Even though we are hearing about a full blown energy crisis, China’s crackdown on financial institutions, and Evergrande missing yet another bond payment, tons of fundamentals which could be adding pressure to US stock markets, I stick with my thinking that the Stock Markets are propped up due to the Fed and chasing yield in the environment they have created. Cheap money and Fed tapering is doing a large part in keeping stock markets propped. It hasn’t been necessarily due to a recovery. As many of you should know by now: the real economy and the stock markets are completely different.

Wall Street (and Main Street) want the party to keep on going. Cheap money. It is a great time to be a trader or an investor. Lot’s of people make money in trending bull markets. But there are signs the party might be coming to an end. I say might, because any bad news could cause the Fed to continue tapering be it pandemic issues with a new variant, or a financial issue from China etc. Remember: monetary policy is really all about confidence. The Fed has been leading investors for months, telling us they will taper. Month after month all of us analyze every word Powell says for hints of a tapering timeline. Now imagine he just came out and said yea we ain’t going to taper. Markets wouldn’t like it. The Fed would need a valid reason (or some cynics might say an excuse to save face) to continue tapering when they told the markets the economy was improving etc. Funnily enough, the transitory inflation narrative fits in with this.

In last months meeting, Fed chair Jerome Powell said inflationary pressures are decreasing, so the Fed committee now is focused on employment data. If employment data came out positive, it would be a sign the US economy is recovering, and the Fed could then issue a taper timeline as early as this month. All eyes were glued on last weeks Non-Farm Payrolls (NFP) on Friday.

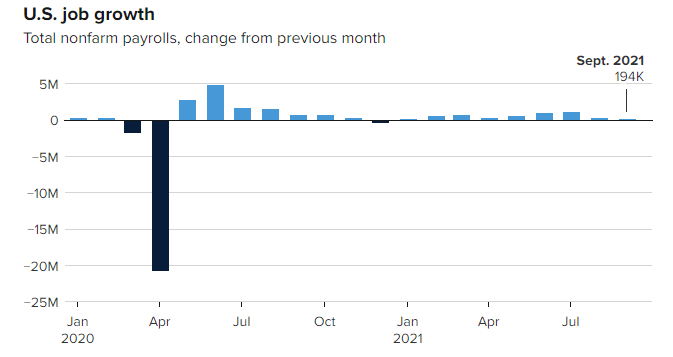

It was a big miss. Nonfarm payrolls rose by just 194,000 in the month, compared with the Dow Jones estimate of 500,000 expected. However, the unemployment rate actually dropped from 5.1% down to 4.8%. Better than expected.

It seems like the Market is split on how to take this data. The numbers were a miss, but unemployment decreased…which fits the Feds criteria. Markets are still choppy, but tomorrow we have the Fed’s CPI data and FOMC minutes to paint a clearer picture on the Fed Committee’s thinking process, and where they all are on tapering.

Last week I discussed how our risk off assets were providing odd signals. The markets didn’t know what to make of it. At time of writing, the VIX is down, Bonds are moving up, the US Dollar is moving up, and the Japanese Yen is moving down. Try to make sense of all of this. BUT there is one explanation on why the US Dollar is rising, and the Japanese Yen is decreasing. But first, a tiny step back. In previous Market Moment posts, I have explained why many consider the Japanese Yen to be the real safe haven currency. The Japanese government is stable (although they just had two different PM’s step down in two years), and the Yen is backed by the people’s savings. Japan has one of the highest savings rate. There are tons of wealthy people and fund managers who do not leave their homes without some Japanese Yen in their wallets. For us traders and investors, the Japanese Yen has a strong positive correlation with Gold, and the Yen pairs have a positive correlation with the stock markets. Meaning if stock markets are dropping, then EURJPY,GBPJPY, CADJPY, AUDJPY etc are dropping, or the Japanese Yen is STRENGHTENING. So during times of real fear and risk off, we see both the US Dollar and the Yen rising.

The Dollar rise and the Yen weakness can be attributed to something else. It seems there isn’t fear. I believe the US Dollar is rising due to taper expectations. Which then is weighing down on Stock Markets because of the taper tantrum. The one thing that has been driving stocks higher is about to go away. This narrative got bigger support from the IMF today. They came out saying that central banks should be prepared to tighten monetary policy as inflation risks loom.

I have discussed this US Dollar (DXY) chart many times here on Equity Guru and over on our Discord channel. This is one of the most important macro charts out there. A new US Dollar bull run is commencing. This could either mean a move into a safe haven drives the Dollar higher, or monetary policy such as tapering and rate hikes drives the Dollar higher. I know there are those who hate the Dollar and think it is doomed, but in terms of fiat, it really is the cleanest laundry in the pile of dirty laundry (I think that’s how that saying goes). Reserve currency status really helps.

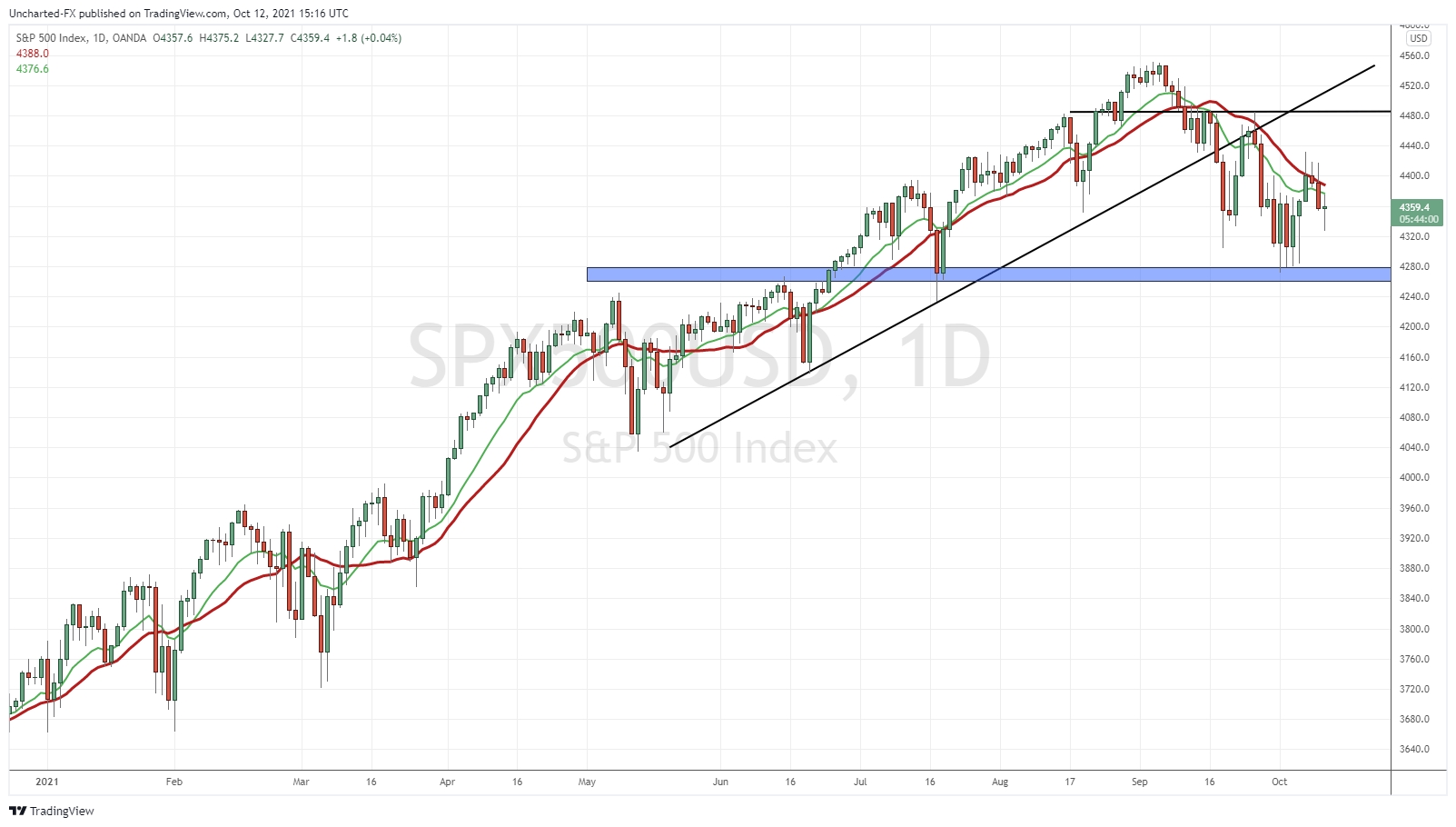

Meanwhile on the stock market side, the S&P 500 hit our major support at 4280, but we can technically make another lower high with another leg down. To nullify this downtrend, we must climb back across 4480.

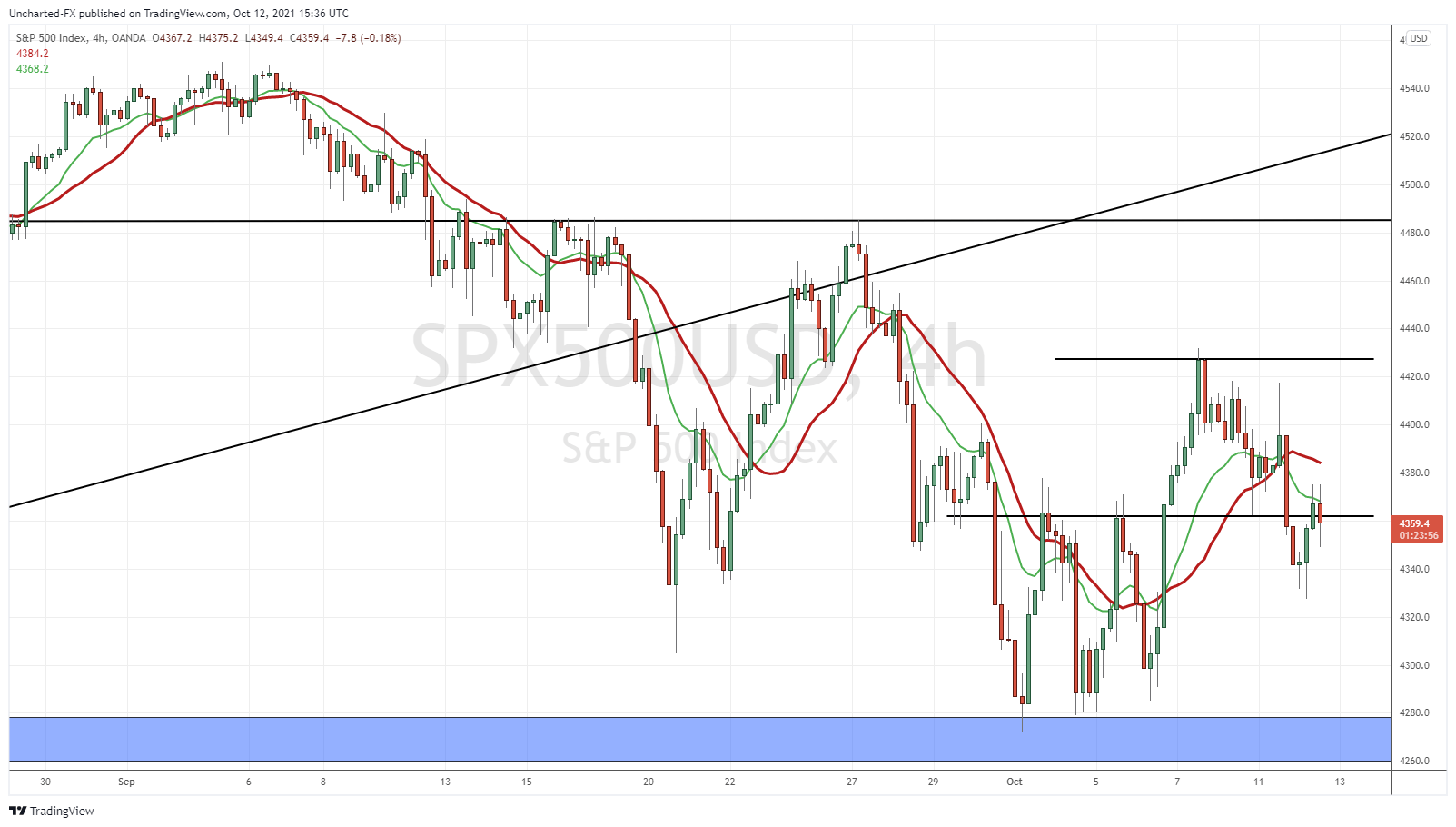

On the 4 hour charts, things get choppy. We had a support level and a triple bottom breakout. But on the retest, we have broken back below. Now we shall see if we can climb back across, but choppy is the perfect word to describe this price action. It has been frustrating, and hasn’t been fun.

My advice? Stick with the longer term charts. I prefer the daily. We are still bearish until we climb back above the lower high I mentioned. Tomorrow’s CPI data will either raise or subdue fears when it comes to transitory inflation. While the FOMC minutes will give us some insight on how hawkish the Fed committee is regarding a taper.