The highly anticipated Federal Reserve meeting has come and gone. We got an update on tapering… well the Fed told us the taper will come ‘soon’. But the market is beginning to form concrete expectations, while in my opinion, the Fed language still allows for the goal posts to be moved.

Before we talk about the tapering, there were comments on FedCoin, the Fed’s central bank digital currency, and recent Fed insider trading.

On FedCoin, a white paper will soon be coming our way. Powell mentioned that he wants broad support from congress when it is time to unveil the FedCoin. A digital currency is not an ‘if’ it comes, it is ‘when’ it comes. When asked whether the Fed might want to speed up the process to get their central bank digital currency (CBDC) out first, the Fed said they want to do it properly rather than being the first. Since the US Dollar is the world reserve currency, it is important for the Fed to roll this out properly.

Just a quick comment on CBDC’s. Right now the Fed prints Fed reserves. The issue is that the money the Fed ‘prints’ cannot directly go to main street. Fed notes is the cash we use today. In summary, wholesale money (Fed reserves) is money that banks use. This is the famous deposits only to private sector banks…who have then used the money to buy stocks. Retail money (Fed notes) is money we the people use. The issue is that the average Joe cannot open a bank account with the Fed. Only the banks can. Thus, the Fed cannot directly provide money to the people.

The whole idea of FedCoin, is so that the Fed will be able to provide money to the people. Main street can benefit from the money printing. Of course this would be a paradigm shift in the way we look at monetary policy. It would also supplant government responsibilities. This is why in the future, we are looking at a some what merger between the Fed and the government. In terms of Universal Basic Income, FedCoin is the final piece for that to become a reality.

Recently, Fed members have been caught trading stocks. Some people say this is a conflict of interest. Fed chair Jerome Powell bought municipal bonds years before he became the Fed chair. With the Covid craziness, the Fed ended up buying municipal bonds… increasing the worth of the bonds Powell is holding. Powell’s defense is that the Fed never bought municipal bonds…it was something that he changed, and he had to, because the muni bonds market was about to collapse. Now, the Fed will be investigating itself on insider trading, and will be cracking down on it.

Now to the tapering.

Powell was definitely more hawkish in tone. A tapering looks like it is coming soon. Powell clarified that a taper does NOT mean the Fed will be looking to raise interest rates. The criteria for an interest rate hike is different. Both do depend on the economic recovery.

For tapering, Powell told markets that bond tapering could conclude by mid 2022. Market analysts are taking this as a sign that some sort of tapering announcement will be coming in November 2021.

In terms of ‘substantial further progress’ for the taper, it depends on inflation and employment. The Fed believes inflation is transitory, and this month’s CPI data release indicated the previous months inflation coming out lower than expected. Still a high 5% mind you.

Employment is now the flavor of the month. Powell told us that ‘further substantial progress’ has been made on employment. He himself thinks employment data is gucci. There are just a few members in the Fed committee who disagree. This means the next NFP data is going to be big. Even though Powell said we don’t need a ‘blowout’ report, you just know the markets will make a big deal out of it. Funnily enough, weekly Jobless claims today came out worse than expected. First-time jobless claims totaled 351,000 last week, an increase from 16,000 a week before and well ahead of the 320,000 Dow Jones estimate.

Any sort of bad employment data, the deterioration of the China Evergrande situation, a sudden rise in inflation, the US debt ceiling drama, Covid cases and new variants can change all of this, and force the Fed to move the goal posts further down the road.

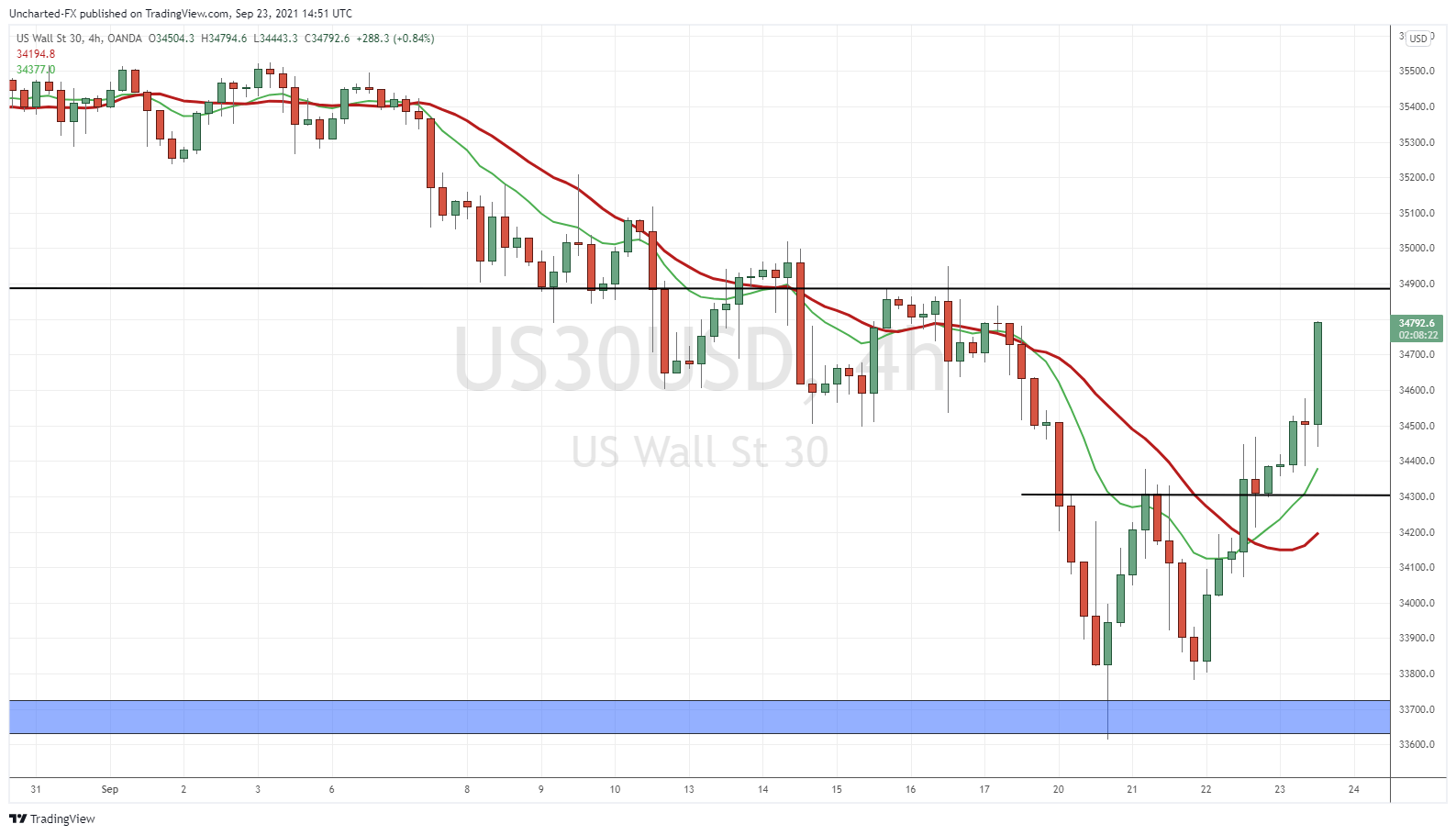

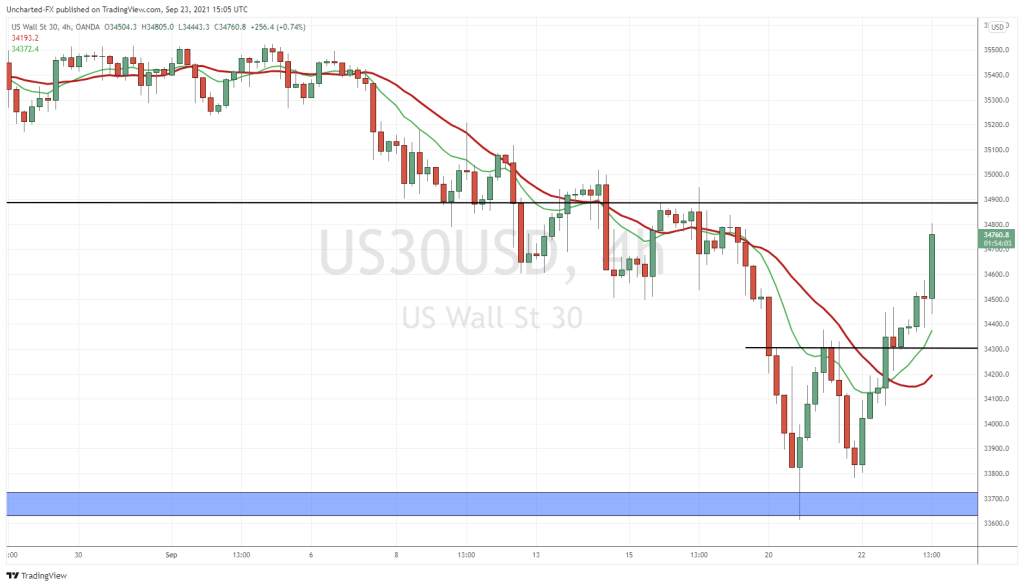

Stock Markets are strong post Fed. The dip has bee bought. Above I have the 4 hour chart of the Dow Jones, but you can substitute the S&P 500 or the Nasdaq. All indices have the same structure: double bottoms. I told our Discord members about this set up. We had the breakout before the Fed, and well, today we spiked.

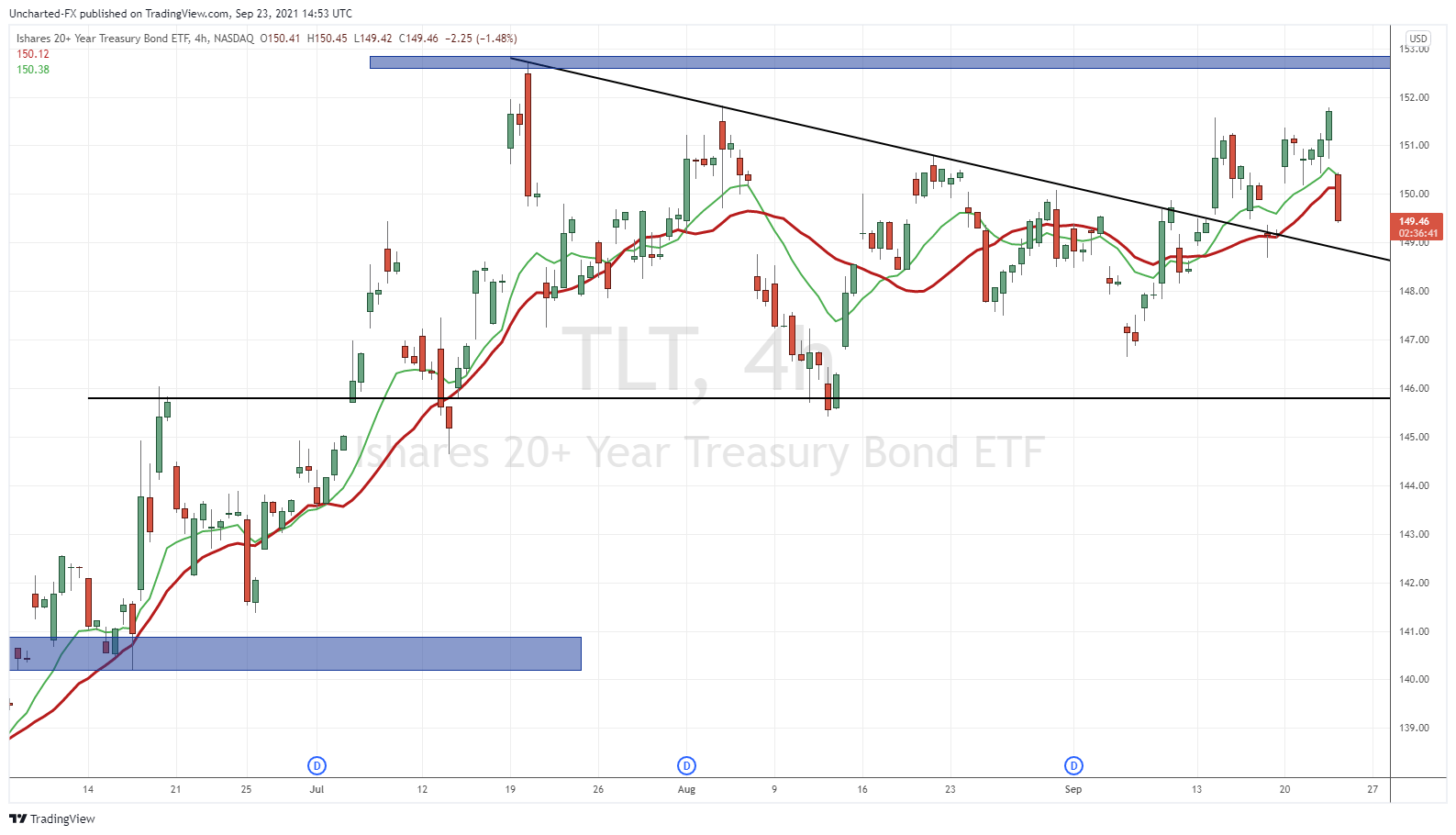

Bonds are also dropping, indicating a move back into stocks. This is a bullish stock market sign. If we can close back below the trendline retest…stock markets are on the road to make new record highs.

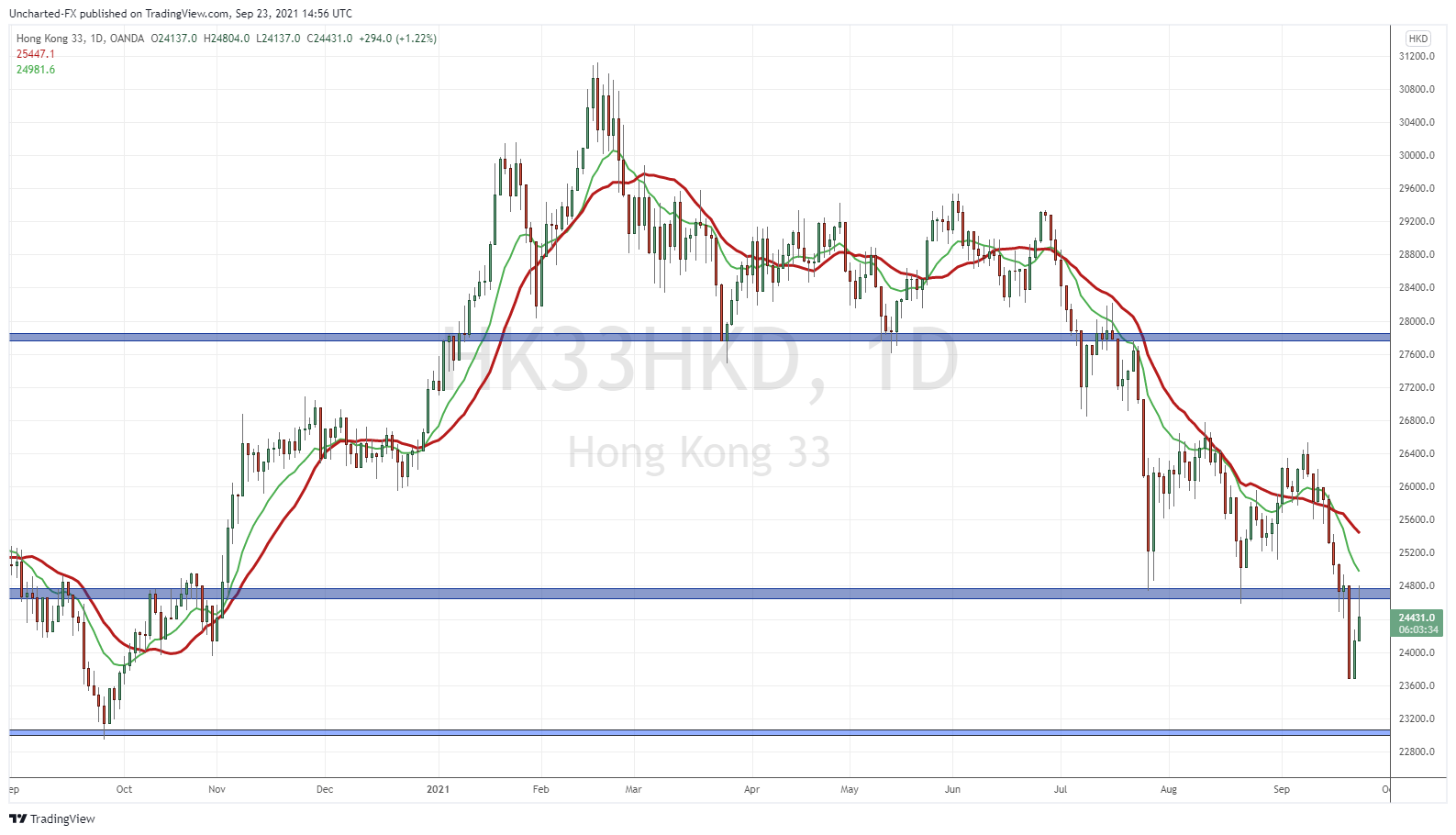

But is it all rosy now? I still think there are some risks out there. Evergrande is making headlines, and honestly, some new headline could put pressure on stock markets once again. Remember this is China we are talking about. When everyone thought Ali Baba and other recent CCP headlines were finished, boom, they hit us again.

I point out the Hang Seng. Yes, it is up, but we have just moved to retest current resistance. A close back above 24800 would be bullish for the Hang Seng…and world stock markets. Watch for this in the coming days.

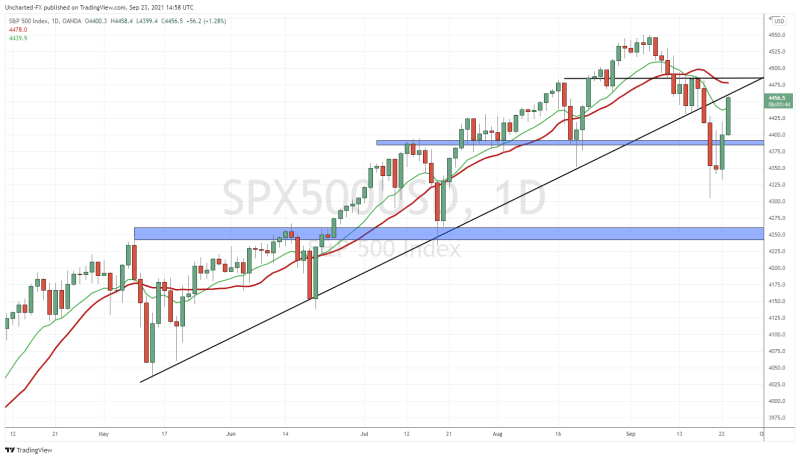

Finally, technically there is one more thing I want to see on the S&P 500:

Last week, I predicted the stock market drop because of what the technicals were indicating. Technically, we are still in danger of making another lower high. We are testing the broken trendline now as a retest. Let’s watch to see if we get some sort of rejection. A close back over the trendline would be uber bullish. Then we can rest easy and say we are out of the woods. But until then, a rejection can still occur. But I must say, things do look bullish. Earlier this morning only 10 stocks on the S&P 500 were red. The S&P 500 has also recovered to climb across the 50 day moving average (not pictured on my chart). The key though is a close above it. We won’t know that until the end of the trading day.

Wealth thefting from good citizens ain’t easy.

Is this discussion of payments for goods and services or currency I owe yous?