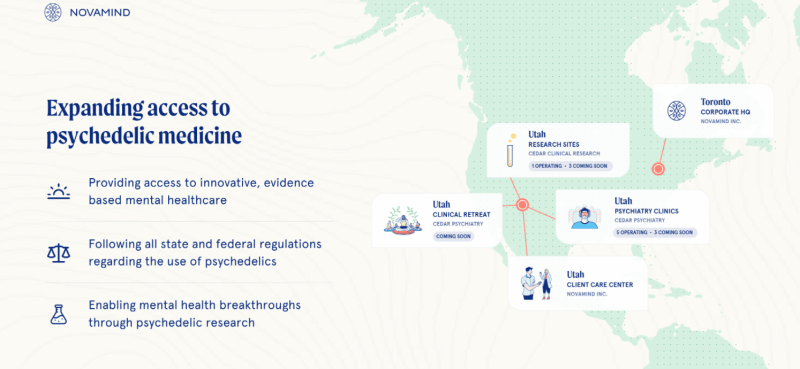

Novamind (NM.CN) is a company that addresses mental health. Utilizing a network of psychiatry clinics, research sites and therapeutic retreats specialized in psychedelic medicine. The company states they are dedicated to advancing psychedelic research and catalyzing personal wellness.

This company is a strange one. If you watched our Investor Roundtable, you’ll understand why.

Right off the bat, it is worth noting the company did make $1.85 Million CAD in fiscal Q3 revenue. Forward guidance also forecasts 65,000 clinic visits in 2021. Novamind saw 20,000 plus clinic visits in 2020. They are also expanding (currently have 5 clinics in Utah), opening three more locations.

The company also has strategic investments with drug sponsors:

This is one for the future, as Novamind is well positioned for pending FDA approval.

First of all, I understand the popularity of retreats. I follow a lot of that alternative stuff, and retreats to places like Costa Rica and Brazil are very popular. Expensive too. You get fresh fruits, and a lot of them deal with a bit more extreme drugs such as ayahuasca. Maybe this example is a bit extreme, but people go there to find themselves, and reboot. There are also more chill-axed retreats too for mental health that has to do with meditation, organic food, all with a lot of sunshine and a great ocean view.

Where I live, private mushroom retreats are getting popular. Other trips of the extreme kind happen here as well. There will be a market especially as shrooms are seen as a way to combat mental health and other problems.

Onto some negatives. Once again, I refer you to our Investor Roundtable on Novamind. Chris Parry even states where he thinks the real money in psychedelics will be made!

The first issue is the longer term time horizon. Waiting for federal legalization might take awhile in the US. Remember when Cannabis was supposed to be legalized at a Federal level very quickly? Congress is still working on it, and Cannabis stocks are still waiting for the catalyst.

The choice in the state of Utah also perplexed us. Not necessarily a state that seems it would welcome the legalization of psychedelics with open arms…or at least without some sort of backlash.

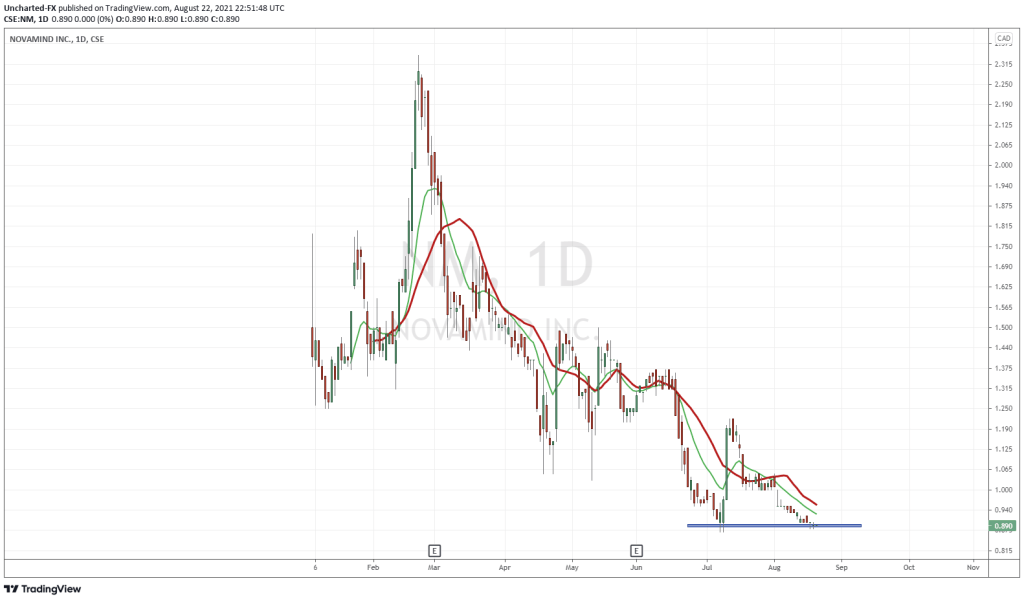

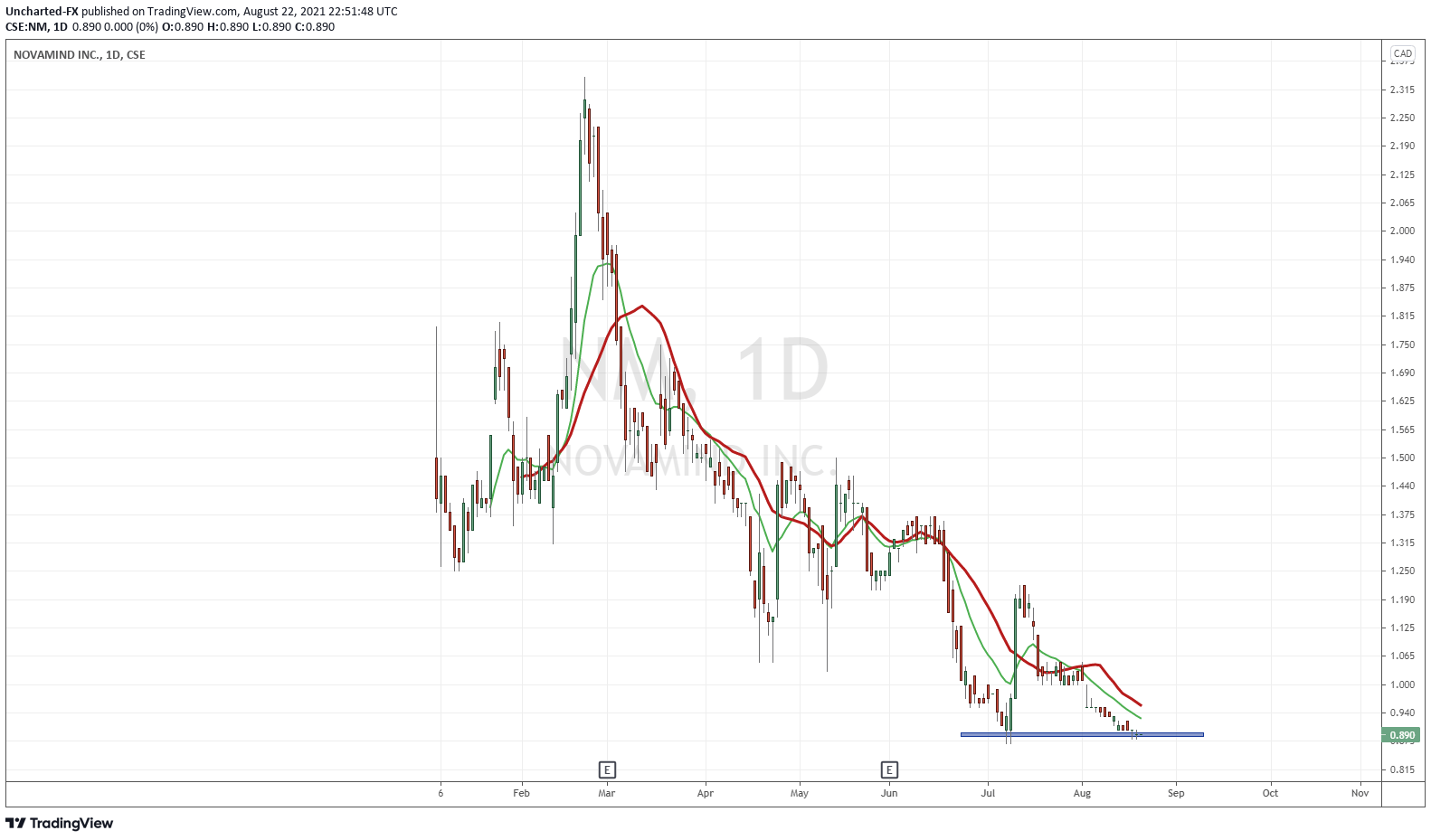

Technical Tactics

Novamind does look attractive on a technical level. I say this because we are at a major support zone. A support zone that separates us from a bounce, or new record lows. There could even be a double bottom pattern here setting up in the case of a bounce. These type of charts are attractive to those that like to play bottoming plays.

According to marketwatch, Novamind is up 137% year to date, and has a market cap of $35.78 million…maybe a bit hefty for what this company does.

One can play the support bounce, but we need volume for momentum and follow through. Things could get interesting on a break above $1.06 as it would take out a lower high level.

Personally, I would invest in psychedelic companies that deal with extraction. I like the basics. Same approach with Cannabis, I invest in the guys who grow it.

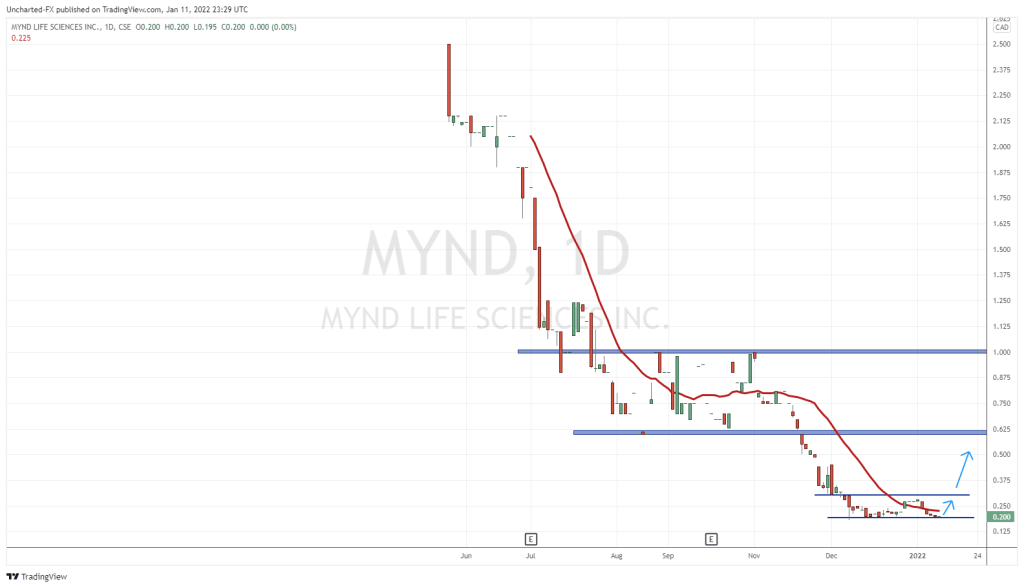

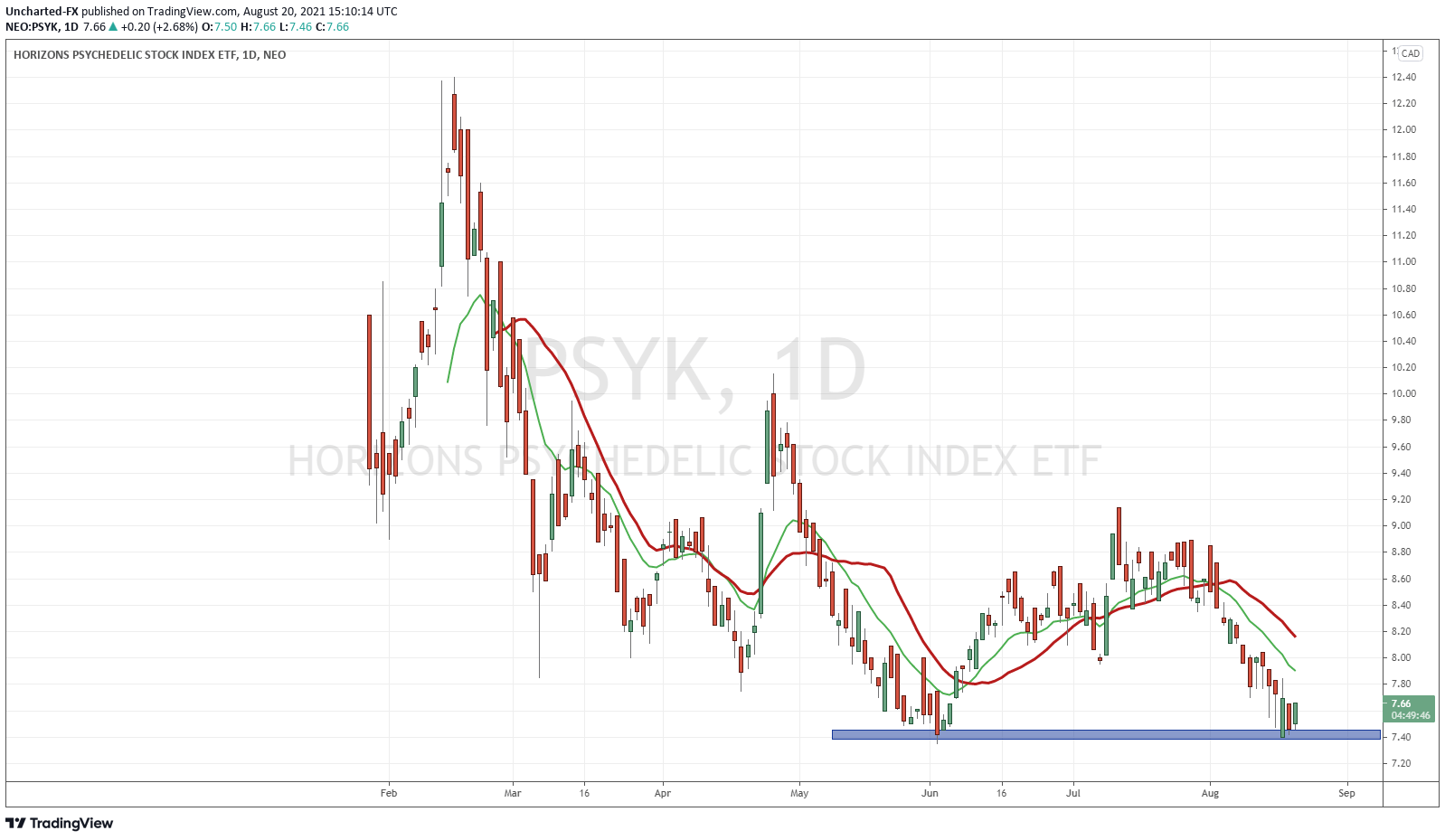

If you cannot decide then I would play Horizon’s Psychedelic ETF PSYK:

In a way, it has the same market structure as Novamind. Bottoming and potential double bottom. We can see buyers are stepping in here with the green candles. This one sees your money in a bunch of psychedelic companies, and the ETF sees better volume. Using this chart, you can then decide to invest in specific names as they are likely to have the same looking chart.