TechX Technologies (TECX.C) closed their previously announced Mobilum Technologies deal. We originally covered it when they inked the share purchase agreement back in May. Mobilium is a fintech start-up that provides fiat infrastructure to the cryptocurrency industry by using a licensed plug and play fiat-to-crypto gateway and payment processing tech.

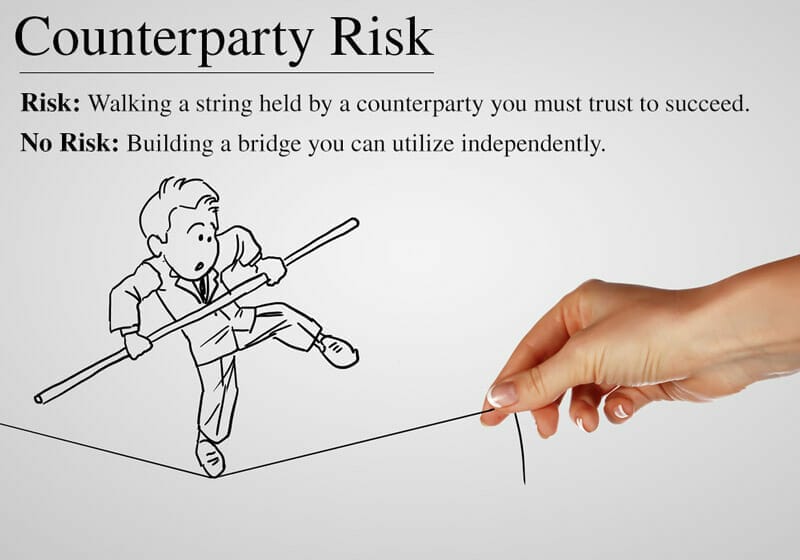

It offers its solution to exchanges, wallets, brokers, liquidity providers and cryptocurrency adjacent businesses. It’s odd that this isn’t the standard for fintech dealing with cryptocurrency, but it isn’t due to technical issues involving scaling and counterparty issues.

Maybe that’ll change in the future.

Regardless, here’s Peter Green, TECX’s CEO,

“We couldn’t be happier about acquiring Mobilum’s on-ramp, off-ramp and digital wallet technology. With the infusion of funds from our last financing round, we expect to quickly grow from the $150,000 in daily processing volumes we are currently doing by expanding the on-ramp offering to other cryptocurrency exchanges and businesses. We’re also excited to be launching the gift and payment card off-ramp and digital wallet solution towards the end of Q3. It’s becoming clear that decentralized finance is gaining global acceptance and we are excited to be part of this multi-billion dollar game-changing industry.”

The biggest problem with this deal is baked into the advertising. Mobilum is supposed to be zero risk, with no clawbacks, but blockchain itself with its scaling issues inculcates risk.

Here’s how:

Let’s suggest you’re buying groceries using litecoin, and the company you’re dealing with uses Mobilum. Litecoin takes 2.5 minutes to close each block. If the person buying the groceries (or the grocer) were particularly nasty, they could cancel the order before the block closed and get away free. Even if both parties are normal, decent human beings, sometimes when too many people try to close the block on a blockchain, it causes a bottleneck. That can boost your 2.5 minute closing time for your groceries to something approximately 15 minutes to a few hours. Meanwhile, your kids get antsy, you get antsy, and your ice cream melts. Hard pass.

Granted, coins like litecoin aren’t the best for this because 2.5 minutes isn’t an awful lot of time to make the call and cancel the approval, but bitcoin, with its ten minute block closure, or ethereum and its scaling issues, certainly is. It’s the reason why one should never do business peer-to-peer in an unmediated cash-exchange like PayPal was before they went all in on crypto. (You probably still shouldn’t do business on PayPal for crypto, but now for different reasons.)

TechX will be taking Mobilum Technologies name in this peculiar marriage of sorts, and the ticker they’ll be using on the CSE is MBLM. The company will release a new release with the date of the shift, subject of course to the CSE giving the nod. Mobilum’s on and off ramp solution makes it easy for businesses who want to offer cryptocurrency options do that, because it will provide the exchange between crypto and fiat in house with no chargebacks, and the highest acceptance rates and at 2.99%, the lowest fees in the industry.

Except there’s nothing in their documentation which suggests how they mitigate the risk. There are a few options—meaning, other companies that have found workarounds. Some companies offer an intermediary cryptocurrency for fiat to crypto and crypto to fiat swaps, or any old transaction, while they wait for the block to close. This intermediary is usually a stablecoin like USDC or USDT, in which the crypto is held in escrow limbo while the block closes. If the customer is long gone and the transaction doesn’t go through, the company usually has some variety of insurance to cover the risk in case they can’t catch the guy.

Included in the deal is Mobilum’s Xcard digital wallet technology platform, anticipated to go live in Q3, 2021.

Here some of its features:

• Stake and earn interest of up to 16 per cent APY on select cryptocurrencies.

• Swap multiple cryptocurrencies with lower fees than ethereum-based protocols but continue

to have the ability to swap ethereum-based tokens.

• Farm DeFi tokens and earn high-interest yields.

• Buy and sell over 237 cryptocurrencies.

• On and off ramp with credit cards, electronic transfer funds and wire transfers.

• Artificial-intelligence-based crypto trading signals.

That’s a decently sweet list. Better than most exchanges.

My tendency here is to be charitable. There’s a stronger probability that this kind of tech isn’t going to be used in the brick-and-mortar sense. Nobody’s going to be taking their shitcoin wallet to Superstore anytime soon to buy their milk and bread using Doge or the Ethereum Classic they couldn’t unload. This is likely going to be used in DeFi applications, which carries its own set of risks and rewards, but it’s still rather galling to not mention the mechanism by which you evade risk in your documentation. Although, in their defense, maybe this stuff is difficult to parse and they need someone to decipher the tech speak for their audience.

I might know a guy.

—Joseph Morton