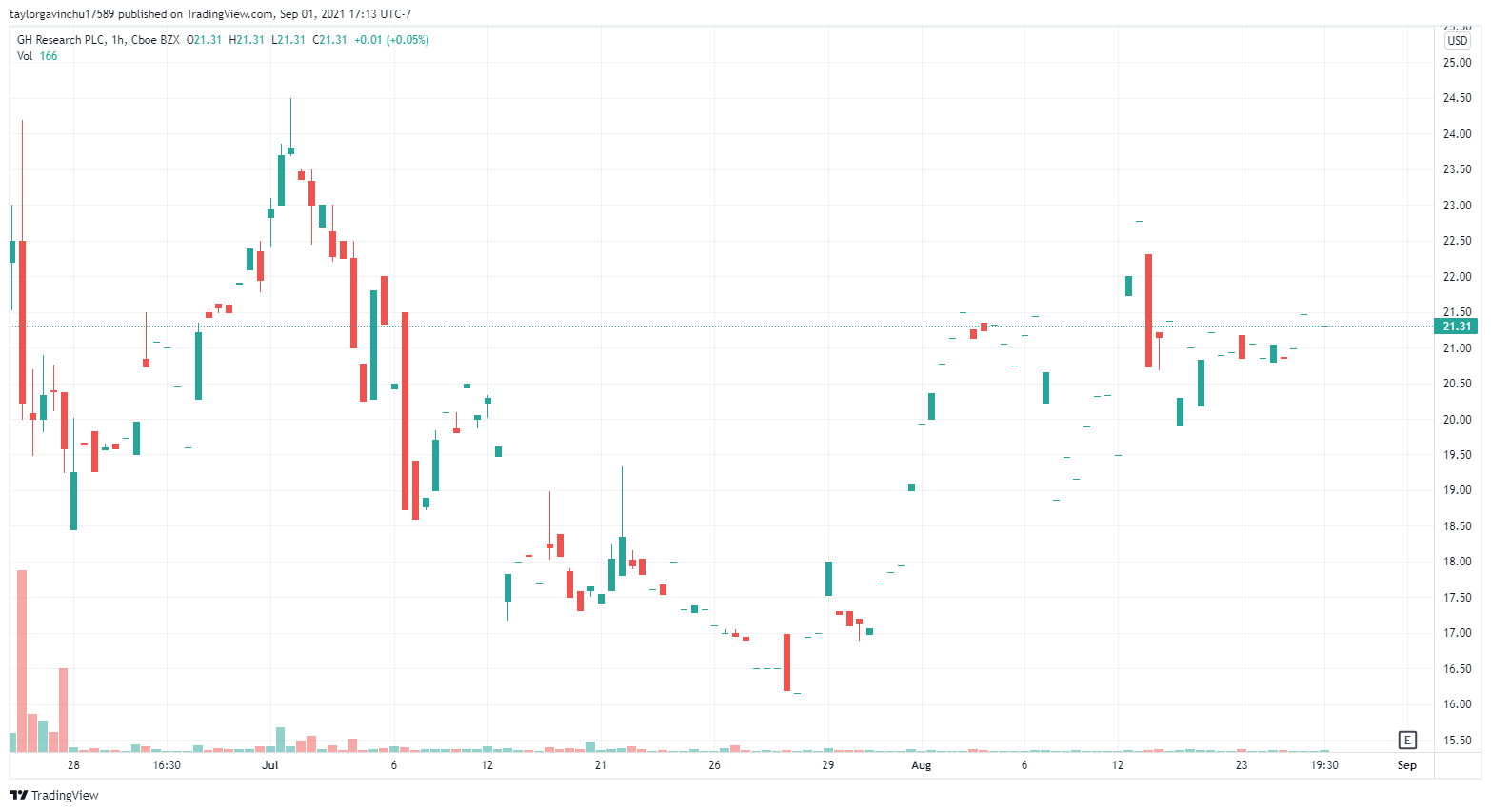

It seems like every few days I stumble across a new name in the psychedelics industry I hadn’t heard before. Usually smaller deals just getting off the ground. But, I came across the Ireland-based GH Research (GHRS.Q) recently and I was stunned at both how deep these guys’ pockets are and how I’ve never seen anyone talk about them.

5-MeO-DMT

GH raised $184 million USD on its Nasdaq IPO in June with plans to spend big on clinical trials for their two current drug candidates.

The company’s initial focus is on developing novel 5-MeO-DMT therapies for the treatment of patients with Treatment-Resistant Depression (TRD). Their portfolio currently includes GH001, an inhalable 5-MeO-DMT product candidate which is delivered via a vaporization device. And, GH002, GH’s 5-MeO-DMT product candidate formulated for https://e4njohordzs.exactdn.com/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistration via a proprietary injectable method.

5-MeO-DMT is a serotonergic psychedelic, a class of psychoactive drugs that act primarily through an agonist action on serotonin receptors and cause an altered state of consciousness. 5-MeO-DMT.is found in the secretion from the parotoid glands of the Bufo Alvarius toad and is sometimes elegantly referred to as ‘toad venom’.

Inhalation of vapor from toad secretion containing 5-MeO-DMT has become popular in naturalistic settings as a treatment of mental health problems or as a means for spiritual exploration.

The drug often produces hallucinogenic, boundless experiences within one second of inhalation that can last from 7 to 90 minutes, with an average of 20 minutes. It’s been gaining notoriety in psychedelics pop culture with the likes of Mike Tyson and Michael Pollan advocating for its usefulness.

Tyson went on Joe Rogan’s podcast and talked about how the experience changed his life.

He said, “I came across this thing called the toad. I smoked this medicine, drug, whatever you want to call it, and I’ve never been the same. I look at life differently, I look at people differently. It’s almost like dying and being reborn… It’s inconceivable. I tried to explain it to some people, to my wife, I don’t have the words to explain it. It’s almost like you’re dying, you’re submissive, you’re humble, you’re vulnerable — but you’re invincible still in all.”

Author of ‘How To Change Your Mind’, Michael Pollan compares his experience with the toad to the Big Bang in reverse: “Rushing backward through fourteen billion years, I watched the dimensions of reality collapse one by one until there was nothing left, not even being. Only the all-consuming roar.”

‘How To Change Your Mind’ is about how psychedelics have progressed over the year, the silly propaganda behind them, and his own re-discovery and experiences with psychedelics as a man in his 60’s who went most of his adult life pretty straight. Highly recommended for people wanting to dive deeper into psychedelics, I have the audiobook and it’s great, bonus points for being read by the author himself.

There isn’t a ton of research out on 5-MeO-DMT, which could be a golden opportunity for GH if things work out, they shouldn’t have much competition if any. They have already made decent progress on their clinical studies as well, and have the cash to fund several more future trials and take on more drug candidates.

Trials

GH plans on using approximately $110 million USD to fund clinical trials.

GH completed a Phase 1 healthy volunteer clinical trial, in which the drug was observed to be well tolerated at the investigated single dose levels and in an individualized dosing regimen with intra-subject dose escalation within a single day. GH001 is currently being investigated in the Phase 2 part of an ongoing Phase 1/2 clinical trial in patients with TRD.

GH is currently conducting a Phase 1/2 clinical trial of GH001 in patients with TRD, who in their current depressive episode have failed at least two adequate courses of pharmacological therapy or one adequate course of pharmacological therapy and at least one adequate course of evidence-based psychotherapy.

Although the company doesn’t have a buffet of candidates like some of the other big fish in the space, management isn’t opposed to bringing on new drug candidates as their R&D budget increases. GH states,

As a result, we expect that our research and development expenses will continue to increase over the next several years as we: (i) advance the clinical development of GH001 for TRD; (ii) advance GH001 into clinical development in additional psychiatric and neurological disorders beyond TRD; (iii) advance GH002 and any potential future product candidate into clinical development; and (iv) build our third-party or in-house process development, analytical, manufacturing and related capabilities, increase personnel costs and prepare for regulatory filings related to our potential or future product candidates. We also expect to incur additional IP-related expenses as we file further patent applications and prosecute our intellectual property to protect innovations arising from our research and development activities.

Last week I wrote about how much money psychedelics companies plan to spend on R&D and clinical trials. For the psychedelics sector, this is kind of unprecedented at this point. GH is putting its dollars into R&D aggressively, even more than Atai (ATAI.Q), Compass Pathways (CMPS.Q), and Mindmed (MNMD.Q) relative to market caps/cash positions.

According to the company, with this newly bolstered cash position, the company is going to establish sales, marketing, distribution, manufacturing, supply chain, and other commercial infrastructure in the future to commercialize products.

In 2019, GH received raised $797,000 USD from the issuance of ordinary shares. In 2020, they raised $5.5 million USD from issuing Series A preferred shares.

Earlier this year GH netted $118.8 million USD from the issuance of Series B preferred shares. Their recent IPO also added $184 million USD to the balance sheet. In March the company had a cash position of $123 million CAD, but because it’s a recent IPO and the new financials haven’t been released yet, the company should have a cash position of roughly $300 million CAD, minus expenses for the past quarter.

This is probably why they haven’t been on my radar yet, they have kept a tight leash on their marketing budget until now, but that looks like it’s changing.