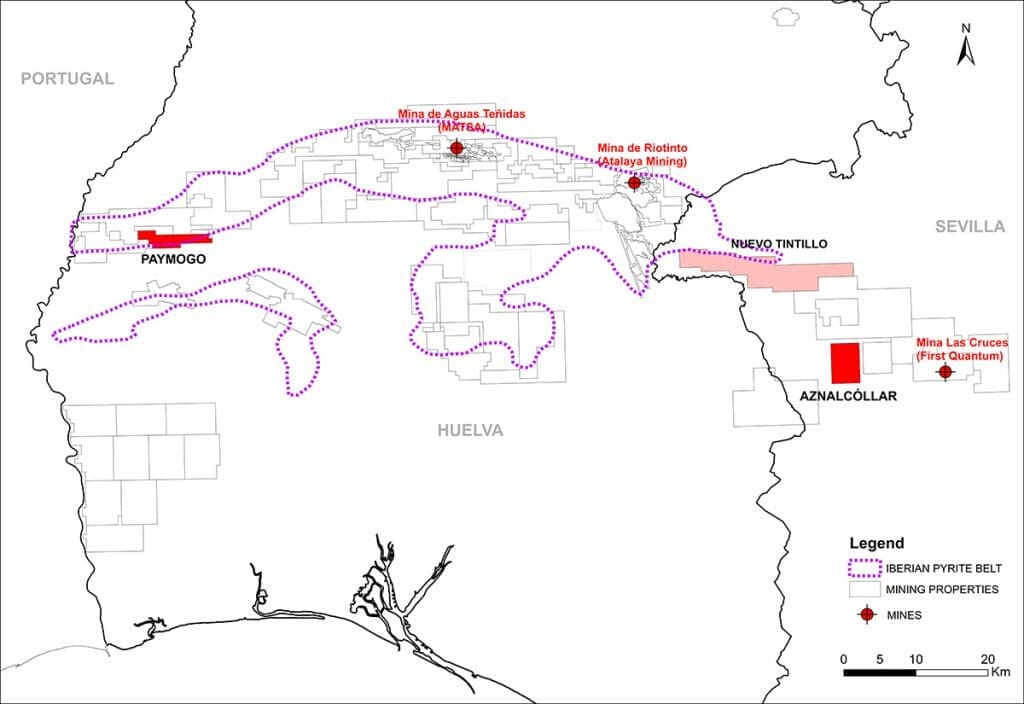

Emerita Resources (EMO.V) provided an update on the ongoing court case over their Aznalcollar property in Southern Spain as a trial is expected soon.

The presiding judge of Court No. 3 of Seville, Judge Patricia Fernandez, has issued new indictments for the irregularities committed in the awarding of the Aznalcollar public tender, abiding by the mandate of the Superior Court’s ruling. This ruling brings the lower court in line with the Superior Court.

For those who need a refresher, this is all related to a court case I wrote about last month involving corruption and mining contracts relating to a mine in Southern Spain. Long story short, there was allegedly some pay-to-play shenanigans (that’s the legal term, by the way) when it came to who was awarded the contracts. Under Spanish law, if there is any corruption involved in the awarding of a contract, it voids the contract which is given to the next qualified bidder, which in this case was Emerita.

Back to today’s news. The new indictment includes the following:

- Increases the number of accused people from 9 to 16.

- Increases the charges to the following 4 crimes related to the award of the tender:

- Administrative Prevarication

- Influence peddling

- Management fraud

- Embezzlement due to unfair management

Judge Fernandez’s indictment stated that these alleged crimes have caused “patrimonial damage to the public treasury” that would constitute the crime of embezzlement by unfair management. The judge also noted that Emerita’s offer was 641.5 million, while the of Minorbis-Grupo México was 304.6 million.

“We are entering the final stage of this legal odyssey. The years of investigations have been concluded, the crimes are serious, the judge is expected to set a trial date in the near future and based on the evidence and numerous decisions by the Spanish courts to date we are confident that the accused will be found guilty of one or more crimes,” stated Joaquin Merino.

Emerita thought it was important to note that, in this indictment, Judge Fernandez includes most of the accusations made by Emerita’s legal counsel. As Merino notes, Emerita is confident the trial will go the way they want it to. The reasoning is that because, according to Emerita’s external Spanish legal council, trials in Spain do not typically proceed to this stage without a “high certainty of guilt” it is rare that parties are not found guilty at this stage.

If Emerita wins the case, they will be able to operate at the historic Los Frailes site. The Los Frailes operation was only in production for ~1.5 years in the 90s when a tailings dam failure combined with low metal prices caused the mine to shut down, and now the government is trying to award a contract for who gets to resume mining operations. Because it was only in production for a short time, most of the resources are still there, making it a very desirable project.

The historical Los Frailes open pit mineral resource was calculated by the previous operator to have an estimated 71 million tonnes grading 3.86% zinc, 2.18% lead, 0.34% copper and 60 ppm silver. A review of the historical drilling data indicates the potential existence of a higher-grade portion of the resource, which they estimated to contain 20 million tonnes grading 6.65% zinc, 3.87% lead, 0.29% copper and 84 ppm silver. Emerita has modeled this higher-grade resource, which would be the focus for the underground mining operation. Most of the historical drilling was primarily constrained to depths accessible by open pit mining, so Emerita is targeting an unmined area by planning underground mining efforts.

“This is an important outcome with respect to the Aznalcollar trial and by extension the ultimate awarding of the public tender. Emerita is well positioned to begin immediately developing this tier 1 asset for the benefit of the community and all stakeholders. This final ruling by Court No. 3 of Seville brings all levels of the judiciary that have been involved in the hearings over the past seven years into alignment and agreement on the charges for the commission of criminal acts related to the awarding of the public tender. Importantly, it also makes it clear that the other bid should have been disqualified from the process as demonstrated by the fact that a number of the charges stem from the fact that it was permitted to proceed even though it did not meet the criteria required by the tender instructions. Considering this, Emerita is the only qualified bidder. This brings the process a step closer to a conclusion. According to legal counsel in Spain it is very rare for a trial to proceed to this final stage in Spain that does not conclude with conviction(s). Counsel also advises that this phase is generally not a long, protracted process as the investigation is closed and no further evidence can be submitted and appeals to delay the process are no longer permitted,” noted David Gower, CEO of Emerita.

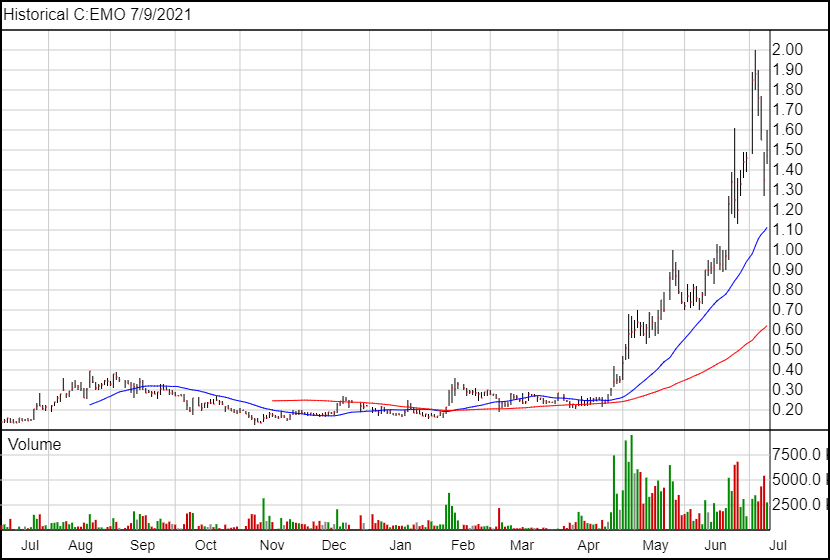

Following the news, Emerita’s shares are up 12 cents and are currently trading at $1.47.