Emerita Resources (EMO.V) announces that the Provincial Court No. 3 in Seville has ruled with respect to appeals filed by the accused parties and by Emerita in February of this year regarding the ongoing dispute over the tender process for the Aznalcollar property.

Okay, before we go any further, a brief explanation of what this whole story is about. So think back to the spring of 2015 (a lifetime ago), Stephen Harper is Prime Minister, Trump has yet to announce his candidacy for President, and in Spain, the Grupo México-Minorbis consortium is trying to restart mining at the Los Frailes mine in Aznalcóllar, near Seville. The Los Frailes operation was only in production for ~1.5 years in the 90s when a tailings dam failure combined with low metal prices caused the mine to shut down, and now the government is trying to award a contract for who gets to resume mining operations.

After the mine shut down the government reclaimed ownership of the site, meaning they controlled its future, and because the mine had only been in operation for a short time, there was plenty left to mine.

According to Spanish law, if there is any corruption, the contract goes to the next qualifying bidder.

What happened next was a classic case of corruption, pay-to-play type of stuff. It’s only prevarication, which is considered the lowest form of corruption under the law, but according to Spanish law, if there is any corruption, the contract goes to the next qualifying bidder.

After various members of the Grupo México-Minorbis, as well as local politicians, were found guilty of prevarication, they filed appeals to prevent their cases from proceeding to sentencing and for some of their cases to be excused. So Emerita hit back, counter appealing. Today’s ruling is the force of the law siding behind Emerita’s counter punch.

Emerita hit back, counter appealing. Today’s ruling is the force of the law siding behind Emerita’s counter punch.

“We are entering the final stage of this legal odyssey. The years of investigations have been concluded, the crimes are serious, the judge is expected to set a trial date in the near future and based on the evidence and numerous decisions by the Spanish courts to date we are confident that the accused will be found guilty of one or more crimes,” stated Joaquin Merino, President of Emerita states.

As long as Grupo México-Minorbis are disqualified for corruption, Emerita would be granted the contract by default, as they would be the only remaining qualified bidder. Winning the contract would allow them to operate a mine that has already produced and has had plenty of exploration. Emerita has been after this property for a long time, and this ruling brings them one step closer.

Winning the contract would allow them to operate a mine that has already produced and has had plenty of exploration.

The historical Los Frailes open pit mineral resource was calculated by the previous operator of the mine to have an estimated 71 million tonnes grading 3.86% zinc, 2.18% lead, 0.34% copper and 60 ppm silver. A review of the historical drilling data indicates the potential existence of an even higher grade portion of the resource, which they estimated to contain 20 million tonnes grading 6.65% zinc, 3.87% lead, 0.29% copper and 84 ppm silver. This higher grade resource has been modeled by Emerita and would be the focus for the underground mining operation. Most of the historical drilling was primarily constrained to depths accessible by open pit mining, so Emerita is targeting an unmined area by organising underground mining efforts.

“We are very determined to complete the process to acquire the Aznalcollar project. Emerita is the company best positioned to develop the project quickly. It has already completed approximately $1 million in engineering studies, that amounted to almost 10,000 pages including detailed plans and maps for the project development. Management has been involved with development of these types of deposits for decades and understands them well. Emerita has strategic financial backing that is prepared fund the project to make sure it is executed to the most modern standards for mine development as demonstrated by the financings in support of developing the IBW project. The Company will be fully transparent with the communities as the development work proceeds and will work to the highest environmental and health and safety standards for its employees and the surrounding communities,” stated David Gower, CEO of Emerita.

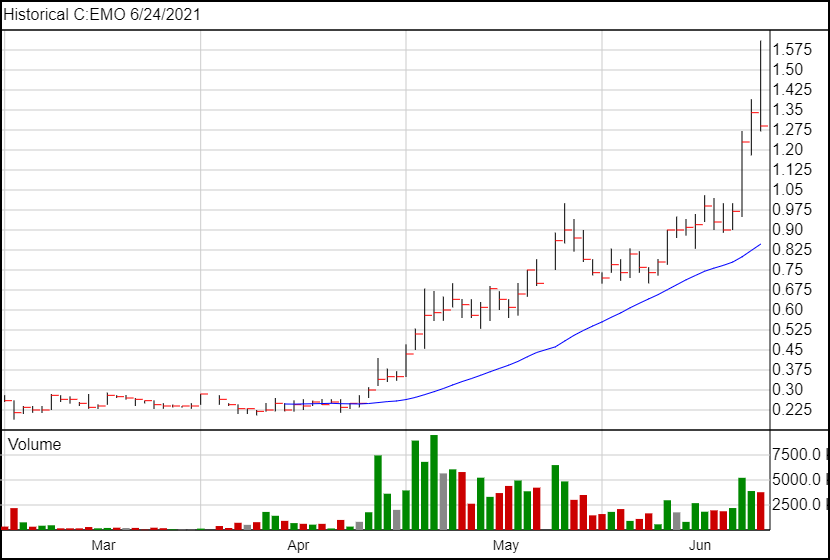

Following the news, shares of Emerita’s share price were up 14 cents, representing a more than 10% increase, but are back down and are currently trading at $1.29, representing a 4 cent drop.