Harvest Health & Recreation (HARV.C) announced today that it has opened a new medical dispensary in South Miami Beach, Florida. Additionally, the Company also announced that it has completed the divestiture of its cultivation and processing operations in Utah.

“We are thrilled to open our eleventh Harvest location in Florida, one of the fastest growing medical markets in the U.S….We look forward to serving patients and providing quality products at this new location in one of our core markets,” said Chief Executive Officer Steve White.

To date, Harvest has divested assets in Arkansas, North Dakota, and now Utah. Moreover, the Company has completed a series of deals including the sale of ten operating dispensaries in California to Hightimes Holdings Corp. and a proposed acquisition with Trulieve Cannabis where Trulieve will acquire Harvest for a total consideration of $2.1 billion. Although Harvest has significantly reduced its assets in California, the largest cannabis market in the world, the Company still possesses four dispensaries in the state. However, with eleven dispensary locations now in Florida, its clear to see that Harvest favors the sunshine state.

Harvest latest divestiture of its cultivation and processing operations to a local operator in Ogden, Utah, signifies the end of the Company’s operations in the state. Divesting typically occurs when a company is looking to improve its operational efficiency and reduce overall costs. Harvest is no exception, having announced its strategic plan to sell non-core assets and reduce expenses. Since November 2019, Harvest has undertaken numerous initiatives which are expected to contribute to a 30% reduction in selling, general and https://e4njohordzs.exactdn.com/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistrative expenses on an annualized basis. These initiatives include a 20% reduction in workforce, salary reduction program at senior management level, downsizing and consolidation of corporate offices, and the implementation of remote workforce programs.

“We are pleased to have completed this divestiture as part of our strategic plan…We will continue to allocate resources to growth opportunities in our core markets,” said Chief Executive Officer Steve White.

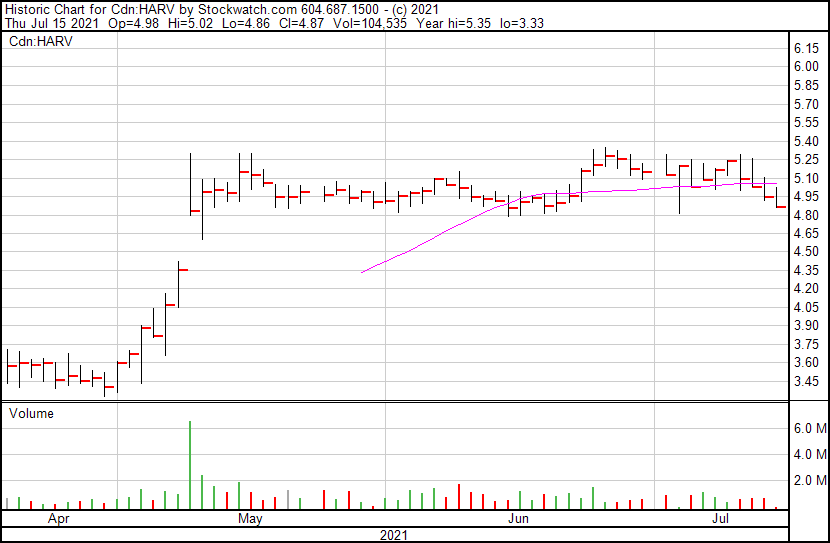

With this in mind, by axing non-core assets like its Utah cultivation and processing operations, Harvest is attempting to minimize costs while building upon its more lucrative prospects like Florida. According to BDS Analytics, Florida’s medical cannabis market is expected to hit $1.5 billion in sales this year, up 53% over 2020 sales. Although Harvest’s stock performance may not be the most impressive now, the Company’s proposed acquisition with Trulieve and the divestment of additional operations will likely help the Company regain its footing in the cannabis sector.

Harvest’s share price opened at $4.98, up from a previous close of $4.95. the Company’s shares are down -2.63% and are currently trading at $4.82 as of 11:17AM ET.