis and hemp as a third-party service to licensed producers for toll processing or white-label processing and for its own private label of products incorporating its full spectrum THC- and CBD- based extracted oils.

On top of their cannabis and hemp business the firm’s subsidiary, Pure Mushrooms, has established a capital-efficient e-Commerce portal on the Amazon platform for direct-to-consumer sales of functional mushroom wellness products.

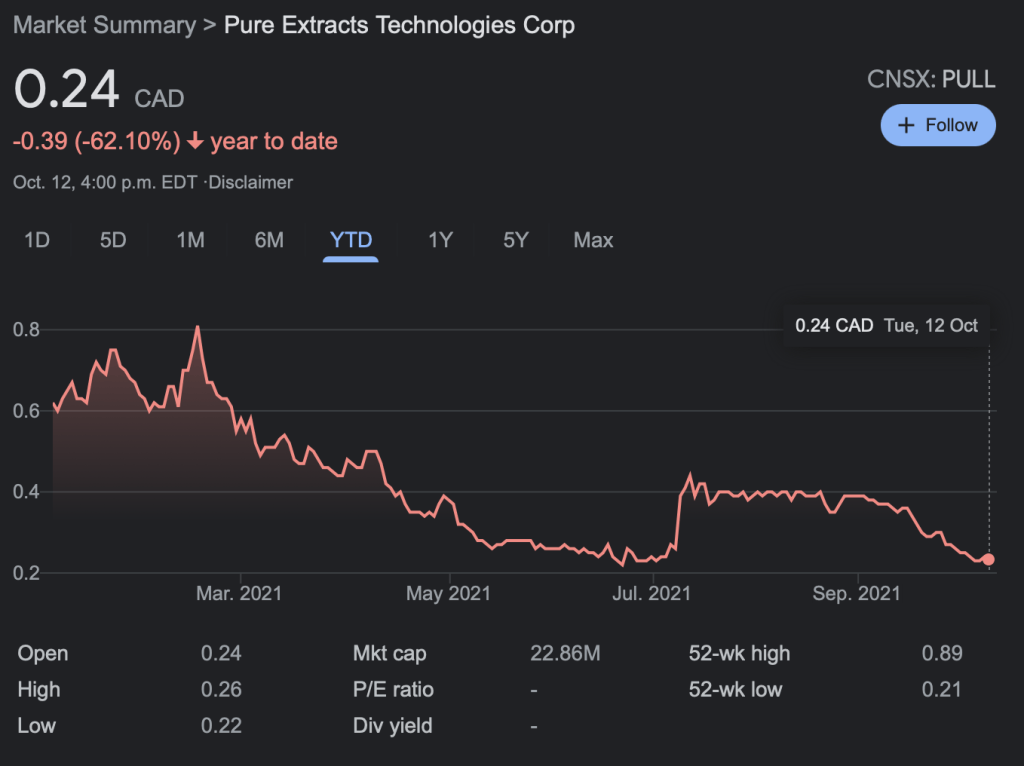

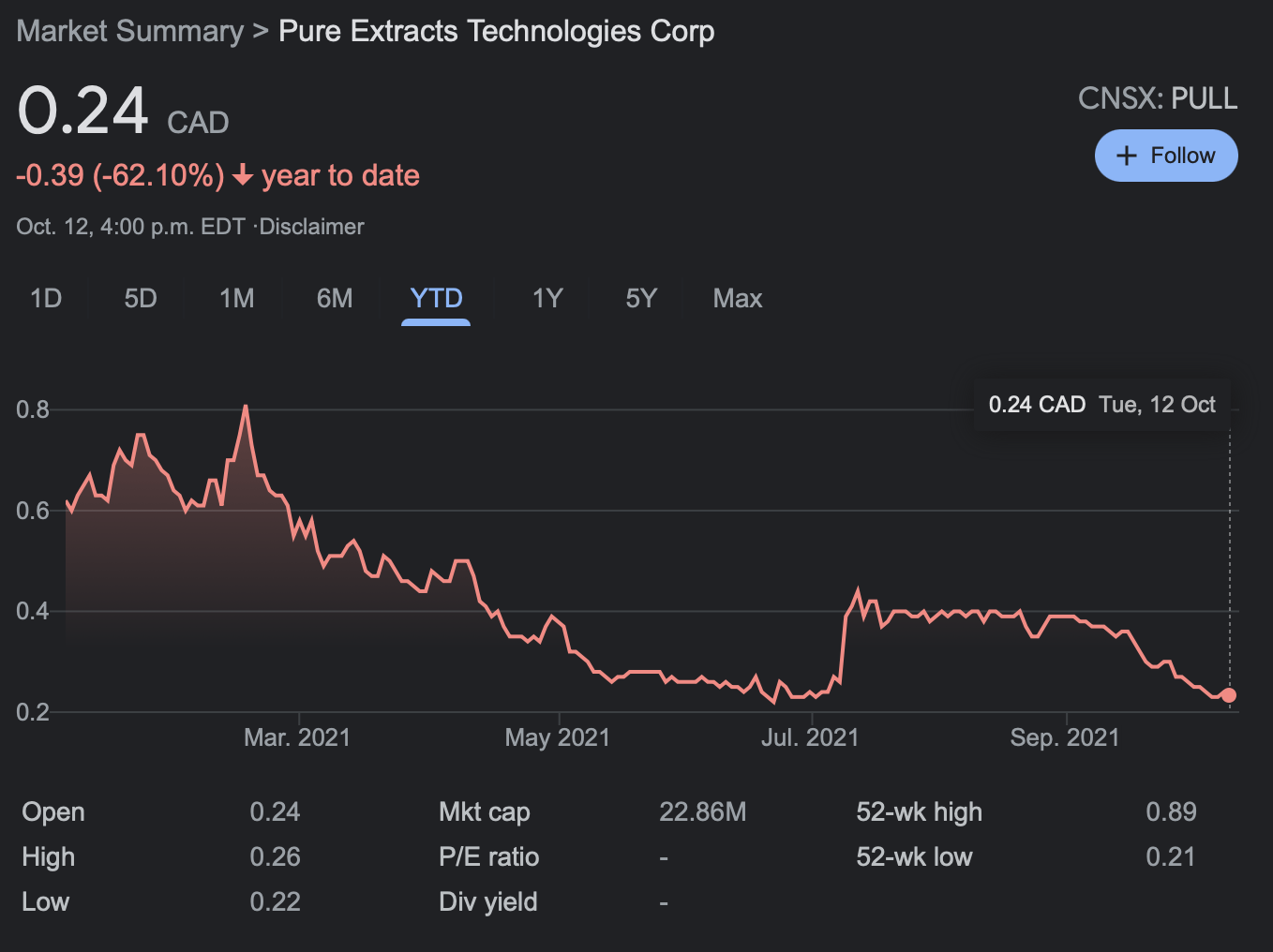

The Cannabis ETF with the ticker symbol THCX that tracks the Innovation Labs Cannabis Index, which consists of global companies engaged in the legal cannabis, hemp, or CBD-based pharmaceutical, consumer product, and wellness markets is down 6% year-to-date(“YTD”). PULLs common on the other hand is down 62% YTD.

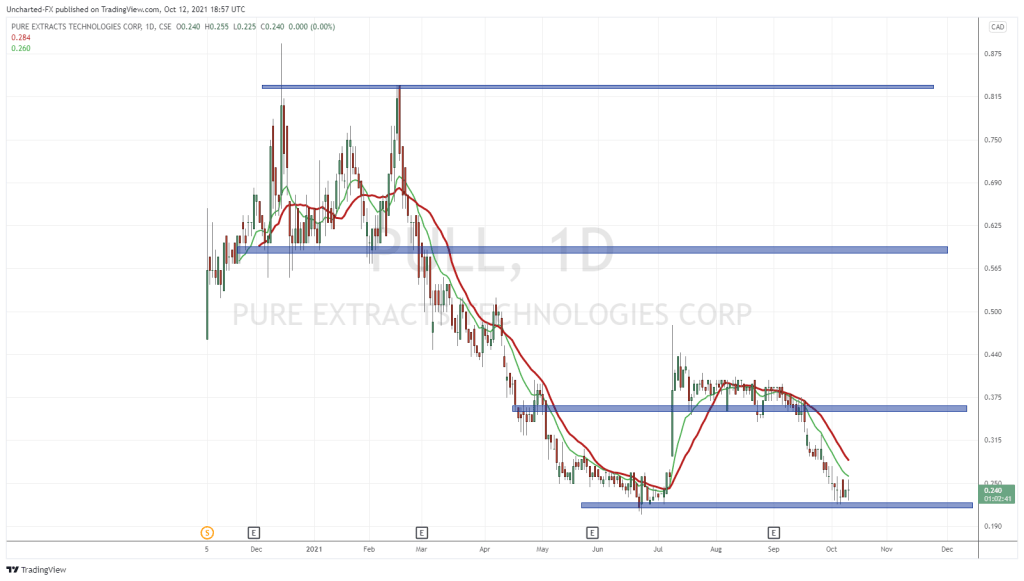

As with any company whose stock is down 62% year to date, the common stockholders comparing with, an index would ask themselves why my is portfolio position down so much. Most people would look to the stock’s price action and come up with some momentum or psychological factors that rely on the movement of the market to conclude their theories. Sadly, I do not have the slightest edge when it comes to the charts and relies mostly on the business accounting numbers for my own conclusions. So as is customary on Wall Street let’s dig deep!

For those with the curiosity of a cat with nine lives, I have reproduced the year-to-date price action for PULL below and an attachment to the great markets analyst, Vishal Tooras’, work on the subject can be found here.

The cleanest number on the financial statements is usually the revenue number or if you’re feeling fancy the top line. I won’t go into too much detail about the accounting behind sales recognition but essentially what you have is price times quantity equals sales. Usually, the assumptions that matter to drive the top-line figure are the price and volume factors of the final goods and services. When the business does not have these factors, this common stock should experience some variability in pricing because of the inherent uncertainty with the business model.

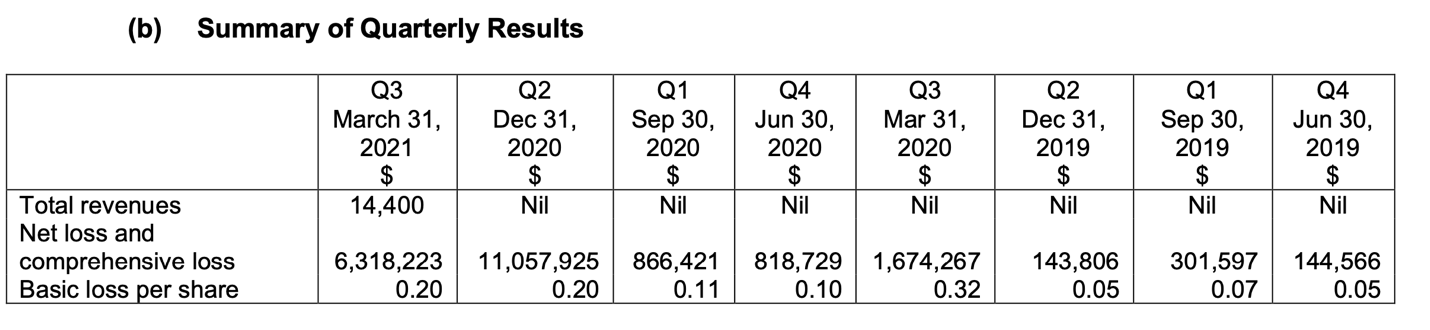

The operators stated in the Risks and Uncertainties section of their quarterly report under Additional Funding Requirements, excluding a sale that was recorded in March 2021 of 14 thousand dollars, that

“The Company has no sources of operating income at present.

The Company’s ability to continue as a going concern is dependent upon its ability to raise funds primarily through the issuance of shares or obtain alternative financing, in which it has been successful in the past but there can be no assurance that additional debt or equity financing will be available on terms acceptable to the Company.”

This is mainly due to limited operating history. That exposes them to many of the risks common to early-stage enterprises, including under-capitalization, cash shortages, limitations with respect to personnel, financial, and other resources, and lack of revenues. Because of their stage of development, the company has a history of losses and an accumulated deficit of 21 million dollars in its balance sheet as of the end of March 2021.

As you can see from a quick glance at the summary of quarterly reports the company has not recorded any sales since Q4 2019. Their net loss has increased from $144,000 in Q4 2019 to about $6 million in the last reporting quarter with a peak of him $11 million in December of 2020. To fund its operations the company has relied on outside sources.

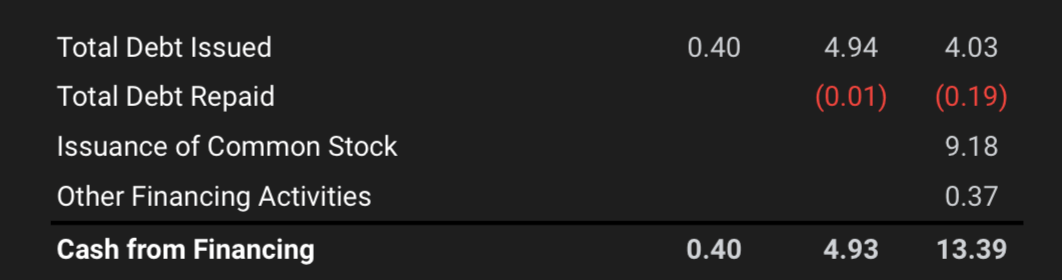

From 2019 until the last 12 months the company has relied on the issuing of debt and common stock. in 2019 the issue $400,000 of debt and in 2020 the number jumped up to $4.94 million and then in the last 12 months, it’s been closer to $4 million issued. they have only issued common stock once and that’s been in the last 12 months with a total of $9.18 million issued. They currently have $3.3 million of cash in hand and 800,000 in current liabilities with a 1.2 million long-term lease liability.

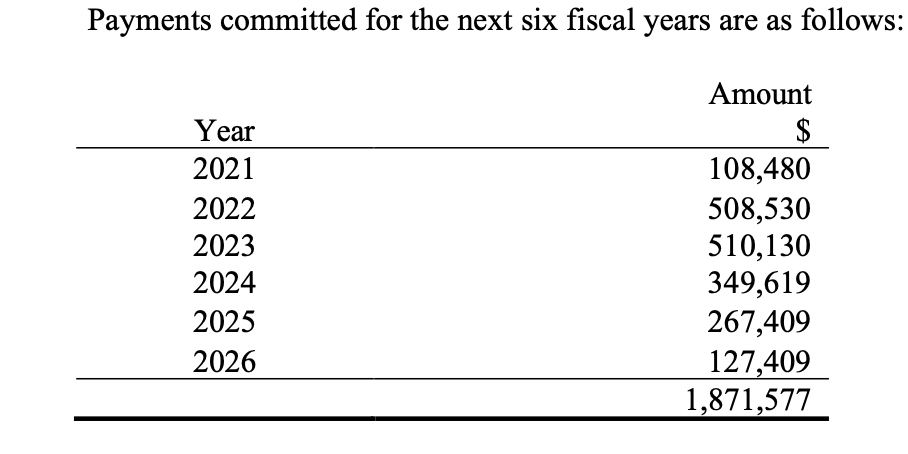

The Company entered into a lease agreement for the headquarter office space on April 30, 2020, with an initial five-year term, a three-year equipment lease commencing July 16, 2020, and a six-year equipment lease commencing January 1, 2021. The payment schedules are below.

Because the majority of the payments come after a year the company has enough liquidity to finance some of its day-to-day operations but would need further financing to continue to expand its business book. The sales made in March came from their Cannabis and Hemp segment and investors would hope for more volume as the firm progresses through its strategic plans. As for now, there is honestly not that much I can say about the company’s operations. but as usual, the cautionary tale is that sit back and watch the show and maybe this is one on the watch list that you might count as deeply discounted if your assumptions about the future of this sector come to light.