Episode 2

Earlier this year Mindmed (MNMD.Q) co-founder JR Rahn went on an epic selling spree, selling nearly 90% of his holdings without telling the public why until days after the fact. Between December 2020 and May 2021, Rahn sold over 8 million shares of MindMed, bringing his original holdings of 10,000,000 shares down to 1,378,200. Of note, since May he has increased his position to 2,212,290 shares.

Rahn claimed he sold his shares, not for any kind of short-term profit-seeking, or because he thought the company was in trouble, but rather to focus on charity work. It did seem like a weird move as MindMed was nicely cashed up with its clinical trials up to schedule aside from the regular Covid delays every company faced.

But JR’s reasoning and rationale after the fact didn’t help MindMed investors who saw their investment decrease instantly once news broke that JR was on a selling spree. It was a really bad look for the company as JR was the biggest MindMed cheerleader and the face of the company since day 1. Business sage Kevin O’Leary said over and over again ‘this is the guy’ when referring to JR.

JR was often associated with MindMed almost like a logo or mascot as he did every investor show and media appearance he could. All of which were basically trust me, I’m a Silicon Valley vet, I know lots of cashed-up VCs and MindMed is going to the moon. 18-MC is going to change the world. JR was also a vocal advocate for psychedelic-assisted therapy as it helped him a lot in his life, namely with his prior cocaine addiction. JR had a good story, and people liked his inroads with the Silicon Valley tech scene as it gives MindMed access to a highly relevant scene within psychedelics, namely microdosing. He did seem like the perfect face for the company, but, even back then some questioned his experience with running a public company of this magnitude. It was unchartered waters for Rahn.

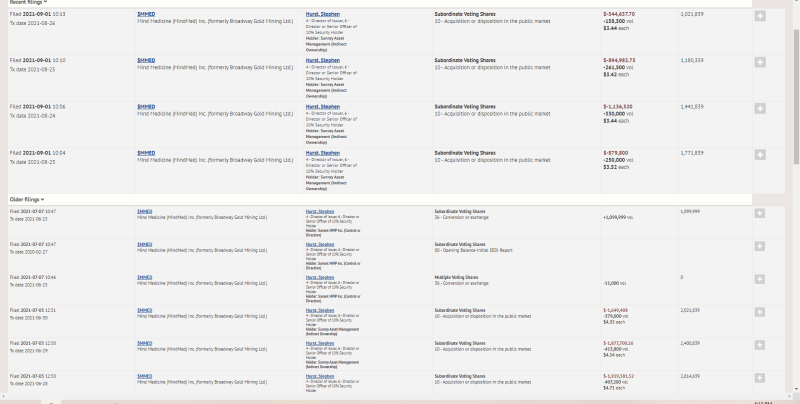

Now it looks like we are heading back down memory lane as company Co-Founder Stephen Hurst began dumping his MindMed shares at the start of July. On July 5th Hurst sold 1,200,000 shares. The transaction brought his share count from 3,221,839 down to 2,021,839. Yesterday Hurst offloaded another 1,000,000 shares bringing his current holdings to 1,021,839 shares. So in the last 60 days, Hurst has decreased his ownership in MindMed by 37% after selling 2,200,000 of his shares.

This is starting to be a troubling pattern for the company. If one co-founder did it and it was a freak event I could look the other way. But to be honest I have had some doubts about MindMed ever since JR bailed. Not because they needed JR, but because he probably knows something we don’t. I buy that he’s doing charity work, but selling that much of your stock to make that big of a pivot this early in the game still doesn’t make sense. It was just so random.

So what is it? Is 18-MC not really that cool? Are the funds maybe going to dry up after this last equity round? Are other competitors in the sector too far ahead for MindMed to really take a chunk out of the upcoming psychedelic drug developer market? These are all questions I am starting to have about the company as those closest to its DNA are losing faith. They can say whatever they want, but actions speak louder than words. If you are really invested let’s see some buybacks, I am happy to see JR increase his position a couple of months ago.

Why now?

Now that we have a second co-founder who looks to be feeling bearish I would be very skeptical about what’s going on underneath the hood. MindMed has enough cash ($200 million CAD) to last them a long time, and they have 17 proposed or upcoming trials that offer the potential for breakthroughs. But, none of that has happened yet, and not because of MindMed, it just takes a long time and money to move through clinical trials, and these are just the beginning stages. Most people in the sector say we are still in the first three innings of this thing, so why bail now?

The timing on all of this is off. MindMed has had a pretty stellar year by most accounts.

The company saw its stock double earlier this year when it was uplisted to the Nasdaq, the stock quickly came back down to earth but has stayed pretty steady since, with a slight decline since the summer, which has been pretty standard for most psychedelics stocks. The company also closed a $92 million CAD financing earlier this year and is sitting on $200 million CAD in cash.

When I look at investing in a company I want to know whether it’s going to be around in 5,10, 20 years. And while I do believe MindMed has the cash and abilities to stay afloat for the near future, I am starting to have serious doubts about the long term. There seems to be something ‘in the water’ over at MindMed and I don’t know what it is. I don’t understand why folks like Rahn and Hurst would sell so much now, they clearly aren’t giving the company a vote of confidence by selling.

So if they don’t think holding is such a great idea, as an investor, why should I? They know boatloads more about the company than I ever could. I could read every single management circular, MD&A, financial, 10-K, 8-K a million times and still not know a fraction of what an insider would, let alone a co-founder. Scratch that, two co-founders.