Plurilock Security (PLUR.V) is a company in the hot cybersecurity space with plenty of positive news. And yes, the chart is very positive too. Be sure to check out our other articles on Plurilock released today for a more in depth look at the company and the financials. In this Chart Attack post, I summarize and focus on what the chart is telling us.

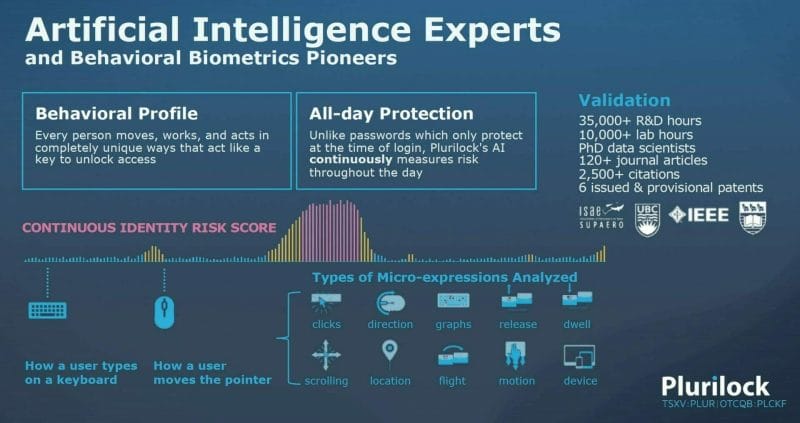

Plurilock is an identity-centric cybersecurity company that reduces or eliminates the need for passwords by measuring the pace, rhythm and cadence of a user’s keystrokes to confirm their identity.”

Our very own Lukas Kane gave this example in his Plurilock rundown, :

Your typing-style is a matrix of unique identifiers.

If I need to write a capital “Z”, I hit SHIFT with my baby left-finger, then swoop my right hand across the keyboard to hit the “Z”. There is no-one else on the planet who does it exactly that way, at exactly my speed. Combine that with 100 other typing quirks, it creates a dynamic fingerprint.

Plurilock’s Artificial Intelligence (A.I) can learn a “unique typing signature” in under 60 seconds.

The company’s technology has the power to disrupt the current status quo: Multi-factor Authentication (MFA) – which is widely disliked and unreliable.

We all know cybersecurity is going to be a big sector in the future. Most would argue it is getting big NOW. Personally, I believe the era of warfare where nations occupy other lands are over. Cyber warfare is where its at. Nations do not know the cyber arsenal of others, but more importantly, cyber warfare is use it or lose it. Unlike nuclear warfare where the other side can fire back, with a cyber attack, you can shit down the grid and then launch an assault.

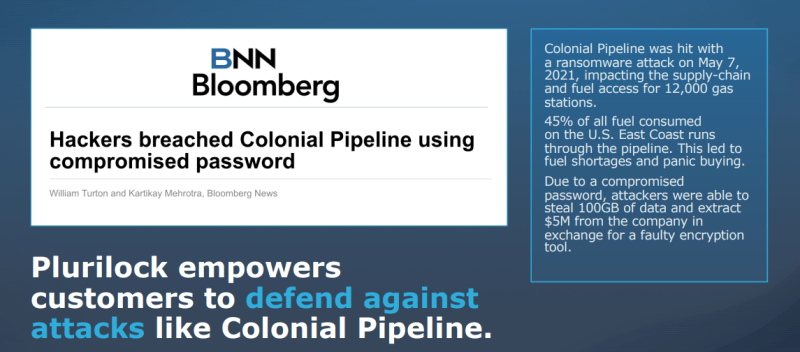

Don’t need to focus solely on warfare. Remember recently the colonial pipeline hack which cause fuel problems? Well:

Let’s face it: cybersecurity will be a trillion dollar plus market. Cyberattacks will increase which means more money will be spent on cybersecurity. And yes, I am pointing at the government and institutions.

Breaking into the government contract space is difficult. It is an achievement itself to get one foot in the door, because it is likely that door remains ajar for future deals.

And boy has Plurilock hit it out of the park! Earlier this year, the company announced a deal with multiple California state agencies. We are talking about Health and Taxation. Both were covered here on Equity Guru. To read more about the Health agency deal, click here. For more info on the Taxation agency, we have you covered here.

But wait. There’s more!

On July 15, 2021 Plurilock Security (PLUR.V) received a US$1.7 million order with the U.S. Department of Defense as part of National Aeronautics and Space Administration’s (NASA) Solution for Enterprise-Wide Procurement (SEWP), a U.S. Government-Wide Acquisition Contract Vehicle (GWAC).

Plurilock Security (PLUR.V) received an order from the National Aeronautics and Space Administration for $140,000 USD. Yes that National Aeronautics and Space Administration, as in NASA.

And then another $1.08 million USD purchase order from the US Air Force as part of the National Aeronautics and Space Administration’s (NASA) Solution for Enterprise-Wide Procurement (SEWP) program.

Revenue, revenue and more revenue.

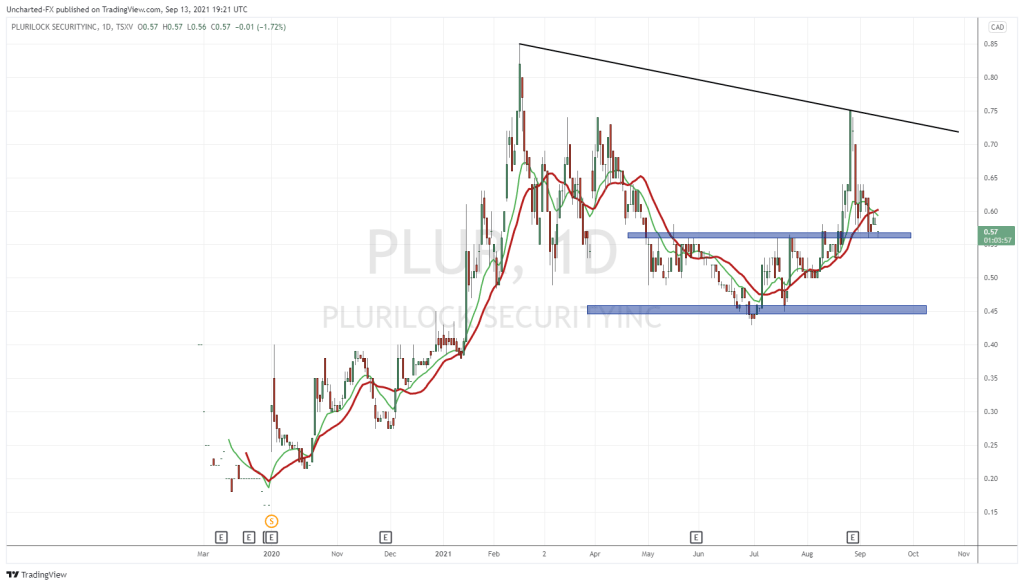

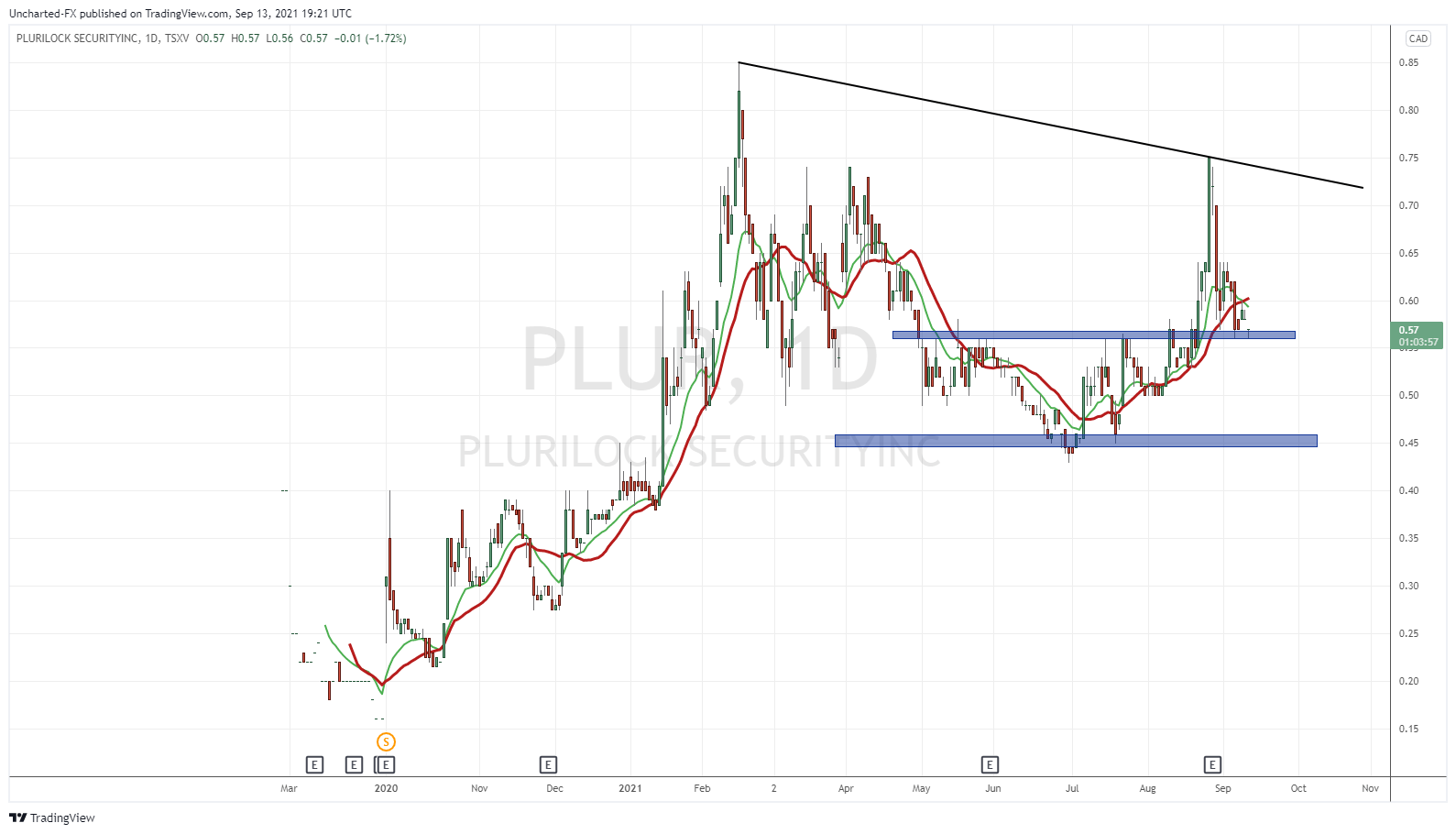

With all this good news, how did the stock react?

According to MarketWatch, Plurilock has a market cap of $34 million and is up 44.30% year to date.

$0.45 is where we developed a local bottom. And I must say, I am a fan of the pattern we see. Those who follow my work can see a dirty looking inverse head and shoulders pattern with a neckline at $0.55. I say dirty, but in realty nothing is ever textbook in trading. The structure from a downtrend to an uptrend is good enough.

The big breakout and subsequent rally on August 23rd coincided with the $1.08 million US Air Force deal. The drop coincided with the recent release of second quarter financials.

Where we stand currently on the chart provides an opportunity for entry. We are retesting the neckline of our pattern. This is support, or price floor. In the last few days, price has remained above. For bulls, they hope for this to be the case moving forward.

A typical retest pattern, and we should expect to see buyers jump in here. Yesterday (Monday Sept.13th 2021) we did not see much volume (around 12k shares). We want to see this pickup to indicate buyers seriously defending this zone. If we do, we can make another rally to $0.75, before retesting record highs at $0.85.

In summary: the chart is at a major support zone, we have positive news and government contracts, all of this occurring in the cybersecurity sector which continues to grow, and will see many future geopolitical catalysts.