Pure Extracts (PULL) is a company that uses CO2 extraction technology to derive full spectrum oil from cannabis biomass. Their purest quality and purity makes them an emerging leader in the extraction space. What the heck does this all mean? Bear with me.

Pure Extracts business model focuses on three things: extraction, formulation, and brand development.

Their extraction facility in Pemberton, BC uses Pure Extracts Vitalis CO2 extraction system producing high quality and pure full spectrum oil. Pure Extracts is aiming to offer different product formulations. Currently focusing on Cannabis and CBD, but the company is positioned to develop functional products in the psychedelic compounds market. A huge growth opportunity.

In terms of brand development, Pure Extracts wants to be number 1! The extract market in Canada is just in the beginning stages, and Pure Extracts is in a good position to leverage their proven success and long term experience!

For more information about the company, check out their Youtube video below, and also check out their investor deck here. Also be sure to take a look at our other Pure Extract articles here on Equity Guru.

My readers know I am a technical guy, so let’s take a look at what market sentiment and structure is telling us! But before we do so, we need to scope out the latest news. This is important, as it can provide momentum for the share price to move higher.

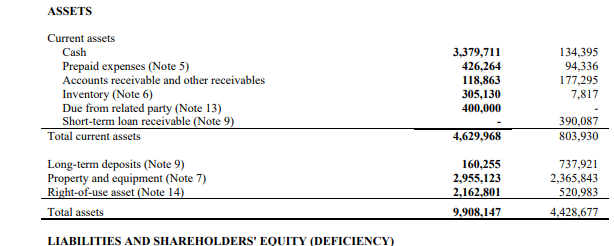

The cash balance is important for any company, but especially for small caps. They need the money to do stuff. For shareholders, it means having the cash to move forward and initiate catalysts for the stock price to go higher.

Going to Sedar.com, and taking a look at Pure Extracts latest financial statements, they do have cash. Sure they can still raise money by issuing shares, which would dilute your shares if you are a shareholder (basically bad if you hold the stock), so cash positions are important to determine whether to buy shares, or await some sort of financing if the companies cash position is low.

In terms of news, it has been a busy few months for Pure Extracts. Recently, they announced the initial shipping of edible cannabis gummies to BC. A revenue producer for the company. This is big news as on July 28th 2021, Pure Extracts received approval to amend their sales license from Health Canada to permit the sale of cannabis extract products to provincially authorized distributors and retailers nationwide as well as to holders of licenses for the sale of medical cannabis extracts.

Very busy July for the company, and the future looks bright with the companies Pure Pills Product brand achieving national consumer recognition.

Onto the charts!

Technical Tactics

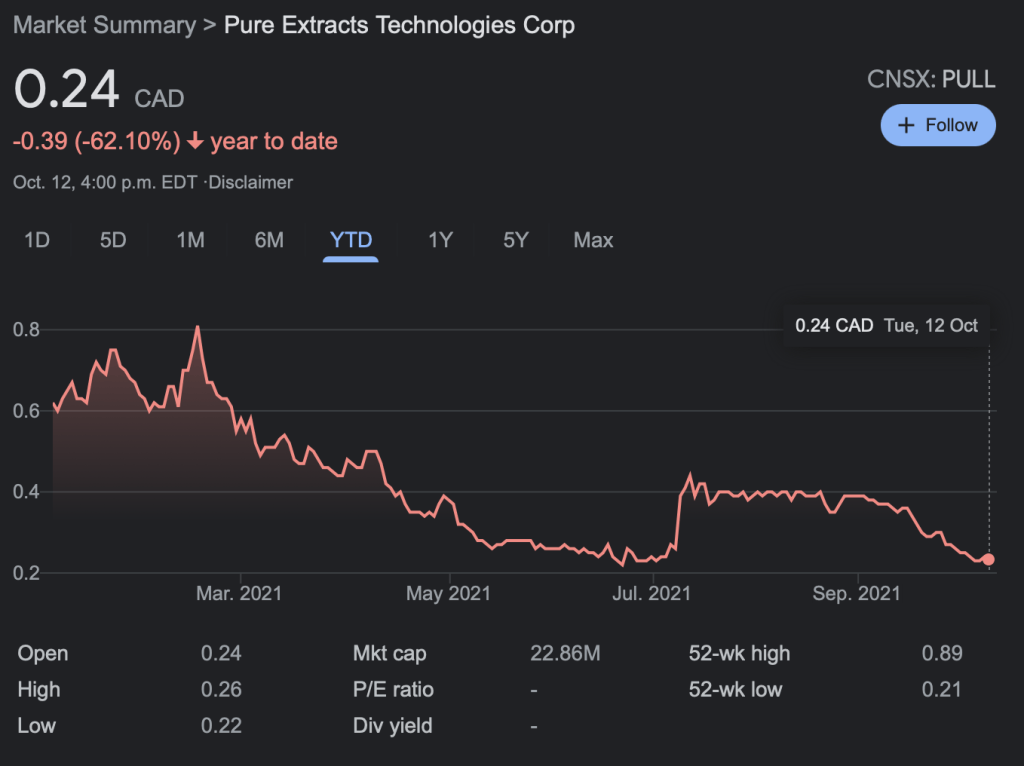

Pure Extracts has a market cap of $37.94 Million, is down -39.84% Year to Date, but up 24.19% in the last three months. Marketwatch has a “Buy” rating for the company.

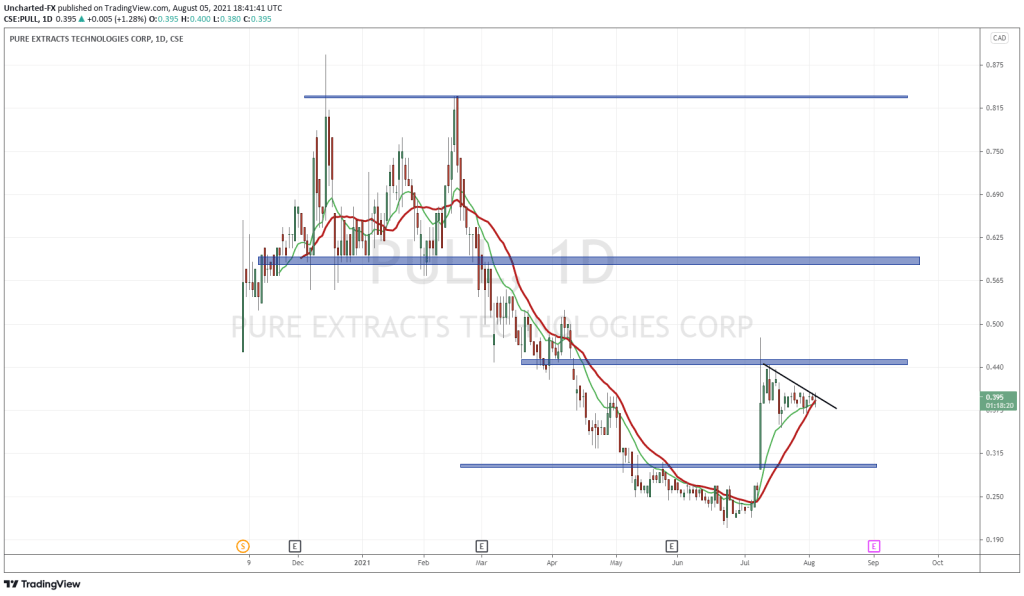

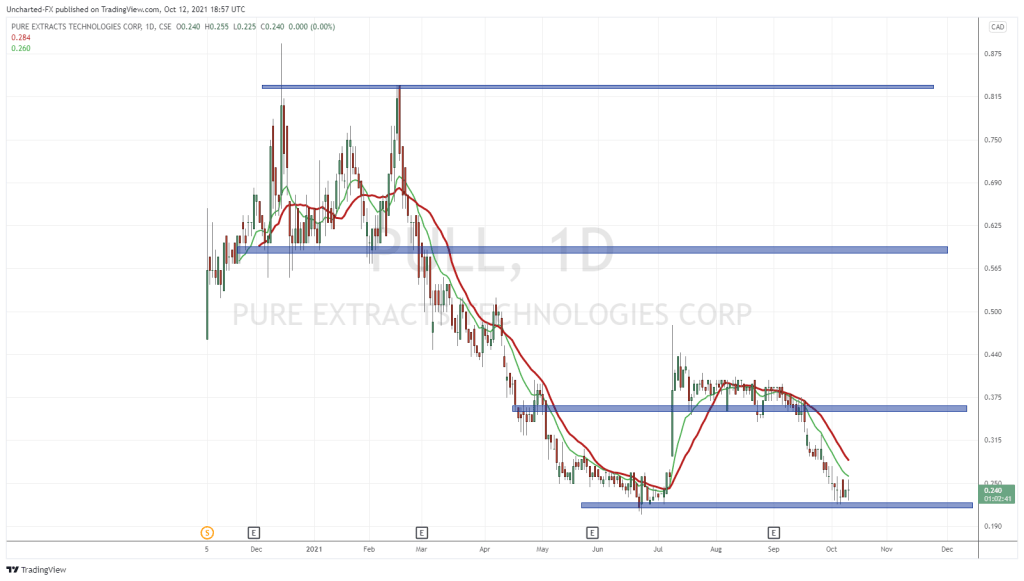

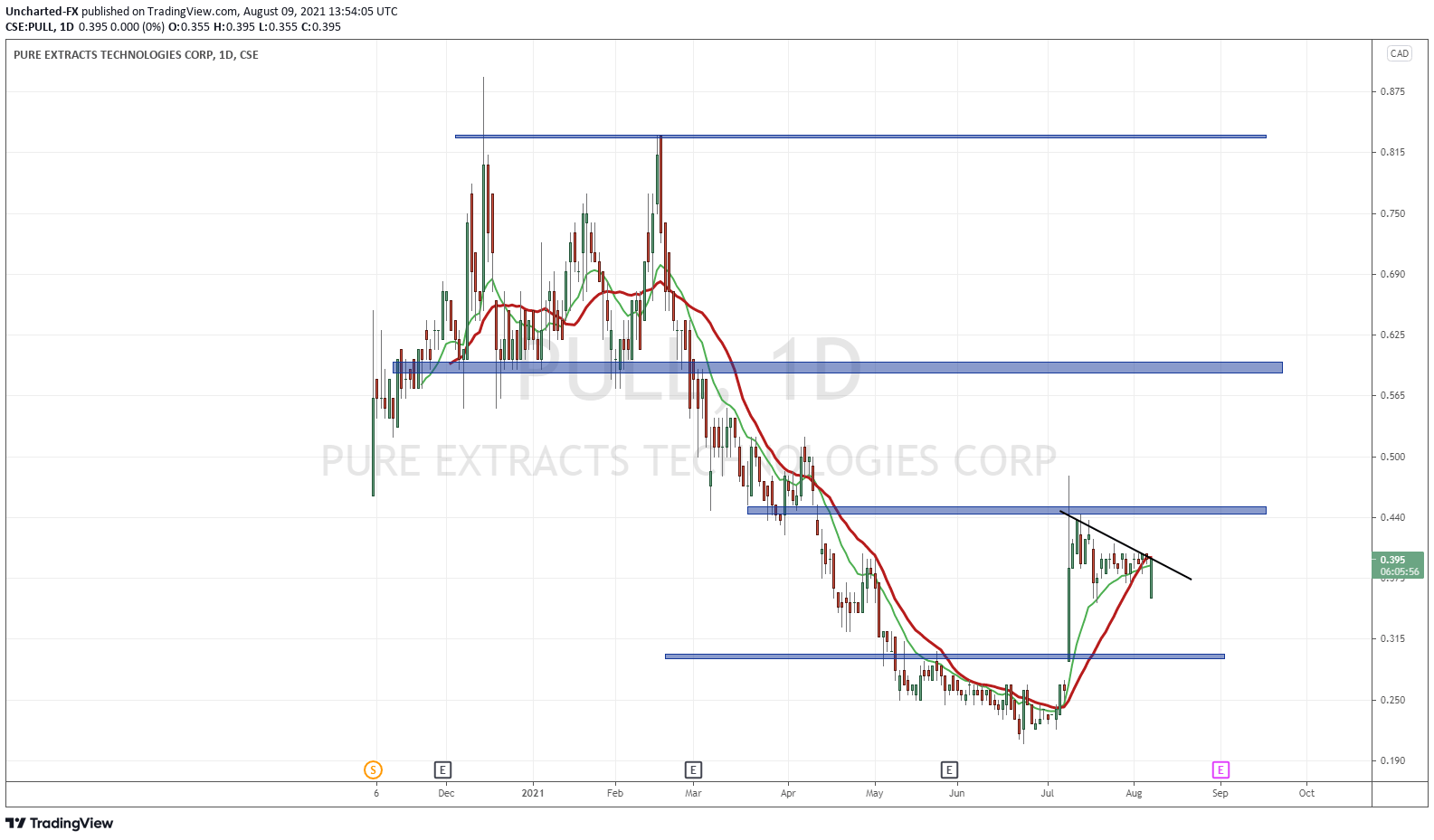

In terms of technicals, I favor the upside. Why? Because in technical terms, a new uptrend has been triggered. Notice the blue line I have drawn below at around $0.30? That was an important zone for a breakout. And boy…did we breakout with some style! Look at that large green candle on July 9th, just two days after Pure Extracts provided a positive corporate update. When you see buying like that, especially on a breakout, we must pay attention. Strong breakouts have a better case of continuing the momentum.

The red and green lines I have are my moving averages (MA). In technical analysis they are simple to use: if price is above the MA, the stock is in an uptrend (buy). If price is below the MA, the stock is in a downtrend (sell). When we see price cross the MA’s after a long time, it means we have a shift of a new trend. Just as we see with Pure Extracts.

The $0.45 zone becomes resistance, or price ceiling. Notice how we tried to climb above, but failed to do so. Going forward, this zone must break.

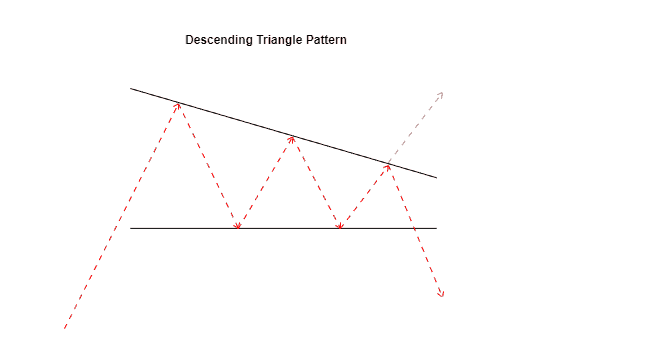

I have drawn a trendline connecting the highs of the recent daily candles. You can see a downwards angled slope. If we can get a daily candle close above it, we have a better chance of retesting $0.45 in the near term. The technical term for this is a descending triangle. An upwards move and then a triangle formation. This is how they usually pan out:

There are two ways to play this. We either wait for a breakout AND await for price to close above $0.45. This would take out a resistance level, and momentum would carry forward with these technical patterns and levels being broken. OR we drift slowly lower and retest the $0.30 breakout zone, providing us the opportunity to enter at that level.

The technicals are aligned, now it is all about whether management can deliver on their goals and create shareholder value. Further catalysts are required for momentum higher.

Cannabis sector headlines seem more likely to come from the US and impact USMJ stocks. We have been told of the Federal legalization in the States, that still remains the big catalyst. Pure Extracts moving to functional mushrooms and psychedelics will be worth monitoring. As I said earlier, this seems to be a high growth sector, and I think we will see a retail mania in it, just as we saw in Cannabis a few years back.