PharmaCyte Biotech (PMCB.Q) released a statement from Kenneth L. Waggoner, the Chief Executive Officer of PharmaCyte, on August 16, 2021. In this statement, Mr. Waggoner comments on the Company’s recent NASDAQ listing and its current business focus.

“Becoming a Nasdaq-listed company is an important milestone in PharmaCyte’s lifecycle as we continue to execute on our initiatives to build long term shareholder value and to develop our treatments for pancreatic cancer, diabetes and other hard-to-treat diseases. We believe being a Nasdaq-listed company will help elevate our public profile, expand our shareholder base, improve liquidity and enhance shareholder value,” stated Mr. Waggoner.

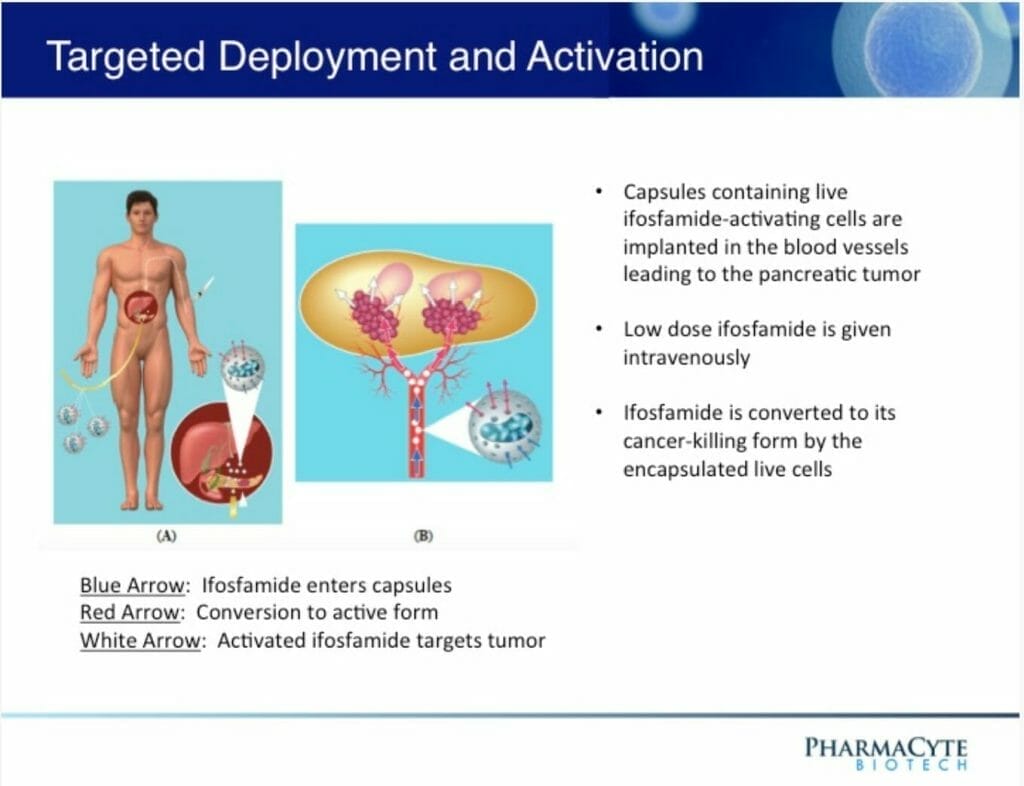

So, what’s the deal with PharmaCyte and why did its share’s skyrocket 140% today? To get a grasp on the situation, let’s start by introducing the Company itself. PharmaCyte is a biotechnology company developing cellular therapies for cancer and diabetes utilizing PharmaCyte’s cellulose-based live cell encapsulation technology known as “Cell-in-a-Box®.” This technology is being used as a platform to develop therapies for several types of cancer and diabetes. How does it work? Cell-in-a-Box® works by encapsulating different types of genetically modified living cells depending on the disease being treated. With regards to pancreatic cancer, Cell-in-a-Box® encapsulated roughly 10,000 genetically modified live cells that produce an enzyme capable of converting the chemotherapy prodrug ifosfamide into its cancer-killing form. These capsules are then implanted into a patient’s blood vessels leading to the pancreatic tumor. Next, ifosfamide is https://e4njohordzs.exactdn.com/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistered intravenously where it is converted into its cancer-killing form.

Now that we have a general understanding of PharmaCyte, let’s get back to the news at hand. As previously mentioned, PharmaCyte recently uplisted to the NASDAQ. Following PharmaCyte’s uplisting, the Company’s shares began trading higher at an abnormally-high volume. I am no expert but this is likely due to PharmaCyte’s recent reverse stock split. For context, a reverse stock split refers to a corporate action that consolidates the number of a company’s existing shares of stock into fewer, more valuable, shares. Paired with PharmaCyte’s extremely low float, the Company’s reverse stock split was able to draw the attention of countless investors. As a result, PharmaCyte was able to complete a recent public offering of approximately $15 million.

“As we were working on the FDA’s requests, we developed a plan to improve both our capital structure and our position in the market by making PharmaCyte more attractive to the investment community and uplisting to a national exchange. Our previous share structure and price made it impossible to continue to fund our work, achieve an open IND and to fund a clinical trial in locally advanced, inoperable pancreatic cancer (LAPC) as an OTC Markets Group company,” continued Mr. Waggoner.

Speaking of the FDA, on November 4, 2020, PharmaCyte receive a clinical hold letter from the FDA with respects to its Investigational New Drug Application (IND) for a planned Phase 2b clinical trial in locally advanced, inoperable pancreatic cancer (LAPC). As stated by Mr. Waggoner, the Company is now focused on complying with the FDA’s request as soon as possible. In the future, PharmaCyte intends to inform shareholders and the investment community as soon as any significant progress has been made. Overall, PharmaCyte has its foot in the pancreatic cancer treatment market, which is expected to reach USD$4.2 billion by 2025. Having garnered an impressive amount of interest following its uplisting to the NASDAQ, PharmaCyte could experience additional growth if and when the FDA approves its Phase 2b clinical trial in LAPC. However, I think it may be best to let the dust settle before putting any eggs in this basket. The Company’s has not reported revenues in the last four years and its cash position was sitting at USD$2,202,106 on April 30, 2021. In total, PharmaCyte reported a net loss of USD$3,551,236.

PharmaCyte’s share price opened at $6.30, up from a previous close of $3.42. The Company’s shares are currently up 112% and are trading at $7.29 as of 1:04PM ET.