The eternal question of how to make money in the stock market has never been more important. With interest rates in the toilet, leaving your hard-earned dollars in a bank account just doesn’t cut it with stocks ringing in 1000% returns. The EV sector is no stranger to crazy multiples but finding the right horse to lay your bet on is as difficult as getting Marjorie Taylor Greene to say something intelligent. Last week, we touched on new players as well as some of the traditional auto makers making their EV entrance. Here we go again. Please note, all share prices and valuations were recorded during trading on Thursday.

Arcimoto’s (FUV.Q) month hasn’t been a good one share pricewise as investors saw a 17.99% drop in value. However, it has maintained a range since the 26th that might indicate the near-future bottoming of a downward trend. Stale news of being added to the renting roster at the Graduate Hotels Eugene, Oregon location hangs on the vine, but the company is cashed up and awaiting the commercial christening of its 200K sq ft manufacturing facility. If stock has indeed found its floor for Arcimoto with investor sentiment bordering on bearish, it may provide a solution on how to make money in the stock market. Remember your due diligence! Shares trade at $11.49 per for a market capitalization of $427.77 million USD.

Arcimoto’s (FUV.Q) month hasn’t been a good one share pricewise as investors saw a 17.99% drop in value. However, it has maintained a range since the 26th that might indicate the near-future bottoming of a downward trend. Stale news of being added to the renting roster at the Graduate Hotels Eugene, Oregon location hangs on the vine, but the company is cashed up and awaiting the commercial christening of its 200K sq ft manufacturing facility. If stock has indeed found its floor for Arcimoto with investor sentiment bordering on bearish, it may provide a solution on how to make money in the stock market. Remember your due diligence! Shares trade at $11.49 per for a market capitalization of $427.77 million USD.

Canoo (GOEV.Q) took a brutal hit on its bottom line, reporting a net loss of $112.55 million for Q2 2021 which was 384.29% worse than the year before. However, the EV manufacturer juiced its cash coffers during that same period bringing cash on hand to $563.57 million when it published its quarterly financials mid-August. Share price popped at the end of August due to a short squeeze but has been ranging ever since. As of Q2, the company is still on the hunt for a battery supplier for its skateboard vehicle design but plans to open a new manufacturing facility in Oklahoma in 2023. Canoo’s pickup and cargo van line is expected to be the first out the door in Oklahoma with MSRP expected to range between $35,000 to $50,000. With the current trade tiff between the U.S. and China, Canoo’s Chinese CCP-connected backing may bring unwanted scrutiny and/or limitations before it can get to market, but the company’s unique architecture and resulting functionality/revenue longevity may play in its favor. This is a wait and see. Canoo share price sits at $6.73 per for a valuation of $1.63 billion USD.

took a brutal hit on its bottom line, reporting a net loss of $112.55 million for Q2 2021 which was 384.29% worse than the year before. However, the EV manufacturer juiced its cash coffers during that same period bringing cash on hand to $563.57 million when it published its quarterly financials mid-August. Share price popped at the end of August due to a short squeeze but has been ranging ever since. As of Q2, the company is still on the hunt for a battery supplier for its skateboard vehicle design but plans to open a new manufacturing facility in Oklahoma in 2023. Canoo’s pickup and cargo van line is expected to be the first out the door in Oklahoma with MSRP expected to range between $35,000 to $50,000. With the current trade tiff between the U.S. and China, Canoo’s Chinese CCP-connected backing may bring unwanted scrutiny and/or limitations before it can get to market, but the company’s unique architecture and resulting functionality/revenue longevity may play in its favor. This is a wait and see. Canoo share price sits at $6.73 per for a valuation of $1.63 billion USD.

ElectraMeccanica (SOLO.Q) broke ground on its Arizona manufacturing facility in May, hoping to open the doors in 2022. Once up and running, EM is looking to pump out 20,000 units of its flagship SOLO 3-wheeler. The company is part of a techno rush to the Golden State joining the likes of Lucid, Nikola and Intel making expansions in the region. Unlike Tesla, EM crafts a product better suited for the average car buyer in terms of price but is still on the edge when it comes to design. With relatively cramped space and little cargo capability, it has the considerable challenge of convincing today’s drivers to ditch their traditional views on personal transportation. The company continues to build its revenue with a 2,382.11% year-over-year increase in Q2 2021. The company experienced a nice bump in share price today on the heels of announcing it will commence customer deliveries of its SOLO EV on October 4th during a special event to be held in Los Angeles. Hopefully this may be a reversal of the downward trend the company endured since the beginning of the month. Will investment in EM illustrate how to make money in the stock market in 2022? Only time will tell. EM trades at $3.38 per share with a market cap of $385.47 million.

ElectraMeccanica (SOLO.Q) broke ground on its Arizona manufacturing facility in May, hoping to open the doors in 2022. Once up and running, EM is looking to pump out 20,000 units of its flagship SOLO 3-wheeler. The company is part of a techno rush to the Golden State joining the likes of Lucid, Nikola and Intel making expansions in the region. Unlike Tesla, EM crafts a product better suited for the average car buyer in terms of price but is still on the edge when it comes to design. With relatively cramped space and little cargo capability, it has the considerable challenge of convincing today’s drivers to ditch their traditional views on personal transportation. The company continues to build its revenue with a 2,382.11% year-over-year increase in Q2 2021. The company experienced a nice bump in share price today on the heels of announcing it will commence customer deliveries of its SOLO EV on October 4th during a special event to be held in Los Angeles. Hopefully this may be a reversal of the downward trend the company endured since the beginning of the month. Will investment in EM illustrate how to make money in the stock market in 2022? Only time will tell. EM trades at $3.38 per share with a market cap of $385.47 million.

Fisker (FSR), like Arcimoto, continues to range after dropping 23.59% in late August. The EV manufacturer got more bad news as Bank of America pulled its “buy” rating due to intense competition. Fisker lags many of its EV rivals as it is still testing its flagship Ocean SUV but the company remains adamant production of the electric SUV will commence in late 2022. Unlike many auto makers, Fisker intends to farm out its production to Magna International. Pushing that responsibility onto an outside player will keep the company tight financially, but it must provide decent incentive to its partners, like a cut of the profits or equity in the company for those relationships to flourish. Not to mention Fisker’s recent offering of convertible debentures may lead to dilution down the road. Bank of America’s reversal questions if investment in this company will be how to make money in the stock market. In a sector where promises still drive value, it might be prudent to wait for material proof of Fisker’s success. Company shares go for $12.61 each, creating a valuation of $3.73 billion.

Fisker (FSR), like Arcimoto, continues to range after dropping 23.59% in late August. The EV manufacturer got more bad news as Bank of America pulled its “buy” rating due to intense competition. Fisker lags many of its EV rivals as it is still testing its flagship Ocean SUV but the company remains adamant production of the electric SUV will commence in late 2022. Unlike many auto makers, Fisker intends to farm out its production to Magna International. Pushing that responsibility onto an outside player will keep the company tight financially, but it must provide decent incentive to its partners, like a cut of the profits or equity in the company for those relationships to flourish. Not to mention Fisker’s recent offering of convertible debentures may lead to dilution down the road. Bank of America’s reversal questions if investment in this company will be how to make money in the stock market. In a sector where promises still drive value, it might be prudent to wait for material proof of Fisker’s success. Company shares go for $12.61 each, creating a valuation of $3.73 billion.

![]() Green Motor Power Company (GPV.V) celebrated the first delivery of its all-electric BEAST school bus to Santa Maria Joint Union School District on Monday. The deal was done through GMPC’s distribution partner, Creative Bus Sales, which operates 22 locations across the United States. Creative’s relationship with GMPC provides an all-in-one answer to potential customers with both products and a nationwide service & parts network. The company until now has been locked into a PR campaign, so this sale puts the proverbial rubber to the road. In Q1 2022, the company generated $2.66 million in revenue before noting a 2.26 million net loss. Unfortunately, the quarterly profit margins are abysmal, plunging to -85.06%. The saving grace for GMPC is its modest valuation. Still, the company needs its partner to sign more deals with the commercial transport sector to gain solid footing. Even though GMPC has joined the league of active EV producers, for it to show how to make money in the market, it needs to follow through on its proposed future. Company shares are $13.75 CAD, giving the Canadian EV manufacturer a market cap of $388.38 million.

Green Motor Power Company (GPV.V) celebrated the first delivery of its all-electric BEAST school bus to Santa Maria Joint Union School District on Monday. The deal was done through GMPC’s distribution partner, Creative Bus Sales, which operates 22 locations across the United States. Creative’s relationship with GMPC provides an all-in-one answer to potential customers with both products and a nationwide service & parts network. The company until now has been locked into a PR campaign, so this sale puts the proverbial rubber to the road. In Q1 2022, the company generated $2.66 million in revenue before noting a 2.26 million net loss. Unfortunately, the quarterly profit margins are abysmal, plunging to -85.06%. The saving grace for GMPC is its modest valuation. Still, the company needs its partner to sign more deals with the commercial transport sector to gain solid footing. Even though GMPC has joined the league of active EV producers, for it to show how to make money in the market, it needs to follow through on its proposed future. Company shares are $13.75 CAD, giving the Canadian EV manufacturer a market cap of $388.38 million.

Kandi Technologies (KNDI.Q) announced on Monday it had received the remaining payment of its sale of the company’s 22% equity in Fengsheng Automotive Technologies Group. The company’s equity stake in Fengsheng amounted to approximately $47.3 million USD and Hu Xiaoming, chairman and CEO of Kandi, said the final payment would juice the company’s “substantial” cash position, allowing it to move forward and “pursue strategic market opportunities as they arise.” The severing of this relationship opens the door for Kandi to create a supply chain free from competitive conflicts, allowing it to shift opportunities as the EV sector heats up. Like Arcimoto, Kandi began an uncomfortable dive on the charts since the beginning of September. One can only hope it has bottomed out, but only time will tell. The company is currently valued at $343.03 million and trades at $4.52 per share.

Kandi Technologies (KNDI.Q) announced on Monday it had received the remaining payment of its sale of the company’s 22% equity in Fengsheng Automotive Technologies Group. The company’s equity stake in Fengsheng amounted to approximately $47.3 million USD and Hu Xiaoming, chairman and CEO of Kandi, said the final payment would juice the company’s “substantial” cash position, allowing it to move forward and “pursue strategic market opportunities as they arise.” The severing of this relationship opens the door for Kandi to create a supply chain free from competitive conflicts, allowing it to shift opportunities as the EV sector heats up. Like Arcimoto, Kandi began an uncomfortable dive on the charts since the beginning of September. One can only hope it has bottomed out, but only time will tell. The company is currently valued at $343.03 million and trades at $4.52 per share.

Li Auto (LI.Q) dropped 8.97% over the last week even though the company seems to have a strong hold on the Chinese EV market. With record deliveries in August, analysts are bullish about the company’s potential performance in September. However, with the CCP announcing on Monday it would like to see a grand consolidation of the country’s EV sector, Chinese EV manufacturers deflated on the boards. As the government continues to crack down on tech and anything western, Li Auto and its fellow competitors face an uncertain future. That said, the CCP isn’t interested in consolidation or breaking up monopolies, it only wants to keep cultural norms and maintain its control of both the public domain and corporate sector. So if Li Auto manages to please the powers that be, it could be on the leading end of the upcoming consolidation and remain a force to be reckoned with both in-country and globally. The one concern is that the company is at the mercy of the Chinese government and trading in its shares may contain too many unknowns for safe sustainable answer for how to make money in the stock market. Li Auto trades at $28.87 per share for a market cap of $29.35 billion.

Li Auto (LI.Q) dropped 8.97% over the last week even though the company seems to have a strong hold on the Chinese EV market. With record deliveries in August, analysts are bullish about the company’s potential performance in September. However, with the CCP announcing on Monday it would like to see a grand consolidation of the country’s EV sector, Chinese EV manufacturers deflated on the boards. As the government continues to crack down on tech and anything western, Li Auto and its fellow competitors face an uncertain future. That said, the CCP isn’t interested in consolidation or breaking up monopolies, it only wants to keep cultural norms and maintain its control of both the public domain and corporate sector. So if Li Auto manages to please the powers that be, it could be on the leading end of the upcoming consolidation and remain a force to be reckoned with both in-country and globally. The one concern is that the company is at the mercy of the Chinese government and trading in its shares may contain too many unknowns for safe sustainable answer for how to make money in the stock market. Li Auto trades at $28.87 per share for a market cap of $29.35 billion.

![]() Lordstown Motors (RIDE.Q) also got a slap in the face from the Bank of America as the big bank applied an “underperform” rating on the beleaguered EV manufacturer. Trading dipped slightly today to rest at $6.72 per share. New executive leadership was intended to propel Lordstown forward and has succeeded for the last month as share price climbed 22.31%. Unfortunately, real material change has yet to arrive at Lordstown. The company has remained silent since Ninivaggi’s appointment to CEO back on August 26th which doesn’t bode well in a time when EV manufacturers are expected to put plans into operation. The next month will be important for Lordstown to produce something besides a management change. You may consider this an opportunity for buying the dip, but there is no indication yet that this is a temporary state. Lordstown is valued currently at $1.21 billion.

Lordstown Motors (RIDE.Q) also got a slap in the face from the Bank of America as the big bank applied an “underperform” rating on the beleaguered EV manufacturer. Trading dipped slightly today to rest at $6.72 per share. New executive leadership was intended to propel Lordstown forward and has succeeded for the last month as share price climbed 22.31%. Unfortunately, real material change has yet to arrive at Lordstown. The company has remained silent since Ninivaggi’s appointment to CEO back on August 26th which doesn’t bode well in a time when EV manufacturers are expected to put plans into operation. The next month will be important for Lordstown to produce something besides a management change. You may consider this an opportunity for buying the dip, but there is no indication yet that this is a temporary state. Lordstown is valued currently at $1.21 billion.

![]() Lucid Group (LCID.Q) followed through on expectations when the company announced that its Lucid Air had an EPA rated range of 520 miles, proving once again that Tesla isn’t the industry leader without Musk’s edgy memes, ridiculous event announcements and stylish tweets. The company tightened up its share structure with a cashless redemption of public warrants back in the first week of September. Lucid still expects to launch its preview week at its AMP-1 facility on September 27th, christening the commencement of commercial production of the company’s flagship Lucid Air. At $77,400 per, it will be a while before you and I can pick up our own slice of technological perfection, but the company expects to churn out more economical editions beginning in 2030. This puts Lucid in the rear for producing normal people cars but gives it an edge over Tesla’s poor assembly and over-valued offerings. Lucid currently trades at $21.17, up 3.36% this week, positively separating it from most other EV manufacturers. The company is too niche at this point to provide a quick lesson on how to make money in the stock market but has a cool slow-burn story that might interest those investors with a penchant for quality, not bravado.

Lucid Group (LCID.Q) followed through on expectations when the company announced that its Lucid Air had an EPA rated range of 520 miles, proving once again that Tesla isn’t the industry leader without Musk’s edgy memes, ridiculous event announcements and stylish tweets. The company tightened up its share structure with a cashless redemption of public warrants back in the first week of September. Lucid still expects to launch its preview week at its AMP-1 facility on September 27th, christening the commencement of commercial production of the company’s flagship Lucid Air. At $77,400 per, it will be a while before you and I can pick up our own slice of technological perfection, but the company expects to churn out more economical editions beginning in 2030. This puts Lucid in the rear for producing normal people cars but gives it an edge over Tesla’s poor assembly and over-valued offerings. Lucid currently trades at $21.17, up 3.36% this week, positively separating it from most other EV manufacturers. The company is too niche at this point to provide a quick lesson on how to make money in the stock market but has a cool slow-burn story that might interest those investors with a penchant for quality, not bravado.

Nio (NIO) slid 6.10% this week on the boards to settle at $37.09 per share. Bank of America cut the company’s target at the end of August to $60 even though Nio was experiencing record high margins. The company’s announcement at the beginning of the month that it intended to sell up to $2.0 billion in American depository shares in an at-the-market offering, started a 8.62% slide it hasn’t recovered from. The CCP’s crackdown on the “uppity” private sector has clouded over the company’s potential if not its continuing existence. There is much speculation as to the reasoning and impact of the government’s reining in, so there is no definite outcome for companies operating in the Middle Kingdom. This leaves foreign investors in the dark without a lot of recourse if the CCP decides to appropriate, tax or shutter Nio for alleged violations. It might be argued with the current state of geopolitics that investment in foreign corporations isn’t how to make money in the stock market. It’s your dime though, just remember your due diligence!

Nio (NIO) slid 6.10% this week on the boards to settle at $37.09 per share. Bank of America cut the company’s target at the end of August to $60 even though Nio was experiencing record high margins. The company’s announcement at the beginning of the month that it intended to sell up to $2.0 billion in American depository shares in an at-the-market offering, started a 8.62% slide it hasn’t recovered from. The CCP’s crackdown on the “uppity” private sector has clouded over the company’s potential if not its continuing existence. There is much speculation as to the reasoning and impact of the government’s reining in, so there is no definite outcome for companies operating in the Middle Kingdom. This leaves foreign investors in the dark without a lot of recourse if the CCP decides to appropriate, tax or shutter Nio for alleged violations. It might be argued with the current state of geopolitics that investment in foreign corporations isn’t how to make money in the stock market. It’s your dime though, just remember your due diligence!

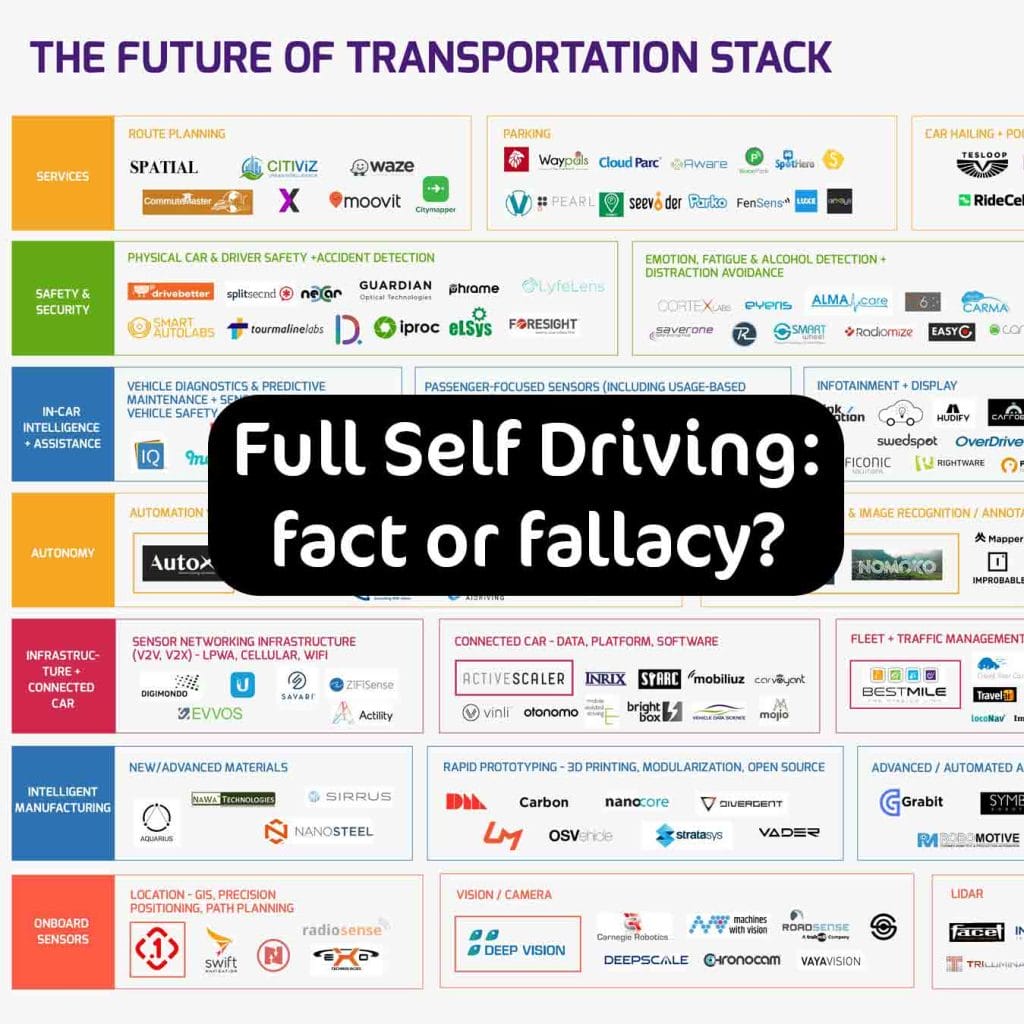

Tesla (TSLA.Q) remains a festering sore on the heart of capitalism. Built on bravado, hyperbole and misdirection, this EV first mover continues to pump out shoddily assembled second-rate vehicles while the CEO who has decided to remain nameless on Twitter plays with his extra-corporate space toys. Relative newcomer, Rivian, who is slated to go public, beat Tesla to the punch with the delivery of Rivian’s R1T pickup truck. Unlike Tesla’s Cybertruck which looks like a cast-off set piece from Space 1999, Rivian’s offering looks like a truck instead of an angled brick on wheels that only an enamoured idiot would buy. This insult sits on top of the injury of Lucid and Lightyear producing significantly better vehicles. Musk’s fancy is falling further behind the competition and even manipulating Wall Street bootlickers like Cathie Wood are dumping shares. Not a good sign if value is expected to climb. With the release of Tesla’s misnamed FSD beta in Canada, I wonder how many emergency vehicles and cement pillars will meet their end before regulatory bodies finally put Musk to task for brazenly circumventing safety protocols. Or do we have to wait for Tesla’s first robot to never make it to production? Or Neurolink to replace speech or Starlink to provide affordable internet? Or SpaceX to build a colony on Mars? Put your money where you want, however. Yup, still not a fan of Tesla.

Tesla (TSLA.Q) remains a festering sore on the heart of capitalism. Built on bravado, hyperbole and misdirection, this EV first mover continues to pump out shoddily assembled second-rate vehicles while the CEO who has decided to remain nameless on Twitter plays with his extra-corporate space toys. Relative newcomer, Rivian, who is slated to go public, beat Tesla to the punch with the delivery of Rivian’s R1T pickup truck. Unlike Tesla’s Cybertruck which looks like a cast-off set piece from Space 1999, Rivian’s offering looks like a truck instead of an angled brick on wheels that only an enamoured idiot would buy. This insult sits on top of the injury of Lucid and Lightyear producing significantly better vehicles. Musk’s fancy is falling further behind the competition and even manipulating Wall Street bootlickers like Cathie Wood are dumping shares. Not a good sign if value is expected to climb. With the release of Tesla’s misnamed FSD beta in Canada, I wonder how many emergency vehicles and cement pillars will meet their end before regulatory bodies finally put Musk to task for brazenly circumventing safety protocols. Or do we have to wait for Tesla’s first robot to never make it to production? Or Neurolink to replace speech or Starlink to provide affordable internet? Or SpaceX to build a colony on Mars? Put your money where you want, however. Yup, still not a fan of Tesla.

Workhorse Group (WKHS.Q) slipped 9.12% this week in the wake of the SEC investigation into alleged accounting fraud, fake pre-orders and keeping investors in the dark regarding its scrutiny by federal regulators. To quell more negative press, the company announced Wednesday that it had withdrawn its bid protest complaint with USPS over the postal service’s enlistment of defence contractor Oshkosh to refit the department’s vehicle fleet. The announcement turned the tide on its share price drop but is not a guarantee that it will be a sustainable upward trend. Workhorse has a lot of work ahead if it intends to extricate itself from this sizeable PR mess, but it remains to be seen if the commercial EV fleet solution provider will be able to rebuild the trust necessary with both its investors and its industry to ensure continued operations. The company currently trades at $8.27 per share for a market cap of $1.03 billion.

Workhorse Group (WKHS.Q) slipped 9.12% this week in the wake of the SEC investigation into alleged accounting fraud, fake pre-orders and keeping investors in the dark regarding its scrutiny by federal regulators. To quell more negative press, the company announced Wednesday that it had withdrawn its bid protest complaint with USPS over the postal service’s enlistment of defence contractor Oshkosh to refit the department’s vehicle fleet. The announcement turned the tide on its share price drop but is not a guarantee that it will be a sustainable upward trend. Workhorse has a lot of work ahead if it intends to extricate itself from this sizeable PR mess, but it remains to be seen if the commercial EV fleet solution provider will be able to rebuild the trust necessary with both its investors and its industry to ensure continued operations. The company currently trades at $8.27 per share for a market cap of $1.03 billion.

![]() XL Fleet Corp (XL) bounced back on Thursday from a weeklong drop to finish at $6.22 per share. No new news to drive this change, but the company’s unique role as electric drive upgrade solution provider for traditional auto manufacturers keeps it out of the saturated EV manufacturer market and thus makes it a prime parking spot for EV investment dollars. The one drawback to XL’s value proposition is the types of deals it has signed which don’t guarantee delivery of product but only make it available to the end customer looking to upgrade their vehicle fleet to electric. Admittedly, the company has teamed up with a titan, Stellantis (STLA), it just needs to gain traction within Stellantis’ product portfolio. If the company can cutdown its sales and https://e4njohordzs.exactdn.com/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistration costs and manage its R&D efforts, it may succeed in securing a solid spot in the EV sector, making it an answer when someone asks how to make money in the stock market. XL shares edged up today by 1.80%, giving the company a $851.53 million market cap.

XL Fleet Corp (XL) bounced back on Thursday from a weeklong drop to finish at $6.22 per share. No new news to drive this change, but the company’s unique role as electric drive upgrade solution provider for traditional auto manufacturers keeps it out of the saturated EV manufacturer market and thus makes it a prime parking spot for EV investment dollars. The one drawback to XL’s value proposition is the types of deals it has signed which don’t guarantee delivery of product but only make it available to the end customer looking to upgrade their vehicle fleet to electric. Admittedly, the company has teamed up with a titan, Stellantis (STLA), it just needs to gain traction within Stellantis’ product portfolio. If the company can cutdown its sales and https://e4njohordzs.exactdn.com/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistration costs and manage its R&D efforts, it may succeed in securing a solid spot in the EV sector, making it an answer when someone asks how to make money in the stock market. XL shares edged up today by 1.80%, giving the company a $851.53 million market cap.

Xpeng (XPEV) just launched their EV economy model P5 sedan which is expected to have an MSRP of less than $25,000 – a feat Tesla has yet to beat. The car has a lidar-equipped advanced driver assistance system with a 290 mile to 370-mile range. Even with its budget-conscious line the company still pulls in 11% profit margins and has been operating with positive margins for the last four quarters, unlike many of its competitors. Xpeng stock suffers like its Chinese counterparts under threat of tech crackdowns and government enforced consolidations. However, despite this, Xpeng delivers a good product that is as good or better than Tesla, so if it is able to assuage its national governing body and retain its independence, the company has some serious potential not only in China, but in the global EV market. Investing in this company just may be how to make money in the stock market. However, like all EV manufacturers, Xpeng needs to ride out the aftereffects of Covid until supply chains normalize, but considering its size and present position, there’s a good chance it will cross the finish line intact. Xpeng still dropped 7.19% this week to rest at $37.59 per share for a market cap of $32.60 billion.

Xpeng (XPEV) just launched their EV economy model P5 sedan which is expected to have an MSRP of less than $25,000 – a feat Tesla has yet to beat. The car has a lidar-equipped advanced driver assistance system with a 290 mile to 370-mile range. Even with its budget-conscious line the company still pulls in 11% profit margins and has been operating with positive margins for the last four quarters, unlike many of its competitors. Xpeng stock suffers like its Chinese counterparts under threat of tech crackdowns and government enforced consolidations. However, despite this, Xpeng delivers a good product that is as good or better than Tesla, so if it is able to assuage its national governing body and retain its independence, the company has some serious potential not only in China, but in the global EV market. Investing in this company just may be how to make money in the stock market. However, like all EV manufacturers, Xpeng needs to ride out the aftereffects of Covid until supply chains normalize, but considering its size and present position, there’s a good chance it will cross the finish line intact. Xpeng still dropped 7.19% this week to rest at $37.59 per share for a market cap of $32.60 billion.

Now to some of the traditional auto manufacturers making a dent in the EV market:

GM’s (GM) Ultium platform, battery and drive power the company’s journey to electrification which seeks to offer 30 new EVs globally by 2025. Buick, Cadillac, Chevy and GMC Hummer will lead the way. Cadillac’s flagship EV model, LYRIQ, is expected to launch in the first half of 2022. This is good news, but the company is still plagued by its Chevy Bolt recall where GM recalled more than 140,000 units due to risk of spontaneous fires. As a result of the recall, the company has recently advised some Bolt owners to not park their electric vehicles within 50 feet of other cars for fear of spreading fires. Not an auspicious moment for the EV manufacturer as it attempts to heal its EV reputation, but Volkswagen pulled through, so maybe a tempest in a teapot.

GM’s (GM) Ultium platform, battery and drive power the company’s journey to electrification which seeks to offer 30 new EVs globally by 2025. Buick, Cadillac, Chevy and GMC Hummer will lead the way. Cadillac’s flagship EV model, LYRIQ, is expected to launch in the first half of 2022. This is good news, but the company is still plagued by its Chevy Bolt recall where GM recalled more than 140,000 units due to risk of spontaneous fires. As a result of the recall, the company has recently advised some Bolt owners to not park their electric vehicles within 50 feet of other cars for fear of spreading fires. Not an auspicious moment for the EV manufacturer as it attempts to heal its EV reputation, but Volkswagen pulled through, so maybe a tempest in a teapot.

![]() Ford (F) reported more than 150,000 reservations for its F-150 electric pickup and has added to its work force to ensure deliveries commence in early 2022.

Ford (F) reported more than 150,000 reservations for its F-150 electric pickup and has added to its work force to ensure deliveries commence in early 2022.

![]() Toyota, Honda and Tesla joined dark forces to fight the Biden Administrations $4,500 EV tax incentive for union-made vehicles. The gig economy ethic poisons labour’s position within a company, leaving workers with no guarantees on wage benefits, overtime, and job security. That said, unions have had a difficult time organizing employees in Toyota’s American facilities and Detroit Free Press recently reported that non-union workers at Toyota had finally received more benefits and pay than their unionized counterparts. When many EVs regularly cost more than most working Americans make in a year, subsidies and tax breaks are important factors in potential sales. Is the government discriminatory for singling out unionized manufacturers or have companies like Tesla enjoyed a free ride on the back of taxpayers for long enough? You decide and again, remember your due diligence!

Toyota, Honda and Tesla joined dark forces to fight the Biden Administrations $4,500 EV tax incentive for union-made vehicles. The gig economy ethic poisons labour’s position within a company, leaving workers with no guarantees on wage benefits, overtime, and job security. That said, unions have had a difficult time organizing employees in Toyota’s American facilities and Detroit Free Press recently reported that non-union workers at Toyota had finally received more benefits and pay than their unionized counterparts. When many EVs regularly cost more than most working Americans make in a year, subsidies and tax breaks are important factors in potential sales. Is the government discriminatory for singling out unionized manufacturers or have companies like Tesla enjoyed a free ride on the back of taxpayers for long enough? You decide and again, remember your due diligence!

Volkswagen analysts claim the company will be a global EV giant by 2025, even eclipsing Tesla. The German EV manufacturer promises to make some 70 battery-powered vehicles globally by 2030, and since the company runs a unionized shop, it will benefit from Biden’s EV tax incentives. Will Herbert Diess’ twitter punch up with Musk materialize in ripping market share away from Tesla? I like the ID4. It looks good, is well-built and isn’t a Tesla. They just might do it. Your call, though.

Volkswagen analysts claim the company will be a global EV giant by 2025, even eclipsing Tesla. The German EV manufacturer promises to make some 70 battery-powered vehicles globally by 2030, and since the company runs a unionized shop, it will benefit from Biden’s EV tax incentives. Will Herbert Diess’ twitter punch up with Musk materialize in ripping market share away from Tesla? I like the ID4. It looks good, is well-built and isn’t a Tesla. They just might do it. Your call, though.

Nissan has made noises it isn’t improbable the company would explore the manufacture of a compact electric pickup. Unfortunately, there hasn’t been any official confirmation, so much surrounding this talk is pure speculation. However, given that the auto manufacturer managed to sell 400,000 units of its LEAF EV in 2019, the possibility of it repeating that success with a new pickup is probably better than Tesla.

Nissan has made noises it isn’t improbable the company would explore the manufacture of a compact electric pickup. Unfortunately, there hasn’t been any official confirmation, so much surrounding this talk is pure speculation. However, given that the auto manufacturer managed to sell 400,000 units of its LEAF EV in 2019, the possibility of it repeating that success with a new pickup is probably better than Tesla.

Okay, I took another crack at it and am ready to rest my brain. Again, please let me know if I have missed any manufacturers that deserve mention (I’m sure I did) and I will endeavour to include them in the next write up. If you really want to know how to make money in the stock market, go to your library and check out anything from Warren Buffett and stay away from Tik Tok influencers. Alright, get out there, the EV sector is slowly becoming real, but as always, do your due diligence and help make the world a better place. Good luck to all!

–Gaalen Engen