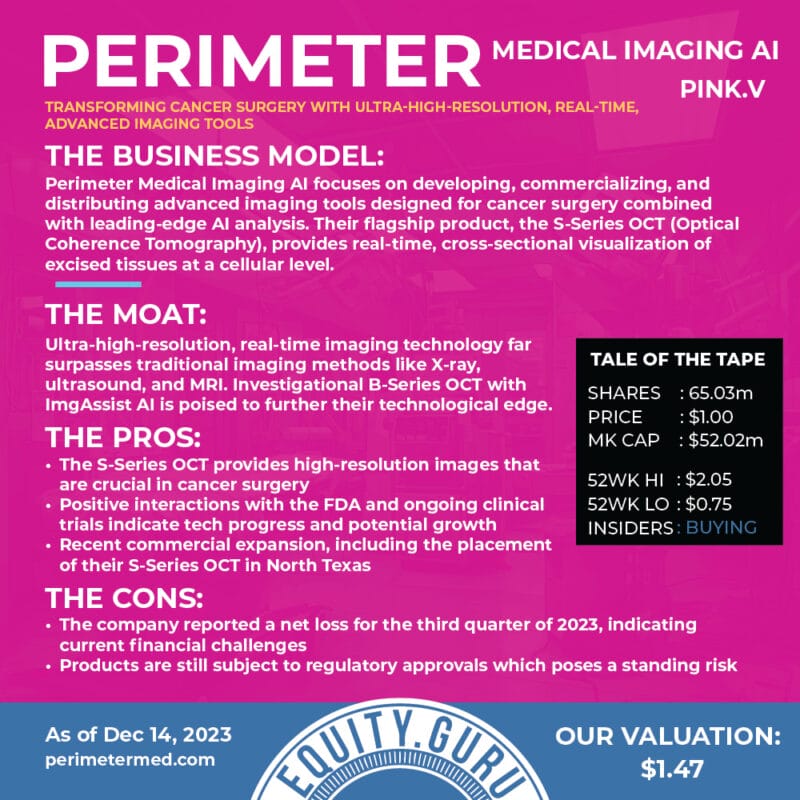

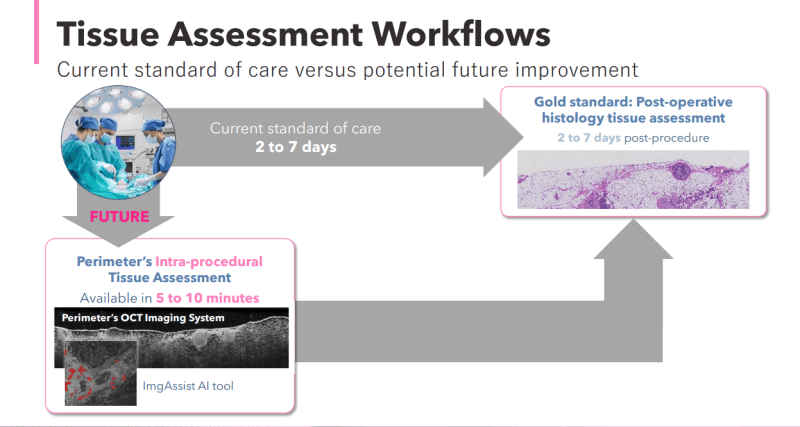

Perimeter Medical Imaging Ai (PINK) is a company that is developing, with plans to commercialize, advanced imaging tools that allow surgeons, radiologists, and pathologists to visualize microscopic tissue structures during a clinical procedure. There are many companies that claims they will either cure cancer, or do something about cancer. Perimeter Medical can claim that they are a company actually doing something about breast cancer.

Their AI tech can be used with real time visualization and assessment to improve surgical outcomes for patients and reducing the likelihood of additional surgeries.

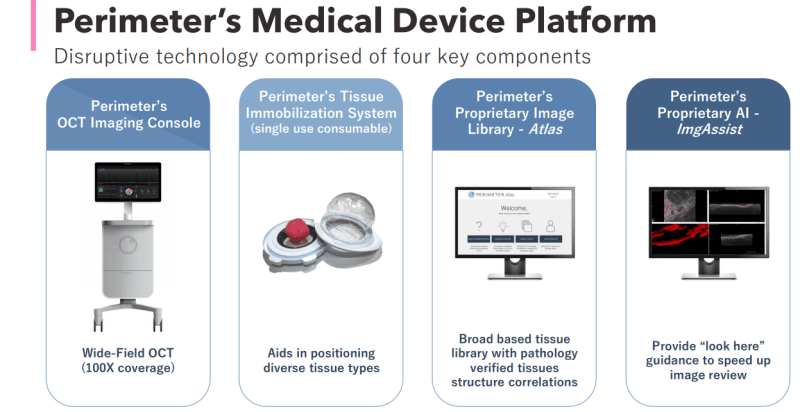

Perimeter’s ATLAS AI project is a way for the company to advance its AI technology through clinical development.

In the first stage, more than 400 volumes of images of excised breast tissue were collected at leading cancer centres (including the University of Texas MD Anderson Cancer Center, Baylor College of Medicine, UT Health San Antonio, and Northern Arizona Healthcare), with the goal to build an extensive library of breast tissue images with a focus on breast cancer.

Later on this year, Perimeter will conduct a randomized, multi site, pivotal study to test its Optical Coherence Tomography (OCT) Imaging System device with AI against the current standard of care and assess the impact on re-operation rates for patients undergoing breast conservation surgery.

Not only will Perimeter’s technology change the current standard of care, but it will reduce costs for patients. New technology which leads to improvement, provides value to society, and lowers costs. This is what true capitalism is all about.

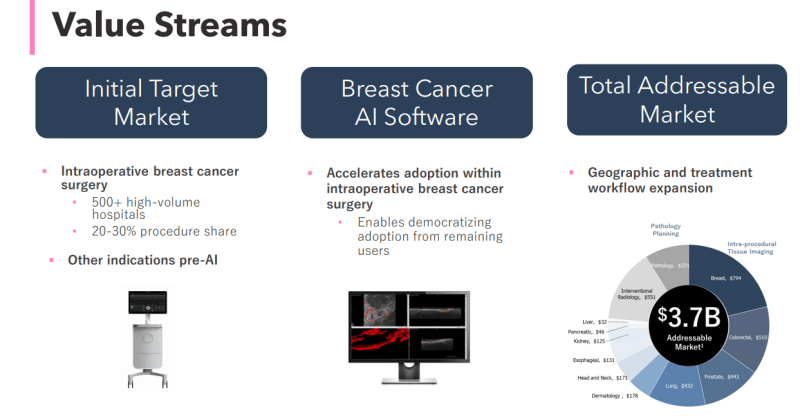

There is also a large addressable market. With cancer rates and breast cancer diagnosis increasing in the US and Canada, new technology to meet and alleviate this challenge provides a significant opportunity for Perimeter Medical. It is a feel good investment.

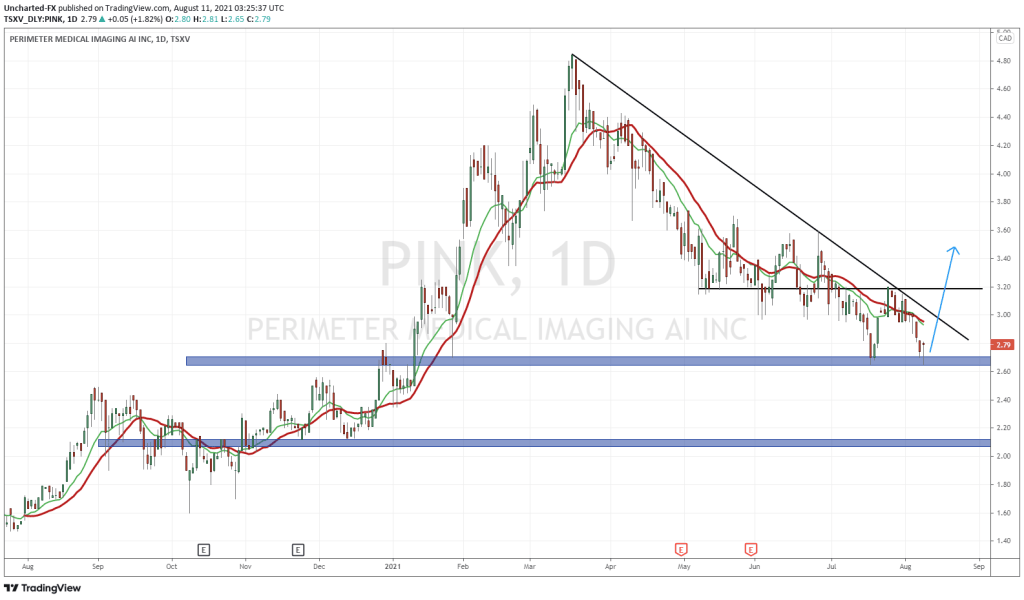

Technical Tactics

Now I am a chart guy. I look at things such as long term trends, cash position, and management when determining whether to buy shares in these type of companies. If the chart looks great, and the fundamentals are solid, I take the dip. I am here to say that the technicals look very appealing, and the fundamentals look solid. For more info on the fundamentals of Perimeter Medical Imaging, I recommend checking out our cover story on Perimeter, as well as TK’s analysis on the fundamentals. Both of which can be found on our site.

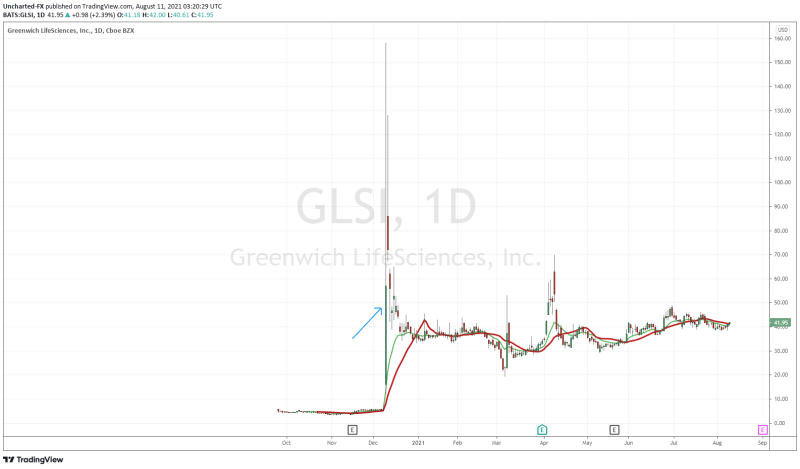

My interest in breast cancer stocks began back at the beginning of December 2020. For those of you following markets, you might remember what happened. A company called Greenwich LifeSciences (GLSI) took the headlines.

Greenwich LifeSciences is a clinical-stage biopharmaceutical company focused on the development of GP2, an immunotherapy to prevent breast cancer recurrences in patients who have previously undergone surgery.

News came out that GP2 was moving onto phase III clinical trials. The stock went to the moon.

The stock closed up nearly 1000% (998.35%). Lows of the day were $12.15, price hit highs of $158.07, before settling at $57.10. It really was something amazing.

Breast cancer stocks can move on big news. Now of course, Greenwich and Perimeter Medical are two different type of companies. However, both deal with preventing breast cancer recurrencies in patients who have undergone surgery. One with immunotherapy, the other with AI technology. Any positive news going forward for Perimeter can see similar volatility in the stock.

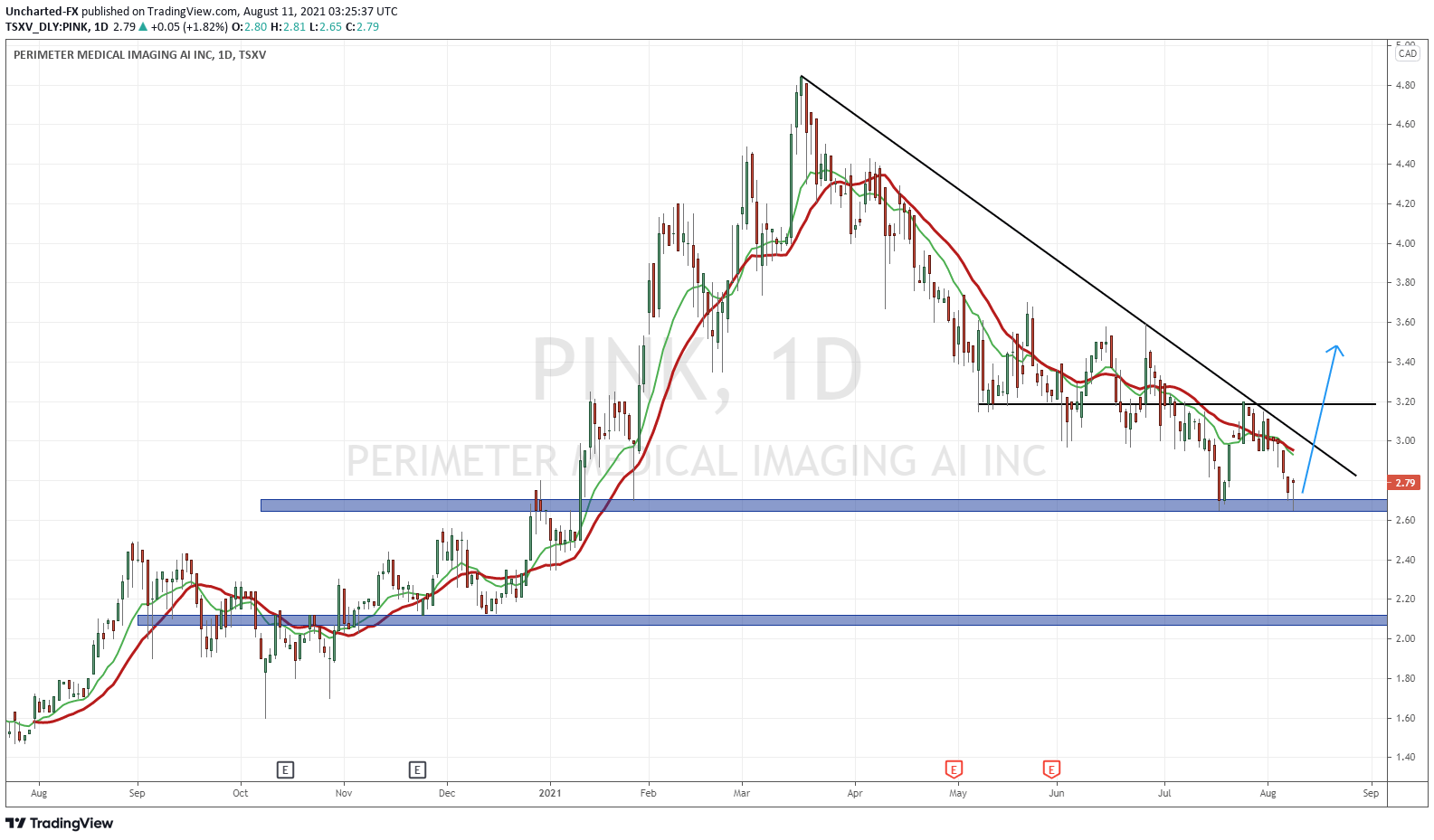

I said the technicals look great. I wasn’t lying. This is one of the best set ups I see on the TSXV. The potential is great, we just need to now wait for the trigger. What I mean by this is a breakout.

The stock is still up 5.28% year to date, and up 56.74% in one year according to marketwatch. Recently, the stock has been trending downwards. Notice my first blue line around $2.60. This is a very important support zone, or price floor. Buyers step in here. Look back at the breakout above $2.60 back at the beginning of this year. We broke out, and then pulled back to retest the breakout before moving higher. A typical breakout pattern. We then came back to test $2.60 again a few weeks ago, and then we tested the zone on August 10th 2021. Tuesday of this week. The wick indicates the buyers stepping in.

From here, we are hoping to see more buying pressure in order to form a double bottom pattern, or what looks like a “W”. My arrow indicates what I want to see, but it doesn’t necessarily have to be in a straight line. It may take weeks to complete. If we can break above $3.20, would be the real trigger of the double bottom.

But how about getting in early? Yes, one can do that if they don’t mind increasing their risk. This is a pretty important support zone, so one can initiate a position here. Buying at support is a popular strategy. I would say to wait for one more trigger. Notice the downtrend sloping line I have drawn out. Just by visualization, you can see that the trend is still down. BUT if price can break and close across this trendline, it would be a significant trend shift. Buyers will be more attracted to the stock, perhaps frontrunning the breakout above $3.20.

If this support breaks, then we would drift lower to around the $2.20 zone. That is the risk of not waiting for the breakout and the trendshift.

In summary, Perimeter Medical Imaging is a company literally fighting breast cancer. The technology has the ability to revolutionize and change the current standard of care. With memories of volatility with the Breast Cancer treatment play Greenwich still fresh, traders and investors should definitely keep Perimeter Medical (PINK.V) on their radar.