Lexaria Bioscience (LEXX.Q) announced today that dosing has been completed for its HYPER-H21-2 study, the Company’s second human clinical study of 2021.

Hypertension, also known as high blood pressure, refers to when blood pressure measures consistently above normal. Hypertension can occur for numerous reasons including smoking, lack of physical activity, stress as well as excessive consumption of alcohol and salt. As someone who enjoys a few cold beers on a hot summer’s day with a bag of chips, I feel personally attacked.

Jokes aside, hypertension can result in a variety of adverse effects including chest pain, heart attack, heart failure, and heart disease. Furthermore, high blood pressure can also cause the arteries that supply blood and oxygen in the brain to burst or be blocked, which can result in a stroke. It is worth noting that in 2018, nearly half a million deaths in the US included hypertension as a primary or contributing cause. Additionally, approximately 45% of adults in the US have hypertension or are taking medication for hypertension.

Overall, high blood pressure costs the US roughly $131 billion each year, averaged over 12 years from 2003 to 2014. With this in mind, the global hypertension drug market is projected to reach roughly USD$23.25 billion by 2026, expanding at a CAGR of 0.6% between 2021 and 2026. Getting back on track, Lexaria has developed a hypertension program consisting of five studies to address this market. These studies including HYPER-A21-1, HYPER-A21-2, HYPER-H21-1, HYPER-H21-2 and HYPER-H21-3.

Lexaria’s human clinical study HYPER-H21-2 consisted of 16 volunteers who were pre-hypertensive or mildly hypertensive. Volunteers received three separate doses of 150 mg each of DehydraTECH™ 2.0-enabled CBD versus a placebo. Over the course of 24 hours, blood pressure and heart rate were monitored, together with evaluation of central arterial stiffness, physical activity and sleep quality. These evaluations were designed to provide a greater understanding of the human response to DehydraTECH 2.0-enabled CBD with regards to potential blood pressure reduction and other real-world effects.

Lexaria announced that its HYPER-H21-2 study is proceeding on schedule and on budget. The Company expects to have at least preliminary results to report in September or earlier. Furthermore, preliminary results from Lexaria’s HYPER-H21-1 study are expected to be reported soon. Following analysis of results from both studies, the Company intends to begin HYPER-H21-3, Lexaria’s third human clinical study of 2021.

According to Lexaria’s most recently quarterly report for the period ended May 31, 2021, the Company achieved a cash position of USD$8,108,512. This indicates significant growth from a previous cash position of USD$2,034,011 year-over-year. Furthermore, as of May 31, 2021, Lexaria’s total assets were sitting at USD$10,547,553 while its total liabilities were USD$281,381. Moreover, Lexaria was granted its second patent in Japan, representing the Company’s 21st patent. Currently, Lexaria has active patent protection in the US, EU, Australia, India and Japan with additional patents pending in Canada, China, Mexico and other countries internationally.

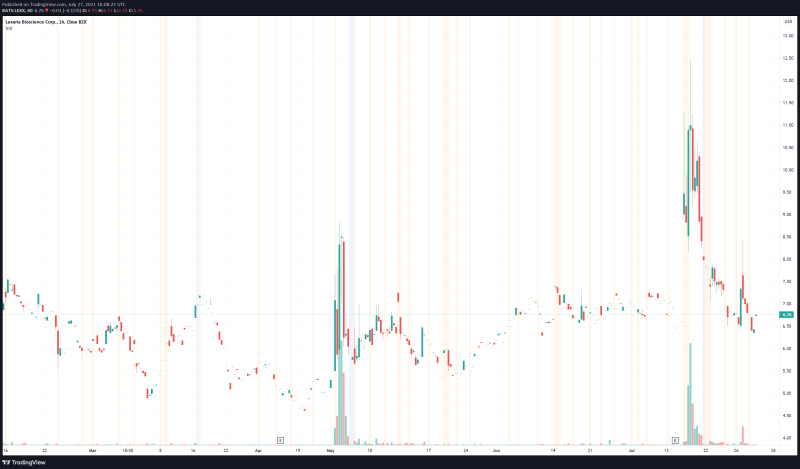

If you ask me, which you didn’t, Lexaria is looking quite attractive. In addition to the Company’s latest press release, Lexaria announced yesterday that it had received USD$4,817,643 from the exercise of share purchase warrants. With this in mind, it might be a good idea to keep an eye on Lexaria. In particular, investors should be looking for any updates related to the Company’s HYPER-H21-1 and HYPER-H21-2 studies.

Lexaria’s share price opened at $6.89, up from a previous close of $6.77. The Company’s shares are down -1.07% and are currently trading at $6.66 as of 12:13PM ET.