Bionano Genomics (BNGO.Q) is a disruption play. The company is a structural variation company focusing on the next generation of cytogenomics with optical genome mapping.

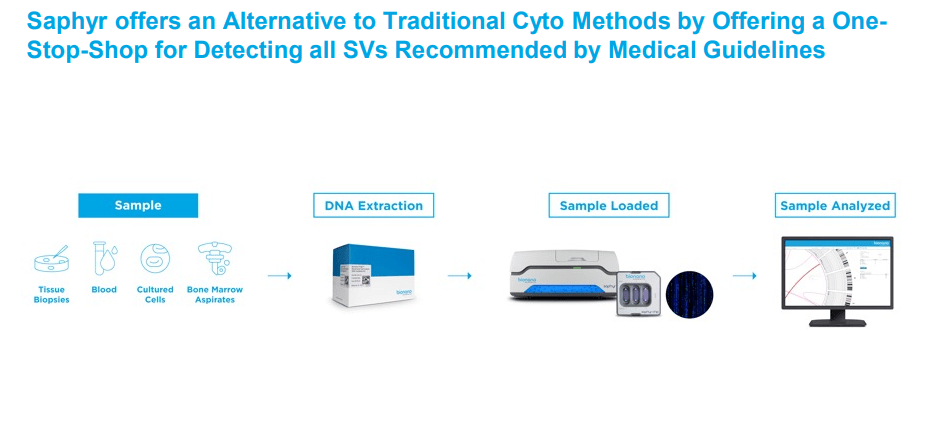

For in depth coverage on the science in laymans terms, I suggest reading Kieran’s piece(s) on Bionano here. You can also read his breakdown on Bionano’s saphyr system here.

Here is an excerpt:

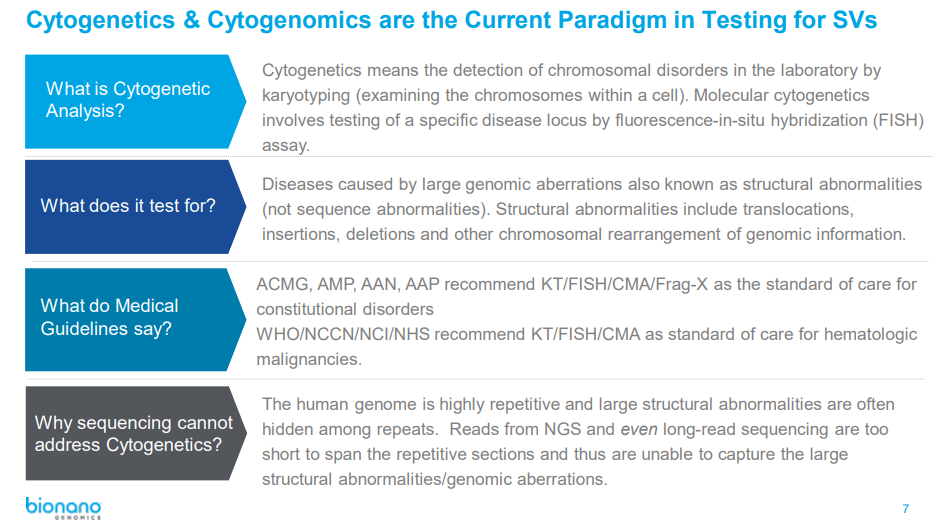

Before we move on, let me give you a quick rundown on Optical Genome Mapping (OGM) that wont make your head explode. Put simply, OGM is used to analyze entire DNA sequences of an organism’s genome. This enables scientists to isolate the DNA of an individual and identify different codes as well as structural variations (SVs). Why is this important? Well, my astute reader, some structural variations are responsible for genetic diseases such as autism. With this in mind, Bionano’s OGM platform, Saphyr System, is intended to identify these SVs in one streamlined workflow, compared to the overcomplicated process of traditional genome analysis methods like Cytogenetics

In a nutshell, the cytogenetics workflow is a nightmare and expensive. But Bionano can do this faster and cheaper.

This stock has been a favorite for the retail crowd. No, not because they like to call it Bingo, but there were rumors that Cathie Wood and ARK would be buying. There is the ARKG ETF, or ARKs Genomic Revolution ETF. You would think Bionano would slot right in. A great fit. However, as I look at the funds holdings, I don’t see Bionano. But maybe that leaves the door open for ARK to buy later? Which would be a catalyst for Bionano stock,

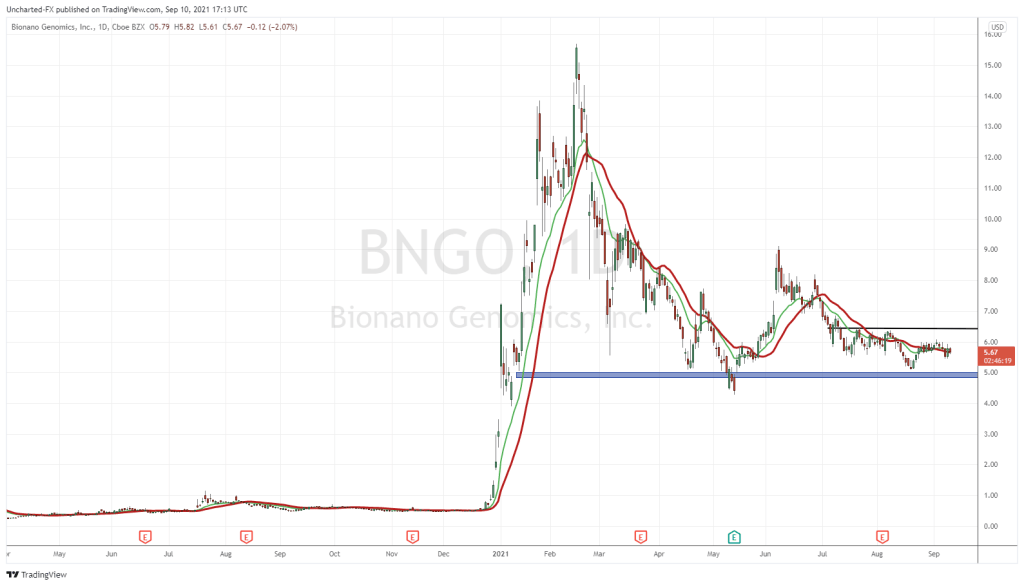

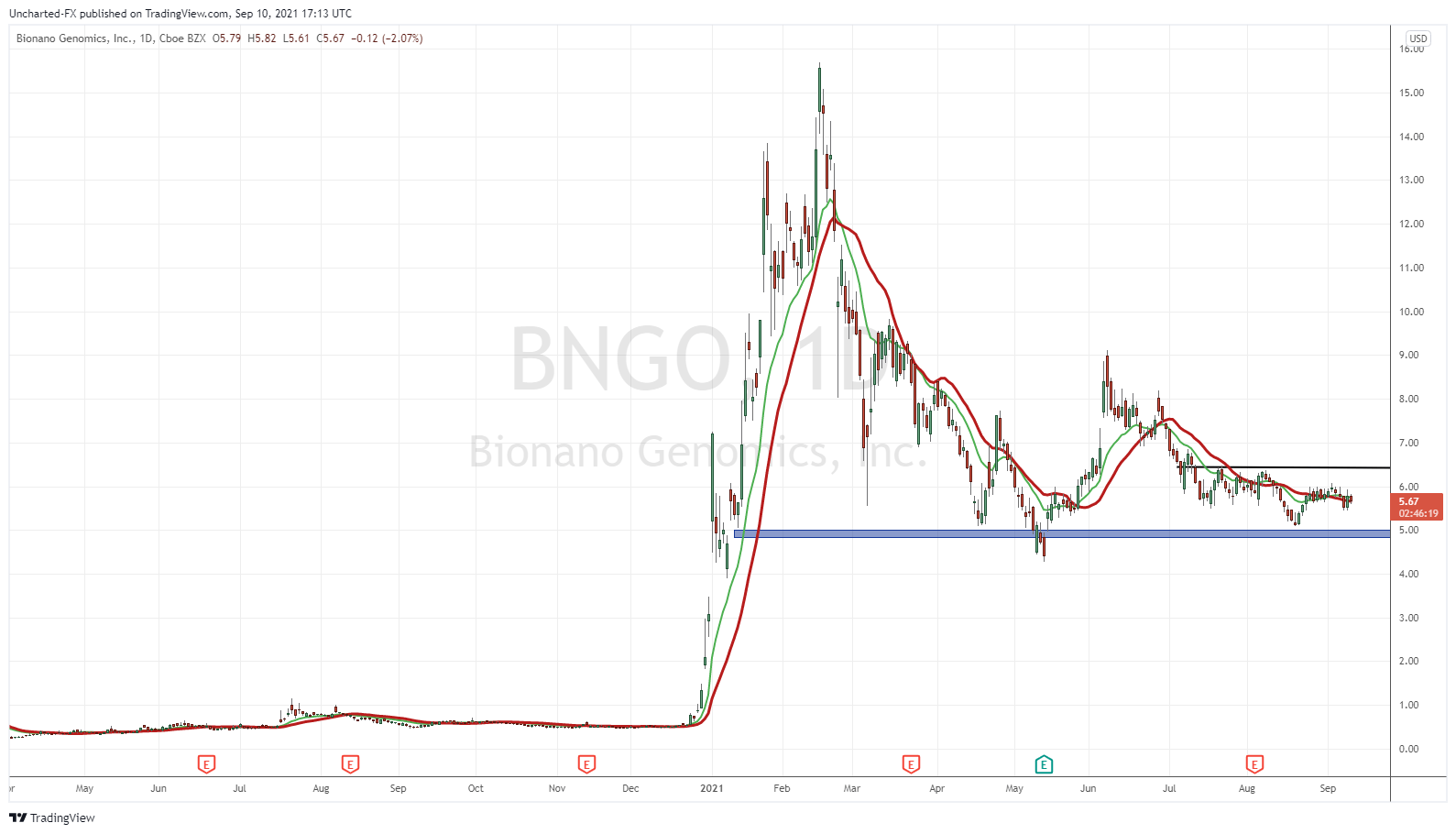

You can probably tell why this stock is popular with the retail crowd. At the end of 2020, and into the beginnings of 2021, Bionano popped from less than a $1.00 to highs of $15.71! Year to date the stock is up 84%. The retail crowd is hoping for the stock to take out those highs once again on an FDA approval…or maybe there are too many bag holders now?

Technically, we have some stuff to work with, and the stock has potential.

Firstly, we are above a major support zone. The $5.00 zone, or the blue area I have marked out. It has held ever since the pop this year. We faltered and broke below support in May, but it turned out to be a fake out with buyers driving the stock higher.

The basing we are seeing might be annoying for holders, but if we remain above $5.00 there is a chance of a new uptrend. As long as we stay above $5.00. If we break below, then what I am about to present will be nullified.

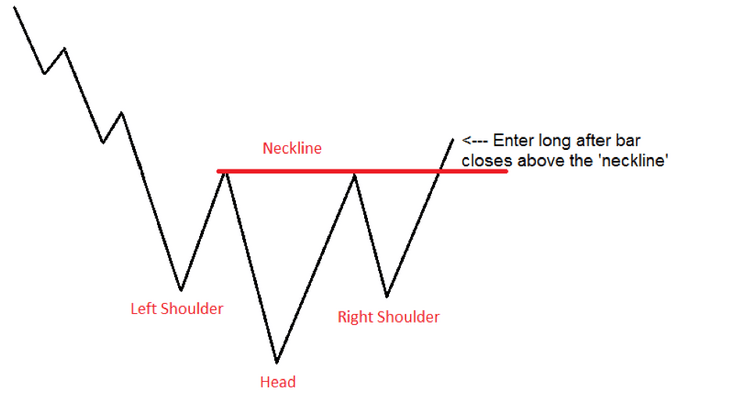

I am excited for the possibility of an inverse head and shoulders pattern. A quintessential reversal pattern. BUT the trigger for the reversal and the new uptrend, is a breakout above $6.50. The horizontal black line I have drawn out.

The kicker? The right shoulder for the head and shoulder needs to print now.

If it doesn’t, then we likely pullback lower to test $5.00 again. Hopefully we don’t break below. If we stay above, it would be a good entry point at support. Plus, the possibility of a double bottom play.