Gold fell hard yesterday after the Federal Reserve announcement and press conference. The precious metal continues to bleed off in today’s trading already down $77 or -4.17%. Silver did the same. Clapped. Both metals under pressure after the Federal Reserve initiates a mini taper. In this Market Moment article, I will explain what I mean by that. Also, why I took a short on Silver.

There was a lot of anticipation leading up to yesterday’s Fed meeting. The markets and traders were curious in regards to what Powell would say about the recent inflation data. To taper or not to taper, that is the question.

And it finally happened folks. The Fed is now talking about thinking of tapering! But of course, when the time comes, the Fed will let us know well in advance. Presumably to prevent a taper tantrum.

“You can think of this meeting that we had as the ‘talking about talking about’ meeting,” Powell said in a phrase that recalled a statement he made a year ago that the Fed wasn’t “thinking about thinking about raising rates.”

In terms of policy, nothing has changed. Rates remain the same, and bond purchases continue at 120 Billion per month. The economy is recovering but policy remains in effect.

In terms of inflation, Powell said that the transitory inflation coming from re-opening could be coming in higher than expected.

Powell did note that some of the dynamics associated with the reopening are “raising the possibility that inflation could turn out to be higher and more persistent than we anticipate.”

The Fed raised its headline inflation expectation to 3.4%, AND is now expecting two rate hikes NOT this year, but at the end of 2023. However, Powell then said that the dot plot, which is used to gauge when rate hikes are to be expected, is “not a great forecaster of future rate moves.”

The Twitter-sphere sort of went off of him on that comment. So overall, it began as a hawkish Fed press conference, but in a way, it felt like Powell talked things down as the conference went on.

The biggest change though that sort of has gone under the radar is is Fed increasing the Interest on Excess Reserves (IOER) from 0.10% to 0.15%. Not so much, BUT it is signaling that the Fed is taking steps to an eventual taper. A tapering of the banks as some are saying.

What the heck is IOER I hear you say? From our friends over on Investopedia:

Excess reserves are capital reserves held by a bank or financial institution in excess of what is required by regulators, creditors or internal controls. For commercial banks, excess reserves are measured against standard reserve requirement amounts set by central banking authorities. These required reserve ratios set the minimum liquid deposits (such as cash) that must be in reserve at a bank; more is considered excess.

The Fed now has the ability to change the rate of interest that banks are paid on required and excess reserves.

If the economy is heating up too fast, the Fed can shift up its IOER to encourage more capital to be parked at the Fed, slowing growth in available capital and increasing resiliency in the banking system.

The last point is the important one. Yes, it is only a small increase from 0.10 to 0.15, but it is signaling higher rates. Pre-pandemic, the IOER was 1%. So the tapering is beginning with the banks first. This now incentives banks to lend (which was their normal business) rather than buy treasuries and or invest into stocks. A lot of this also aided in controlling the pressures in the repo market, but this topic deserves a longer chat later.

Technical Tactics

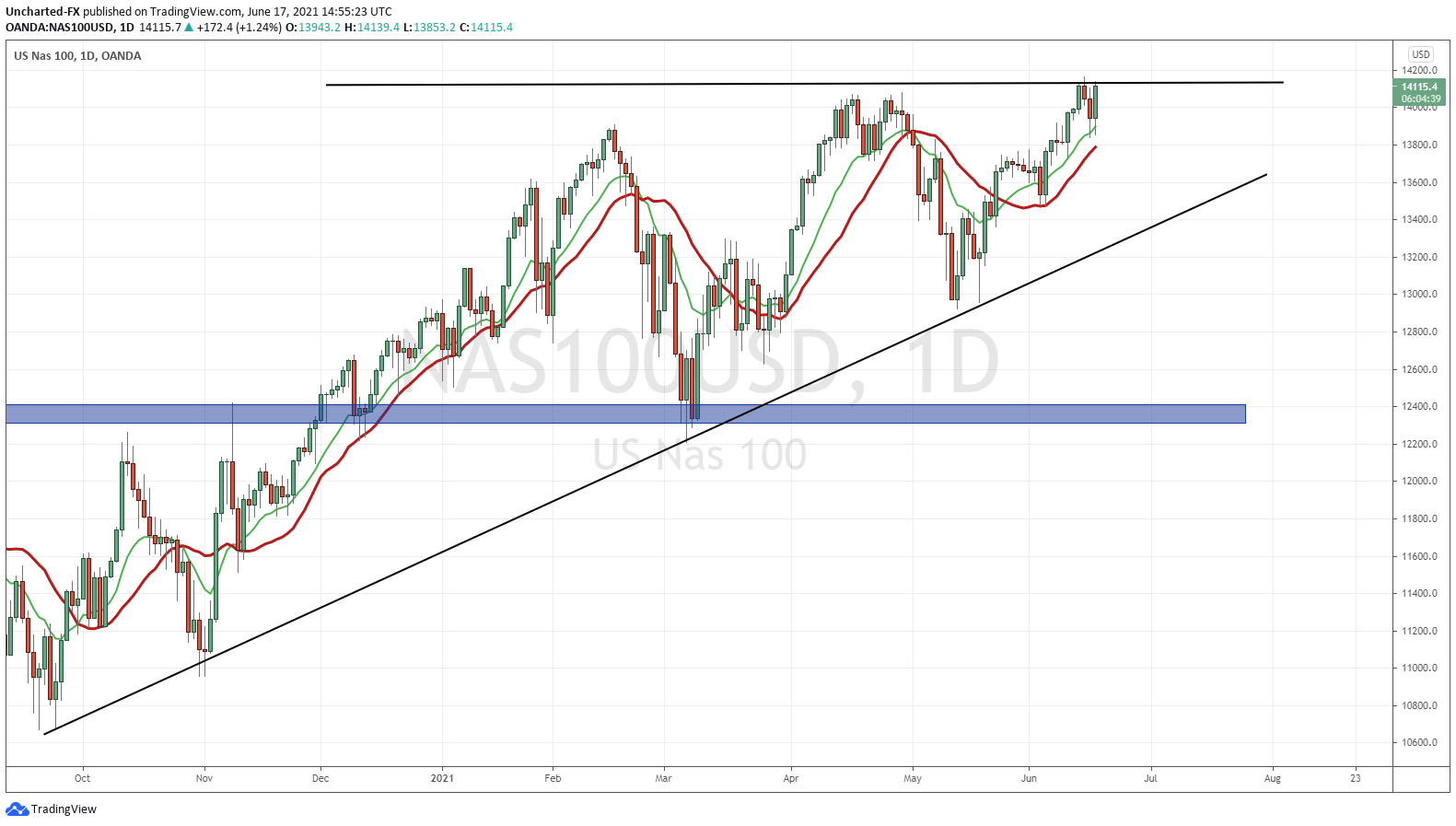

On the Market side, the S&P 500 and the Nasdaq are faring better than the Dow Jones and the Russell. Perhaps the move out of value and into growth continues. We have made up all the Powell losses. Some say this is a sign the Markets are not buying the Feds comments.

I believe the key Fed meetings will be the ones in late Summer and September. If inflation reading is still coming in above 5%, then the market might find a hard time believing the transitory inflation story especially since economies have been re-opened for a few months. But maybe rising Oil prices will be the excuse…just as I have been predicting here on Market Moment.

Now I know you want to hear about Gold. I had to mention the things above to set up the stage. With that rise in IOER, the market is now expecting higher interest rates to follow. These means two things here which will put pressure on Gold in the short term.

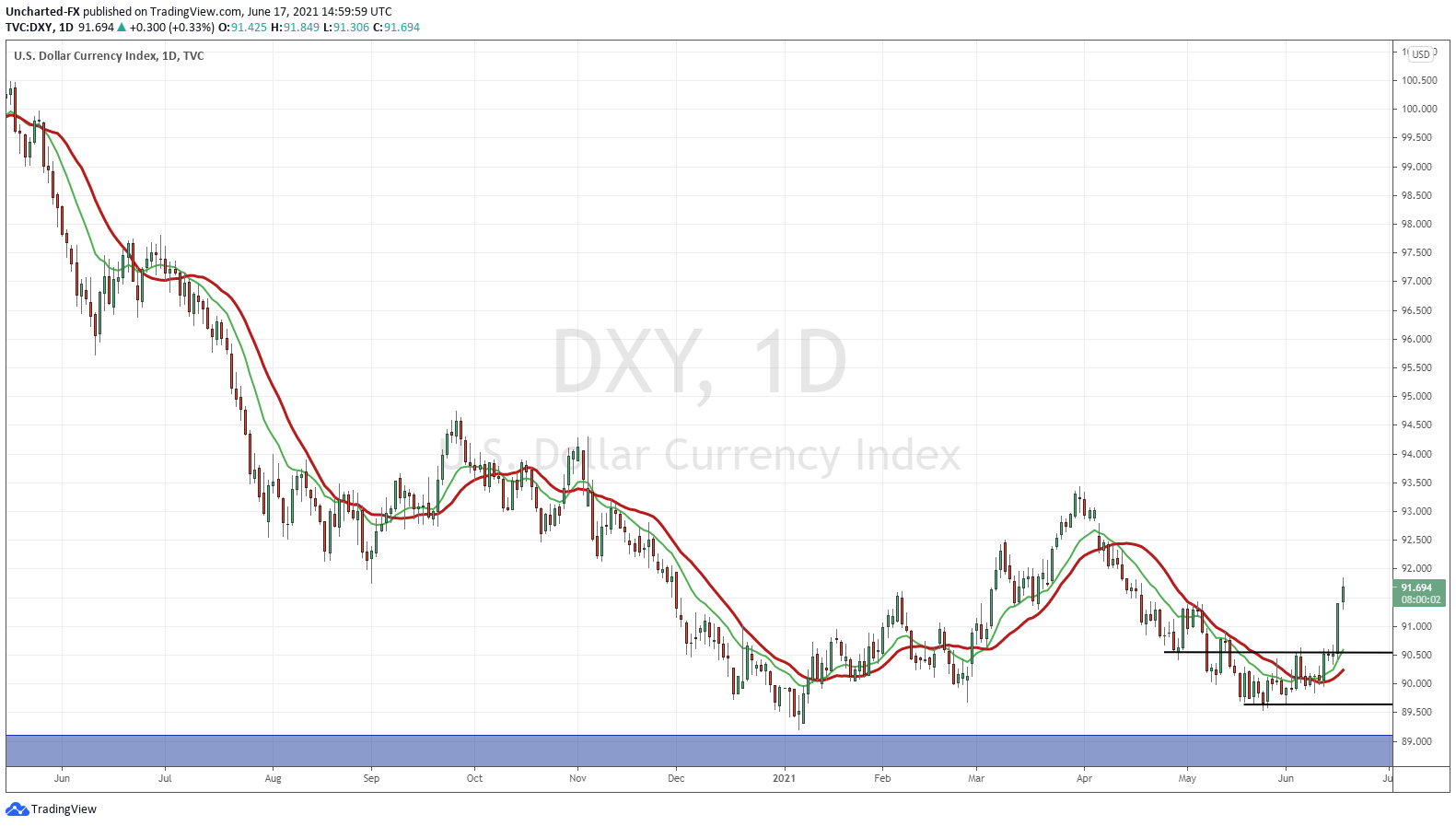

First off the Dollar popped HARD after the meeting. Its strongest close in months. In this case, it is not due to fear and uncertainty. It is pricing in higher interest rates and the Dollar gaining on interest differential. As the Dollar rises, Gold drops (although this isn’t always the case as readers are well aware of!). The Dollar is now bullish above 90.50 on the DXY, and we likely have some more upside as long as we remain above that level.

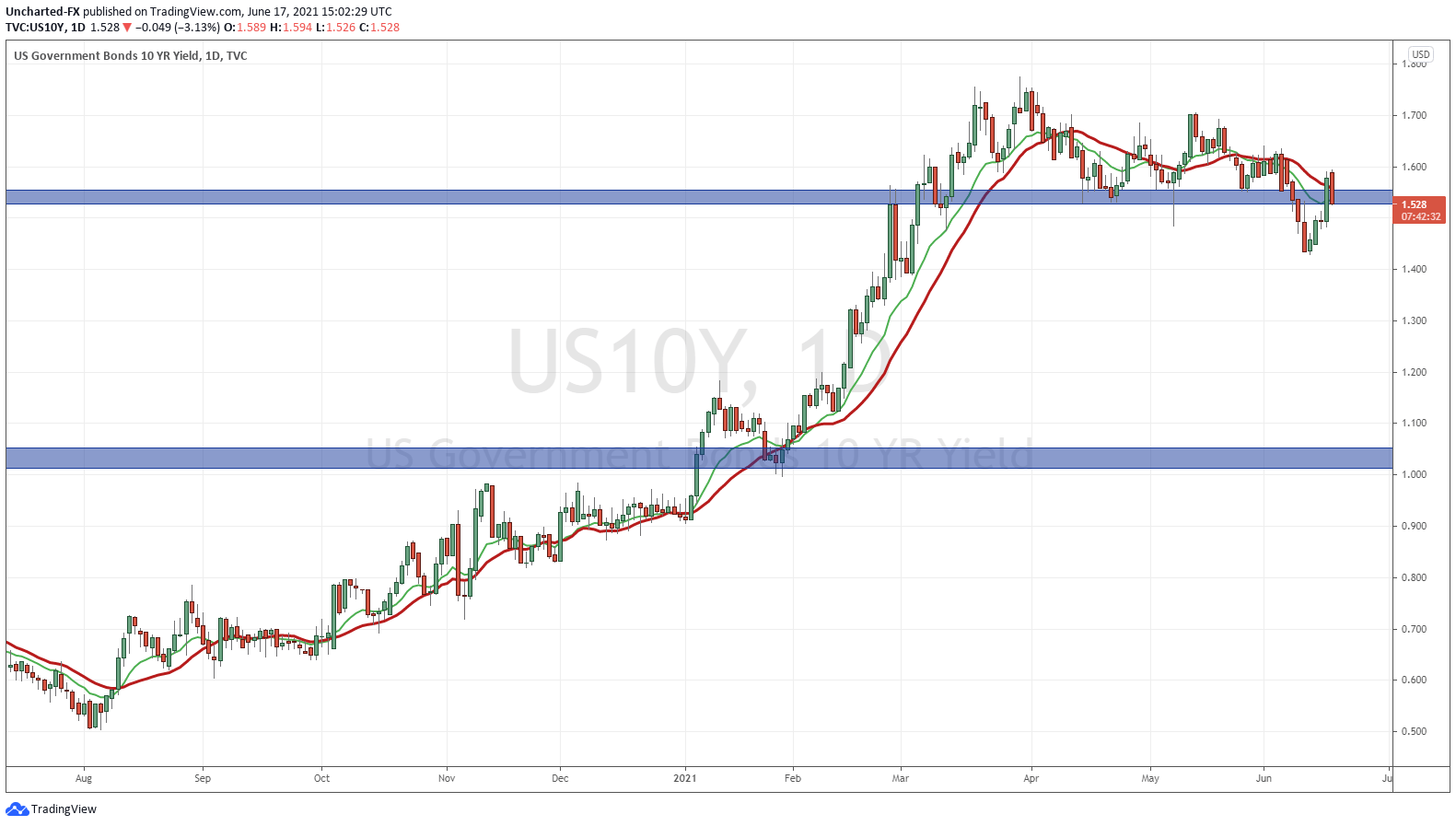

The second cause of concern shows up on the chart of the 10 year yield. But this concern could be shifting to favor Gold. As bonds sold off, rates spiked. We closed back above 1.50%. This is important because we closed below 1.50%, and that level was our new resistance going forward. We expected price to retest it and then for rates to head lower.

I say there is some hope, because today’s candle can close back below 1.50%. Why is this important for Gold? Higher rates are negative for the Gold prices. Remember, Gold pays no interest, so it is great to hold during periods of low rates.

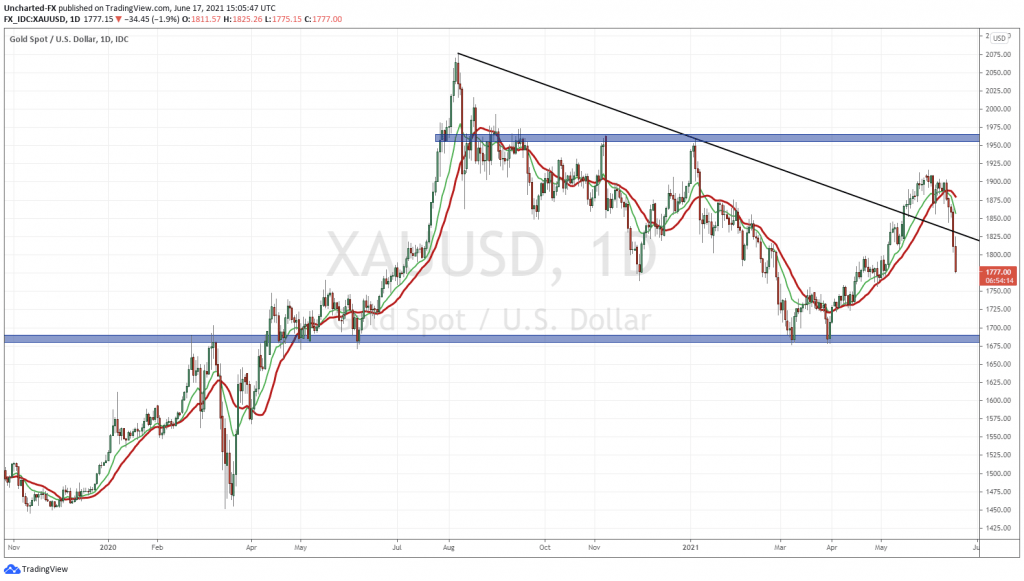

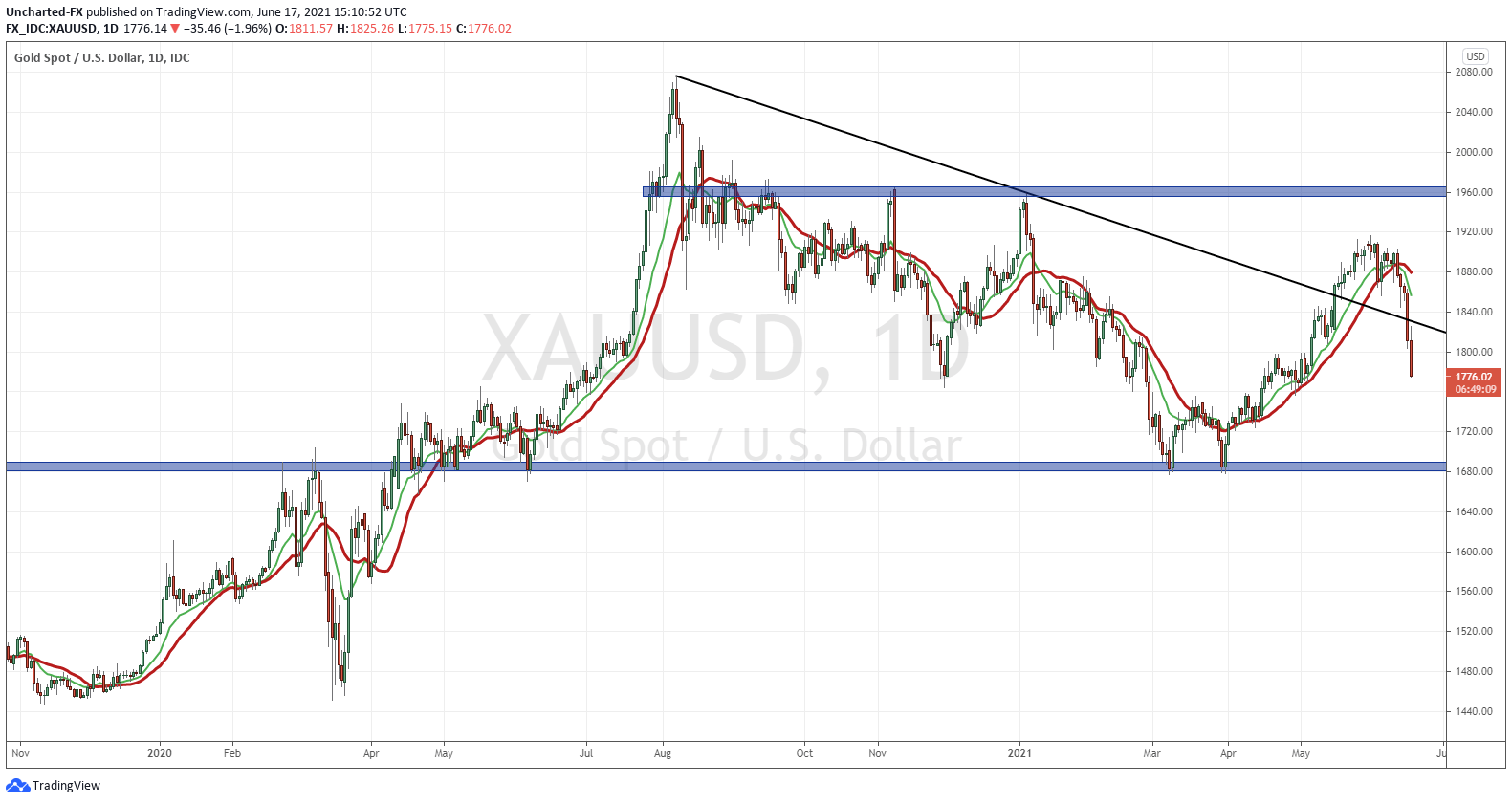

Gold chart is looking ugly. Clapped is the technical term I used. Notice my trendline. It had three touches, and I was hoping yesterday would be the fourth. I was hoping buyers would step in to enter on the trendline retest. But we sliced through it like a hot knife through butter. There is some support here around 1775, but if this doesn’t hold, we are likely to pull back to retest the 1700 zone.

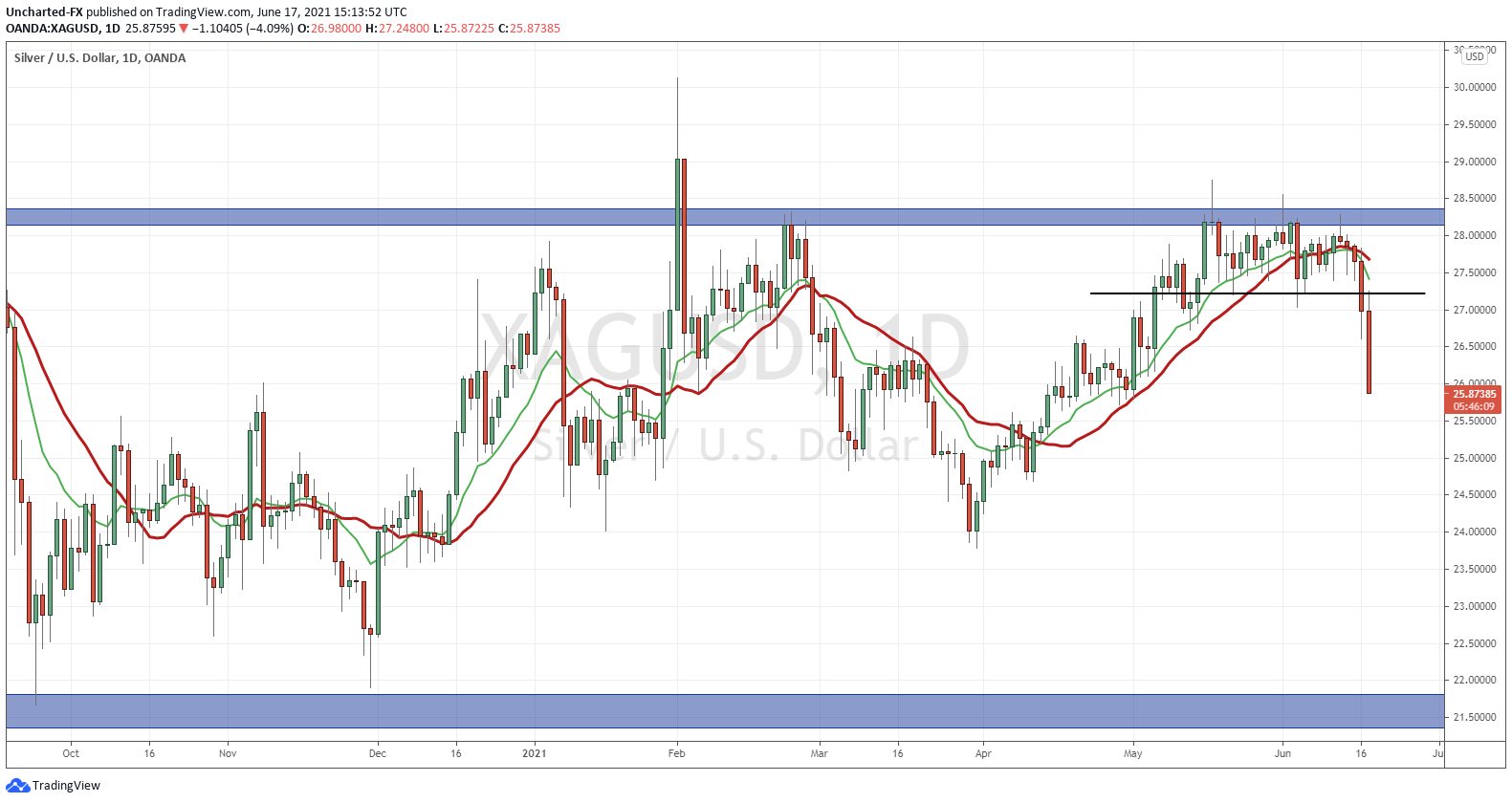

I personally shorted Silver yesterday on the close below 27.25. It is doing well for me right now. There is some support here around 25.75, but 25.00 will be the key psychological level. If that breaks, there is a strong possibility we go back to 22.

So the Fed is now saying that rate hikes are coming. It is now whether or not the market believes them or not. For those that think markets would sell off on fears of tapering…the market recovering is a sign traders don’t buy the tapering talk. But the US Dollar says something else. If you are a Gold or Silver trader, watch that US Dollar chart. Further Dollar strength means another leg lower on the precious metals.