“You take the high road, and I’ll take the Green Roads”

The Valens Company (VLNS.T) announced they have closed their acquisition of Green Roads and its manufacturing subsidiary.

The cash and share portion of the acquisition will cost Valens $40 million USD, plus there is an additional payment of up to $20 million USD to be made if certain EBITDA milestones are met, which would represent an approximately 4.5x fiscal 2022 EBITDA.

The cash and share portion of the acquisition will cost Valens $40 million USD

“With the closing of this Acquisition, Valens now has a significant presence in the largest cannabinoid market in the world, representing a monumental step in our international expansion strategy and furthering our vision of becoming a global manufacturer of cannabis consumer packaged goods. We expect to realize strong synergies and to aggressively pursue various strategic opportunities that are now available to our combined business through this transaction, including expanding the distribution of our ever-growing product offerings overseas and further disrupting the North American market with innovative cannabis products,” stated Tyler Robson, CEO, Co-Founder and Chair of Valens.

“The combination of Valens and Green Roads makes for an unbeatable team, diversified distribution network, and unparalleled product development and manufacturing platform, which we expect will provide us the footprint to become one of the biggest players in the global cannabis health and wellness market. Stay tuned for updates on anticipated synergies as we move forward as a stronger, combined company.”

The biggest strategic advantages Valens sees to their Green Roads acquisition are market penetration and presence. Green Roads provides them with direct entry into the US markets with a known brand level, as well as established manufacturers and distribution networks. They are also getting a leadership team that knows the US consumer landscape well.

The biggest strategic advantages Valens sees to their Green Road acquisition are market penetration and presence.

They also hope to strengthen their position in the Canadian market by offering Green Roads in the Great White North by the second half of the fiscal 2021 year. They are also looking to increase their global exposure, as the company is already engaged in late-stage discussions regarding various international distribution opportunities in Latin America, Asia-Pacific, and Europe.

Valens expects to invest $10 million to better capitalize on the growing US CBD market. They expect this investment in the Green Roads products to also bolster their e-commerce, the expansion of their retail distribution network, and increase the brand’s sales.

“The combination of Green Roads and Valens creates a truly global company with a clear leadership position both within the US CBD market and Canada’s domestic cannabis market. With this larger platform, we look forward to launching Green Roads products in Canada in the second half of 2021 and leveraging our own manufacturing facilities to export CBD products internationally. Valens and Greens Roads have a shared ethos of keeping our customers at the heart of our strategic decision-making and offer complementary products that foster brand loyalty and drive high margins. With our enhanced platform, we look forward to accelerating our global expansion plans and bringing our growing portfolio of products to an even broader customer base,” commented Dale Baker, President & Chief Operating Officer of Green Roads.

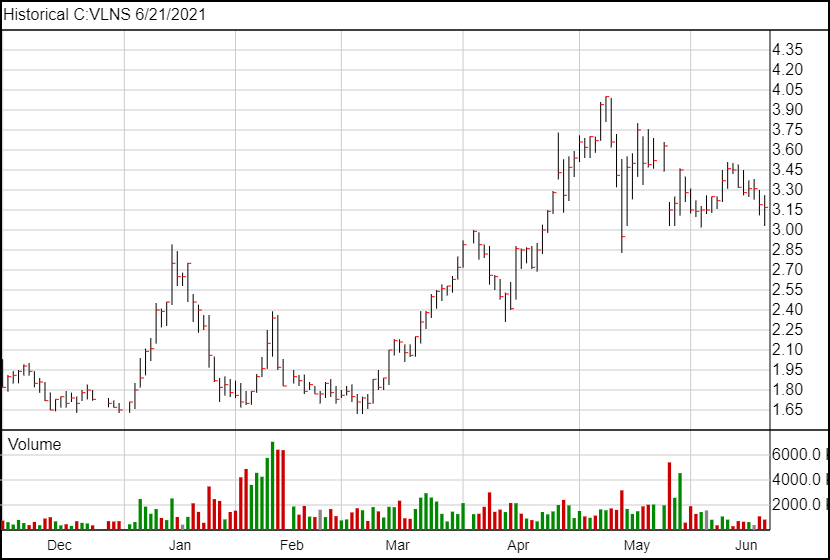

Following today’s news, Valens shares are down 3 cents and are currently trading at $3.16.