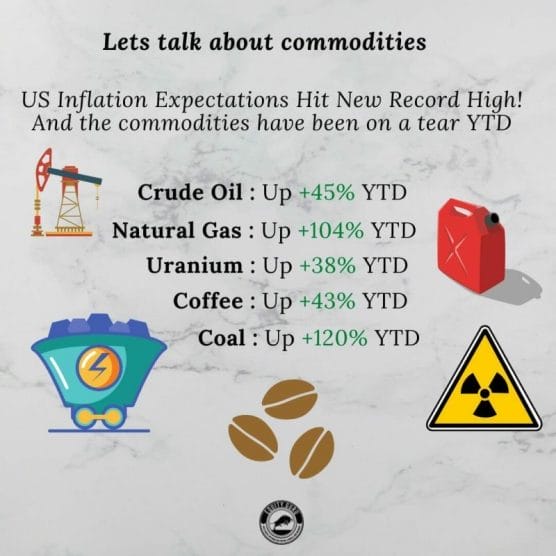

One of our macro outlooks for being bullish the agriculture sector has been a food crisis. Supply chain issues. It seems the signs are upon us! The story recently has been commodities printing big gains. Steel, Oil, Lumber, Coal, Natural Gas have made or are making headlines. Believe it or not but both Natural Gas and Coal are up over 100% year to date on supply issues.

Add agriculture to this. Maybe commodities are rising because they look the cheapest compared to stocks, bonds, real estate and crypto’s? If this is the case, then agriculture looks even more attractive in this hunt for yield.

But supply chain issues is the culprit. Bloomberg with a major piece this week on food prices seeing highs not seen since the 1970s! The global implications of this? Angry people turning on the government.

Whether for bread, rice or tortillas, governments across the world know that rising food costs can come with a political price. The dilemma is whether they can do enough to prevent having to pay it.

Global food prices were up 33% in August from a year earlier with vegetable oil, grains and meat on the rise, data from the United Nations Food and Agriculture Organization show. And it’s not likely to get better as extreme weather, soaring freight and fertilizer costs, shipping bottlenecks and labor shortages compound the problem. Dwindling foreign currency reserves are also hampering the ability of some nations to import food.

From Europe to Turkey and India, politicians are now handing out more aid, ordering sellers to cut prices and tinkering with trade rules to mitigate the impact on consumers.

The issue is more acute in emerging markets where the cost of food accounts for a greater chunk of household spending, and in crisis-hit nations. In Lebanon, militant group Hezbollah has tightened its grip on the country by distributing food. But even the U.S. is taking action to address affordability made more urgent during the coronavirus pandemic.

Food inflation spurred more than two dozen riots across Asia, the Middle East and Africa, contributing to the Arab Spring uprisings 10 years ago. Pockets of discontentment are growing again. Unrest in South Africa triggered by the arrest of former President Jacob Zuma in July turned to food as people looted grocery stores and restaurants. Shortages in Cuba led to the biggest protests in decades.

Adjusted for inflation and annualized, costs are already higher now than for almost anytime in the past six decades, according FAO data. Indeed, it’s now harder to afford food than it was during the 2011 protests in the Middle East that led to the overthrow of leaders in Tunisia, Libya and Egypt, said Alastair Smith, senior teaching fellow in global sustainable development at Warwick University in the U.K.

Yikes. Just something I have been thinking about, and I am NOT saying this is going to happen. But just imagine more restrictive lockdown measures are implemented this Fall or Winter. Remember people hoarding toilet paper and canned foods? Well we did not have a supply chain issue back then. Now we do. If this occurs, I bet we see more empty shelves…something already being seen in some major cities.

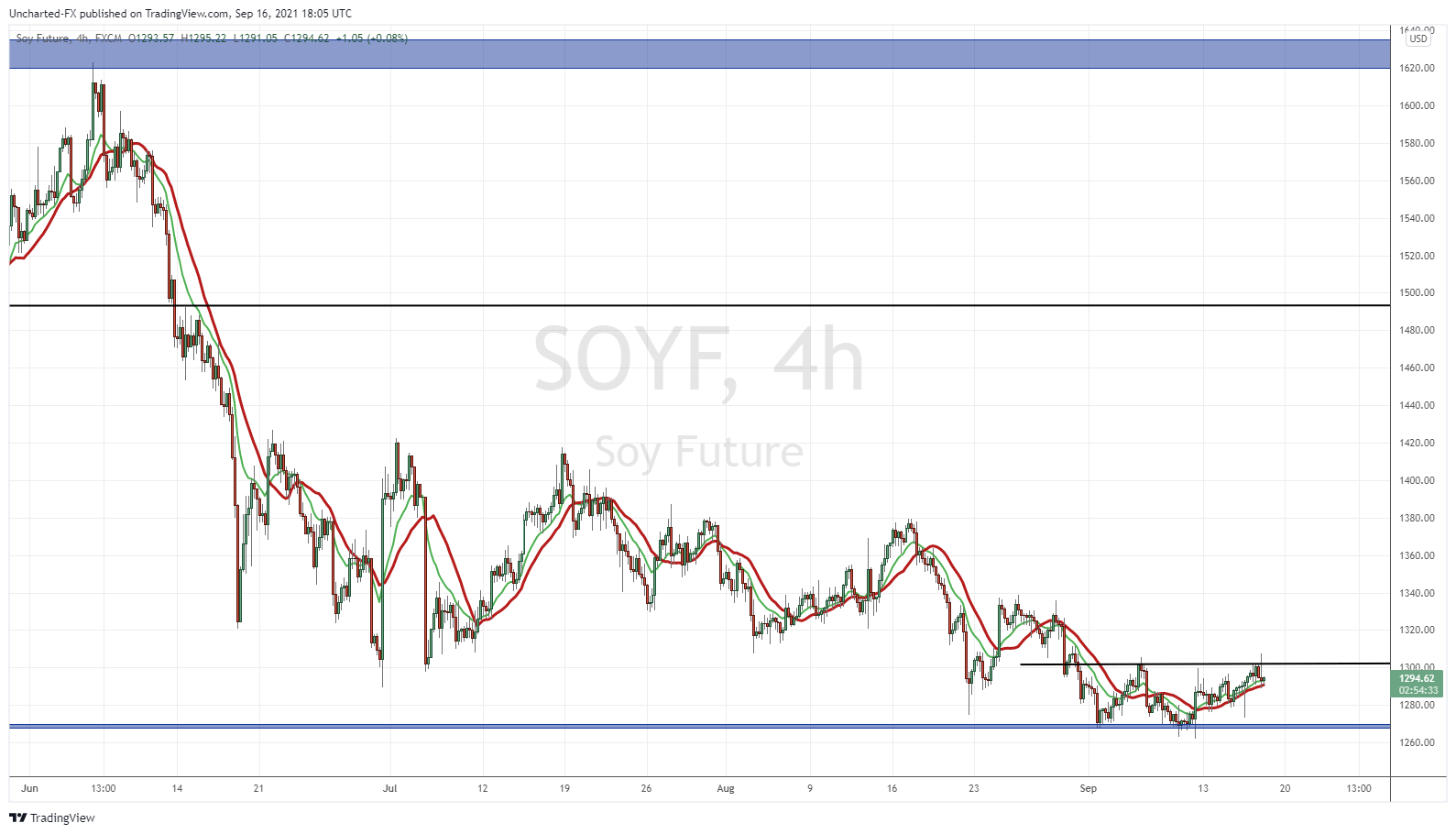

Let’s look at how the agriculture commodities performed this week. Some nice looking set ups.

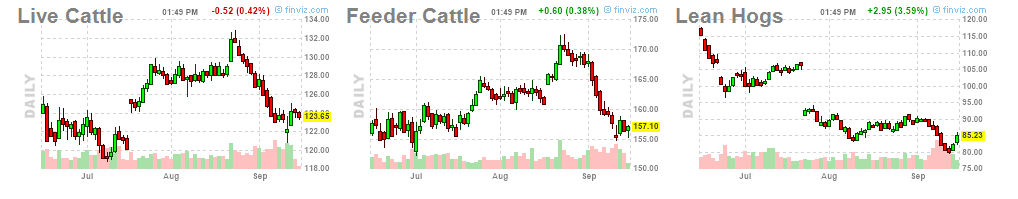

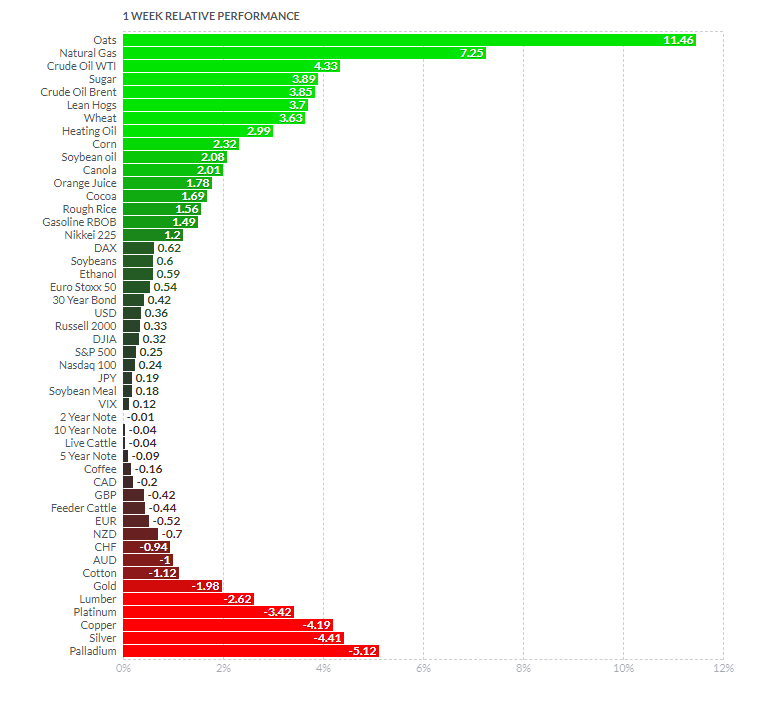

I want to start off with the meats. Lean Hogs unfortunately did now hold our support. Hence why we prefer to await the breakout trigger for confirmation. But there could be some fundamental news which may drive pork prices. A massive culling of hogs in the Dominican Republic after swine fever has led to a boost in US pork exports to the country. Let’s see how this develops.

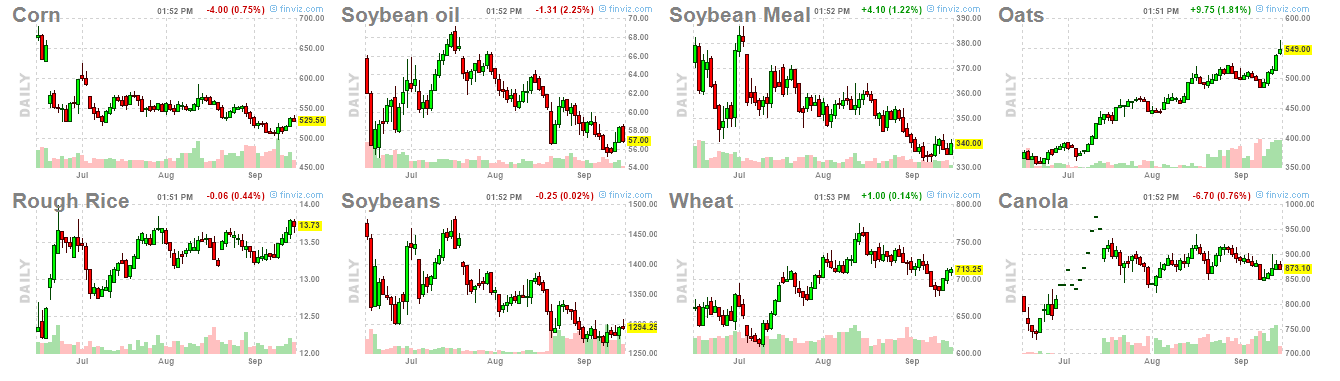

I want to take a closer look at Soybeans. Other than that, Oats is breaking out. Corn is looking interesting. Maybe a potential cup and handle pattern in the next few days if we pull back. Wheat could also trigger a reversal if it closes back above this resistance zone it is testing.

Considering taking a long on Soybeans. I like the basing pattern happening at a major support zone. I am waiting for a confirmed break of $1300. A very nice set up and market structure.

Here is the weekly performance of assets from Monday to Thursday. Oats ftw! While metals compose the bottom tiers.

Let’s get to some big news and interesting chart set ups!

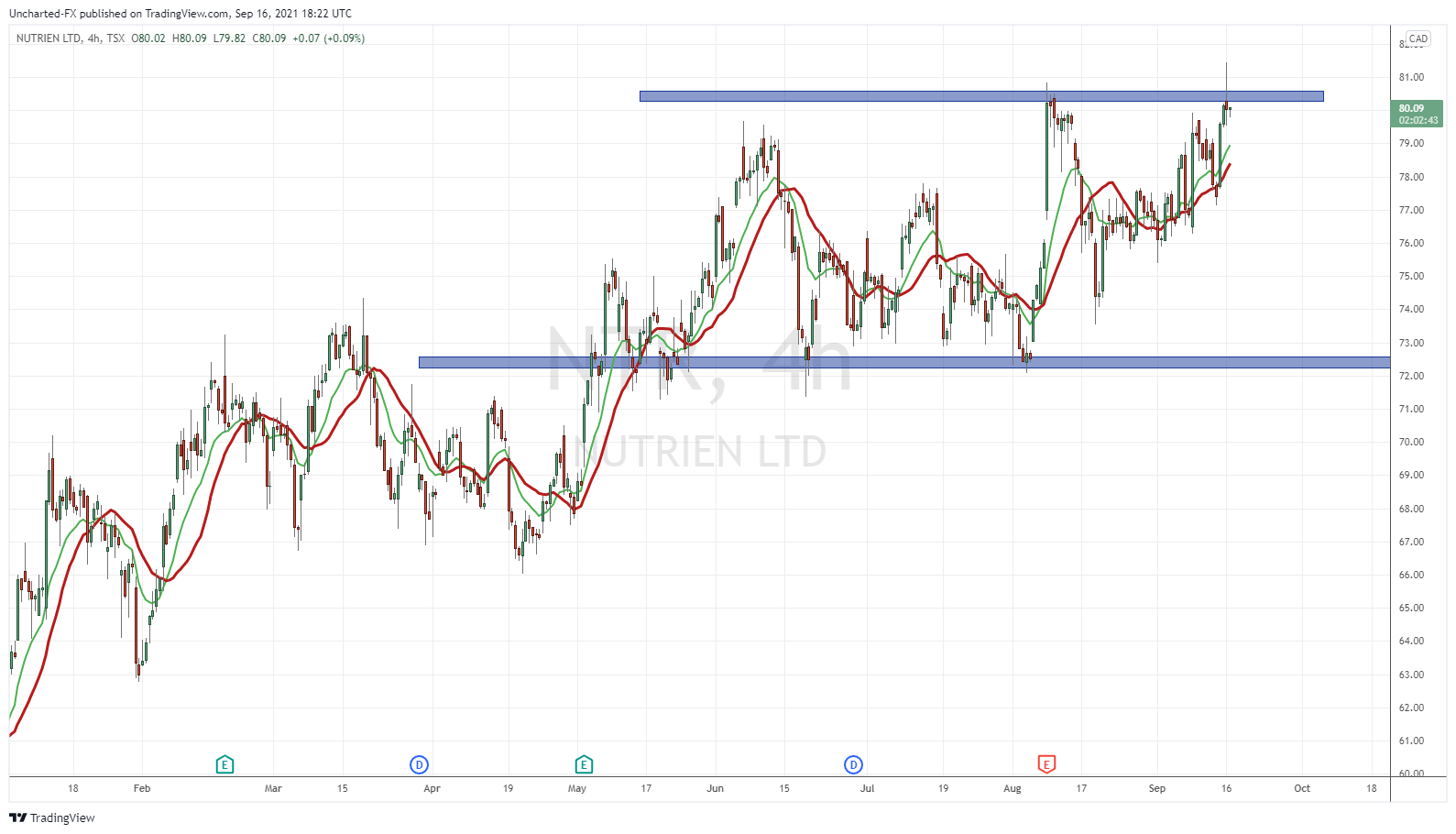

Nutrien Ltd (NTR.TO)

No major news, but we looked at Nutrien last week. I highlighted the resistance zone and potential new record highs. Well we printed record highs on Wednesday, but could NOT get a candle close confirming the record high close. We still remain under our resistance zone. Let’s watch for a close above, and then follow through. If we see a major rip on the breakout, this would be a sign that institutions are getting involved. Look at price action on Loblaws, Facebook, Microsoft, Facebook and Apple for an example of what to look for when new record high breakouts occurred followed by heavy institutional buying.

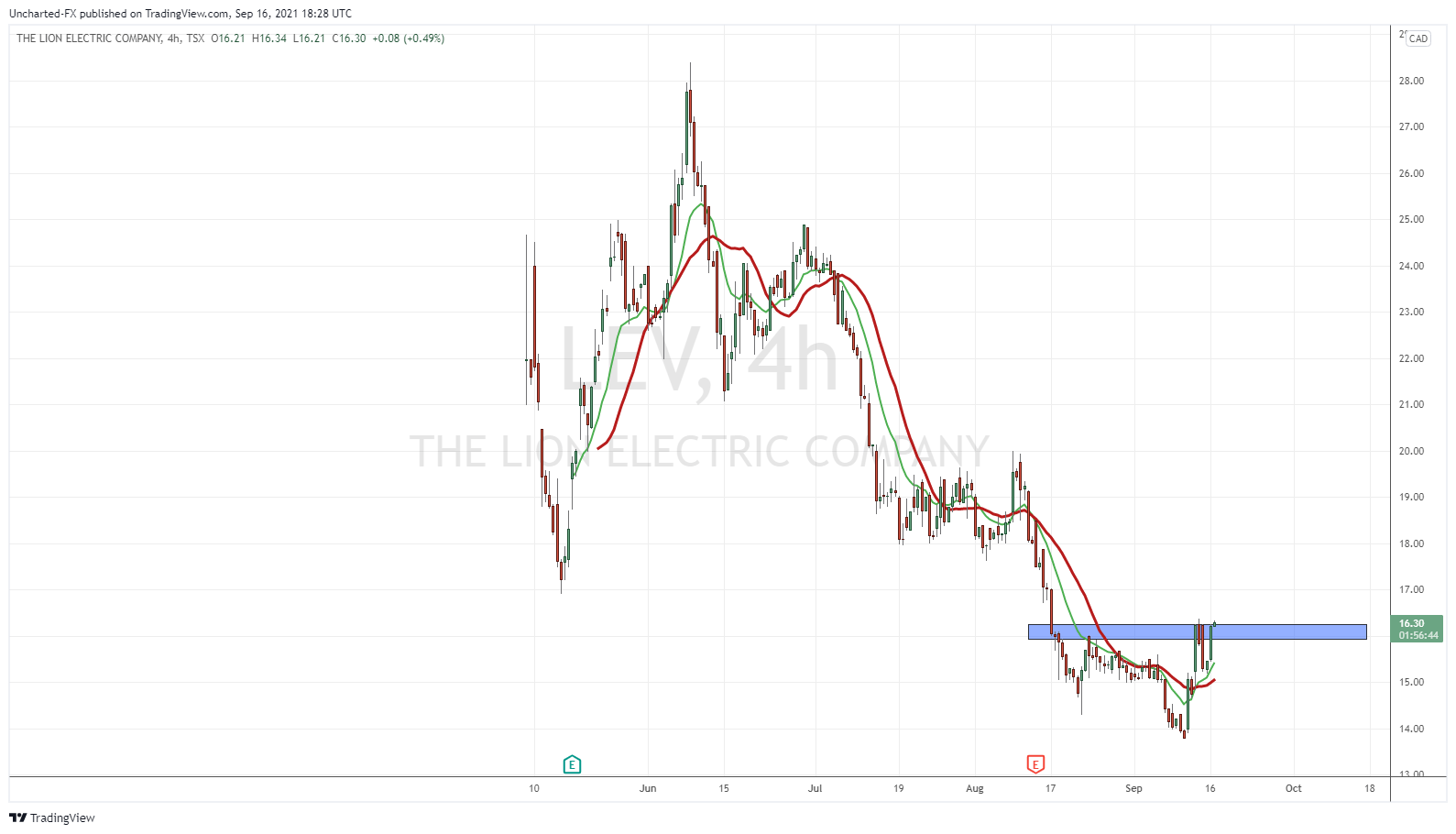

The Lion Electric Company (LEV.TO)

The Lion Electric Company is a new company making its appearance on my agriculture sector round up. They produce zero emission vehicles, and they can be made for agricultural purposes. We’ll keep it on the list since there is an ag component. No news but the chart! Love what I am seeing!

Can anyone say bottoming pattern? A higher low seems in development with price bouncing at $15.00 and my moving averages. A strong close above $16.25 will get this stock going. In the past two weeks we have seen volume rising significantly more than the average volume traded. News on the way?

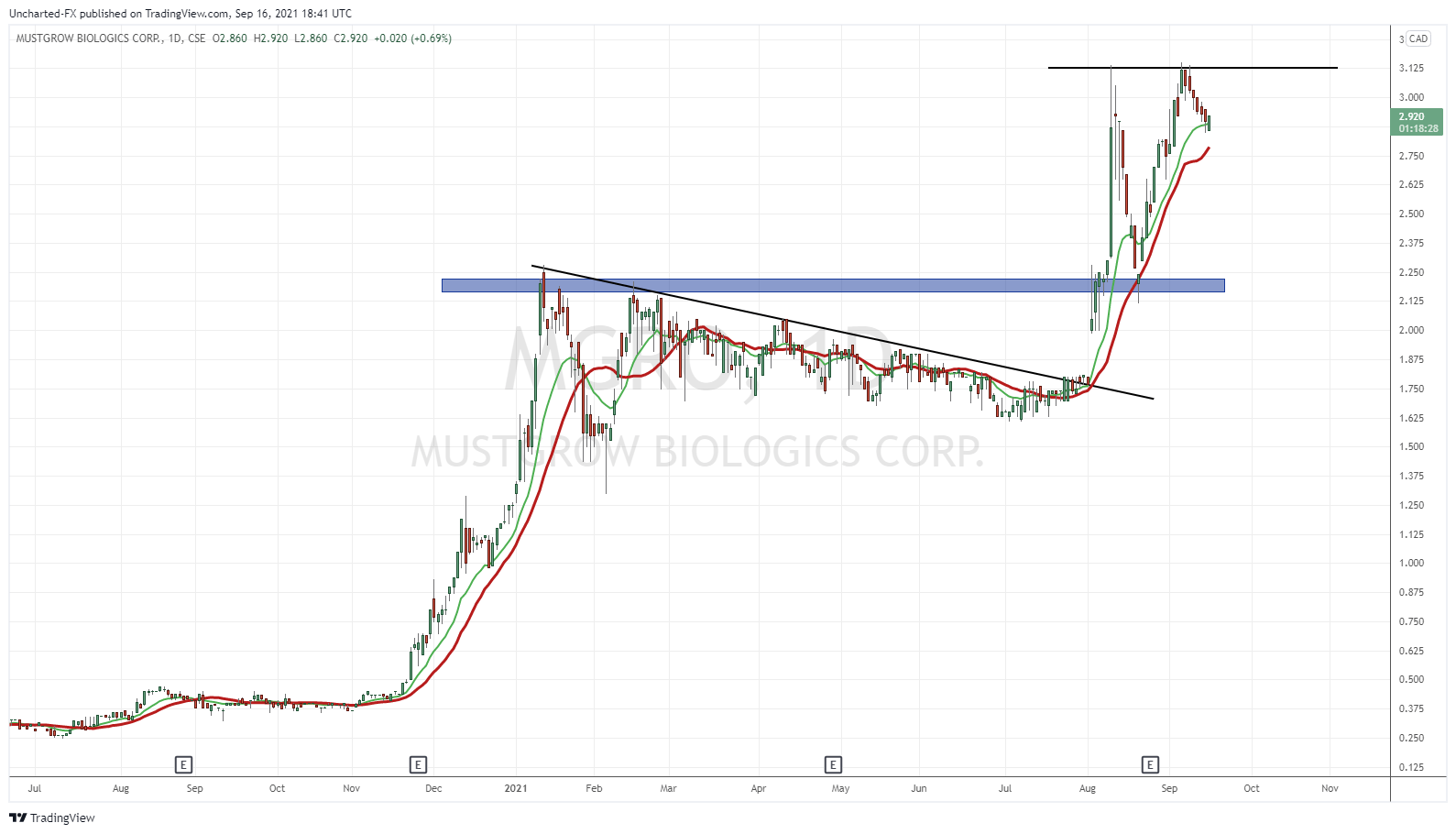

MustGrow Biologics Corp (MGRO.CN)

MustGrow has been the talk on the street. Major technical levels taken out as shown on my chart. Recently seeing a retest confirmation at $2.12. And we printed some record highs recently before falling. The stock is now up 133% year to date!

The company is now raising cash. Future catalysts. MustGrow announced a non-brokered private placement of approximately 770,000 units for gross proceeds of around $2 Million at a price per share of $2.60. Each unit consists of one common share and one-half of one common share purchase warrant which entitles the holder to acquire one common share at a price of $4.00 for a period of 24 months following the closing of the private placement.

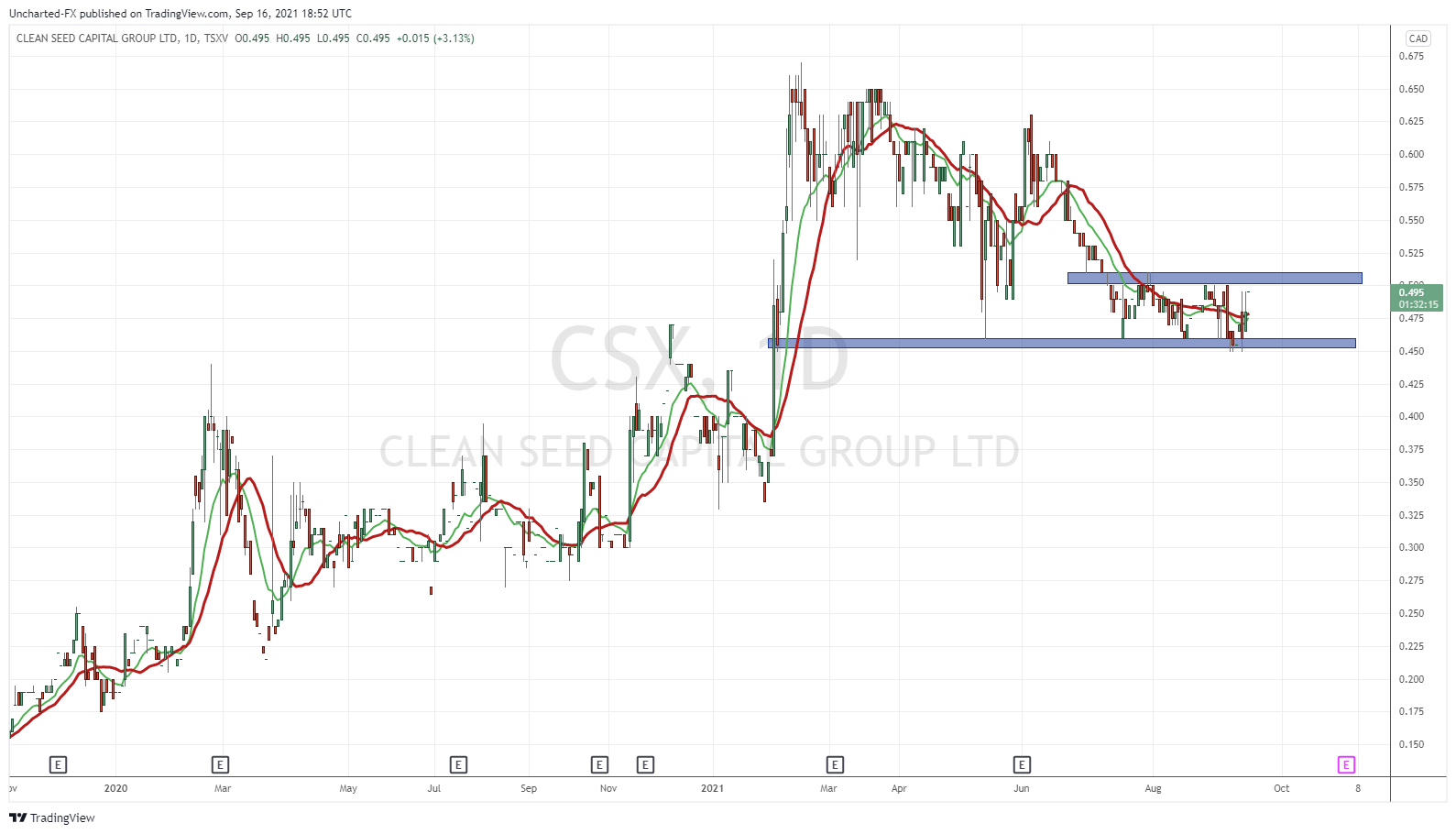

Clean Seed Capital Group (CSX.V)

Clean Seed Capital operates in the agriculture equipment industry in North America. It offers seeding and planting equipment. The company focuses on building the SMART Seeder MAX-S prototype and advancement of the related SMART Seeder technology.

No news on Clean Seed, but I want to highlight a basing pattern. We are finding some support here at $0.45. We saw some big orders on Sept.14th which continued on Sept. 15th. Keep tabs on this one. Watch for a close above $0.50, an important psychological resistance zone, for a breakout confirmation.

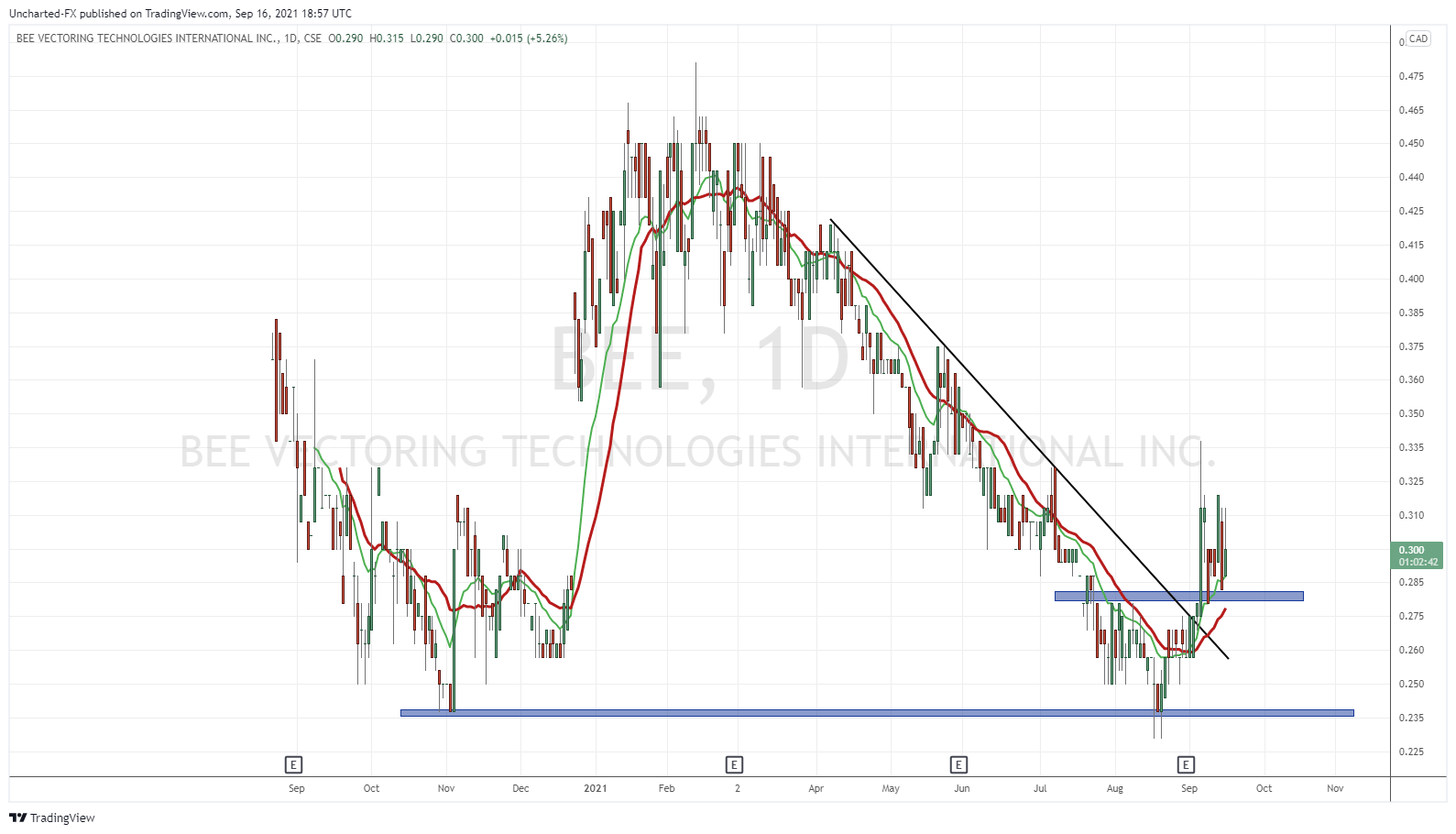

Bee Vectoring Technologies (BEE.CN)

Bee Vectoring Technologies International Inc., an agriculture technology company, develops and provides natural commercial farming solutions. Its solutions include the Hive and Bees, an inoculum dispenser system; Vectorpak with Vectorite, a recipe of ingredients that allows bees to carry crop BVT-CR7 and other beneficial fungi or bacteria in their outbound flights to the crops; active ingredients, such as BVT-CR7, an organic strain of a natural occurring endophytic fungus; and pollen distribution systems. The company’s patented bee vectoring technology uses commercially-reared bees to deliver targeted crop controls through the natural process of pollination. It provides natural pest and disease management solutions for various crops, such as strawberries, sunflowers, apples, tomatoes, canola crops, blueberries, and other crops.

Very cool stuff and one of my favorite ag plays!

Last week, I highlighted this chart. The trendline break, over my moving averages, and a break above resistance at $0.28. Very big, and now it is all about the momentum. It hasn’t taken off just yet. Instead, price has pulled back to retest the breakout zone. Just something to note: 109,594 shares were traded on Sept. 15th (insert double eyes emoji here). Let’s watch for this support to hold which sets up more continuation.

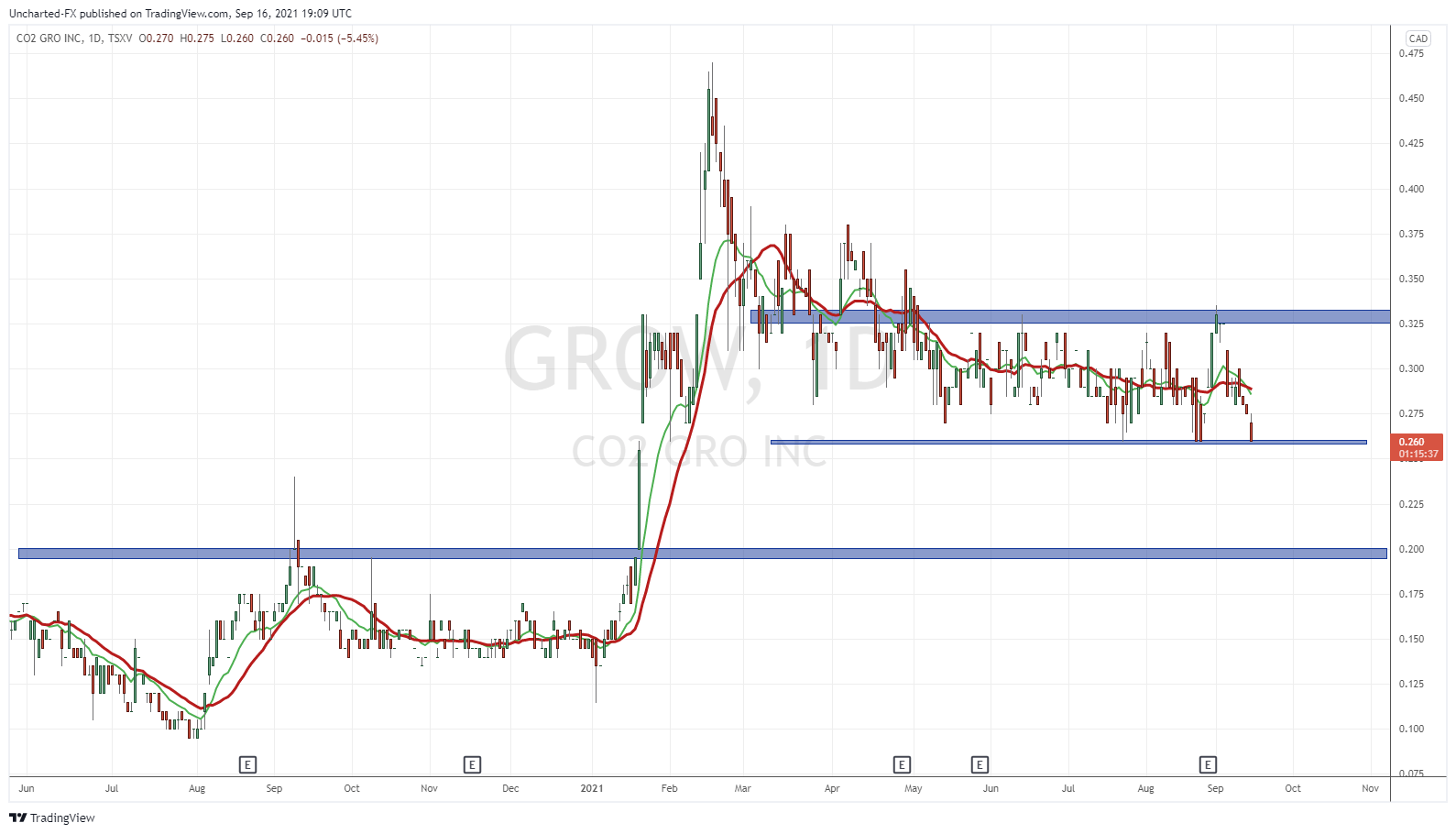

CO2 Gro Inc (GROW.V)

CO2 Gro Inc., together with its subsidiaries, focuses on commercializing patent-licensed CO2 gas infusion technology and patent-pending US PTO CO2 delivery solutions system.

CO2 Gro announced a commercial feasibility of a CO2 Delivery Solutions system with a California based TreeSource Citrus Nursery. This will be conducted on 2,000 square feet of citrus young plants using a CO2 Delivery Solution Systems integrated with an existing fogging system.

We have been following the range on CO2 Gro for the last few weeks. We are at the bottom limits of the range. If the daily candle closes below…then we likely head lower to $0.20. I am waiting to see if buyers step in here and we develop a green candle. 107,750 shares traded on Thursday. Almost 4x the average daily volume.

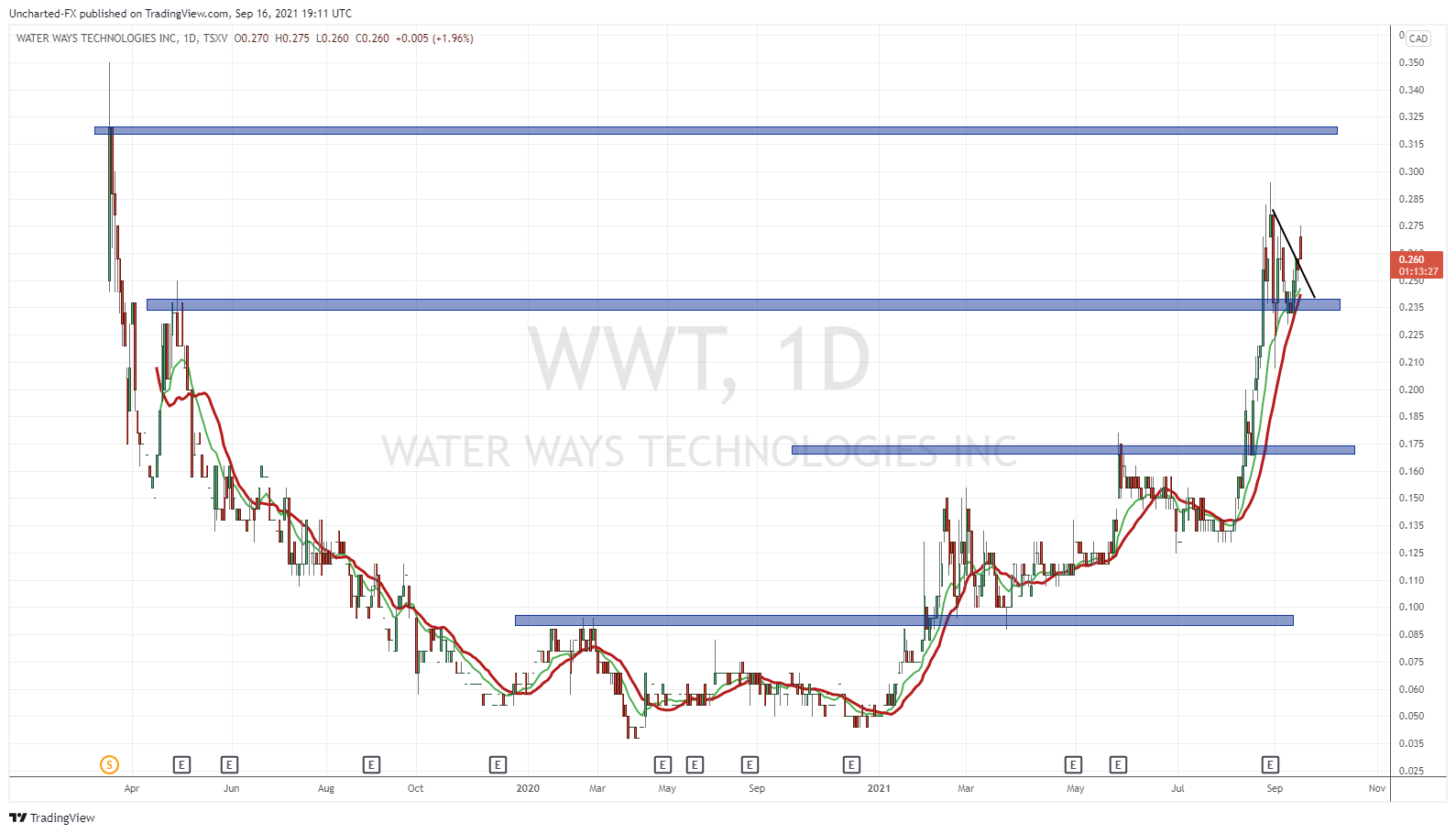

Water Ways Technologies (WWT.V)

This company doesn’t need an introduction for regular readers. There is always something going on with the company, and the chart is moving! Water Ways Technologies Inc., an agriculture technology company, provides water irrigation and agriculture solutions to agricultural producers in Israel and internationally. It designs, supplies, installs, and maintains irrigation systems for application in various agricultural and aquaculture operations. The company offers integrated solutions, including the precise irrigation and project implementation solutions for cannabis growers. It also sells irrigation equipment and components.

Over on Equity Guru, Water Ways was one of our daily ideas of this week! Check out Joseph’s deep dive on Water Ways and why this company presents a great opportunity for investors here! Be sure to check out my technical piece as well!

News released on Monday Sept.13th 2021 regarded two new smart irrigation component orders totaling $1.3 Million:

- A C$375,000 order to deliver smart and drip irrigation components for Nurseries in Ethiopia.

- A C$975,000 order to deliver smart irrigation components to a Blueberries irrigation project in Peru.

Chart wise we remain above support of $0.235. Very important support, and if we remain above, we can test zones around $0.32 and then record highs.

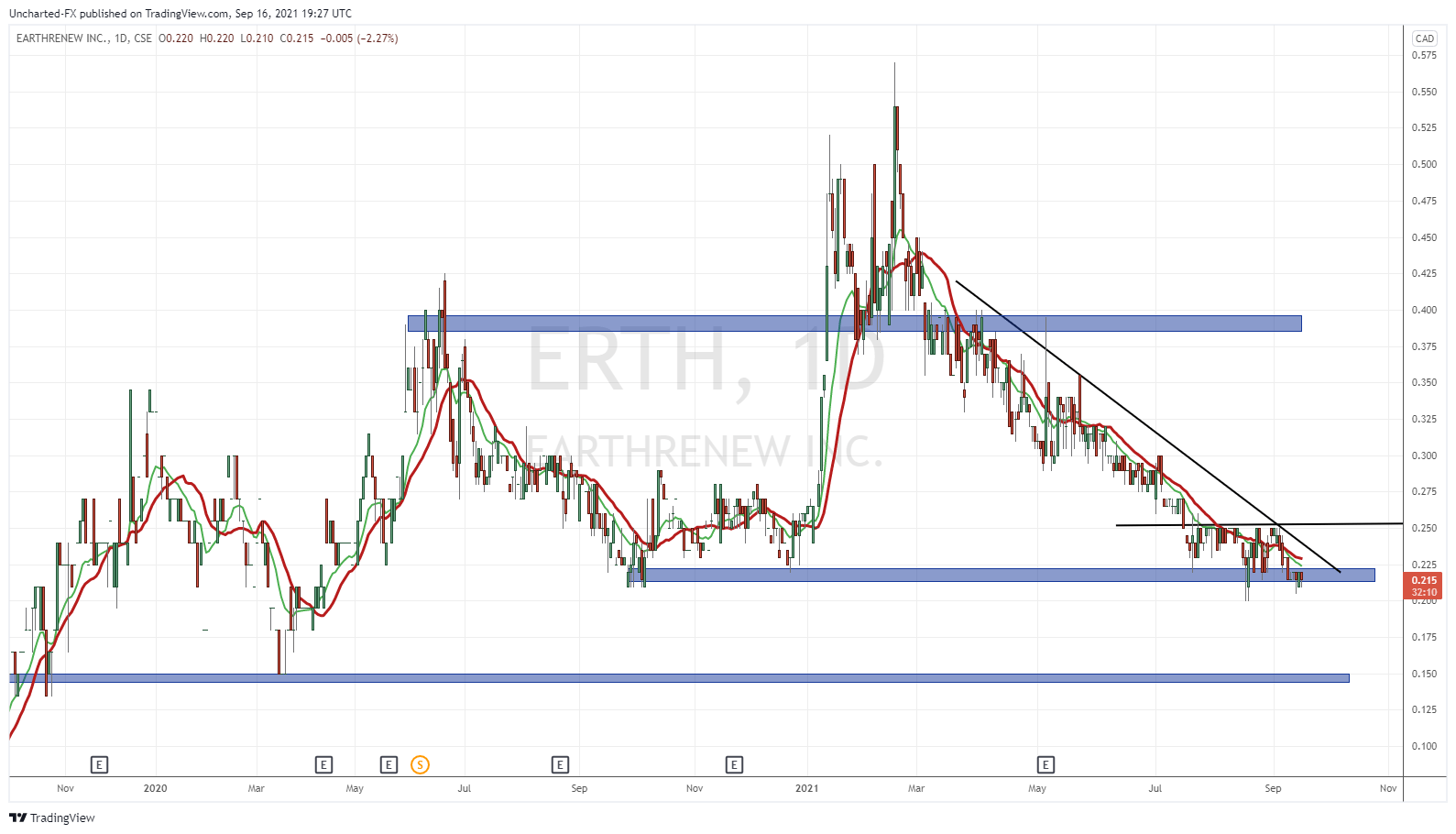

EarthRenew (ERTH.CN)

EarthRenew Inc. produces and sells organic fertilizers from livestock waste in North America and Europe. It also produces electricity from natural gas using an industrial-sized gas turbine and supplies to electrical grid and cryptocurrency miners. The company sells it fertilizers under GrowER and GrowER Biochar names.

No news this week, but take a look at this chart!

Basing at major support. Bottoming pattern. Breakout confirmation is a close above $0.25. Which would also take out my trendline. Important to note that when price touched the bottom limit of support on September 13th and 14th, we had volume of 136,089 and 181,250 shares. A big trading day back on September too with 618,677 shares traded.

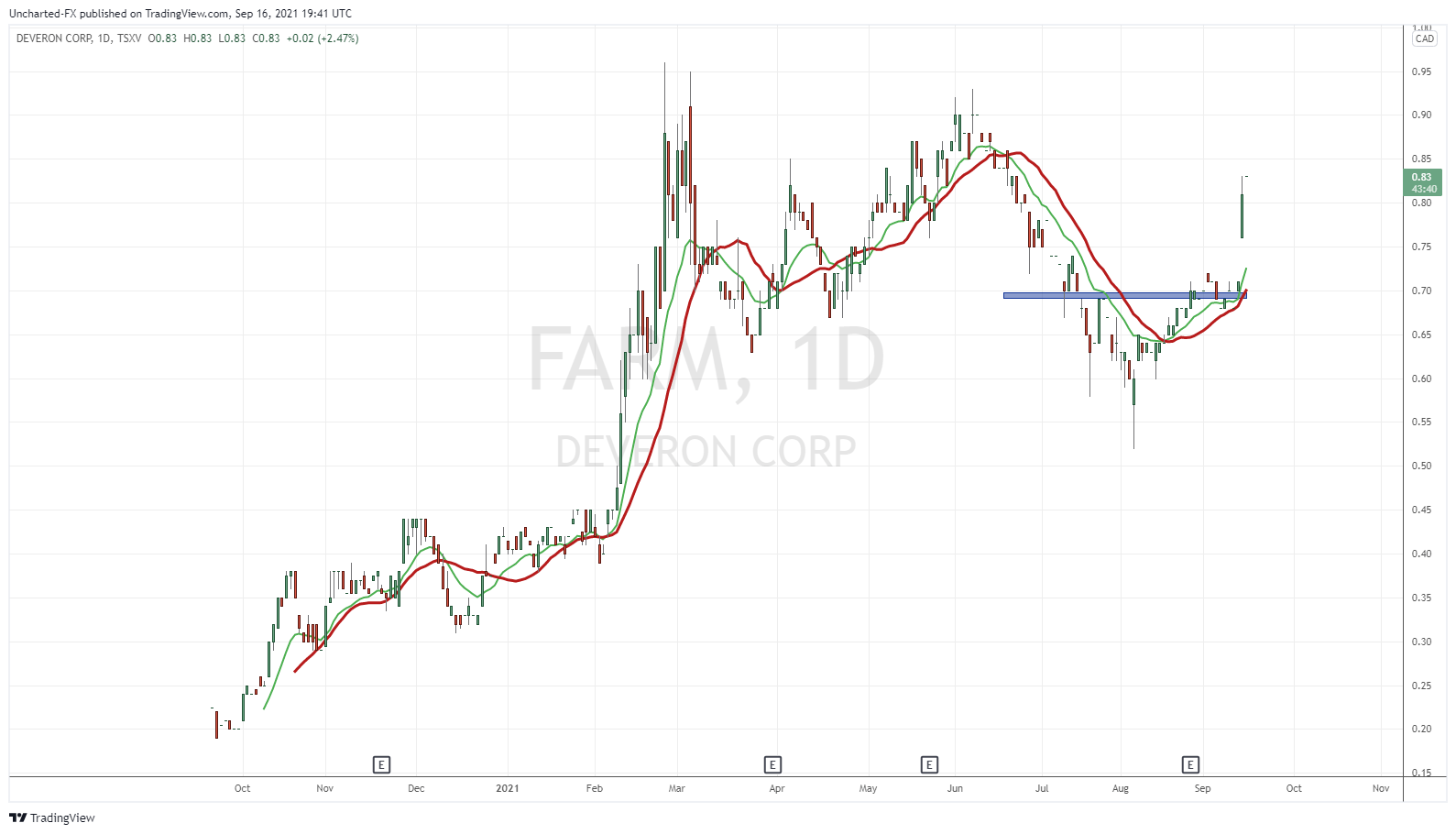

Deveron Corp. (FARM.V)

Another company that regular readers are aware of!

Deveron Corp., an agriculture technology company, provides drone data services to the farming sector in the United States and Canada. It offers data acquisition services and data analytics based on digital recommendations and data interpretations. The company provides data collection services, including data collection for soil sampling, drone data, etc.; and script and soil insight services. It also offers remote sensing and precision agriculture data aggregation and analytic services.

I highlighted the acquisition last week, and I want to point out the chart. We were watching for that breakout…and we got it!

Bit of a cup and handle pattern I see too. We had a strong gap up and green candle on Sept. 15th. 144,900 shares traded! Going forward, $0.70 is now our support. Resistance comes in at $0.90-$0.95, previous record highs.

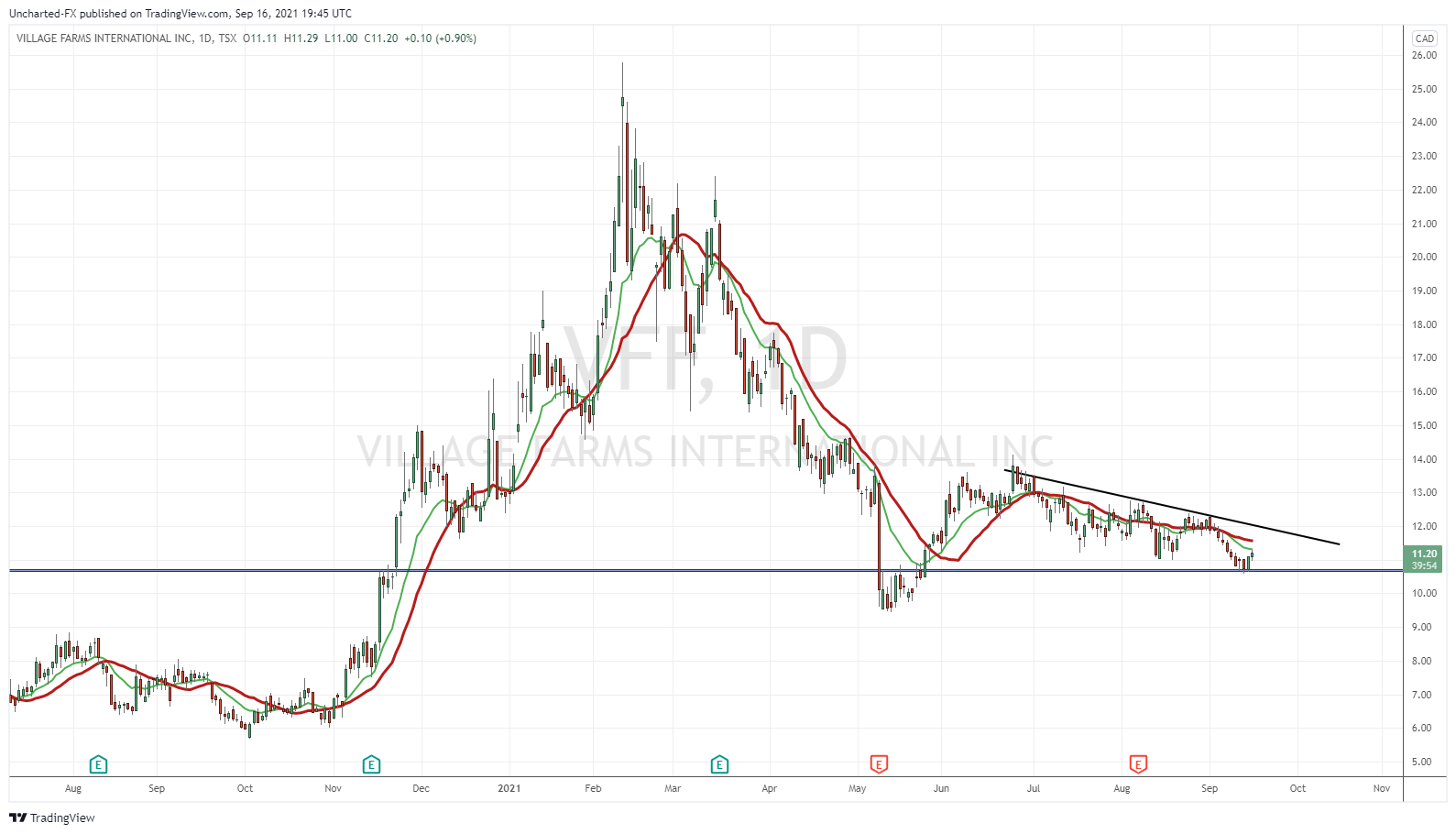

Village Farms (VFF.TO)

Village Farms leverages decades of experience as a large-scale, Controlled Environment Agriculture-based, vertically integrated supplier for high-value, high-growth plant-based Consumer Packaged Goods. Village Farms has a strong foundation as a leading fresh produce supplier to grocery and large-format retailers throughout the US and Canada, along with new high-growth opportunities in the cannabis and CBD categories in North America and selected markets internationally.

The company has done a corporate rebranding and a new website. It looks much more of an agriculture website than cannabis. Probably a smart play given how the Canadian Cannabis space is doing right now. Readers know I jumped on this stock back in the day under $1.00. I jumped in due to the farming aspect, but the Cannabis boom gave me a nice ride.

Loving this technical set up. We are holding support, and are developing a triangle pattern. We just await the breakout confirmation! Keep eyes on this one folks!

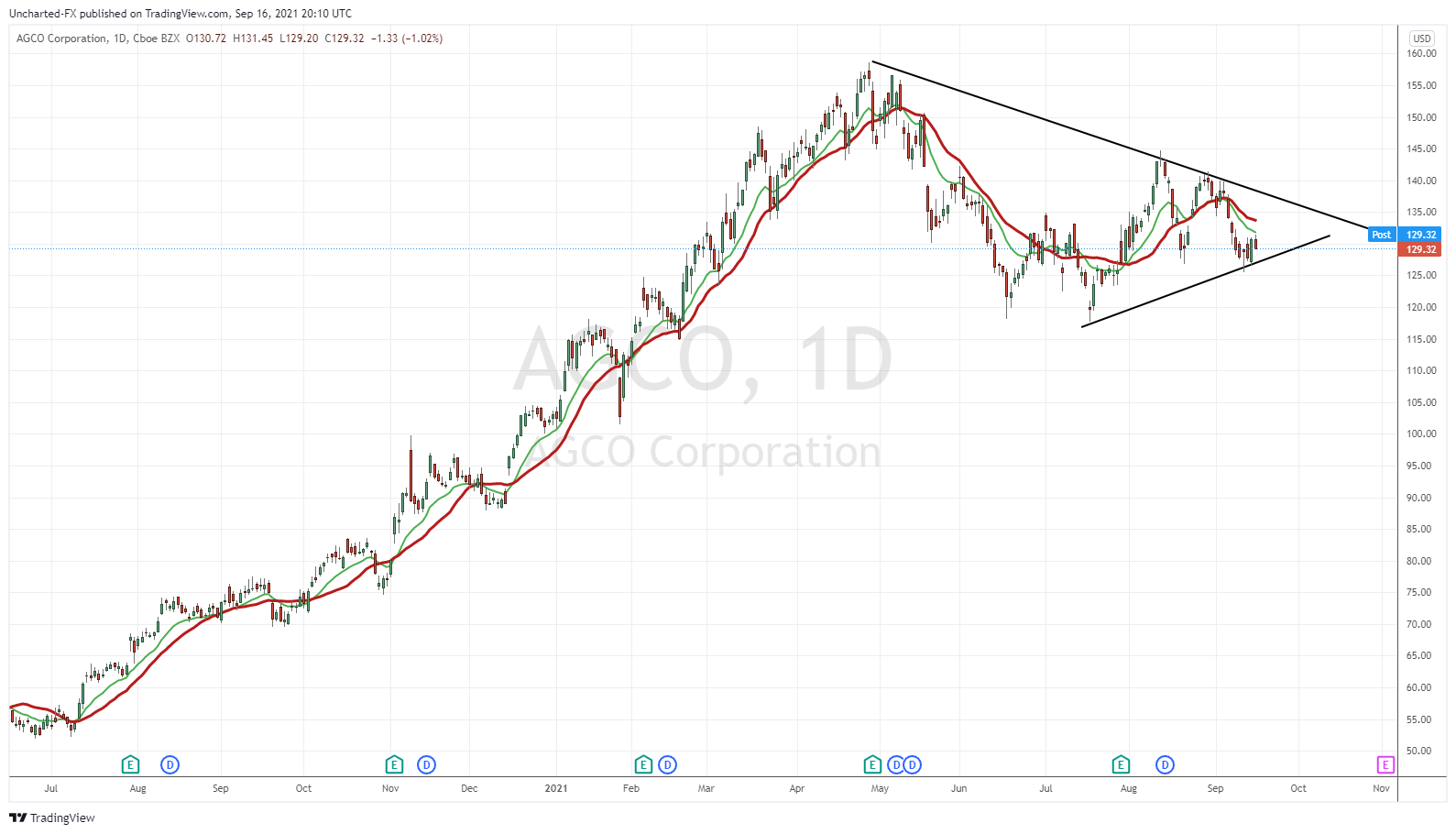

AGCO Corporation (AGCO)

AGCO is a global leader in the design, manufacture and distribution of agricultural machinery and precision ag technology. AGCO delivers customer value through its differentiated brand portfolio including core brands like Challenger®, Fendt®, GSI®, Massey Ferguson® and Valtra®. Powered by Fuse® smart farming solutions, AGCO’s full line of equipment and services help farmers sustainably feed our world.

A big player with net sales of $9.1 Billion in 2020. And also one of Jim Cramer’s favorite agriculture picks alongside Deere.

On September 13th, AGCO acquired Farm Robotics and Automation S.L, a precision livestock farming company.

Faromatics is the creator of ChickenBoy, the world’s first ceiling-suspended robot that monitors broiler chickens and helps farmers increase animal welfare and farm productivity. ChickenBoy uses a complete set of sensors to measure thermal sensation, air quality, light and sound. It also uses artificial intelligence (AI) to identify risks to health, welfare and farm equipment.

An interesting triangle pattern here. It does look like there is some support here as well. Like a lot of the larger companies, price movement depends on what market indices are doing. Algo’s and institution flows.

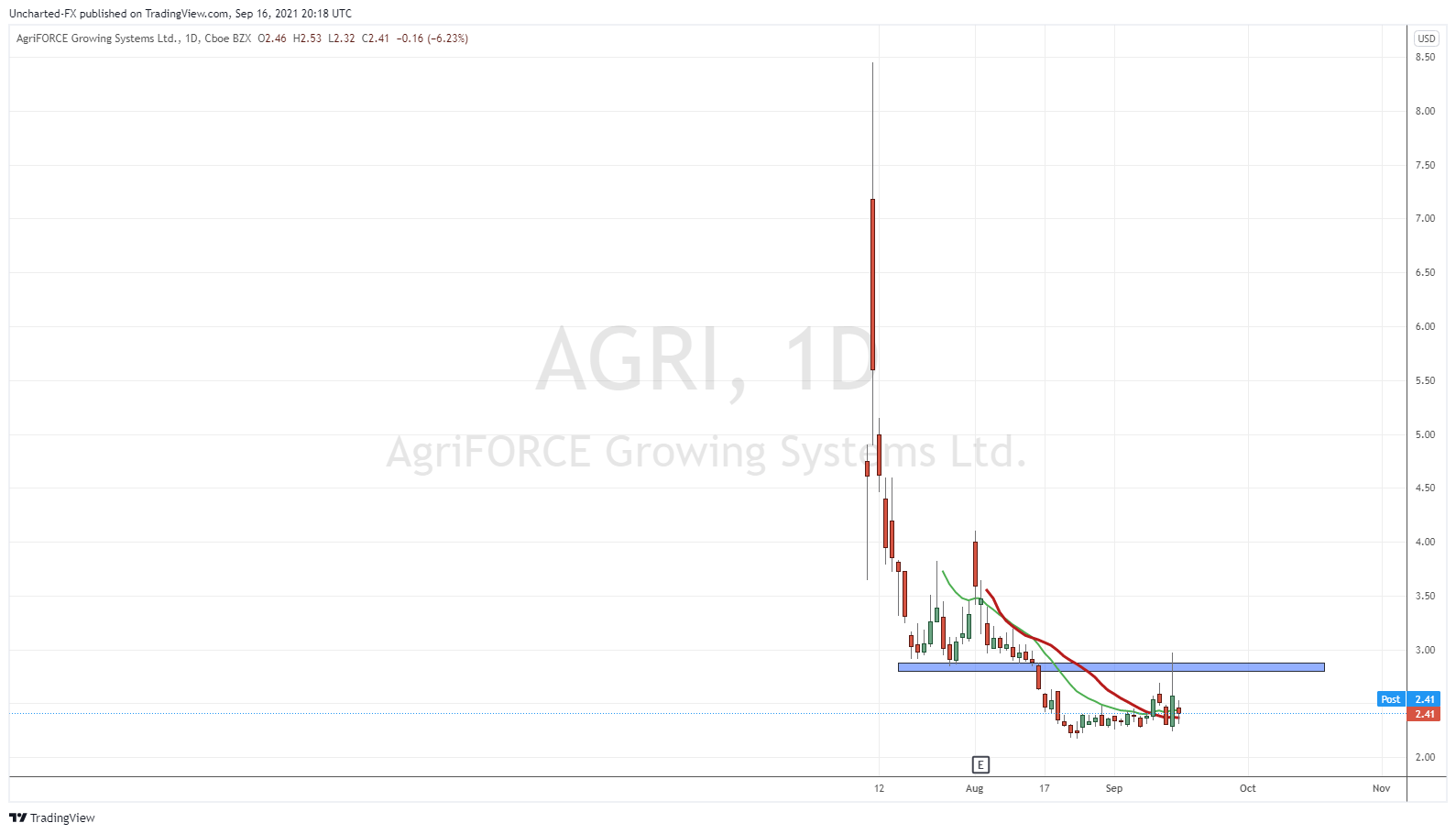

AgriFORCE Growing Systems Ltd. (AGRI)

AgriFORCE Growing Systems Ltd is an AgTech company focused on developing and acquiring agriculture IP that changes the way plant cultivation and processing is done to provide more sustainable and better quality food, pharmaceuticals, nutraceuticals, plant-based products and ingredients. Our vision is to be a leader in delivering plant-based foods and products through advanced and sustainable AgTech solutions. The Company’s foundational IP includes a proprietary facility design and automated growing system for high-value crops focused on improving the way that crops are grown. The Company calls its facility design and automated growing system the “AgriFORCE Grow House.” The Company has designed its AgriFORCE Grow House to produce in virtually any environmental condition and to optimize crop yields to as near their full genetic potential possible, while using substantially fewer natural resources and eliminating the need for the use of herbicides, pesticides and/or irradiation. The AgriFORCE goal: Clean. Green. Better.

On September 15th, entered a definitive agreement to acquire the intellectual property (IP) from Manna Nutritional Group. The IP encompasses patent-pending technologies to naturally process and convert grain, pulses and root vegetables, resulting in low-starch, low-sugar, high-protein, fiber-rich baking flour products, as well as a wide range of breakfast cereals, juices, natural sweeteners and baking enhancers. The core process is covered under a pending patent application in the U.S. and key international markets.

One word comes to mind: BASED. On the day the news dropped, 5,669,900 shares were traded. We couldn’t break out though. I have drawn out the major resistance zone above. Let’s round it up to the $3.00 zone. We close above, then the range breakout is triggered. I like the price action AND the regular volume on this stock. I’ll be watching for the break next week.