Stock Markets beginning this week exactly where they left off on Friday, red. After Friday’s decline, I was curious to see how markets would open last night in over night futures. I was expecting to see a bit of a pop up, and then we sell off on Monday. Instead, we saw markets dump on the futures open, and continue to bleed off as trading hours began. We will cover the technicals under Technical Tactics, because there are some major zones we are testing.

But first, let’s cover what is causing markets to sell off. Fear.

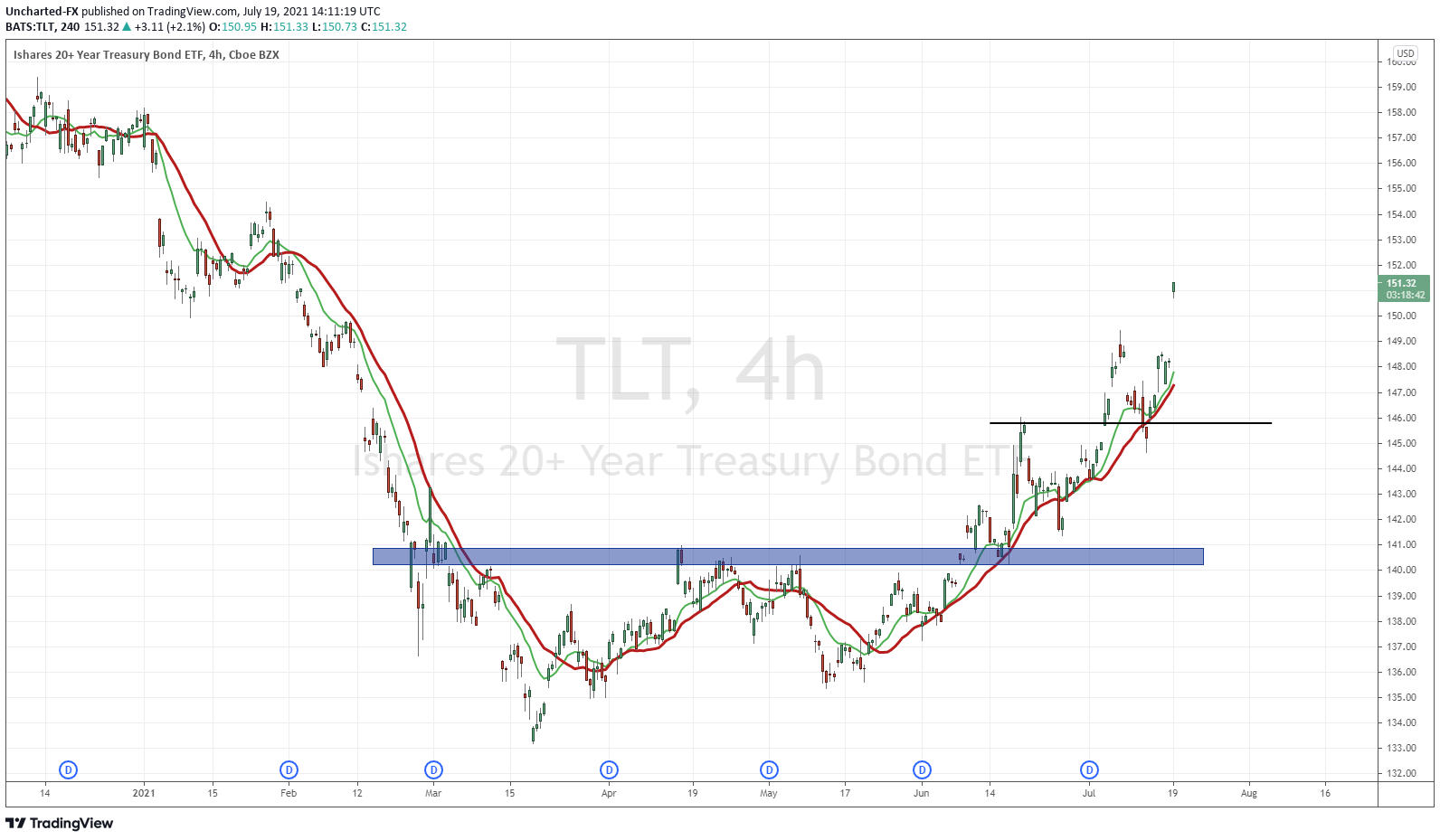

When we see the US Dollar rise, and TLT rise, we are seeing fear. Yes, you can look at the VIX as well. A pan sell off with Gold, Silver, Oil, Stocks, Bitcoin all being sold off. TLT has been the chart I have been calling the most important macro chart recently on Market Moment.

The market is afraid of either two things.

First, fears of new lockdowns. We are hearing about the Delta variant. Just last week, Covid deaths began to rise in the US after weeks of decline. Covid cases are surging in almost every US state, with some States like New York seeing numbers for the first time since 6 months.

With new lockdown fears, the Airlines, Cruise ships and travel stocks are getting hammered. Meanwhile stocks such as Clorox, Wal-Mart, Costco, pharmaceutical stocks are moving higher. More on these charts later this week.

New lockdowns would be devastating for the economy and small businesses which are still recovering from previous lockdowns. The US still sees weekly Jobless Claims come in the 6 figures (around 380,000 last week). However, there is some hope. Many professionals think the Delta fear is overhyped. With people having the vaccines, hospitals won’t be overrun which was the point of lockdowns when we were flattening the curve back in the day. Bill Ackman came out saying that the spread of Delta will not cause new lockdowns, and the economy is still on the path to a recovery. Definitely a contrarian outlook.

Second reason for markets dropping, and nobody is talking about is the Federal Reserve. Remarks from Powell and Yellen last week dropped “transitory” when they spoke about inflation. Yellen came out and said that Inflation she sees, “several more months of rapid inflation” before it moderates. Not transitory anymore folks.

What if markets are now losing confidence in the Fed? Truth is the Fed cannot come out and ever admit they were wrong…especially when it comes to inflation. It could be that the market believes the Fed can’t control inflation. But a lot of this is being covered over with the variant news. In a way, this news is great for the Fed because it means they can now defer Interest Rate Hikes and Tapering talks to another time. Now is not the time to taper with uncertainty with this new variant.

One thing that can prop up markets are the earnings. To be honest, right now with current price action, it doesn’t seem like earnings can get the job done but you never know. We are still early on in the trading day. Netflix for tomorrow is the one I will have my eyes on. The chart looks great as I have covered over on Equity Guru’s Free Discord Channel. The added bonus is that technically Netflix can be considered a lockdown play.

Technical Tactics

Without further ado let’s break down some charts.

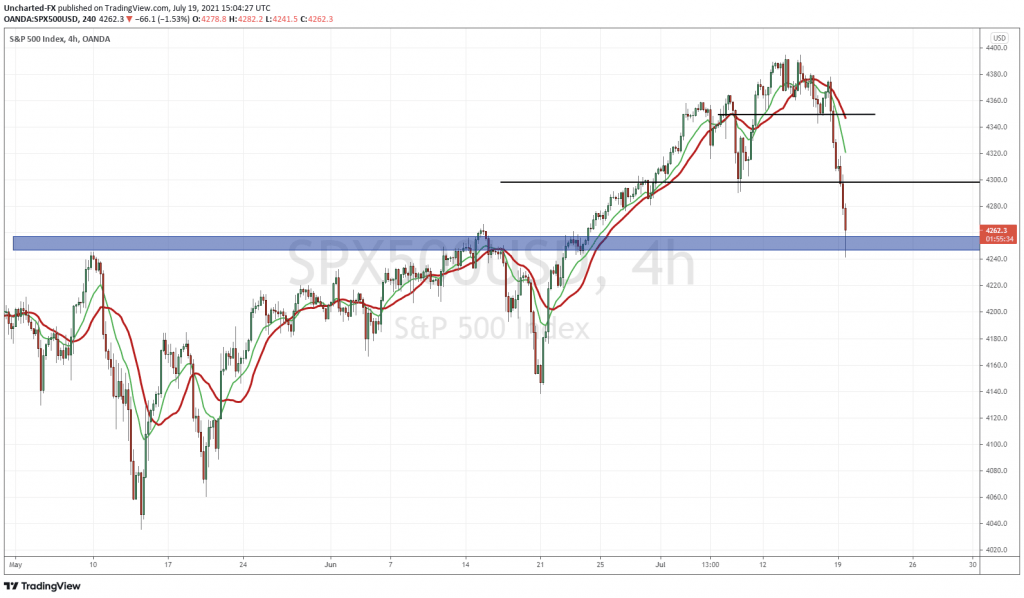

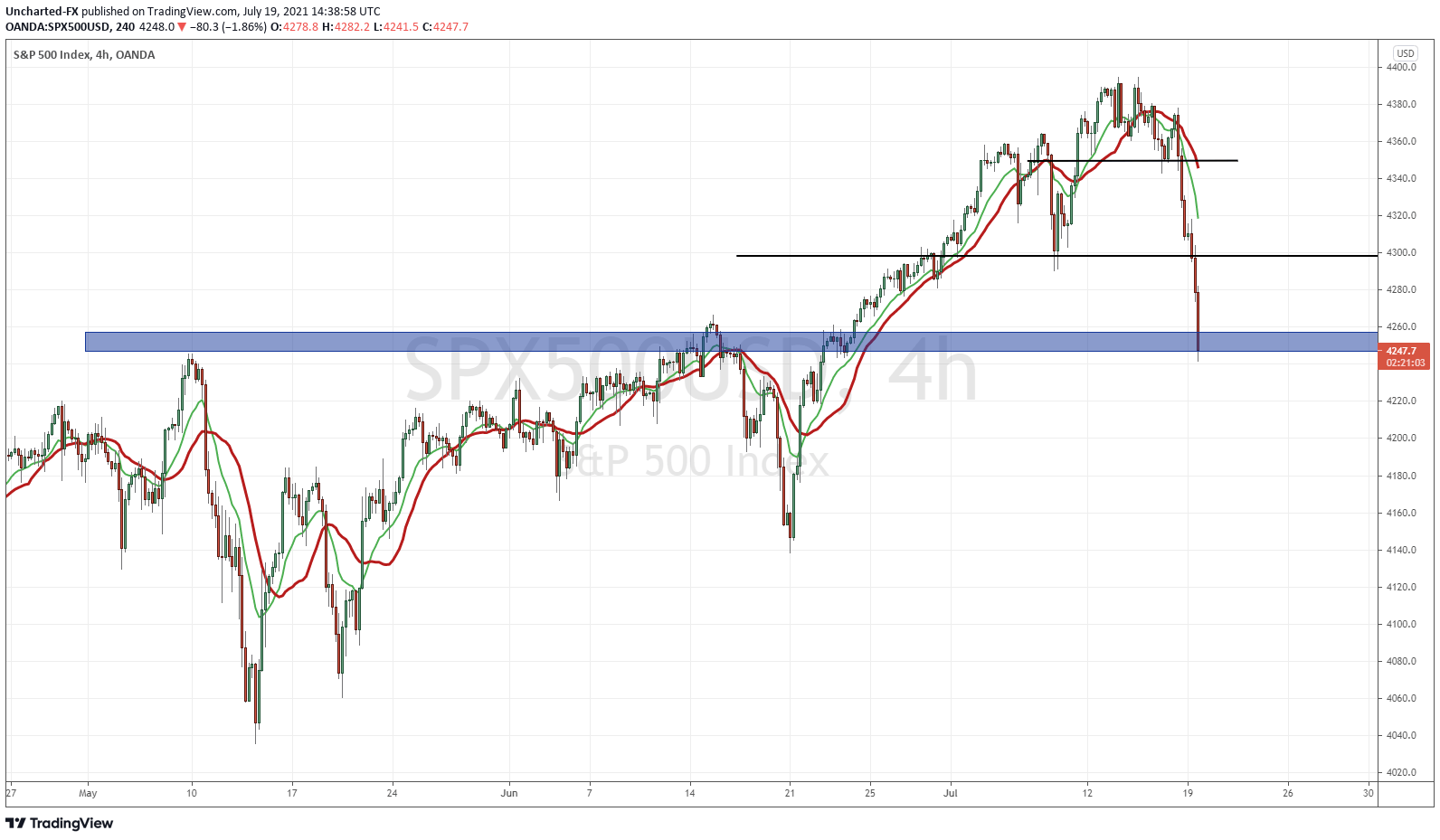

The S&P 500 has indeed reached a major support zone. The trigger for us was the break way back at 4350. I was thinking overnight and into today we would pullback to retest 4350. It would give me an opportunity to enter short. Instead, overnight futures tumbled and we broke below 4300. We are currently trading at 4250 which is a major support zone. Expect a battle here.

So here is a lesson from years of trading: look at all those red candles. We have too many in a row and in this case, it would be chasing the move. I am on the sidelines waiting for a relief rally. A pullback which could be considered a dead cat bounce if the downtrend maintains. To nullify the downtrend, sure a close above 4300 would help, but I would like to see a close above 4350 again. It will be a volatile week. So the gameplan for now: wait for a relief rally here and then assess the short later.

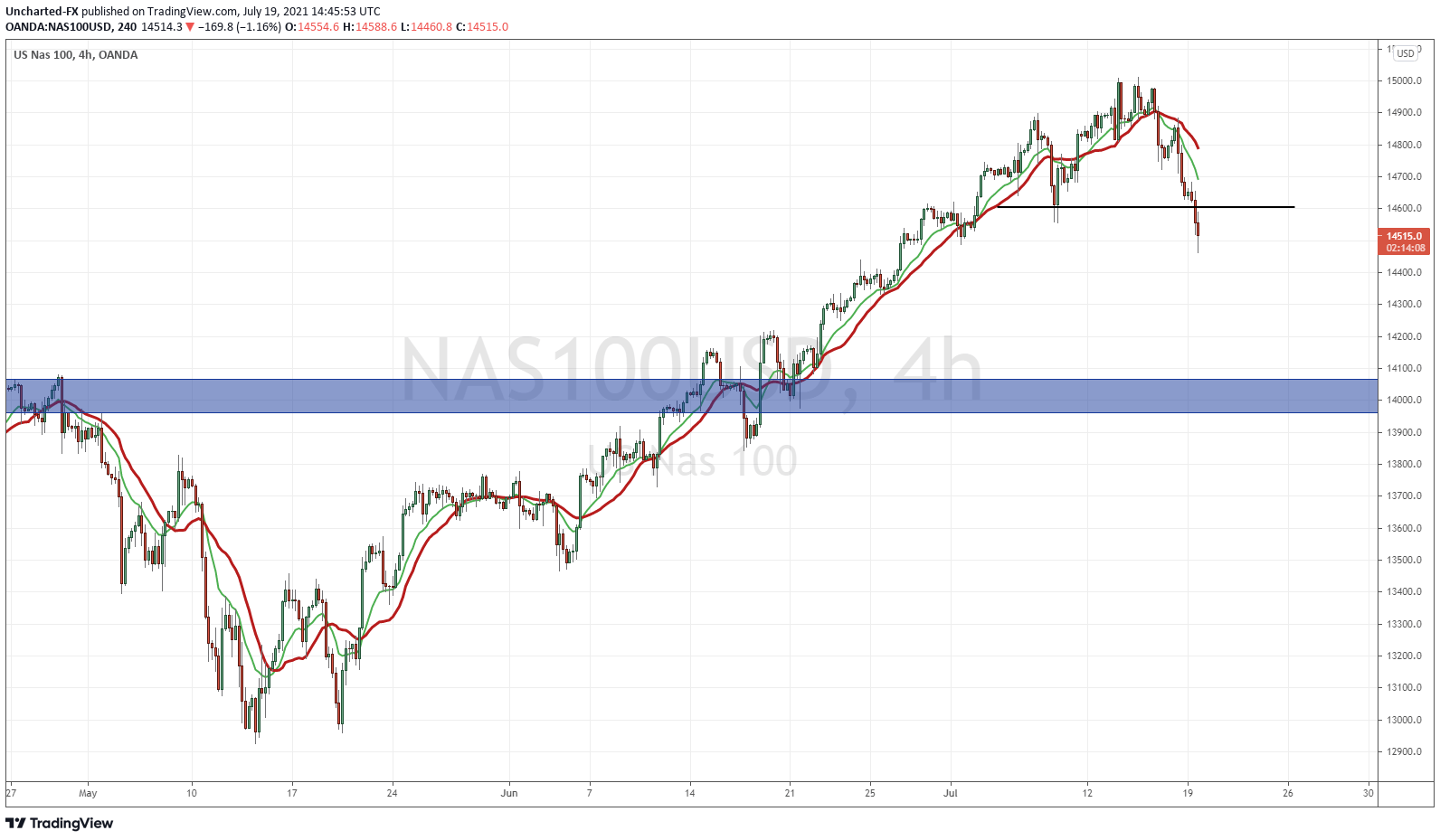

The Nasdaq looks dangerous. It actually has some room to the downside. A lot of room if the downtrend continues. Unlike the S&P 500 (and the Dow and the Russell which you will see in a sec) there really is no major support the Nasdaq is currently testing. Gameplan is simple: await for a close back above 14,600. If that occurs, we are likely going to continue higher. If not, then I would like to see prices pull up to 14,600 on the retest and then see sellers pile in. Would create a lower high for us to work with.

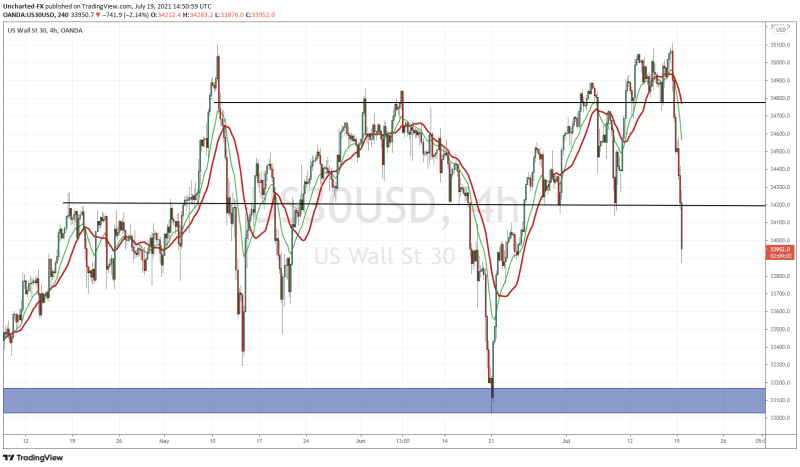

The Dow earlier was finding support at 34,200 but at time of writing, we have cut through that support like a hot knife through butter. That’s the zone I will use heading forward. Perhaps we retest 34,200 before selling off again. Or, we close above 34,200 nullifying this move.

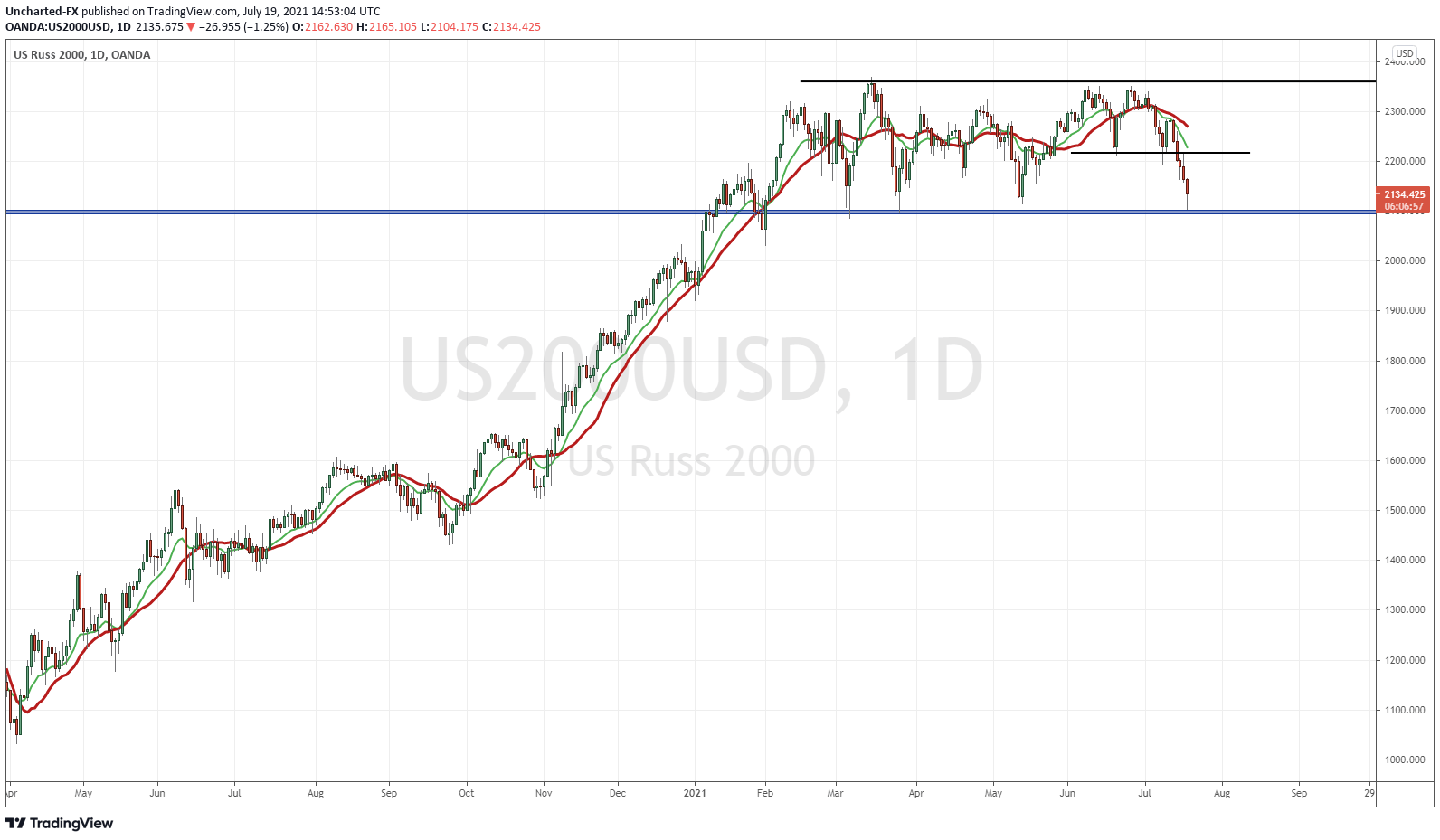

Finally the Russell 2000. Months ago, we were looking at the Russell on the Daily chart and warned of a topping pattern. The small cap index has been ranging for months, after a long uptrend. This is typically the sign that the uptrend is over, and we will begin a new downtrend. The key though is the break and close to trigger this new downtrend. That zone to trigger is the 2100 zone. Rather than breaking it back in May, we bounced and hit the top band of resistance at around 2350. We did not make new record highs.

Now we find ourselves once again back at 2100 support. Do we pop from here? Looking at today’s daily candle, we are seeing buyers jump in. The large wick on the candle is evidence. Once again, notice how many red days we have had in a row. Five by my count including today.

I think this chart is prime for a dead cat bounce scenario. See a day of green (likely tomorrow) and then a sell off afterwards. The line I have drawn out at 2215 was interim support. It broke, so now it is interim resistance. If we close back above 2215, then the likelihood that we move to continue to the upper portion of major resistance at 2350 is high.

So in summary there is fear in the markets. Delta variant, Inflation, heck even things with China are heating up again. Right now the media is peddling the variant news. Nobody is really discussing the Fed’s inflation talk and the fact it’s not transitory anymore. The variant will likely mean more uncertainty so the Fed will NOT taper anytime soon. In this weird low interest environment, I ask again: where do you go for yield? In my opinion in still is the Stock Markets. Once the fear subsides, people will realize this and I think we still head higher, especially if the Fed keeps monetary policy unchanged.