The NYSE

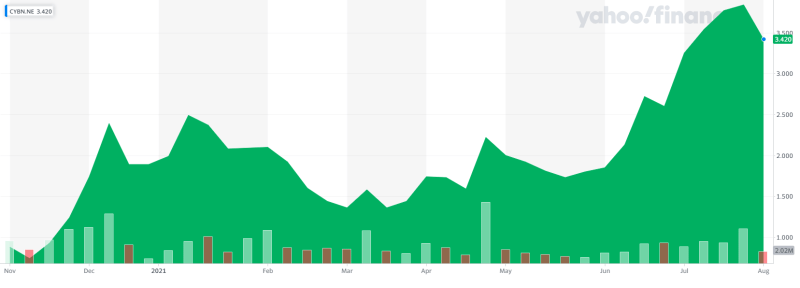

Cybin (CYBN.N) just finished its first trading day on the New York Stock Exchange (NYSE) after announcing the upcoming uplisting last month. It was a less than desirable day for the stock, but it’s really only a blip when factoring in the runup to the NYSE debut.

In recent months we have seen more and more psychedelics companies uplist onto bigger exchanges. Field Trip (FTRP.Q) and MindMed (MNMD.Q) uplisted to the Nasdaq from the TSX and NEO exchanges, while Compass Pathways (CMPS.Q), Seelos (SEEL.Q), and Atai (ATAI.Q) used the Nasdaq as their jumping-off point. Cybin will be the first psychedelics company listed on the NYSE, which has slightly stricter prerequisites for getting in.

Earlier this week Cybin closed an overnight public offering of 10 million shares priced at $3.40 CAD, totaling $34 million CAD. Cybin has now raised over $120 million CAD. They are cashed up and ready to go.

Cybin’s uplisting created a huge buzz, folks all over the net were talking about it. I don’t go out to coffee shops much anymore but I’m sure conversations were happening there as well. Several investors loaded up on Cybin when the first announcement of an uplisting dropped, and for those who were already in it presented an opportunity to get more equity before the anticipated run. It looks like a smart move in retrospect. Trying to time the market is impossible, but an upcoming uplisting is usually a layup, at least for a short-term gain.

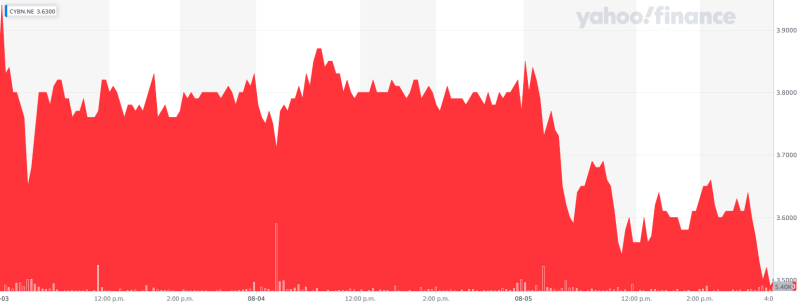

Buy on rumor, sell on news

While this is a big day for the company, it was less than desirable for the stock, which had been on a great run as of late. But, unfortunately, the stock dipped $0.35 CAD today to $3.42 CAD on 1,193,800 shares traded.

But zooming out for a second, the dip today, the dip isn’t that substantial.

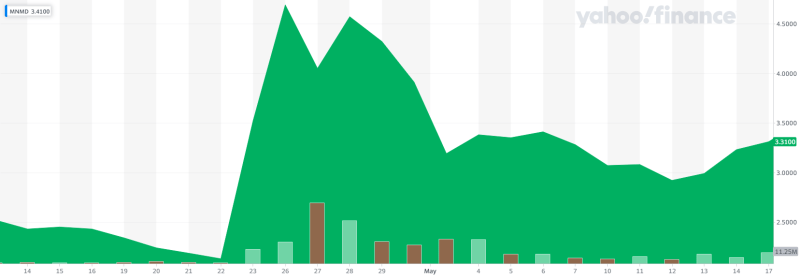

There was a huge run-up to the uplisting over the past couple months. This is similar to MindMed’s runup and debut day after they announced their Nasdaq uplisting earlier this year. It’s likely there was a selloff after the run.

“Buy on rumor, sell on news.”

MindMed’s run-up to the uplisting was a lot faster and more drastic, but the psychology is similar.

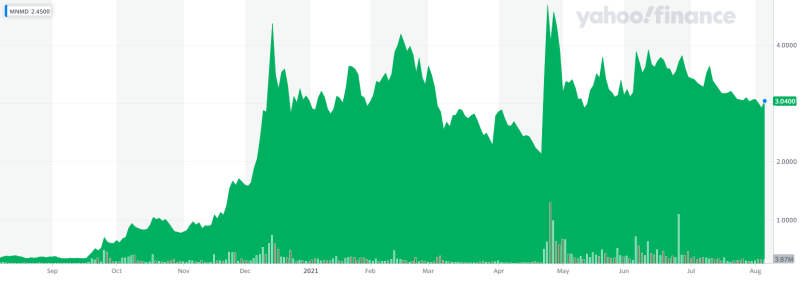

And again if we zoom out to see more context, the bigger picture doesn’t look all that different than Cybin.

No frills

Cybin didn’t pick the NYSE just to be first as some marketing gimmick, CEO Doug Drysdale said the NYSE felt like a more natural fit for his company, as many of its partners are already listed there.

Cybin uplisting to the NYSE does a lot more than give it extra prestige, rather it opens up the company to investment from Americans who don’t buy over-the-counter stocks. Canada is blessed with the NEO and CSE as mid-level exchanges whereas the US has a massive valley between the NYSE & Nasdaq and the OTC. Yes, the OTC has different levels that require stricter pre-requisites, but at the end of the day it’s still the OTC.

To get an NYSE listing, a company must have a minimum of 400 shareholders who own more than 100 shares of stock, have at least 1.1 million shares of publicly traded stock, and have a market value of public shares of at least $40 million.

Pre-tax earnings from operations must total $10 million USD for the last three fiscal years, including a minimum of $2 million USD in each of the two most recent fiscal years and positive amounts in all three years, or if there is a loss in the third fiscal year, $12 million for the last three fiscal years, including a minimum of $5 million in the most recent fiscal year and $2 million in the next most recent fiscal year. Or they can skip all of that if they have $200 million USD in market cap. Cybin’s market cap is currently $476 million USD.

Full Disclosure: Cybin is an Equity Guru marketing client